This oil and gas industry trends report explores the recent innovations that are reshaping energy production and management within the industry. The application of AI-powered analytics, Internet of Things (IoT) technologies, and sophisticated robotics are revolutionizing upstream operations. These technological breakthroughs are increasing efficiency, mitigating environmental impacts, and aligning the industry with sustainability objectives. The integration of renewable energy and carbon capture and storage (CCS) solutions signifies a deliberate effort to reduce the sector’s carbon emissions. These initiatives are vital for environmental sustainability and also for the industry’s long-term resilience.

From a financial standpoint, the industry’s evolution is characterized by substantial growth and influence. As per The Business Research Company, the global oil and gas market size escalated from US$6,989.65 billion in 2022 to US$7,330.80 billion in 2023. This marks a compound annual growth rate (CAGR) of 4.9%. These oil and gas market trends are anticipated to persist, with the market projected to grow to US$8,670.91 billion by 2027, at a CAGR of 4.3%.

In this data-driven oil and gas industry trends report, we delve into the current trends in oil and gas, emphasizing oil and gas exploration, oil and gas security, IoT, 3D visualization, and advanced analytics. For this detailed analysis of O&G trends, we used TrendFeedr, our all-in-one trend intelligence platform. TrendFeedr uses advanced algorithms to identify future industry and tech trends. With a focus on trend discovery, clustering, and analysis, the AI-powered platform reviews thousands of trends each week to provide actionable insights.

