Emerging markets, once hindered by limited traditional banking, are now witnessing a financial revolution. Instant transactions without intermediaries, personal control over finances, and democratized financial systems are becoming a reality due to the ongoing cryptocurrency revolution. From Bitcoin’s adoption in regions with unstable fiat currencies to the emergence of decentralized finance offering services without traditional institutions, these cryptocurrency trends are more than merely a means to swift wealth.

According to the Mordor Intelligence Report, the cryptocurrency market size in terms of transaction value is expected to grow from US$1.33 trillion in 2023 to US$5.02 trillion by 2028. These numbers represent a major shift in financial systems, global trade, and everyday transactions.

The financial ecosystem, traditionally dominated by centralized banks and fiat currencies, is undergoing groundbreaking changes due to blockchain and decentralized finance (DeFi) platforms. For example, major institutions, such as PayPal and Mastercard, are offering cryptocurrency services, and countries, like El Salvador, are adopting Bitcoin as legal tender.

As businesses redefine their operations, the financial industry faces its own challenges and opportunities with cryptocurrency technologies. Therefore, understanding emerging trends of cryptocurrency allows you to maximize investment returns and be a part of a revolution that is redefining finance, law, and governance.

Key Takeaways

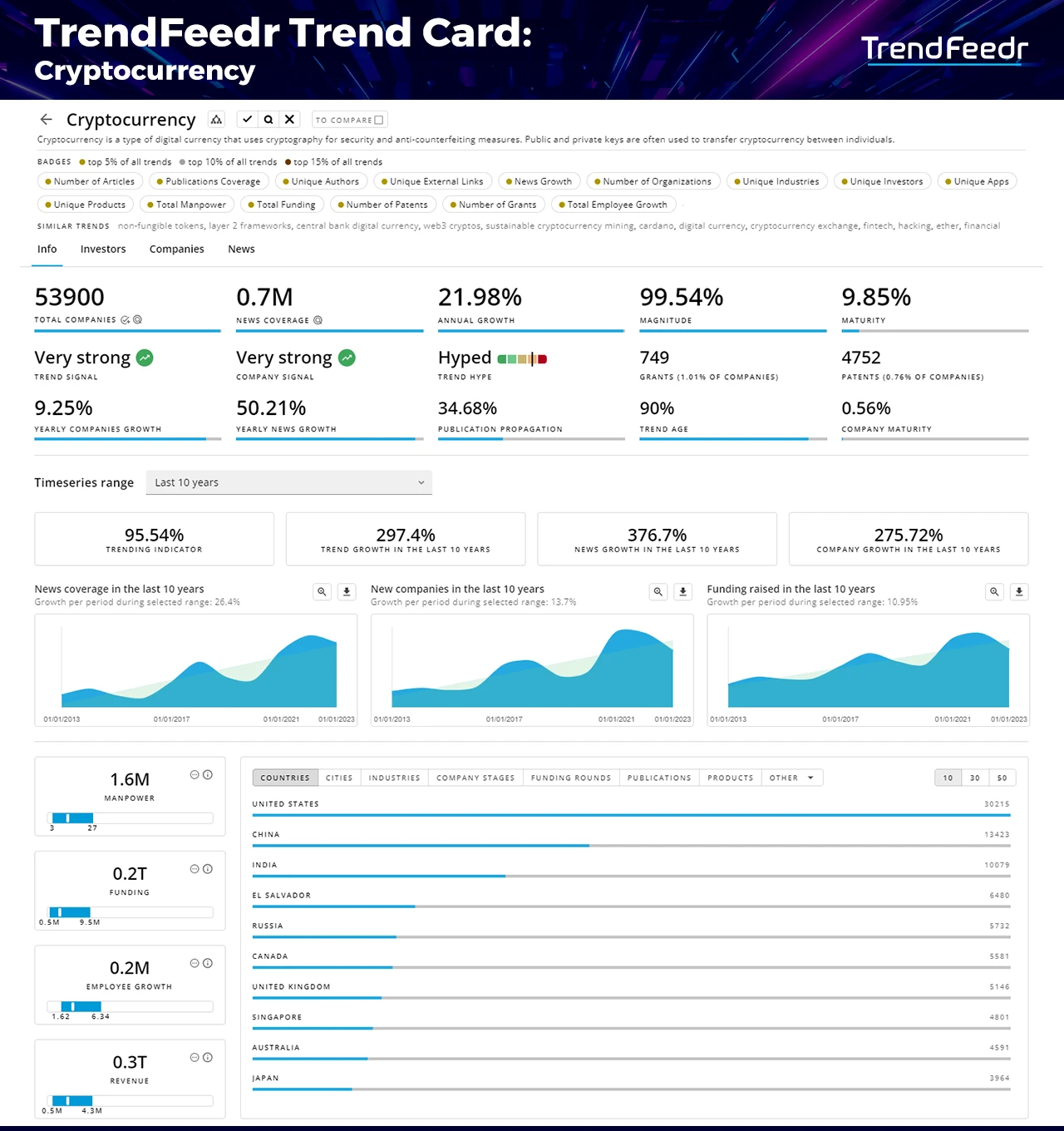

- Leading Trend: With an annual growth rate of nearly 22% and a trend magnitude of 99.54%, cryptocurrencies are revolutionizing our world.

- Diverse Financial Innovations: Entities in the cryptocurrency realm are expanding their focus into trends, such as non-fungible tokens (NFTs), layer 2 frameworks, central bank digital currency, web3 cryptos, and sustainable cryptocurrency mining.

- Financial Heft: With 53,900 companies involved and total funding exceeding US$200 billion, cryptocurrencies receive serious financial backing.

- Prominent investors like Binance Labs, Andreessen Horowitz, and Paradigm have made substantial investments in cryptocurrency projects.

- Global Reach: The United States, China, India, El Salvador, and Russia are at the forefront of cryptocurrency initiatives, while cities like London, New York City, Singapore, San Francisco, and Tallinn stand out for their significant activity.

- Rising Prominence: There has been an impressive yearly growth of 26.4% in cryptocurrency news coverage over the last decade.

Table of Contents

- Understanding Cryptocurrency Trends

- Cryptocurrency: A Performance Analysis

- Diverse Cryptocurrency Trends & How Companies are Advancing Them

