Compressed Natural Gas Report

: Analysis on the Market, Trends, and TechnologiesThe compressed natural gas market has attracted significant capital and strategic attention, with the internal trend data showing total funding of $52.78 billion across industry players, which underpins rapid project-level activity and infrastructure buildout. Market-size estimates vary but confirm a large base and clear upside: Grand View Research places global revenue near USD 188.9 billion in 2023 and projects growth to about USD 224.0 billion by 2030 while other major forecasters show higher growth scenarios (see Trends). The immediate commercial opportunity concentrates in fleet conversions, RNG production from waste streams, and modular/refill infrastructure; success will hinge on policy incentives, station rollout economics, and lowering compression and storage costs so fleets and logistics operators capture fuel-cost savings and emissions benefits.

We updated this report 124 days ago. Noticed something’s off? Let’s make it right together — reach out!

Topic Dominance Index of Compressed Natural Gas

The Topic Dominance Index trendline combines the share of voice distributions of Compressed Natural Gas from 3 data sources: published articles, founded companies, and global search

Key Activities and Applications

- Public and municipal fleet conversions to CNG for buses, refuse trucks, taxis, and local delivery vehicles — driven by urban air-quality rules and operator economics that favor lower per-mile fuel costs for high-utilization fleets.

- Renewable natural gas (RNG) production and integration into CNG distribution — landfill gas, agricultural and food-waste digesters convert waste streams into RNG that substitutes pipeline gas and produces higher ESG value for fleet customers.

- Distributed and virtual pipeline delivery (mobile CNG trailers / virtual pipeline) to serve depots and remote industrial sites where pipelines are absent — this model lowers time to market for fleets and industrial customers.

- On-site compression and mobile compression services to fill fast-turnaround depots and temporary projects, including zero-emission event power and construction sites.

- Methane abatement and monetization of flare/stranded gas through onsite conversion, RNG upgrading, or powering local compute (bitcoin mining) or micro-grids — creates monetizable capture streams and aligns with methane-reduction mandates NGON Solutions.

Emergent Trends and Core Insights

- Multiple credible market forecasts diverge materially, exposing policy and infrastructure risk sensitivity. Conservative scenario: Grand View Research shows measured growth to USD 224.0 billion by 2030 grandviewresearch. Aggressive scenarios in other market research projects assume double-digit CAGRs (for example, a 12.1% tank market CAGR to 2037) that depend on rapid station rollout and heavy-duty adoption researchnester - 2025. So what: policy changes, subsidy rollouts, or large fleet conversion programs can swing commercial outcomes sharply.

- RNG becomes the strategic differentiator for CNG sellers and fleet buyers. Producers that pair RNG volume guarantees with refueling access extract premium value from low-carbon fuel markets and satisfy corporate procurement requirements.

- Modular, mobile and virtual pipeline solutions reduce entry cost for refueling networks and accelerate corridor development where pipelines are missing; these models change station economics and create near-term opportunities in emerging markets.

- Heavy-duty truck and bus segments carry the highest policy-driven upside because fuel-cost savings and emissions rules make payback periods much shorter for fleet operators than for private light vehicles thebusinessresearchcompany - 2025.

- Digital monitoring and remote management of CNG stations and cylinder inventories improves uptime and safety while shrinking operational costs for multi-site operators, creating a recurring-revenue service layer for technology providers.

Technologies and Methodologies

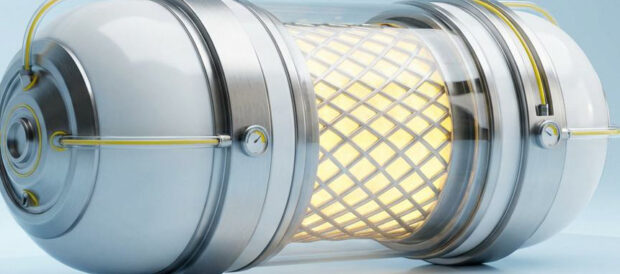

- Type-4 composite, higher-pressure onboard tanks and lightweight cylinder systems that increase vehicle range and reduce weight penalty — essential for wider light-vehicle and heavy-duty adoption marketresearch (CNG Tanks report).

- Modular, containerized compression units and fast-fill dispensers that lower capex per station and enable rapid deployment at fleet depots researchandmarkets - 2022.

- Virtual pipeline trailers and mobile CNG delivery systems that substitute for physical pipeline builds; they unlock demand in corridors and remote regions and shorten project lead times.