Key Takeaways

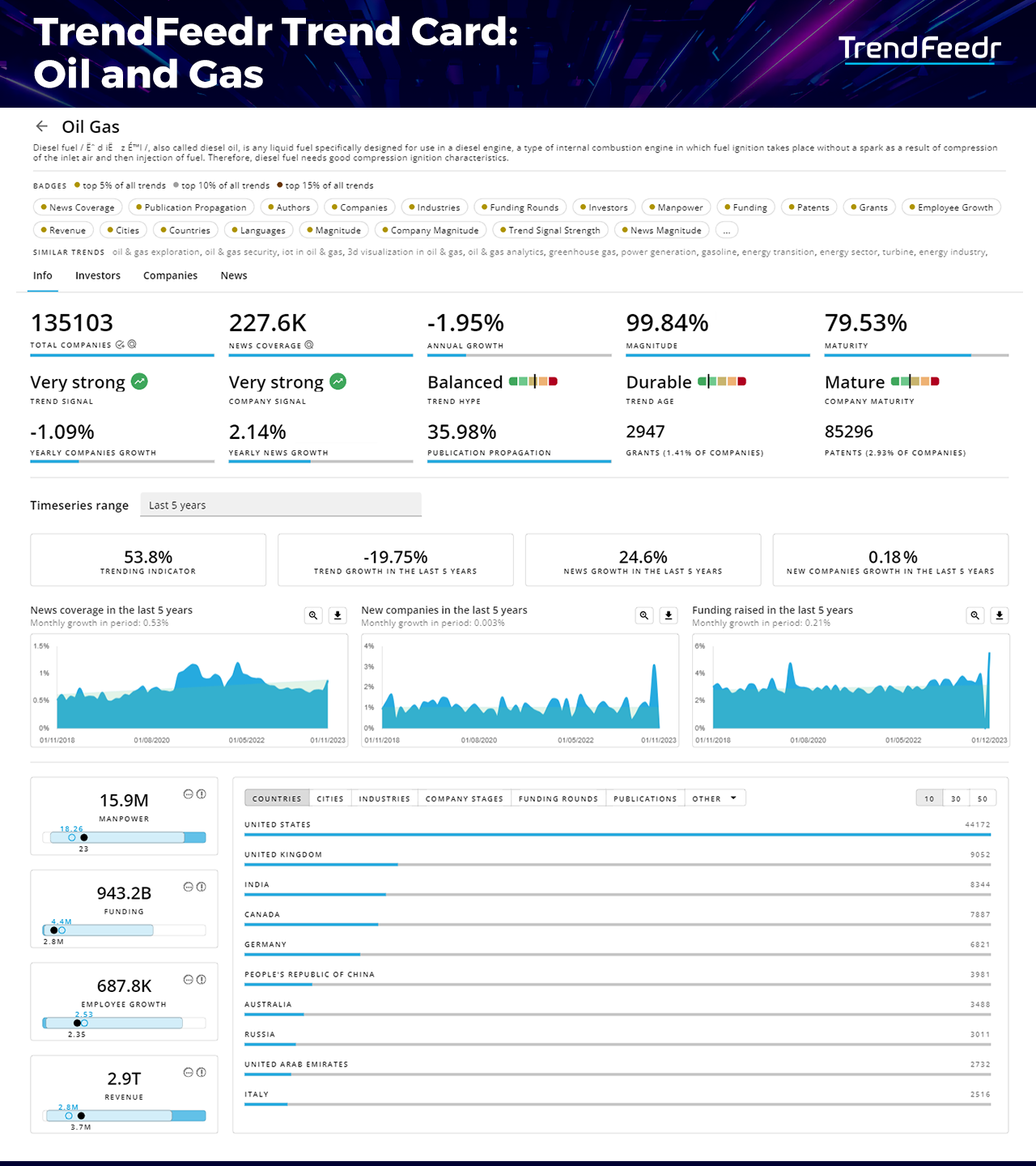

- Dominant Trend: TrendFeedr’s data reveals that the oil and gas industry, with a trend magnitude of 99.84% and a trend maturity of 79.53%, emphasizes its crucial position in the global energy

- Technological Diversification: Companies within the oil and gas sector are progressively broadening their technological pursuits, focusing on trends such as exploration, security, IoT, 3D visualization, and analytics in oil and gas.

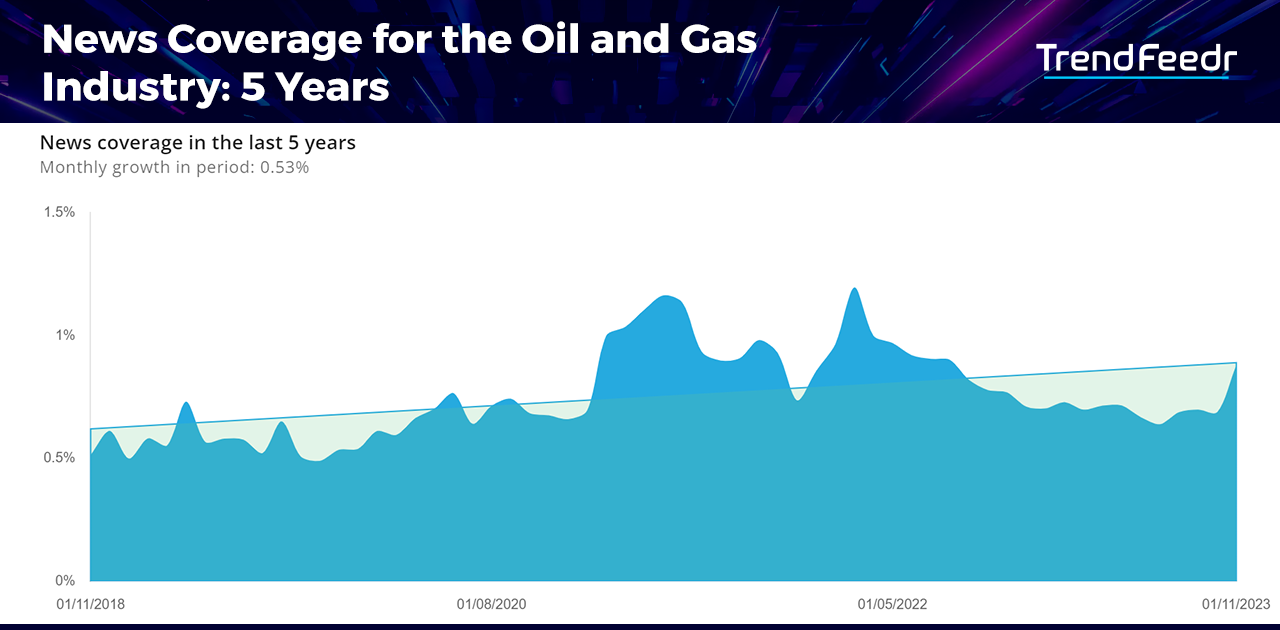

- Media Coverage: Over the past 5 years, the sector has seen a steady monthly growth of 0.53% in news coverage.