- How Cryptocurrencies Disrupt Industries

- Financial Commitment to Cryptocurrency

- Cryptocurrency Hubs: Mapping Global Adoption

- Future Outlook of Cryptocurrency

In this data-driven analysis, we explore the current trends in cryptocurrency, focusing on developments in non-fungible tokens, layer 2 frameworks, central bank digital currency, web3 cryptos, and sustainable cryptocurrency mining.

For this detailed analysis of crypto trends, we use TrendFeedr, our all-in-one trend intelligence platform. TrendFeedr uses advanced algorithms to identify future industry and tech trends. With a focus on trend discovery, clustering, and analysis, the AI-powered platform reviews thousands of trends each week to provide actionable insights.

Among more than 20,000 trends and technologies monitored by TrendFeedr, cryptocurrency has made a significant impact. Here’s why:

- Cryptocurrency ranks within the top 1% of the top 100 global trends, showing the massive attention it receives in technological and financial sectors.

- With a maturity of 9.85%, cryptocurrency is a standout trend that is transforming many aspects, including business, transactions, and people’s perception of value.

- The persistence and resilience of cryptocurrency from regulatory hurdles and market volatility also highlight its potential for long-term sustainability and growth.

This article will discuss various aspects of cryptocurrency trends, including performance metrics, investment landscapes, regional adoptions, and the technologies that will shape the future of finance.

Understanding Cryptocurrency Trends

Cryptocurrencies have evolved beyond their original purpose as a digital medium of exchange for online transactions. They now serve as the foundation for a broader DeFi ecosystem that is revolutionizing the way we interact with financial products and services.

Blockchain Technology: The Foundation of Cryptocurrencies

At the core of every cryptocurrency lies blockchain technology—a decentralized ledger that records all transactions across a network of computers. Proof-of-Work (PoW) and Proof-of-Stake (PoS) are the two primary mechanisms used to secure these networks. With advancements such as sharding and layer 2 solutions, the technology is constantly evolving to improve scalability and efficiency.

What is Trending in Cryptocurrency?

The cryptocurrency landscape is constantly evolving, with several key trends emerging. One such trend is the growth of decentralized finance, which is transforming traditional financial services such as lending and borrowing by removing the need for intermediaries. Concurrently, NFTs have peaked in popularity as unique digital assets verified by blockchain technology. It is often used for digital art, collectibles, and more.

