Cancer Diagnostics Report

: Analysis on the Market, Trends, and TechnologiesThe cancer diagnostics industry is experiencing rapid expansion driven by increasing global cancer incidence, technological innovations, and heightened government awareness initiatives. The industry is projected to grow at a 9% CAGR from USD 158.7 billion in 2024 to an estimated USD 372.5 billion by 2034 (Global Market Insights). Notably, internal trend data indicate that 9,241 articles have been published on cancer diagnostics with a growth in news coverage of 18.45% over the past five years. This progress is underpinned by innovative diagnostic tests and non‑invasive techniques that enable early cancer detection, which is critical for improving patient outcomes and reducing mortality.

We updated this report 163 days ago. Noticed something’s off? Let’s make it right together — reach out!

Topic Dominance Index of Cancer Diagnostics

The Topic Dominance Index trendline combines the share of voice distributions of Cancer Diagnostics from 3 data sources: published articles, founded companies, and global search

Key Activities and Applications

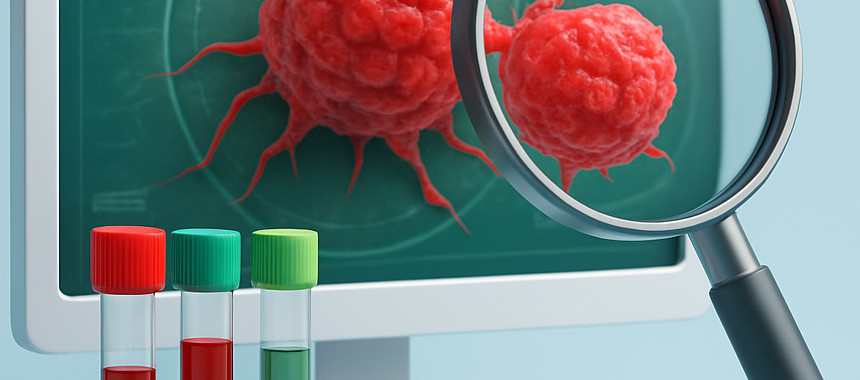

- Early Detection and Screening: Deployment of non‑invasive liquid biopsy and imaging tests to identify cancer at early stages, thereby facilitating timely treatment decisions (Global Market Insights).

- Molecular and Genetic Testing: Use of next‑generation sequencing (NGS) and PCR‑based assays to profile tumors and identify actionable genetic biomarkers for tailored therapy (United Arab Emirates Tumor Marker Market Report – Research and Markets).

- Digital and AI‑Assisted Diagnostics: Integration of computer‑assisted imaging and AI algorithms to improve diagnostic accuracy and efficiently analyze diagnostic images (US Tumor Markers Testing Market Report – VPG Market Research).

- Integration of Multimodal Platforms: Combining imaging, molecular, and immunohistochemical techniques to provide a multifaceted diagnostic approach.

- Monitoring and Surveillance: Implementation of tests for monitoring minimal residual disease (MRD) and cancer recurrence during and after treatment.

Emergent Trends and Core Insights

- Increased Adoption of Liquid Biopsy: Non‑invasive blood tests are increasingly being used for early diagnosis and monitoring of cancer, reducing the need for invasive tissue biopsies.

- Expansion of AI and Digital Imaging Technologies: The adoption of AI‑based diagnostic platforms in imaging has led to enhanced diagnostic precision, particularly in detecting breast and lung cancers.

- Personalized Treatment Approaches: Advances in molecular diagnostics are facilitating tailored treatment strategies, resulting in better patient management and improved outcomes.

- Growing Demand in Emerging Markets: The expansion of diagnostic laboratories and the increasing incidence of cancer in developing regions continue to drive market growth.

- Stronger Regulatory and Public‑Private Collaborations: Collaborative initiatives between governments, research institutes, and diagnostic companies are reinforcing the development of innovative diagnostic solutions.

Technologies and Methodologies

- Next‑Generation Sequencing (NGS): Offers comprehensive tumor profiling and mutation detection to guide personalized therapy.

- Polymerase Chain Reaction (PCR): Used for rapid and sensitive detection of cancer biomarkers from blood and tissue samples.

- Liquid Biopsy Platforms: Utilize blood samples to detect circulating tumor cells and DNA, which are critical for early cancer detection and monitoring.