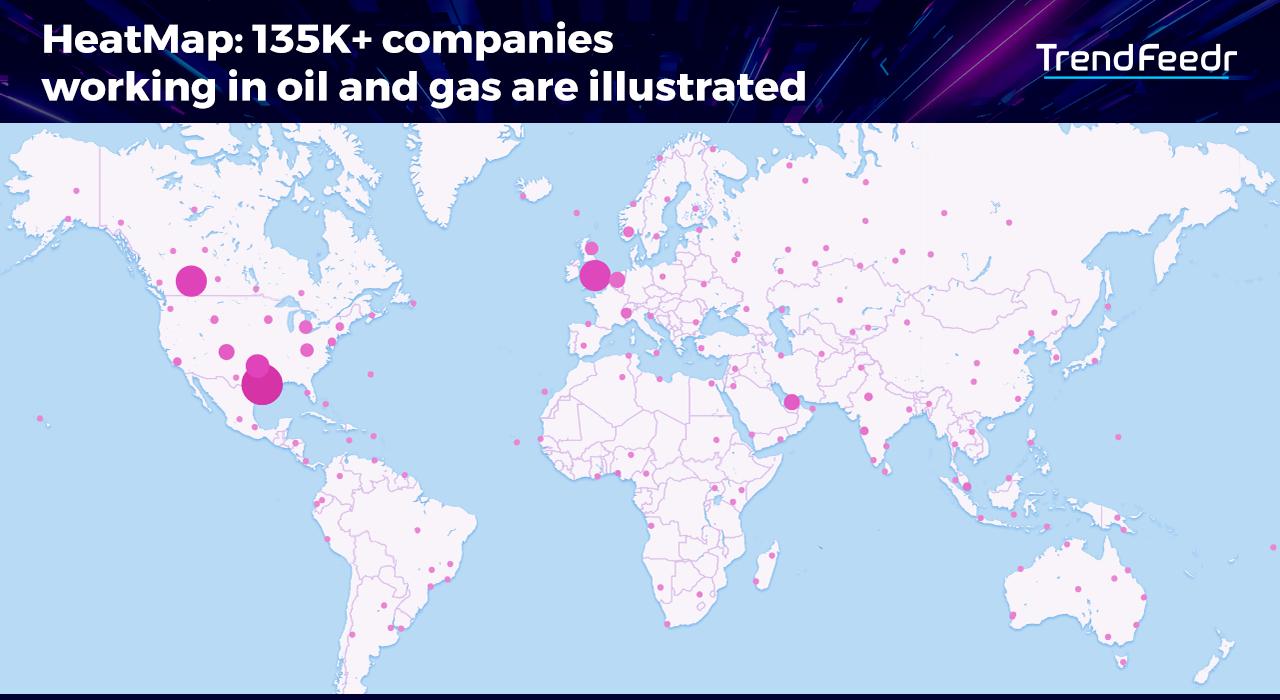

- Organizational and Funding Landscape: The oil and gas industry is a massive global player, with approximately 135,000 entities actively involved, collectively attracting US$943.2 billion in investment capital.

- Major Investors include EnCap Flatrock Midstream, Warburg Pincus, and Quantum Energy Partners are infusing billions in oil and gas ventures.

- Global Presence and Leadership: The United States, the United Kingdom, India, Canada, and Germany lead the oil and gas sector. Key cities like Houston, Calgary, London, Dubai, and Mumbai also play pivotal roles.

Table of Contents

- Understanding Oil and Gas Industry Trends

- Oil and Gas Industry Trend Card

- Emerging Trends & Technologies Disrupting the Oil and Gas Industry

- 5 Key Oil and Gas Industry Trends

- 5 Emerging Oil and Gas Industry Companies

- Oil and Gas Industry Investment Trends

- Mapping Global Oil and Gas Companies

- Media Coverage for the Oil and Gas Industry

- Future of the Oil and Gas Industry

Understanding Oil and Gas Industry Trends

The oil and gas industry is undergoing a significant transformation, marked by a series of evolving trends. These trends reflect the industry’s response to environmental concerns, technological advancements, and changing market dynamics.

What are the trends in the oil and gas industry?

A growing emphasis on sustainability and environmental stewardship is evident, with efforts to reduce carbon footprints and implement eco-friendly practices. This includes investments in renewable energy sources, CCS, and more efficient utilization of resources.

