Automotive Software Report

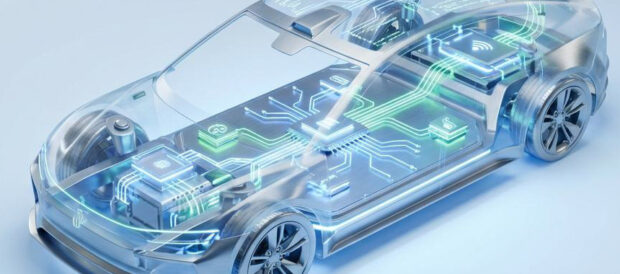

: Analysis on the Market, Trends, and TechnologiesThe automotive software market is shifting into a primary profit vector, driven by software-defined vehicles and a high sustained CAGR; the internal trend data forecasts a 16.1% CAGR and a market of $63.4 billion by 2029. Multiple independent market studies align on double-digit growth but show dispersion in near-term sizing (examples: $29–37B in 2024 in major market studies and forecasts to $66–140B by 2030–2032) which signals consensus on scale-up but disagreement on segmentation and monetization capture

This report was last updated 92 days ago. Spot an error or missing detail? Help us fix it by getting in touch!

Topic Dominance Index of Automotive Software

To identify the Dominance Index of Automotive Software in the Trend and Technology ecosystem, we look at 3 different time series: the timeline of published articles, founded companies, and global search.

Key Activities and Applications

- Advanced driver assistance systems and autonomous driving software (ADAS/AD). ADAS and autonomy represent the largest growth wedge of software spend and drive sensor-fusion, perception, and decision stacks that require massive validation and data management Global Automotive Software Market Report.

- Over-the-air update systems and lifecycle/version control. Fleetwide OTA and configuration management scale the post-sale revenue model and reduce recall costs; patent and product activity shows configuration, rollback, and state-aware update mechanisms are a dominant engineering focus

- Software-defined vehicle (SDV) platform and middleware development. Convergence on service-oriented architecture and unified middleware enables feature-on-demand, zonal controllers, and domain consolidation, raising demand for middleware that supports cross-domain service discovery and secure remote management

- Digital cockpit and infotainment systems with monetizable UX. Infotainment remains the single largest application slice in many studies and serves as the customer interface for subscription and app ecosystems

- Vehicle connectivity, V2X, telematics and fleet analytics. V2X and telematics enable new safety use cases, fleet optimization and insurance products; markets and government programs in several regions accelerate deployment

Emergent Trends and Core Insights

- Software monetization and feature subscriptions are mainstream plans for OEMs. Survey and market data report a majority of OEMs plan to monetize optional software and treat software as recurring revenue, raising the importance of secure payment, entitlement, and OTA delivery functions Automotive Software Trends | Deloitte US.

- Platform consolidation with a middleware market explosion. SDV middleware grew ~72% year-over-year in recent measurements, forcing suppliers to choose platform partnership or deep specialization to retain margin

- Validation moves to simulation and digital twins. High-fidelity simulation, synthetic data generation, and large scale scenario coverage compress physical test needs and accelerate compliance of L3+ features

- AUTOSAR, SOA frameworks, and unified middleware define interoperability. Widespread AUTOSAR Classic/Adaptive use and SOA middleware adoption enable cross-vendor integration but create a new dependency on tooling, configuration and MCAL compatibility

- Security and certification as product constraints. ISO 26262 and UNECE WP.29 cybersecurity requirements make secure boot, secure OTA and runtime intrusion detection mandatory product elements, not optional add-ons

Technologies and Methodologies

- AUTOSAR (Classic and Adaptive), SOA and service buses for cross-domain decoupling. OEMs and Chinese full-stack players already implement SOA for centralized EE architectures and expose atomic vehicle capabilities as services AUTOSAR Software Platform Report, 2021.