Another trend is stablecoins which offer the stability of a traditional fiat currency combined with the advantages of cryptocurrency. In a wider context, we are witnessing the advent of central bank digital currencies (CBDCs), a development that signifies the potential for nations to establish their own digital currencies. Further, in response to escalating concerns about the environmental footprint of cryptocurrency mining, the community is actively developing more sustainable mining technologies.

What is the Current Trend of Cryptocurrency?

Bitcoin started as a decentralized digital currency, but now the landscape encompasses a wide range of applications, each with its own unique value proposition. Statista reports there are over 9,000 distinct cryptocurrencies as of 2023, each tailored to specific use cases. For instance, Ethereum provides decentralized computing power while VeChain improves supply chain management.

Who Are the Key Players in the Cryptocurrency Market?

In the realm of cryptocurrency exchanges, Binance stands as a global frontrunner, enabling smooth trading across a diverse range of digital assets. Coinbase is another big player known for its intuitive interface and wealth of educational resources.

The NFT marketplace is a bustling sector within the cryptocurrency world. Emerging platforms like Blur are making their mark, offering spaces for trading and showcasing NFTs. OpenSea, one of the largest NFT marketplaces, continues to dominate the scene, while Immutable X carves out its niche with a focus on eco-friendly NFT transactions.

Beyond exchanges and marketplaces, the cryptocurrency landscape is further enriched by an array of developer tools and custody services dedicated to secure crypto management. The mining hardware sector is led by companies like Bit Main Technologies, known for their specialized cryptocurrency mining hardware. Tech giants NVIDIA, AMD, and Intel also provide GPUs vital for various crypto-related tasks, with AMD and Intel also offering systems specifically designed for mining.

Cryptocurrency: A Performance Analysis

Presenting the Cryptocurrency Trend Card – an exhaustive overview of the dynamic digital asset landscape. It features insights into influential players, technical innovations, and regulatory developments. Our data-driven analysis tracks key financial metrics such as market capitalization and liquidity provided by leading investors and institutions steering the crypto market. With a focus on blockchain technology’s transformative effect on various sectors, regions, and financial systems, this snapshot captures the current updates, along with key articles and narratives shaping the discourse. Discover the growth trajectory in the cryptocurrency sector and how the media landscape contributes to its mainstream adoption.

The cryptocurrency trend is experiencing a remarkable annual growth rate of 21.98%, with a trend magnitude of 99.54%. This positions it among the top 1% of all trends covered by TrendFeedr, our trend management tool. Furthermore, its trend maturity score of 9.85% indicates a stable yet dynamic market, with many young companies seeking opportunities for growth and innovation.

Looking for all trends related to cryptocurrencies?

Discover Cryptocurrency Trends & How Companies are Advancing Them

Based on the latest data from TrendFeedr, 53.9K companies specializing in cryptocurrency are also accelerating other emerging trends in the digital asset landscape. Let’s delve into what they’re doing to shape the future of digital assets:

1. Non-Fungible Tokens

- NFTs are unique digital assets on the blockchain, allowing businesses to authenticate and establish rarity in the digital world.

- A staggering 24.2K organizations are delving into this cutting-edge trend, collectively gathering a substantial US$53.9B in funding, peaking in 2022.

- Driven by a dynamic workforce of 532K individuals, these organizations are reshaping the landscape of digital art, collectibles, and wider content markets with verifiable uniqueness and provenance.

2. Layer 2 Frameworks

- Layer 2 frameworks bolster the scalability and efficiency of blockchains by functioning on top of the primary blockchain layer without sacrificing security.

- A specialized yet impactful 859 organizations are driving this trend, attracting a robust US$5.1B in funding.

- These entities, supported by 26.7K professionals, are committed to enhancing cryptocurrency transactions. This facilitates quicker and more cost-effective processes without overloading the main blockchain.

3. Central Bank Digital Currencies

- CBDCs are revolutionizing the financial sector by introducing digital currency alternatives that are directly issued and backed by central banks.

- A total of 385 progressive organizations have ventured into this domain, securing an impressive US$955.5M in funding.

- With a unified team of 29.2K professionals, these institutions are leading the charge in merging traditional and digital financial systems, ensuring stability and trustworthiness.

4. Web3 Cryptos

- Web3 Cryptos lays the foundation for a decentralized internet, empowering users to control their data and digital interactions.

- A total of 971 forward-thinking organizations are exploring this trend, collectively raising US$6.14B in funds.

- Backed by a dedicated team of 24.2K individuals, these entities offer a more transparent, secure, and user-focused digital experience, shifting away from the centralized structures of the existing web.

