Lithium-ion Battery Report

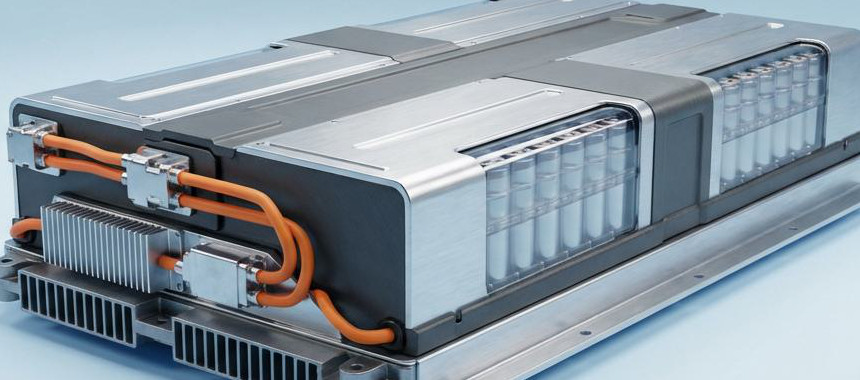

: Analysis on the Market, Trends, and TechnologiesThe lithium-ion battery market sits at the center of electrification with a 2024 market size of $65,700,000,000, and projections that imply continued double-digit expansion toward $144,100,000,000 by 2030 given a 14.0% CAGR. Investment and commercial activity concentrate on three commercial imperatives: securing feedstock and circular supply (extraction and recycling), raising per-cell energy or pack value (silicon anodes, LMFP/LFP strategies), and removing safety/cost constraints that limit faster adoption in transport and grid use (electrolyte and solid-state initiatives). These dynamics create a tactical window for firms that combine material access with manufacturing economies and software-driven pack integration.

Our latest update of this report was 36 days ago. If you found a mistake or missing information, tell us!

Topic Dominance Index of Lithium-ion Battery

The Topic Dominance Index evaluates Lithium-ion Battery's significance by analyzing data on the distribution of news articles that mention Lithium-ion Battery, the timeline of newly founded companies working in this sector, and global search trends

Key Activities and Applications

- Electric vehicle traction packs — Mass production and pack engineering for passenger, commercial, and two/three-wheeler EVs remain the largest demand driver; vehicle adoption is the chief force raising cell volumes and prioritizing cost per kWh MarketsandMarkets - Lithium-ion Battery Market Report.

- Stationary energy storage systems (BESS) — Grid and behind-the-meter storage are expanding product lines to 8-hour and multi-hour applications, shifting cell format and cell chemistry choices toward cost-optimized chemistries for long duration Future Market Insights - Lithium-Ion Battery Market.

- Cell-level performance upgrades — Transition efforts focus on higher energy density (silicon-rich anodes, high-nickel cathodes) and rate capability (3D anode structures, engineered SEI/CEI layers) to shorten charge times while preserving cycle life.

- Recycling and second-life systems — Industrializing hydrometallurgical and regeneration processes to supply cathode-grade materials locally, reducing raw-material exposure and complying with evolving circularity regulations.

- Fast-charging systems and BMS software — System-level optimization via advanced BMS and thermal management (including immersion and cell-to-pack architectures) extends usable life and permits commercial LFP adoption in more vehicle segments Clean Electric.

- Niche mobility and marine/aerospace packs — Tailored modular packs for maritime, aerospace, and off-highway vehicles require certification and advanced thermal/EMS integration, making pack integrators high-value partners Lehmann Marine GmbH.

Emergent Trends and Core Insights

- Chemistry mix is diversifying — NMC/NCA remains targeted at premium, high-energy applications while LFP/LMFP capture cost-sensitive EV and stationary segments. LFP's revenue share and manufacturing scale make it the pragmatic workhorse for mass market vehicles and stationary storage.

- Anode market is accelerating — Silicon-dominant and silicon-carbon composites are growing fastest; the anode market shows a high CAGR (reported 30.3%) and is expected to scale materially through 2030.

