Green Transportation Report

: Analysis on the Market, Trends, and TechnologiesThe green transportation sector is at a pivotal integration moment: electrification, alternative fuels, and infrastructure investments are converging around platform plays that coordinate vehicles, energy and operations — and the internal trend data shows total funding raised across green transportation companies at $3.81B with 219 funding rounds, signalling active capital allocation into operational solutions. This funding footprint and patent activity concentrated on batteries and charging (e.g., 169 filings under energy storage tags) indicate that energy storage and charging are the immediate bottlenecks for scaling zero-emission fleets.

We updated this report 139 days ago. Missing information? Contact us to add your insights.

Topic Dominance Index of Green Transportation

The Topic Dominance Index combines the distribution of news articles that mention Green Transportation, the timeline of newly founded companies working within this sector, and the share of voice within the global search data

Key Activities and Applications

- Electrification of fleets: large-scale conversion of buses, delivery vans and municipal fleets to electric drivetrains is a primary activity; purpose-built medium and heavy-duty vehicles are being commercialized to meet urban and regional freight demand GreenPower Motor Company Inc..

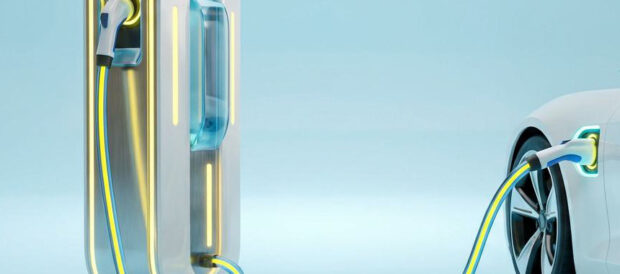

- Charging and refueling networks: deployment of public fast-charging and hydrogen/RNG refuelling nodes to service commercial fleets and long-haul operations addresses range and uptime constraints Greenlane™ Infrastructure.

- Last-mile zero-emission logistics: operators replace vans with e-cargo bikes, trikes and compact EVs to cut urban delivery emissions and curb congestion Fernhay Solutions.

- Smart fleet orchestration and SaaS optimisation: real-time routing, battery state management and TMS integration reduce energy use and operating cost per km GreenSys - SaaS.

- Alternative fuels for heavy-duty: RNG and renewable liquid fuels provide near-term decarbonization paths where batteries or hydrogen are immature Clean Energy and Verde Clean Fuels.

- Novel transit hardware and networks: modular podways, personal rapid transit and in-road conductive charging prototypes target high-frequency urban mobility and logistics corridors Transit X.

Emergent Trends and Core Insights

- Platform consolidation is accelerating: market advantage accrues to players offering end-to-end stacks (vehicle + charging + software + operations), because solving multi-stakeholder coordination reduces total cost of ownership and adoption friction.

- Energy systems are the gating factor: patent concentration on batteries, capacitors and charging stations demonstrates that range, charging throughput and grid integration determine fleet economics more than vehicle OEM advances Patent Landscape Report.

- Heavy-duty decarbonization will be multimodal: electrification, hydrogen, RNG and electrified corridors (eHighway concepts) will coexist; pragmatic adopters pick the lowest-cost, lowest-infrastructure-friction pathway per use case.

- Urban last-mile will fragment by operational model: micro-depots, battery-swap hubs and roaming cargo hubs enable operators to choose low-capex local logistics footprints while lowering emissions and parking load Oberon Electrodynamics.

- Data and AI become differentiators: route optimisation, predictive maintenance and dynamic charging scheduling deliver measurable reductions in energy use and downtime; technology buyers should prioritise systems with proven fleet-level savings Technologies Enabling Sustainable Transportation and Logistics Services.

- Policy and localized targets shape adoption speed: national and municipal mandates (e.g., China city targets for environmentally friendly travel) create concentrated markets where scale and regulatory-compliant solutions can be rapidly monetized News Landscape Report.