The industry is also undergoing a digital transformation. It is leveraging technologies such as AI, big data, analytics, and IoT to optimize operations, enhance safety, and improve decision-making processes.

In response to fluctuating oil prices, there is a concerted effort to improve operational efficiency and reduce costs, often through technological innovations and process optimizations. Lastly, there is an enhanced focus on supply chain optimization for better resilience and efficiency, particularly in the wake of global disruptions like the COVID-19 pandemic.

What are emerging technologies in the oil and gas Industry?

The implementation of advanced robotics and automation is enhancing safety and efficiency in exploration, drilling, and maintenance activities. The deployment of the IoT allows for real-time data collection and monitoring, enabling predictive maintenance and operational insights.

Moreover, AI and machine learning enable data analysis and predictive analytics for driving operational efficiencies across various industry segments. The adoption of blockchain is also enhancing transparency, security, and efficiency in supply chain management. Lastly, 3D printing allows companies to create equipment parts on-demand, reducing lead times and costs associated with spare parts inventory.

Oil and Gas Trend Card: Explore the Most Recent Developments in the O&G Landscape

The Oil and Gas Trend Card offers a comprehensive overview of the industry’s current state and emerging patterns, providing valuable insights into key metrics:

Looking for all trends related to the oil & gas industry?

- Industry Overview: The oil and gas sector, with its robust network of 135,103 companies, continues to be a formidable force in the global market.

- Sector Maturity: The sector’s maturity index stands at 79.53%. This maturity, coupled with a durable trend age, underscores the sector’s established nature and its potential for sustained growth and relevance.

- Media Engagement: The industry has been the focus of 227.6K news stories, indicating a balanced trend hype. Even with a minor dip in news growth over the past 5 years, the sector continues to command significant attention in the global narrative.

- Innovation Focus: The industry’s commitment to innovation is evident in the 85,296 patents filed and 2,947 grants provided.

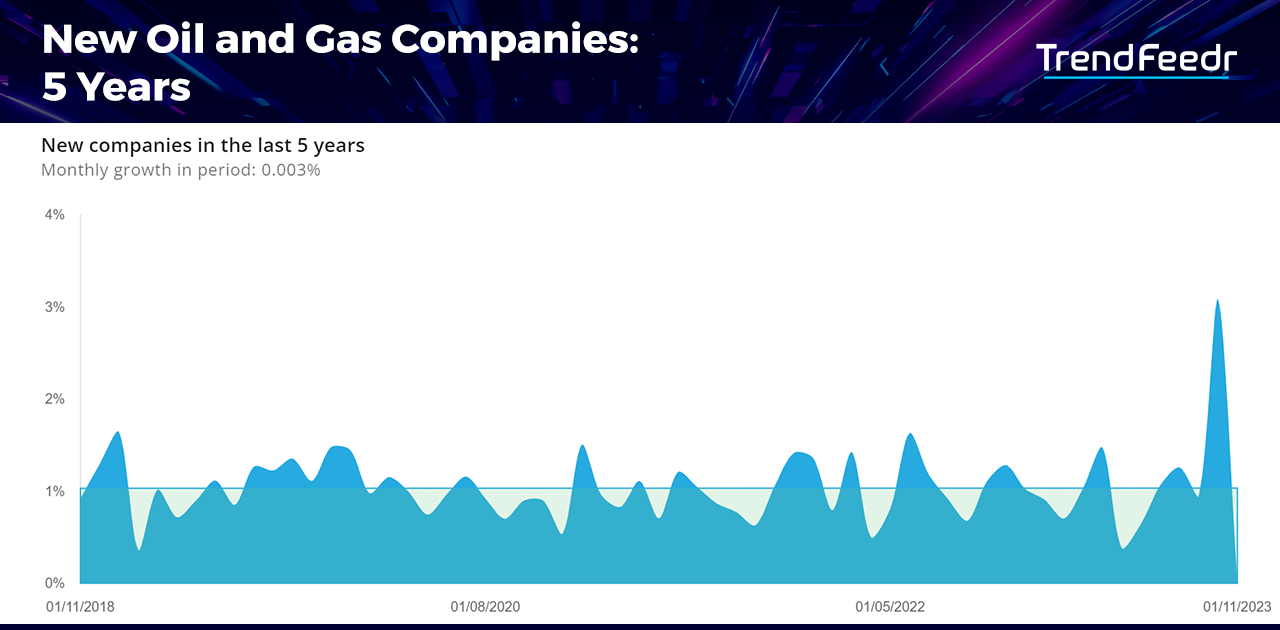

- Financial Dynamics: The industry has attracted a total funding of US$943.2 billion. However, the number of new companies has seen only a small increase of 0.18% over the last 5 years, possibly signaling a phase of market maturity or saturation.