5. Sustainable Cryptocurrency Mining

- Green crypto mining prioritizes eco-friendly practices in the cryptocurrency mining process to reduce the carbon footprint.

- 1,124 innovative organizations have embraced this sustainable initiative, raising an impressive US$20.06B.

- With a combined force of 46.9K committed experts, these organizations are ensuring sustainable progress in the cryptocurrency industry, striking a balance between technological innovation and environmental responsibility.

A diverse range of companies are leading these different trends within the cryptocurrency industry, from non-fungible tokens to sustainable cryptocurrency mining. Each trend is backed by significant funding and a dedicated workforce, highlighting the dynamic and multifaceted nature of the cryptocurrency landscape.

How Cryptocurrencies Disrupt Industries

Along with representing an asset or technological innovation, cryptocurrency is also a far-reaching trend that is affecting multiple industries. Here are the industries standing at the intersection of this seismic shift:

Financial Services

The influence of blockchain technology on the financial services sector is profound, particularly in the context of the cryptocurrency market. Traditional banking is undergoing a transformation as blockchain-based solutions are being implemented for payment processing, fraud reduction, and improved customer experience. Companies such as Ripple are revolutionizing the way money is transferred, enabling faster and more secure transactions through the use of digital assets.

E-commerce

Cryptocurrency payments have started to gain traction in the e-commerce world. Platforms such as Shopify have embraced this trend, integrating crypto payments into their systems. This integration provides a swift and secure alternative to conventional payment methods, underscoring the growing influence of cryptocurrencies in the digital marketplace.

Healthcare

Cryptocurrency is revolutionizing the healthcare industry by streamlining transactions and incentivizing patient engagement. Platforms such as Solve.Care is at the forefront of this movement, rewarding patients with its own cryptocurrency, SOLVE, for healthcare benefits. These tokens can be used within the Solve.Care ecosystem to pay for a variety of healthcare products and services.

Real Estate

In traditionally complex and paper-intensive real estate, cryptocurrencies and smart contracts are introducing transformative simplifications. Companies such as Propy are utilizing blockchain to streamline international property transactions, making the process more transparent, secure, and efficient. Moreover, the tokenization of real estate assets allows for fractional ownership, democratizing access to real estate investment.

Cryptocurrency is a disruptive force that is transforming multiple industries, including financial services and healthcare. By utilizing the power of blockchain technology, cryptocurrencies are revolutionizing the way transactions are conducted, assets are managed, and data is secured across various sectors.

Pioneering Organizations: Who is Riding the Cryptocurrency Wave?