- RNG upgrading and water-based biogas conditioning technologies that ensure pipeline-quality gas for transport use and allow producers to capture higher value via credits and offtake contracts.

- IoT telemetry, safety interlocks, and predictive maintenance for compressors and dispenser systems; these reduce unplanned downtime and regulatory exposure while enabling software monetization for station operators.

Compressed Natural Gas Funding

A total of 173 Compressed Natural Gas companies have received funding.

Overall, Compressed Natural Gas companies have raised $56.0B.

Companies within the Compressed Natural Gas domain have secured capital from 471 funding rounds.

The chart shows the funding trendline of Compressed Natural Gas companies over the last 5 years

Compressed Natural Gas Companies

- NLC Energy — NLC Energy owns and operates renewable natural gas plants converting food-industry and agricultural organic waste into RNG, dry ice and liquid CO2. The company focuses on mid-scale projects that turn waste streams into monetizable fuel and commodities for local buyers, which shortens project commercialization timelines. Their model addresses both feedstock management and downstream RNG sales, creating cross-sector revenue while meeting fleet RNG demand.

- Cowboy Clean Fuels — Cowboy Clean Fuels develops carbon-negative RNG via patented processes in basin settings and pairs RNG production with geologic carbon removal, positioning customers to buy higher-value low-carbon fuel. The firm targets areas with co-located feedstock and sequestration options, which improves project margins versus standalone RNG plants. Their work illustrates how integrated RNG plus carbon credit streams change project economics.

- Vision RNG — Vision RNG targets landfill gas capture and mid-sized LFG sites that historically fell below commercial thresholds, using proven LFG technologies optimized for smaller sites. The team scales projects by combining gas extraction, conditioning and pipeline-quality upgrading to feed regional CNG corridors and utility customers. This focus helps expand RNG supply beyond large utility projects and supports localized CNG refueling demand.

- Clean Recompression — Clean Recompression supplies mobile and cross-compression equipment and services that reduce methane losses during pipeline operations and evacuation activities, enabling operators to recover gas that otherwise would be vented. The company's hypermobile compressor systems fit temporary and retrofit scenarios, reducing downtime and delivering captured gas back into commercial streams or for CNG use. Their kit-and-service model shortens deployment time for midstream customers.

- GasVisor — GasVisor offers IoT and analytics solutions that transform cylinder and station management into a data service, automating reorder, leak detection and inventory forecasting for distributed gas assets. This product reduces stockouts and idle inventory costs for cylinder-based supply chains and provides a software revenue stream for distributors and station operators. For operators that run multi-site CNG or cylinder networks, this improves working capital and safety metrics.

Gain a better understanding of 1.0K companies that drive Compressed Natural Gas, how mature and well-funded these companies are.

1.0K Compressed Natural Gas Companies

Discover Compressed Natural Gas Companies, their Funding, Manpower, Revenues, Stages, and much more

Compressed Natural Gas Investors

Gain insights into 380 Compressed Natural Gas investors and investment deals. TrendFeedr’s investors tool presents an overview of investment trends and activities, helping create better investment strategies and partnerships.

380 Compressed Natural Gas Investors

Discover Compressed Natural Gas Investors, Funding Rounds, Invested Amounts, and Funding Growth

Compressed Natural Gas News

Gain a competitive advantage with access to 4.2K Compressed Natural Gas articles with TrendFeedr's News feature. The tool offers an extensive database of articles covering recent trends and past events in Compressed Natural Gas. This enables innovators and market leaders to make well-informed fact-based decisions.

4.2K Compressed Natural Gas News Articles

Discover Latest Compressed Natural Gas Articles, News Magnitude, Publication Propagation, Yearly Growth, and Strongest Publications

Executive Summary

The compressed natural gas market sits at a practical inflection where existing technology, significant funding and clear policy levers combine to create near-term commercial opportunities in fleets, RNG production and modular refueling. The largest, fastest value capture will go to organizations that pair reliable fuel supply (RNG or pipeline gas) with accessible refueling (modular stations or virtual pipelines) and operational services (IoT, mobile compression, maintenance). Forecast divergence underscores that regulatory action and targeted subsidies will determine whether growth follows a measured path or accelerates rapidly; therefore strategic moves that shorten time to fuel delivery and secure low-carbon supply contracts will yield the strongest returns.

We seek partnerships with industry experts to deliver actionable insights into trends and tech. Interested? Let us know!