- Workforce & Economic Impact: With a manpower of 15.9 million, the industry plays a significant role in job creation. The sector’s economic impact is substantial, generating a revenue of US$2.9 trillion.

- Global Presence: The United States leads the industry, with the United Kingdom and Canada also making significant contributions.

Keep reading as we unpack these intriguing numbers and their implications, offering a deeper understanding of the oil and gas sector’s trajectory and its pivotal role in shaping the future.

How Do Emerging Trends and Technologies Disrupt the Oil and Gas Industry?

As we look into oil and gas industry advancements, we see practical impacts and the dynamic evolution unfolding within this robust sector.

1. Oil and Gas Exploration

Adopting technologies such as horizontal drilling, seismic imaging, hydraulic fracturing, and offshore drilling, allows O&G companies to improve efficiency and sustainability. Further, the development of 4D seismic technology is enhancing exploration and reservoir management.

For example, SEIMAX Technologies develops SeisUP, its software for processing large volume 2D and 3D seismic surveys for oil and gas exploration. The software offers a full range of 2D and 3D land and marine processing services for companies to reduce exploration risk. The startup also provides 5D interpolation to optimize subsurface imaging and galvanize seismic libraries through 3D survey merging.

2. Oil and Gas Security

Security in oil and gas involves the use of technology like surveillance systems and access control for oil rigs and pipelines. Such solutions allow businesses to manage resources, detect risks, and ensure authorization, thereby ensuring the uninterrupted availability of energy sources.

Terra Sound, for instance, combines intelligent software, specialized sensors, and fiber optic cables to monitor vibrations around assets and facilities. Its product, SafeGuard, leverages fiber optic cable to detect sound waves from dangerous conditions near critical in-ground assets like pipelines and telecommunications cables.

3. Internet of Things

IoT in this industry includes a network of devices with embedded sensors, software, and network connectivity that enables data collection and exchange. This technology allows for remote monitoring, predictive maintenance, and optimization of production processes.

Startups such as HazTrack develop wireless remote tank monitoring sensors. These devices are mounted inside a chemical tank and report tank level, pump rate, temperature, GPS location, and impact events. They send custom alerts to maximize operational efficiency while assisting companies in reducing their environmental impact.

4. 3D Visualization

By creating 3D subsurface models, oil and gas companies get a better understanding of geology and identify issues such as soil erosion early on. 3D visualization thus allows for detailed analysis and optimization of exploration and production processes as well as reduces costs significantly.

Geotexera is a startup that develops geophysical modeling and inversion software. Its MAGNUM supports a wide range of geophysical methods while PODIUM is a suite of utilities for data preparation and mesh generation. These software products feature various inversion techniques including independent, joint, constrained, and clustering inversions. They support magnetic, gravity, seismic, and other geophysical data types.

5. Oil and Gas Analytics

Leveraging big data, oil and gas companies analyze data from various field devices. It is used for reservoir characterization, reservoir behavior analysis, and estimated recovery forecasting. Oil and gas analytics thus allows O&G plants to increase production rates, optimize operations, and enhance decision-making.

Startups like Nsight Analytics convert raw data from oil and gas drilling operations into actionable business intelligence. Nsight Analytics offers a machine learning-assisted drilling optimization service that involves the consumption, ingestion, and enrichment of drilling data. It then recommends optimal drill bits and drilling parameters, identifies inefficiencies, and generates automated reports using real-time and historical operational data.

Key Oil and Gas Trends and Firmographic Insights

Coming to workforce statistics, the oil and gas industry employs 15.9 million individuals. The average company size, with 158 employees, suggests that the industry is composed of a mix of large corporations and numerous medium-sized enterprises. The median employee count of 23 indicates a considerable number of smaller or more specialized firms, contributing to the industry’s diverse ecosystem.