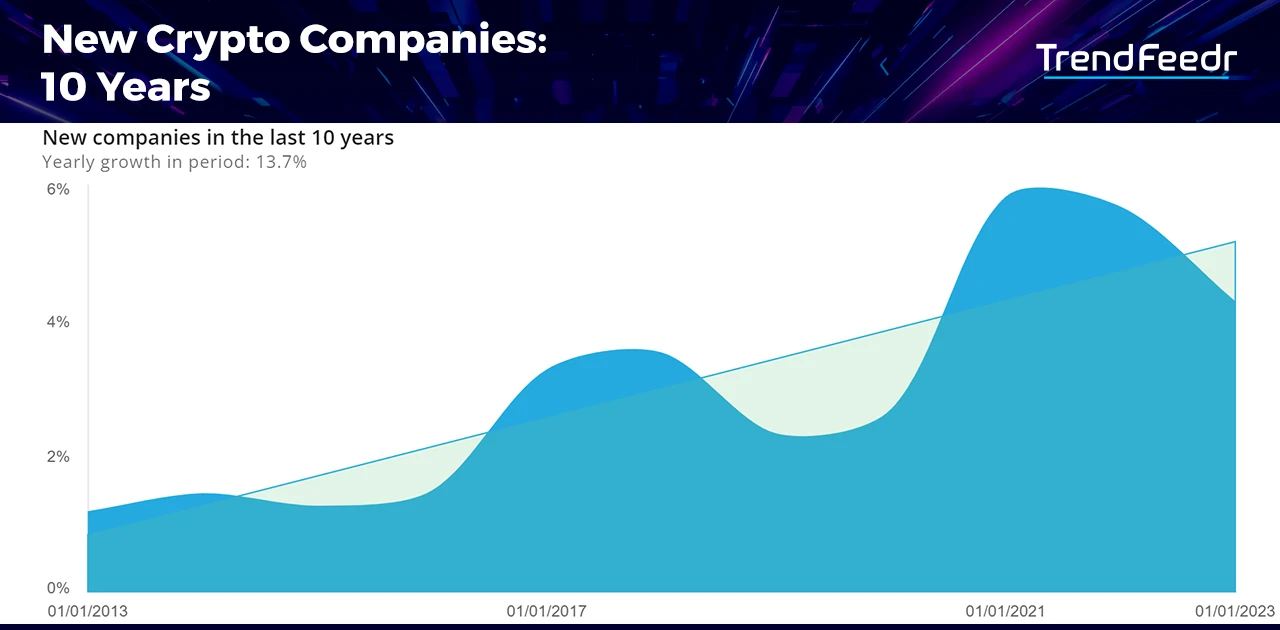

The cryptocurrency trend is experiencing strong organizational growth, placing it in the top 10% of all trends.

The line chart demonstrates a steady growth of 13.7% in the number of crypto companies founded over the past decade. This growth rate suggests that not only are established companies adapting to include cryptocurrencies, but new players are also entering the market and finding opportunities for innovation and expansion.

Moreover, innovative startups are addressing some of the most significant challenges in the industry, including secure and fast cross-border payments, DeFi, and tokenized asset management. By harnessing the power of blockchain, these companies are also focusing on essential features such as smart contracts, scalability solutions, and privacy-enhanced transactions.

Let’s take a closer look at the top cryptocurrency startups founded in the past six years:

- Plisio – A payment service provider (PSP) that facilitates payments, receipts, and storage of digital currency.

- Moonbeam – A smart contract platform that enables building connected applications with cross-chain access to users, assets, and services.

- CryptCard – A cryptocurrency credit card provider that simplifies and secures crypto payments, empowering customers to spend in digital currencies.

- DropsTab – A cryptocurrency market tracker that offers real-time analytics, monitoring, and portfolio management for crypto enthusiasts.

- CoinSmart – A digital asset trading platform that provides an intuitive interface for buying and selling digital assets, coupled with seamless fiat on-ramping and off-ramping.

The cryptocurrency sector employs a total of 1.6 million individuals. The average size of organizations is 45 employees, while the median size is 11. This indicates that while there are many smaller startups, there is also a significant number of larger, more established companies. Additionally, the sector has experienced impressive employee growth, with a yearly increase of 209,600 employees. The average employee growth rate for companies is 8 employees per year, while the median is 3. This suggests that some companies are expanding rapidly, and the majority have a more moderate growth rate. This could be due to various factors such as market maturity, capital constraints, or strategic focus.

Financial Commitment to Cryptocurrency

In terms of financial backing, the total funding allocated to cryptocurrency initiatives ranks among the top 5% of over 20,000 trends and technologies, demonstrating significant investor interest. Additionally, cryptocurrency ranks in the top 10% for funding growth, indicating strong and sustained support.

