Automated Guided Vehicles Report

: Analysis on the Market, Trends, and TechnologiesThe AGV market sits at an inflection point where software-led fleet orchestration and sensor-fusion navigation are driving measurable commercial expansion: the internal trend data shows a projected market CAGR of 12.15% and a 2033 market projection of USD 14.05 billion, indicating a sustained growth runway for vendors who solve deployment friction and fleet-level optimization. Combined market estimates from recent industry studies align around mid-to-high single-digit to low-teens CAGR ranges and 2025 valuations in the mid-single-digit billions, confirming demand from e-commerce, manufacturing, and ports as primary revenue engines Grand View Research – Automated Guided Vehicle Market The Business Research Company – Automated Guided Vehicle Market Overview 2025 Precedence Research – Automated Guided Vehicle Market.

This report was last updated 101 days ago. Spot an error or missing detail? Help us fix it by getting in touch!

Topic Dominance Index of Automated Guided Vehicles

To identify the Dominance Index of Automated Guided Vehicles in the Trend and Technology ecosystem, we look at 3 different time series: the timeline of published articles, founded companies, and global search.

Key Activities and Applications

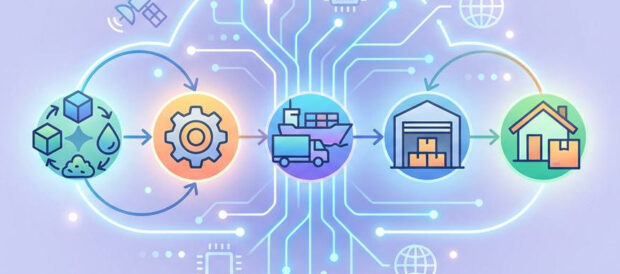

- Warehouse inbound/outbound dock automation: AGVs and AMRs automate trailer loading/unloading and dock-to-storage transfers to reduce dock idle time and improve throughput in e-commerce and 3PL operations VisionNav launch & trailer systems.

- Intra-plant material flow and assembly support: AGVs move JIT kits, feed assembly stations, and perform precision docking with sub-millimeter alignment for manufacturing lines Automated Guided Vehicle Market Trends 2025.

- Unit load and pallet transport in dense storage: Unit-load carriers and pallet trucks dominate warehousing applications where pallet throughput and integration with AS/RS matter Mordor Intelligence – North America AGV Market.

- Specialized environments (healthcare, cold storage, ports): Purpose-built AGVs deliver contamination-controlled transfers in hospitals, freezer-rated vehicles in cold chain, and container movers in port terminals Seaport AGV projection article.

- Fleet management and predictive maintenance services: Centralized orchestration (VDA 5050 adoption) and predictive analytics extend uptime and scheduling efficiency across mixed fleets Zion Market Research – AGV Fleet Management Platform Kollmorgen VDA 5050 support note.

Emergent Trends and Core Insights

- Sensor-first navigation replaces floor infrastructure: The industry moves away from magnetic/tape guidance toward LiDAR, vision SLAM, and natural navigation to cut site retrofit costs and speed deployments Future Market Insights – AGV trends 2025-2035.

- Software and data become the differentiator: Fleet orchestration platforms, digital twins, and simulation for safety validation create recurring-revenue levers and lock-in above the hardware sale Autonoma AutoVerse.

- Hybrid AGV/AMR adoption model: Customers buy mixed navigation models—fixed-path AGVs where throughput predictability matters, and AMRs for dynamic, unstructured tasks—leading vendors to offer hybrid stacks AGV/AMR differentiation analysis.

- Commercial consumption models lower barriers: AGV/AMR-as-a-Service and Battery-as-a-Service reduce upfront CapEx and accelerate adoption among mid-market customers.

- Vertical specialization wins: Firms that combine domain sensing and handling (e.g. healthcare trays, trailer interiors, mining terrain) capture higher margins than generic fleet sellers.

Technologies and Methodologies

- LiDAR + SLAM + vision fusion: Multi-modal perception stacks permit mapless navigation and dynamic obstacle handling in dense, changing environments.