Technologies and Methodologies

- Advanced batteries and energy management: improvements in energy density, thermal management and bidirectional charging (V2G) reduce operational cost and grid strain; patents show concentrated R&D and filings in battery architectures and energy storage control Patent Landscape Report.

- Fast-charging + hydrogen station networks: combined charging and alternative fuel sites for fleet operations reduce refuelling downtime and broaden adoption choices for medium and heavy vehicles Greenlane™ Infrastructure.

- In-road conductive charging and dynamic charging corridors: vehicle-agnostic ground rails allow opportunistic charging while driving or parked, lowering battery sizing requirements and TCO Elonroad.

- Battery-swapping and mobile hubs: swapping or mobile charging units remove long idle time for high-utilization delivery fleets and enable smaller batteries per vehicle Oberon Electrodynamics.

- AI-driven fleet orchestration and TMS integration: predictive scheduling, charge window optimization, and integrated payments reduce energy peaks and improve asset utilisation GreenSys - SaaS.

- Materials and circular design: bio-composites and recyclable components lower embedded carbon and total lifecycle impact for light urban vehicles Oberon Electrodynamics.

Green Transportation Funding

A total of 73 Green Transportation companies have received funding.

Overall, Green Transportation companies have raised $4.2B.

Companies within the Green Transportation domain have secured capital from 220 funding rounds.

The chart shows the funding trendline of Green Transportation companies over the last 5 years

Green Transportation Companies

- GreenCell Mobility

GreenCell operates as an India-focused shared electric mobility platform with integrated e-bus deployments, charging solutions and eMaaS offerings backed by climate-impact investors; its model targets lower-cost, shared public mobility and municipal fleet electrification while leveraging solar and local generation strategies. - Fernhay Solutions

Fernhay sells zero-emission last-mile equipment (eQuad, eWalker and modular Cube containers) focused on dense urban parcel delivery; the product design emphasises load capacity, manoeuvrability and depot-minimizing operations to reduce urban delivery emissions and operating cost per stop. - Greenlane™ Infrastructure

Greenlane is developing a nationwide fast-charging and hydrogen refuelling network for commercial vehicles, structuring its rollout to support zero-emission truck and bus corridors; its capital-backed model targets fleet uptime and corridor reliability as commercial propositions. - Elonroad

Elonroad develops in-road conductive charging rails enabling on-the-move or parked charging for logistics and delivery fleets; the technology aims to lower battery sizing and grid peak demand by spreading charge events, improving asset utilisation for high-frequency urban vehicles.

Gain a competitive edge with access to 386 Green Transportation companies.

386 Green Transportation Companies

Discover Green Transportation Companies, their Funding, Manpower, Revenues, Stages, and much more

Green Transportation Investors

Leverage TrendFeedr’s sophisticated investment intelligence into 305 Green Transportation investors. It covers funding rounds, investor activity, and key financial metrics in Green Transportation. investors tool is ideal for business strategists and investment experts as it offers crucial insights needed to seize investment opportunities.

305 Green Transportation Investors

Discover Green Transportation Investors, Funding Rounds, Invested Amounts, and Funding Growth

Green Transportation News

TrendFeedr’s News feature provides a historical overview and current momentum of Green Transportation by analyzing 939 news articles. This tool allows market analysts and strategists to align with latest market developments.

939 Green Transportation News Articles

Discover Latest Green Transportation Articles, News Magnitude, Publication Propagation, Yearly Growth, and Strongest Publications

Executive Summary

Green transportation is shifting from technology experiments to operational systems where energy provisioning and networked infrastructure determine commercial success. Investors and operators should prioritise plays that (1) integrate vehicle solutions with charging/refuelling and software, (2) demonstrate measurable TCO improvements through energy management and routing intelligence, and (3) choose technology mixes matched to use-case (batteries for urban fleets, hydrogen/RNG for specific heavy-duty routes). The patent and funding signals indicate the most immediate value lies in energy storage, fast and distributed charging, and software orchestration — those capabilities will separate platform leaders from point-solution vendors as markets consolidate and regulatory demand increases.

Interested in contributing your expertise on trends and tech? We’d love to hear from you.