Food Manufacturing Report

: Analysis on the Market, Trends, and TechnologiesThe U.S. and global food manufacturing complex faces simultaneous pressure to modernize operations and to reconfigure product portfolios for health and traceability, with the internal food manufacturing data projecting a $12,500,000,000 production-capex forecast for 2035 and a 5.0% sector CAGR that frames near-term investment priorities Food Contract Manufacturing Market Research Report: By Ingredient Type (Dairy & Dairy Alternatives, Fruits & Vegetables, Meat, Poultry & Fish, Bakery & Cereals, Oil & Fat) (2025). Manufacturers that combine closed-loop quality, predictive maintenance, and ingredient reformulation win cost and margin advantages while meeting regulatory traceability demands Food Processing Trends 2025: 10 Technologies Transforming Production.

This article was last updated 97 days ago. If you find any info is missing, let us know!

Topic Dominance Index of Food Manufacturing

The Dominance Index of Food Manufacturing looks at the evolution of the sector through a combination of multiple data sources. We analyze the distribution of news articles that mention Food Manufacturing, the timeline of newly founded companies working in this sector, and the share of voice within the global search data

Key Activities and Applications

- Ingredient reformulation for clean-label, plant-based, and functional products — manufacturers invest in formulation capability and contract co-manufacturing to scale limited-run, higher-margin SKUs Food Processing Ingredients Market Research Report (2025).

- Digital traceability and compliance reporting to satisfy FSMA-type mandates and retail transparency requirements; software for lot tracking and recall readiness becomes core infrastructure Focus Works Inc.

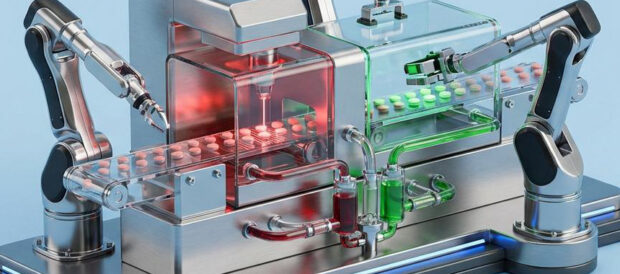

- Predictive maintenance and condition-based servicing of process lines to reduce unplanned downtime and extend equipment life, supported by IoT sensors and MES integration.

- Closed-loop quality control and at-line analytics (FT-NIR, vision inspection) to lock in OEE gains and defect reduction across high-speed lines.

- Niche contract manufacturing and dedicated lines (gluten-free, vegan, allergen-segregated) to service brand owners that require strict segregation and certification Apogee Foods Canadian Co-Packing.

Emergent Trends and Core Insights

- Health-driven premiumization: growth in natural, low-additive, and plant-based SKUs drives both ingredient demand and specialized processing requirements 2025 Trends in Food Manufacturing: Navigating Health, Sustainability and Innovation.

- Efficiency as competitive moat: automation and analytics deliver measurable gains (examples of defect and downtime reductions reported by early adopters) and create a profitability divide between high-tech operators and commodity producers.

- Process-physics specialization: companies that own specific processing capabilities such as high-moisture extrusion or ohmic heating capture premium demand for plant-based textures and aseptic liquid platforms Alimentos Profusa.

- Regional resilience and nearshoring: brands and retailers prefer auditable, proximate suppliers to reduce logistics risk and meet retailer ESG and traceability requirements China Food Processing Market Research Report (2025).

- Contract manufacturing platformization: digital-first co-packers that provide end-to-end visibility and formulation services command faster growth and stickier customer relationships Global Food Contract Manufacturing Report, 2025.

Technologies and Methodologies

- Closed-loop quality control with at-line spectrometers and machine-vision inspection to detect compositional and foreign-body issues in real time Food Processing Machinery – Market Share Analysis (2025).

- Predictive maintenance driven by edge analytics and MES integration to prevent up to 70% of unplanned downtime reported by early adopters in production environments.

- High-moisture extrusion and proprietary texturization techniques to reproduce meat-like structures for plant-based lines.

- Aseptic and ohmic processing for shelf-stable, preservative-free liquids and purees that reduce cold-chain dependence.

- Digital twin simulation for recipe and line change validation, lowering commissioning time and speeding new SKU ramp-up Automation in Food Manufacturing: How AI and Robotics Are Reshaping the Industry.

Food Manufacturing Funding

A total of 306 Food Manufacturing companies have received funding.

Overall, Food Manufacturing companies have raised $8.1B.

Companies within the Food Manufacturing domain have secured capital from 749 funding rounds.

The chart shows the funding trendline of Food Manufacturing companies over the last 5 years

Food Manufacturing Companies

- Yost Foods, Inc. & Food Basics — A small custom ingredient and formulation partner that focuses on clean-label solutions and ingredient manufacturing for regional brands. The company positions itself as a practical development partner offering product prototyping, distribution, and manufacturing services that address the growing need for rapid formulation shifts in health-forward portfolios.

- Bally Plus Food Solutions — Provides turnkey co-packing and custom sauce and meat processing with USDA and SQF level 2 certifications, enabling mid-size brands to launch specialty SKUs without building dedicated lines. Their capability in prepared sauces and protein handling supports clients moving from test-market to regional distribution.

- Holmach Ltd — UK-based specialist in thermal processing and aseptic/sterilization solutions; they consult, supply, and validate pasteurization and sterilization processes for wet and dry foodstuffs. Their services help manufacturers extend shelf life and meet food-safety audits while supporting product trials and commissioning.

- Suite42 — A VC-backed digital-first contract manufacturer and marketplace that connects brands to manufacturing capacity while providing inventory visibility and NPD support. Suite42’s model accelerates time-to-market for D2C and emerging CPG brands that require reliable, certified production without large capex.

Uncover actionable market insights on 4.2K companies driving Food Manufacturing with TrendFeedr's Companies tool.

4.2K Food Manufacturing Companies

Discover Food Manufacturing Companies, their Funding, Manpower, Revenues, Stages, and much more

Food Manufacturing Investors

Get ahead with your investment strategy with insights into 688 Food Manufacturing investors. TrendFeedr’s investors tool is your go-to source for comprehensive analysis of investment activities and financial trends. The tool is tailored for navigating the investment world, offering insights for successful market positioning and partnerships within Food Manufacturing.

688 Food Manufacturing Investors

Discover Food Manufacturing Investors, Funding Rounds, Invested Amounts, and Funding Growth

Food Manufacturing News

TrendFeedr’s News feature offers access to 2.0K news articles on Food Manufacturing. The tool provides up-to-date news on trends, technologies, and companies, enabling effective trend and sentiment tracking.

2.0K Food Manufacturing News Articles

Discover Latest Food Manufacturing Articles, News Magnitude, Publication Propagation, Yearly Growth, and Strongest Publications

Executive Summary

Manufacturers face a clear strategic choice: invest in process technologies, digital controls, and specialized manufacturing capabilities to earn premium margins, or remain low-cost, high-volume suppliers exposed to commoditization. Demand for health-driven products and traceable supply chains will continue to reallocate value to companies that can guarantee consistent quality at scale. For operators, the tactical priority is to convert capital spending into proprietary processing capacity and data-enabled operations that shorten product development cycles, reduce regulatory risk, and secure retailer access. For investors, the most attractive targets sit at the intersection of specialized process IP, certified contract capacity, and software that ties production to compliance and market responsiveness.

Have expertise in trends or technology? Your input can enrich our content — consider collaborating with us!