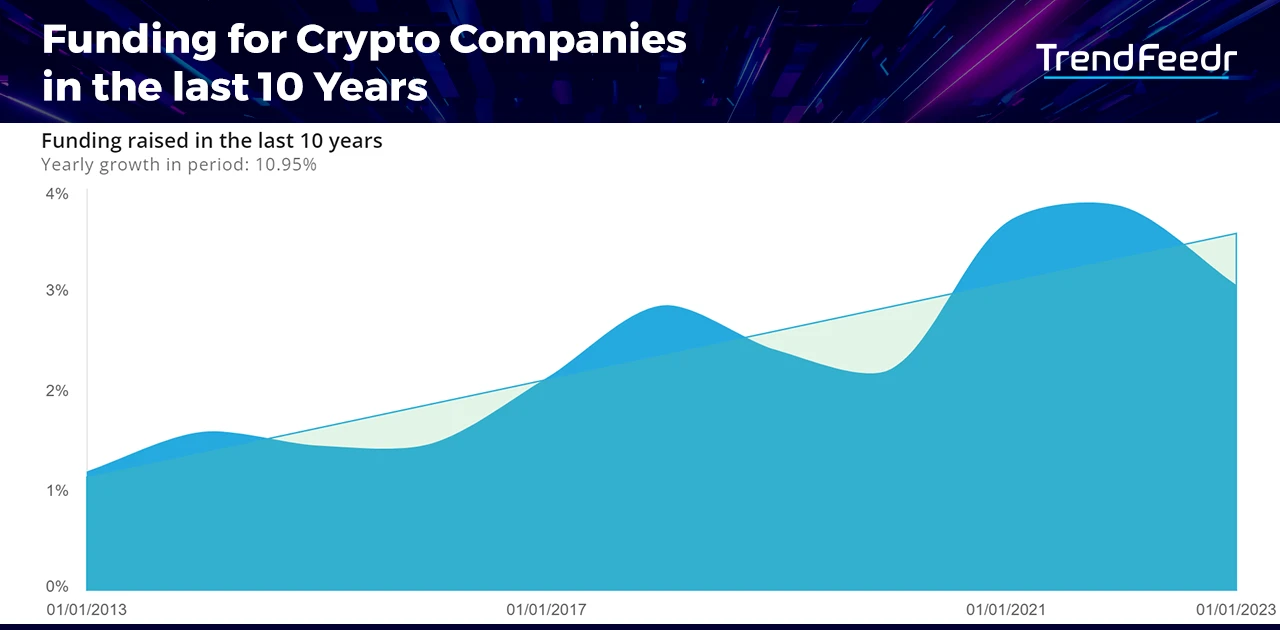

In fact, over the past decade, investment in this sector has grown by 10.95% yearly, as demonstrated by the line graph below.

Digital Currency Investment Trends

Cryptocurrency has seen significant monetary backing – a total funding of US$200 billion according to TrendFeedr data. Funding amounts range from a high of US$1.3 billion to an average of US$20.8 million and a median of US$2.4 million. This indicates that a few major players attract the majority of financial support.

According to estimates, the total revenue generated by the cryptocurrency industry is a robust US$300 billion. While the average revenue per organization is US$7 million, the median revenue is a more modest US$1.8 million. This suggests that the average revenue figures are significantly inflated by a few big players in the industry.

Further, the cryptocurrency landscape is characterized by various funding stages. Seed rounds often serve as the initial stepping stones for budding crypto startups. Early-stage VC/Series A funding typically acts as a significant catalyst, driving promising companies towards higher valuations. Pre-seed rounds are usually the initial spark for nascent ideas in the crypto realm. Venture Rounds often signify a mature stage of business expansion, leading to a wider impact within the industry. Accelerator/Incubator rounds act as a growth platform for emerging firms, offering both financial support and operational guidance.

Interestingly, grants remain a largely untapped resource, with only 0.93% of cryptocurrency companies benefiting from a total of 681 grants.

Cryptocurrency Funding Examples

Binance Labs is at the forefront of investment in the cryptocurrency sector, with a staggering US$6 billion invested across 24 diverse companies. Its most significant investments include Bitquery, which was funded with US$8.5 million.

Andreessen Horowitz is another major player in the sector, with a significant cryptocurrency investment pool of US$3.3 billion spread across 45 companies.

Paradigm also makes a notable appearance, with US$1.9 billion invested across 36 companies. Its portfolio includes standout investments in Genesis Digital Assets and SkyMavis, with funding of US$431 million and US$302 million respectively. This demonstrates its commitment to both established and emerging players in the market.

It is also important to highlight the role of public investment in shaping the crypto landscape. Public institutions have invested US$2.6 billion in 26 different ventures, with New World Resources receiving significant funding of US$2.2 billion.

Moreover, the diversity of investment in the cryptocurrency space is noteworthy, with the unique investor count belonging to the top 5% of all trends.