The annual increase of 687.8K employees reflects the sector’s vitality and its capacity to generate employment opportunities. The average annual employee growth rate per company is 8, while the median is 2. This suggests that while some companies are experiencing rapid expansion, the majority are growing at a more measured pace.

Let’s delve into the market evolution of five key trends that we discussed. For each trend, we will examine the companies involved, the total investment, and the workforce engaged.

1. Oil and Gas Exploration

- Novel technologies for O&G exploration identify potential drilling locations by analyzing geological and seismic data. This, in turn, optimizes resource extraction.

- This critical endeavor is driven by 3,385 organizations, collectively securing US$271.5 billion in funding.

- These entities employ a significant workforce of 680.9K professionals, spearheading advancements in exploration technologies.

2. Oil and Gas Security

- Oil and gas security solutions protect infrastructure and data against physical and cyber threats, ensuring uninterrupted and safe operations.

- A total of 430 organizations are dedicated to this vital aspect, having raised US$1.3 billion in funding.

- The sector employs 43.5K individuals, who specialize in safeguarding the industry’s operations.

3. Internet of Things

- By real-time monitoring and control of equipment, IoT improves efficiency and safety as well as enables predictive maintenance in the oil and gas sector.

- This innovative trend is embraced by 350 organizations, collectively amassing funding of US$3.43 billion.

- It employs a dedicated workforce of 18,939, who are instrumental in integrating IoT technologies for enhanced industry performance.

4. 3D Visualization

- Creating detailed 3D models of geological formations, 3D visualization aids in planning and decision-making for exploration and drilling.

- Spearheading 3D Visualization are 294 organizations, with a total funding of US$729.7 million.

- The sector employs 11,749 professionals, leveraging 3D technology to provide clearer insights into complex operations.

5. Oil and Gas Analytics

- By analyzing large data sets, analytics platforms in oil and gas optimize production, forecast trends, and enhance decision-making in exploration, production, and distribution.

- Oil and gas analytics involves 157 organizations and has attracted funding of US$294.3 million.

- A skilled workforce of 7,505 is at the forefront, turning data into actionable insights for the industry.

Each of these trends highlights a unique aspect of the oil and gas industry’s evolution, fueled by a combination of innovation, investment, and dedicated manpower.

5 Emerging Oil and Gas Companies

Despite market volatility, the oil and gas sector has seen a consistent influx of new entrants over the past five years, as indicated by a monthly growth rate of 0.003%. This modest growth highlights a calculated expansion strategy. It is shaped by the industry’s capital-intensive nature and the need for careful navigation in light of geopolitical and environmental factors.

5 Promising Oil and Gas Startups

Startups in the oil and gas sector introduce innovative technologies and strategies, reshaping conventional energy sectors. They bring advanced exploration techniques, enhanced oil recovery methods, digital transformation in oilfield operations, and sustainable practices, tackling the pressing challenges of efficiency, safety, and environmental impact. Let’s delve into five oil and gas startups established in the last five years, highlighting their contributions to the future of energy:

- inerG develops an energy asset management platform to achieve optimal returns through timely insights on production yields, costs, and risks.

- RevSolz builds a cloud-based AI platform that optimizes frac wells using aggregated surface data, delivering state-of-the-art IoT fracking solutions.

- Applied Impact Robotics develops a robotic solution to inspect an in-service crude oil tank floor.

- Geolog Technologies leverages advanced analysis technologies to deliver high-efficiency solutions across the oil, gas, and geothermal industries.

- ANIAN provides specialized asset tracking and geolocation services for the oil and gas industry.