- Imaging Technologies: Incorporate advanced modalities such as MRI, CT, and digital mammography, often enhanced with AI to improve accuracy.

- Immunohistochemistry and In Situ Hybridization: Provide molecular and protein‑level diagnostics that assist in the precise classification of tumors.

Cancer Diagnostics Funding

A total of 785 Cancer Diagnostics companies have received funding.

Overall, Cancer Diagnostics companies have raised $29.9B.

Companies within the Cancer Diagnostics domain have secured capital from 3.1K funding rounds.

The chart shows the funding trendline of Cancer Diagnostics companies over the last 5 years

Cancer Diagnostics Companies

- SAGA Diagnostics: Based in Sweden, SAGA Diagnostics focuses on personalized cancer medicine and disease monitoring through molecular genetic analyses of circulating tumor DNA and tissue biopsies. Their proprietary technologies aim to revolutionize the detection of molecular residual disease to inform individualized treatment decisions. A less‑prominent yet innovative player, they exemplify the shift towards non‑invasive diagnostic methods.

- Creatv MicroTech, Inc.: Creatv MicroTech, Inc. from the United States is dedicated to early cancer detection with their LifeTracDx® liquid biopsy platform that identifies circulating tumor cells and cancer‑associated macrophage‑like cells. Their technology supports not only early diagnosis but also treatment monitoring and post‑treatment surveillance, offering a promising alternative to traditional tissue biopsies.

- Definitive Diagnostics, Inc.: This U.S.‑based company leverages a patented protein‑based diagnostic platform enhanced with artificial intelligence to achieve high sensitivity in detecting a range of cancers, including breast, lung, colorectal, pancreatic, and ovarian cancers. Their approach focuses on reducing false results in cancer detection and is designed to streamline diagnostic workflows.

- CDx Diagnostics®: With a mission to provide cost‑effective, easily implemented diagnostic tools, CDx Diagnostics® offers a proprietary platform that synthesizes computer imaging, molecular biology, and 3‑D cytopathology for the early detection of precancerous lesions. Their innovations have led to improved diagnostic accuracy, particularly in preventing unnecessary biopsies by accurately classifying suspicious lesions.

- QCDx: Focused on the detection and deep characterization of circulating tumor cells (CTCs), QCDx from the United States utilizes its nCYTE™ technology to analyze unenriched blood samples quickly and accurately. Their approach aids in identifying early cancer presence and provides valuable prognostic insights, supporting precision treatment selection while targeting a traditionally under‑addressed segment in the market.

Gain a better understanding of 2.7K companies that drive Cancer Diagnostics, how mature and well-funded these companies are.

2.7K Cancer Diagnostics Companies

Discover Cancer Diagnostics Companies, their Funding, Manpower, Revenues, Stages, and much more

Cancer Diagnostics Investors

Gain insights into 2.8K Cancer Diagnostics investors and investment deals. TrendFeedr’s investors tool presents an overview of investment trends and activities, helping create better investment strategies and partnerships.

2.8K Cancer Diagnostics Investors

Discover Cancer Diagnostics Investors, Funding Rounds, Invested Amounts, and Funding Growth

Cancer Diagnostics News

Gain a competitive advantage with access to 9.2K Cancer Diagnostics articles with TrendFeedr's News feature. The tool offers an extensive database of articles covering recent trends and past events in Cancer Diagnostics. This enables innovators and market leaders to make well-informed fact-based decisions.

9.2K Cancer Diagnostics News Articles

Discover Latest Cancer Diagnostics Articles, News Magnitude, Publication Propagation, Yearly Growth, and Strongest Publications

Executive Summary

The cancer diagnostics sector is witnessing significant advancements driven by the need for early and non‑invasive detection methods. Increasing global cancer incidence, improved imaging and molecular diagnostic techniques, and supportive government initiatives are catalyzing industry growth. The emergence of integrated and AI‑enhanced platforms is transforming how early‑stage cancers are identified and managed, ultimately contributing to better patient outcomes and more efficient treatment strategies. These trends present substantial opportunities for companies and startups that are developing innovative diagnostic solutions, particularly those offering personalized and precise diagnostic tools.

We seek partnerships with industry experts to deliver actionable insights into trends and tech. Interested? Let us know!