- Fleet orchestration protocols and standards: Adoption of VDA 5050 and cloud fleet managers enable cross-vendor interoperability and centralized traffic reservation to minimize deadlocks.

- Digital twins and pre-deployment simulation: Virtual validation reduces commissioning time and supports safety case generation for regulatory acceptance.

- Low-infrastructure navigation techniques: Natural navigation and mapless autonomy reduce installation cost and support rapid rollouts across trailer docks, outdoor yards, and multi-site fleets.

- Predictive maintenance via edge analytics: Onboard telemetry feeding ML models increases uptime and transforms service into a predictable revenue stream.

Automated Guided Vehicles Funding

A total of 466 Automated Guided Vehicles companies have received funding.

Overall, Automated Guided Vehicles companies have raised $24.7B.

Companies within the Automated Guided Vehicles domain have secured capital from 1.8K funding rounds.

The chart shows the funding trendline of Automated Guided Vehicles companies over the last 5 years

Automated Guided Vehicles Companies

- Slip Robotics — Slip offers a robots-as-a-service Automated Loading Robot that autonomously loads and unloads trailers without dock modifications or Wi-Fi. The product targets a high-pain, high-ROI dock operation where labor and dwell time are acute constraints; Slip’s RaaS model shortens payback and reduces integration friction for distribution customers.

- driveblocks — driveblocks provides a Physical AI autonomy stack and a world model designed for industrial vehicles in off-road and harsh environments. Their platform emphasizes sensor-agnostic environment understanding and a safety supervisory layer that speeds deployment in mining, construction, and outdoor logistics.

- ROVIGOS — ROVIGOS combines robotics and AI to deliver practical logistics solutions and an analytics-driven operations layer; the company focuses on applying lightweight AI to optimize existing fleets and provide business intelligence for material handling operations.

- Navflex Inc — Navflex targets the autonomous trailer and container loading problem with AMRs designed to operate in unstructured, dark, and variable trailer interiors without infrastructure change. Their pitch centers on fast deployment, compatibility with irregular loads, and short ROI timelines for dock automation.

- Agovor Limited — Agovor builds robotic towing machines for agricultural and outdoor yard tasks, applying a simple, modular approach that fits low-infrastructure environments and RaaS economics; the product addresses decentralized labor shortages outside classic warehouse settings.

Identify and analyze 2.6K innovators and key players in Automated Guided Vehicles more easily with this feature.

2.6K Automated Guided Vehicles Companies

Discover Automated Guided Vehicles Companies, their Funding, Manpower, Revenues, Stages, and much more

Automated Guided Vehicles Investors

TrendFeedr’s investors tool offers a detailed view of investment activities that align with specific trends and technologies. This tool features comprehensive data on 2.3K Automated Guided Vehicles investors, funding rounds, and investment trends, providing an overview of market dynamics.

2.3K Automated Guided Vehicles Investors

Discover Automated Guided Vehicles Investors, Funding Rounds, Invested Amounts, and Funding Growth

Automated Guided Vehicles News

Stay informed and ahead of the curve with TrendFeedr’s News feature, which provides access to 6.5K Automated Guided Vehicles articles. The tool is tailored for professionals seeking to understand the historical trajectory and current momentum of changing market trends.

6.5K Automated Guided Vehicles News Articles

Discover Latest Automated Guided Vehicles Articles, News Magnitude, Publication Propagation, Yearly Growth, and Strongest Publications

Executive Summary

The available data paints a consistent strategic picture: AGV demand will continue to grow materially, but revenue and margin capture will shift toward software, data services, and verticalized applications. Vendors that eliminate deployment friction—through mapless navigation, standards-based fleet control, and strong domain sensing—gain immediate commercial advantage. Meanwhile, RaaS and fleet-management economics broaden the buyer base to mid-market adopters. For investors and integrators, the most actionable priorities are: invest in fleet orchestration and simulation capabilities, target verticals with clear handling complexity (healthcare, docks, ports, mining), and design flexible commercial models that convert CapEx risk into predictable service revenue. These moves convert the current technology momentum into sustainable, defensible business models without reliance on legacy, infrastructure-heavy approaches.

Interested in enhancing our coverage of trends and tech? We value insights from experts like you - reach out!