Cryptocurrency Hubs: Mapping Global Adoption

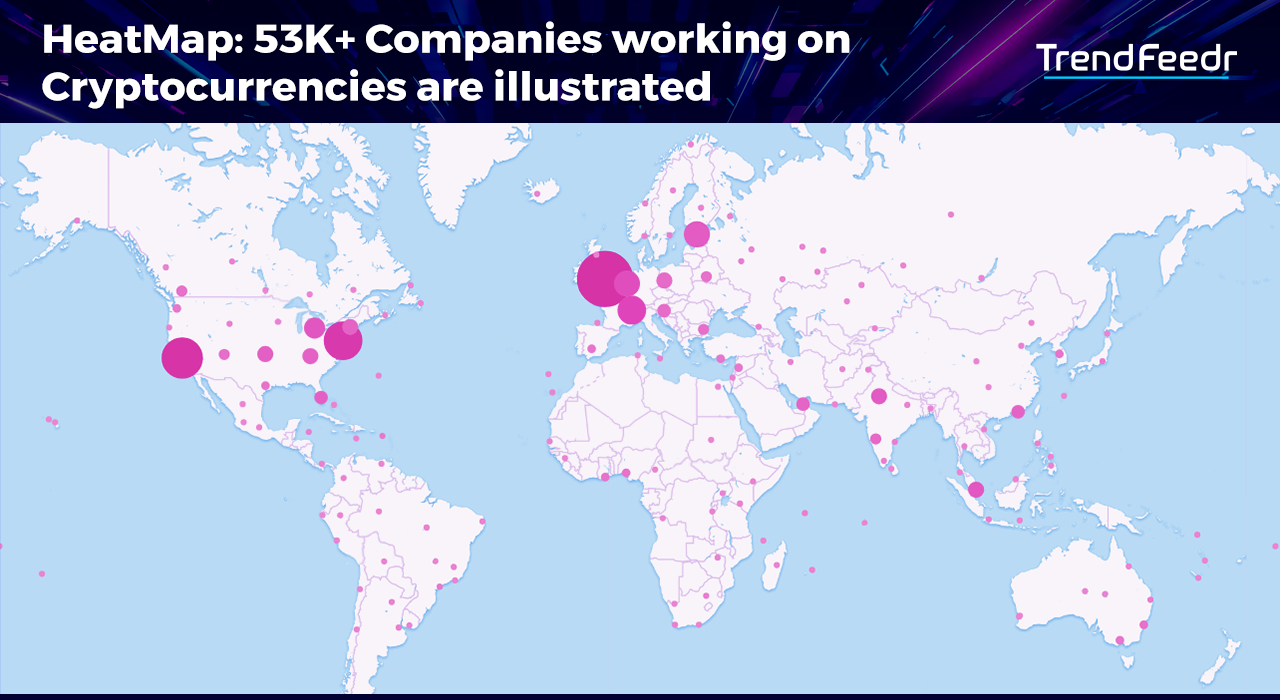

The map below offers a visual representation of the 53.9K cryptocurrency companies located around the globe, showcasing the widespread interest in this sector.

Interested to explore all 53K+ cryptocurrency companies?

The United States is currently leading the pack, thanks to supportive laws and a strong network of investors, startups, and big tech companies. China is not far behind, but stricter regulations on cryptocurrency have slowed its growth.

Meanwhile, India and El Salvador are quickly catching up. India’s young population and growing tech industry have sparked a surge in cryptocurrency activity. El Salvador has taken a bold step by making Bitcoin an official currency, which has boosted its reputation in the crypto world.

Russia is somewhere in the middle, with a slight increase in cryptocurrency use. However, unclear regulations have left many potential investors unsure and waiting for more guidance from the government.

If we look at cities, London and New York City stand out as major centers for cryptocurrency because of their status as financial capitals. Singapore is also a key player due to its strategic location and friendly regulations. San Francisco is known for its tech scene, which includes cryptocurrency. Lastly, Tallinn, the capital of Estonia, is becoming known as a growing European tech hub that’s contributing to the crypto world in its own quiet way.