Oil and Gas Industry Investment Trends

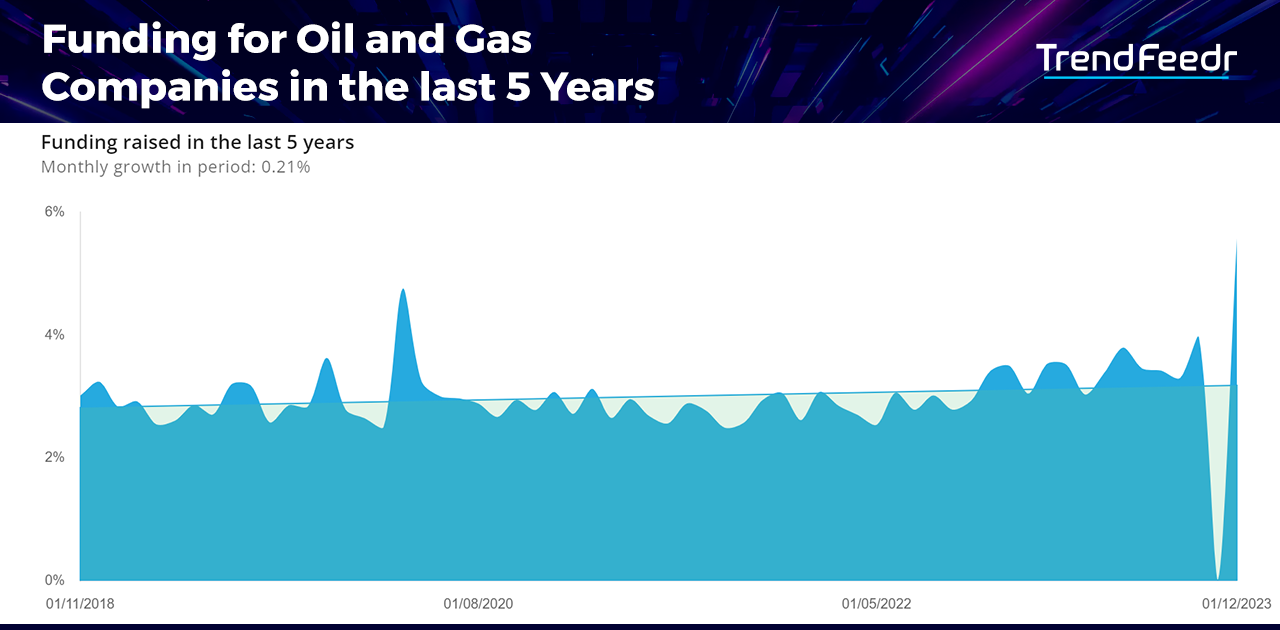

In terms of financial backing, the total funding for the oil and gas industry trends is in the top 5% of all 20K+ trends and technologies covered by TrendFeedr.

Over the past five years, the industry demonstrated a steady monthly growth rate of 0.21% in funding. This indicates a consistent flow of capital into the sector despite the fluctuating nature of global energy markets and economic cycles.

A Closer Look at the Financials

According to TrendFeedr, the oil and gas industry has attracted an impressive total funding of US$943.2 billion. The funding landscape is diverse, with the highest reported investment being US$6 billion in ONEOK. On average, companies have received about US$94.9 million, with a median funding level of US$2.8 million.

When it comes to revenue, TrendFeedr estimates the oil and gas industry stands at US$2.9 trillion. The highest revenue recorded by a single entity is US$2.8 billion in Calpine, demonstrating the significant earning potential within this sector. The average revenue across the industry is calculated at US$28.2 million, with a median of US$3.7 million, indicating that a wide range of companies contribute to the overall financial health of the industry.

7.36% of oil and gas companies have successfully navigated through various funding stages to fuel growth and innovation. The venture round is a critical phase for companies aiming to scale up operations after proving their product’s market fit. Meanwhile, grants, with 2947 awarded representing 1.41% of companies, serve as a crucial lifeline for research and development without diluting ownership. Seed funding marks the beginning of many startups’ journeys, providing the essential capital to take their first steps in the competitive oil and gas arena.

For those with an established track record, early-stage VC or series A funding offers a significant boost, enabling them to refine their business models and operations. Lastly, debt financing provides a pathway for more mature companies to secure funds they need to grow, with the commitment to repay the borrowed amount with interest, reflecting a common strategy among well-established players in the industry.

Prominent Investors in the Oil & Gas Industry

EnCap Flatrock Midstream stands out with a substantial investment totaling US$6 billion across 19 companies. Notably, Rangeland Energy and Greenfield Midstream are among the top recipients, with investments of US$800 million and US$750 million respectively.

Warburg Pincus has allocated US$4.9 billion to 28 companies, with WildFire Energy and Trident Energy each securing US$500 million, showcasing its significant stake in the industry’s growth.

Quantum Energy Partners rounds out the list with investments of US$2.4 billion in 12 companies. High-impact investments include US$600 million in Trace and US$500 million in FireBird Energy, indicating a focused strategy on midstream and upstream segments.