- Containerized microservices and cloud-native toolchains for OTA and rapid feature delivery. Containerization enables isolation, versioning and safe incremental OTA payloads while shortening time to deploy new features

- Edge/cloud hybrid inference and model management. Distributed AI (on-vehicle quantized models plus cloud retraining) supports perception and predictive maintenance while controlling bandwidth and privacy exposure

- Formal verification, safety certification toolchains and model-based design. L3+ decision logic adoption increases use of formal methods to satisfy ASIL requirements and reduce failure domains

- Configuration synthesis and tool automation for ARXML and mapping. Patent and market signals show strong investment into automatic generation and reconciliation of AUTOSAR configuration artifacts to eliminate human error and scale variant management

Automotive Software Funding

A total of 109 Automotive Software companies have received funding.

Overall, Automotive Software companies have raised $5.8B.

Companies within the Automotive Software domain have secured capital from 367 funding rounds.

The chart shows the funding trendline of Automotive Software companies over the last 5 years

Automotive Software Companies

- sdverse.auto — sdverse operates a B2B software marketplace that matches OEM/Tier-1 procurement to embedded software vendors and simplifies licensing and entitlement workflows. The company addresses the procurement bottleneck created by SDV modularization and provides cataloging, compliance checks and transactional capabilities that reduce integration friction Automotive Software Market Size, Share & Trends Analysis Report – Industry Overview and Forecast to 2031.

- Carmatic — Carmatic provides lightweight vehicle edge middleware and a modular OTA delivery engine tailored for lower cost EVs and fleet operators. Its stack focuses on deterministic update windows, package delta compression and ECU-aware rollback that reduce downtime and service costs Software-Defined Vehicles in 2025: SOA and Middleware Industry Research Report.

- Algo-Ville — Algo-Ville builds synthetic data and scenario generation for ADAS validation targeted at rare edge conditions. Their toolchain integrates with major simulation engines and exports training datasets suitable for federated learning, shortening the validation loop for perception teams Automotive Software Market Size | Industry Report, 2030.

- Alefbits — Alefbits delivers compact, safety-certified hypervisor and partitioning software optimized for mixed-criticality zonal controllers. The product targets OEMs moving from many ECUs to zonal domain controllers and reduces certification cost per aggregated function.

- Nuvus — Nuvus develops an AI-assisted configuration synthesis toolset that generates AUTOSAR ARXML artifacts from high-level product options and test telemetry, focusing on reducing ECU build explosion in multi-variant fleets. Their tooling directly addresses the configuration management bottleneck highlighted in patent and industry analyses

Identify and analyze 884 innovators and key players in Automotive Software more easily with this feature.

884 Automotive Software Companies

Discover Automotive Software Companies, their Funding, Manpower, Revenues, Stages, and much more

Automotive Software Investors

TrendFeedr’s investors tool offers a detailed view of investment activities that align with specific trends and technologies. This tool features comprehensive data on 407 Automotive Software investors, funding rounds, and investment trends, providing an overview of market dynamics.

407 Automotive Software Investors

Discover Automotive Software Investors, Funding Rounds, Invested Amounts, and Funding Growth

Automotive Software News

Stay informed and ahead of the curve with TrendFeedr’s News feature, which provides access to 1.5K Automotive Software articles. The tool is tailored for professionals seeking to understand the historical trajectory and current momentum of changing market trends.

1.5K Automotive Software News Articles

Discover Latest Automotive Software Articles, News Magnitude, Publication Propagation, Yearly Growth, and Strongest Publications

Executive Summary

The business imperative is clear: software is the competitive product. Firms that win will either control a broadly adopted platform stack or provide narrowly essential capabilities that cannot be substituted by platform owners. Near term priority actions for executives are to (1) secure middleware and OTA competence or partnerships, (2) treat configuration and version management as core IP rather than an operational afterthought, and (3) invest in simulation, formal verification and ISO/UNECE-aligned security workflows to protect monetization paths. Markets will continue to grow strongly, but value capture will concentrate at the operating layer and in recurring-revenue services; specialized startups that remove deployment friction or materially cut validation cost represent the most attractive commercial opportunities.

Interested in enhancing our coverage of trends and tech? We value insights from experts like you - reach out!