Cryptocurrency Coverage Skyrockets with a 26.4% Annual Surge

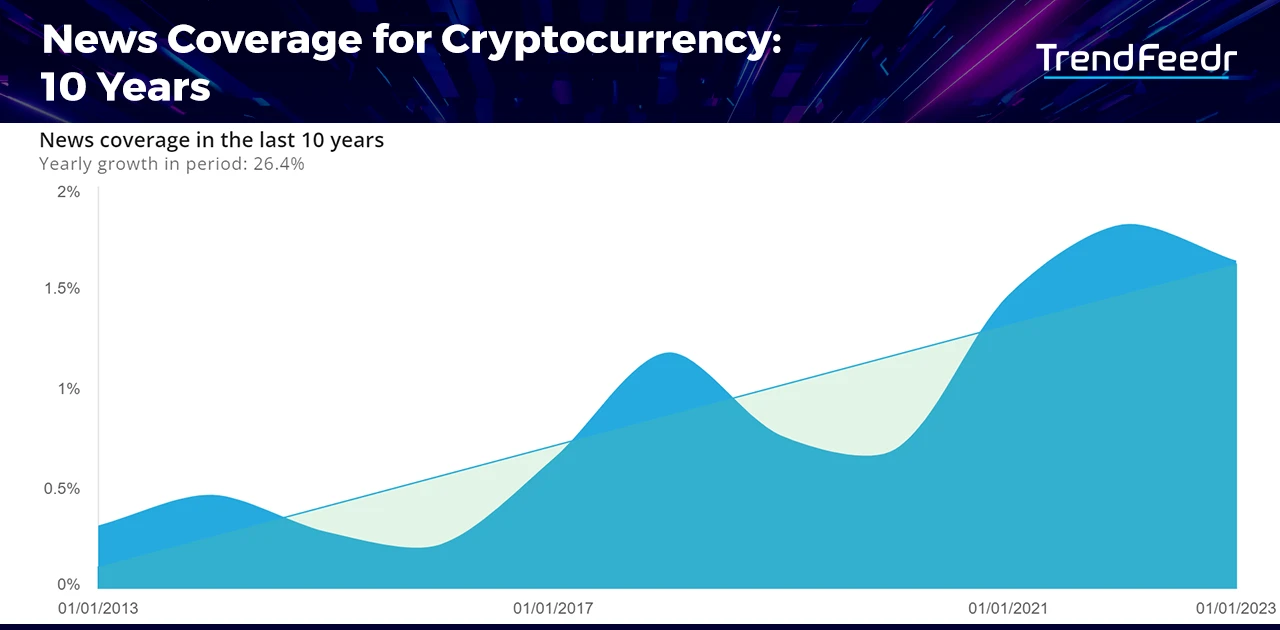

The time series chart shows a remarkable 26.4% annual growth in media coverage of cryptocurrency over the past decade, highlighting its rapidly expanding influence and public interest. This sustained attention reflects not only the maturing landscape of the technology but also its position among the top 5% of all trending news topics.

Further, the cryptocurrency sector attracting significant media attention is in the top 5% among all industry trends in terms of publication coverage growth. The volume of articles related to cryptocurrency is impressive, placing it in the top 5% of all trends with an astounding 726,722 articles published between 2008 and 2023.

Future Outlook of Cryptocurrency

The trajectory of cryptocurrencies is influenced by a multitude of factors, making the future of crypto trends nuanced. Here are some key areas that will shape the future of cryptocurrency in the coming years:

1. Policy and Regulatory Changes

The global rise of cryptocurrencies has presented challenges to existing financial systems due to inconsistent regulatory guidelines. Governments worldwide are now adapting their frameworks to ensure the safe and widespread adoption of these digital currencies by introducing both pro-crypto regulations and necessary stricter policies.

2. Technological Advancements

Current limitations in scalability, speed, and security pose challenges to the wide-scale adoption of cryptocurrencies. However, new protocols and consensus algorithms are being developed to address these concerns and redefine the technological landscape.

3. Mainstream Adoption

Cryptocurrencies face challenges in achieving widespread acceptance due to complexities in usage. However, as they become more user-friendly, a significant surge in mainstream adoption is anticipated. This will be further propelled by corporations integrating crypto payments and blockchain solutions into their established business frameworks.

4. Institutional Investment

The hesitancy of institutional investors has historically limited the perceived legitimacy of the crypto realm. Yet, as prominent companies embrace cryptocurrencies, this trend is shifting, adding validity and paving the way for a broader influx of institutional investment in the near future.

5. Global Economic Conditions

Cryptocurrency markets remain susceptible to broader global economic conditions with events like economic downturns, pandemics, or geopolitical tensions potentially swaying market dynamics. Depending on the specific circumstances, these events can either propel increased interest and investment in cryptocurrencies or deter potential investors, reflecting the market’s inherent volatility and responsiveness to global shifts.

How to Keep Up with the Advancements in the Cryptocurrency Landscape?

The world of cryptocurrency is rapidly evolving, with new innovations and trends emerging constantly. The future of cryptocurrencies looks promising, with data indicating sustained growth. Breakthroughs from various players are driving us towards a more integrated financial future powered by crypto.

To stay competitive and align your business strategies with this dynamic landscape, it’s crucial to stay informed. How can you do this? Explore niche cryptocurrency publications, engage in dedicated online forums, follow insights from crypto experts, and attend relevant webinars and conferences. A trend intelligence tool like TrendFeedr also is a valuable resource, it tracks as many as 379 cryptocurrency sub-trends. This way, it provides you with insights into emerging trends in the cryptocurrency space.

By keeping up with the latest developments in the cryptocurrency world, you get to make informed business decisions that align with the market’s changing demands.