In the public investment arena, a whopping US$20.2 billion has been invested across 401 companies. Leading the charge, Nexa received US$496 million, and Jovo secured US$446.9 million, evidencing the considerable public confidence in the oil and gas sector’s prospects.

The unique investors dedicated to this industry’s trends rank in the top 5% of all trends, showcasing the sector’s strong investment appeal and potential for innovation.

Mapping Oil and Gas Companies around the Globe

Our heatmap provides a comprehensive snapshot of the current oil and gas landscape, showcasing around 135,000 companies accelerating innovations in this field.

The United States is at the forefront of the global scene, with many oil and gas firms leveraging the country’s natural resources and advanced technology. The United Kingdom, too, holds a robust position, bolstering energy trade and investment. India is making its mark as a significant player, with a surge in oil and gas activities driven by escalating energy demands. Canada continues to be a pivotal player, albeit grappling with environmental concerns and market access issues. Additionally, Germany has witnessed a slight growth in its oil and gas company presence, primarily attributed to technology-driven solutions and a commitment to energy transition.

On a city-specific level, Houston emerges as the epicenter of the oil and gas industry, housing a multitude of companies and industry titans. Calgary reflects a similar trend in Canada, serving as the base for the majority of Canada’s oil and gas operations. London also continues to enable the flow of capital and international deals vital for the oil and gas markets. Dubai, owing to its strategic geographic location, has experienced a boom in oil and gas activities. It is capitalizing on its connectivity and conducive investment environment. Concurrently, Mumbai is swiftly establishing itself as a central hub in Asia, mirroring India’s growing investment in the oil and gas sector.

Interested to explore all 135K+ oil and gas companies?

Media Coverage for Oil and Gas Sees a Monthly Uptick of 0.53% Over the Last 5 Years

A closer examination of the time series chart reveals a steady monthly increase of 0.53% in media coverage related to the oil and gas industry over the past five years. This trend underscores the industry’s evolving significance in the global energy landscape and its profound impact on economies and environmental considerations. Noteworthy events such as the economic recovery post-pandemic in 2021 and the Russian invasion of Ukraine in 2022 have introduced considerable disruptions and uncertainties, thereby contributing to the surge in news coverage.

Further, the oil and gas sector demonstrates a remarkable presence in media, with its growth in publication coverage ranking within the top 5% of all trends. From 2005 to 2023, a total of 227,021 articles have been published about oil and gas, positioning it within the top 5% of all trends.

What is the Future of the Oil and Gas Industry?

Given the current trajectory and available data on oil and gas industry trends, we can anticipate several developments in the future. Here’s the oil and gas outlook:

Increased Digitization

The oil and gas industry is set to further embrace digitization, backed by consistent investment in technologies such as IoT, AI, and automation. These technologies are expected to permeate all facets of the industry, from exploration to distribution, bolstering efficiency, safety, and environmental monitoring.

Innovation in Operations

The industry will witness a surge in innovative operational methods. This includes the utilization of advanced materials, the adoption of 3D printing for parts manufacturing, and the introduction of novel exploration and recovery techniques. These technologies allow O&G businesses to reduce costs and their carbon footprint.

Enhanced Collaboration and Strategic Partnerships

The oil and gas industry is poised to witness an increase in collaboration and strategic partnerships. This will take the form of joint ventures between oil companies and renewable energy firms, partnerships with technology providers for digital transformation, and collaborations with governments for infrastructure development.

Oil and Gas Trends: Steering the Course of Energy Transformation

As we wrap up our oil and gas industry trends report, it is clear that we are moving through a rapidly changing landscape. The pace of discoveries is fast, and the range of possibilities seems endless. Keeping up with these changing trends is very important. It allows you to anticipate changes, take advantage of new opportunities, and stay ahead in a field that is shaping the future of technology. But how do you do that?

Connect with oil and gas industry trends enthusiasts, industry leaders, and innovative creators; their insights can provide valuable perspectives and open up opportunities for collaboration. Dive into oil and gas industry market research reports, attend oil and gas industry trends-focused seminars and conferences, and participate in online oil and gas industry trends communities. Also, leverage trend-tracking tools, like TrendFeedr, that meticulously track up to 260 oil and gas sub-trends, offering a comprehensive view of the evolving oil and gas industry trends landscape.