- Supply-chain sovereignty matters strategically — Direct Lithium Extraction (DLE) and modular refining are becoming enterprise priorities to reduce exposure to volatile raw-material markets and to meet domestic content rules in key buyer markets.

- Solid-state progression but with scaling friction — Solid-state lithium-metal markets show very high projected growth (market CAGR ~32.0% in that segment), yet practical deployment remains constrained by interfacial impedance, manufacturing cost, and cycle-life scaling QuantumScape.

- Recycling moves from compliance to feedstock strategy — Regeneration methods that return cathode active materials (CAMs) drop-in ready to manufacturing lines create a durable cost advantage and reduce geopolitically sensitive imports.

- Sodium-ion challenges the stationary market — Sodium-ion offers lower cost, improved safety and high cyclability, making it a credible alternative for stationary applications where energy density compromises are acceptable Statista - Key figures of sodium-ion and lithium-ion batteries 2024.

Technologies and Methodologies

- Direct Lithium Extraction (DLE / DLE-R) — Modular, low-water extraction and on-site refinement that can produce battery-grade salts quickly; technologies that eliminate evaporation ponds materially shorten time-to-product and lower footprint ElectraLith.

- Silicon-dominant and 3D anodes — Engineered silicon-carbon composites, nanoscale architectures, and roll-to-roll compatible manufacturing aim to raise gravimetric capacity while mitigating volumetric expansion through protective coatings and prelithiation.

- Advanced electrolytes and non-flammable formulations — Novel solvent systems and additives that stabilize SEI/CEI layers, and shear-thickening or impact-responsive chemistries that rapidly passivate during mechanical shock to prevent short circuits.

- Solid electrolytes and anode-less designs — Polymer, sulfide, and halide solid electrolytes targeting dendrite suppression and enabling lithium-metal anodes; successful interfaces reduce reliance on heavy passive safety systems.

- Dry electrode and solvent-free manufacturing — Adopted to cut cost, remove NMP from processes, and accelerate scale with lower environmental compliance burdens; these process innovations reduce factory OPEX and capital intensity INITION.

- AI/ML for materials & lifecycle optimization — Machine-learning accelerated materials discovery and battery lifecycle management tools shorten lab-to-line lead times and improve in-field prognostics for fleet and second-life operations Mitra Chem.

Lithium-ion Battery Funding

A total of 2.0K Lithium-ion Battery companies have received funding.

Overall, Lithium-ion Battery companies have raised $375.3B.

Companies within the Lithium-ion Battery domain have secured capital from 7.9K funding rounds.

The chart shows the funding trendline of Lithium-ion Battery companies over the last 5 years

Lithium-ion Battery Companies

- Green Li-ion — Green Li-ion develops modular recycling plants that claim to convert spent cells into production-ready cathode and anode materials at higher economic yields than legacy processes; this addresses concentrated upstream risk and provides localized feedstock for cell makers. The company's approach emphasizes modularity for in-country deployment, cutting transport and import exposure. Their IP targets full CAM regeneration rather than producing low-value black mass, positioning them to capture margin in closed-loop supply chains.

- Silib — Silib commercializes 3D, 100% silicon anodes that increase cell capacity by up to 40% within the same form factor via integrated current-collector designs. Their value proposition concentrates on a drop-in anode material that reduces the need for wholly new cell lines, lowering adoption friction for OEMs. Scale challenges remain, but their capital deployment of ~$18.0M in funding indicates viable pilot capacity and early customer validation.

- Elementium — Elementium develops advanced electrolyte systems licensed from academic partners, targeting higher voltage, improved cycle life, and enhanced thermal stability to enable faster charging without shortened calendar life. Their electrolyte formulations aim to be compatible with existing electrode chemistries, making them an attractive partner for incumbent cell manufacturers seeking incremental performance gains. Elementium's small team focuses on rapid pilot validation and licensing revenue models.

- ExPost Technology Inc. — ExPost operates a cathode-regeneration platform (PRIME) that prioritizes upcycling manufacturing scrap and EoL LFP cells into reuse-ready CAMs, improving raw material economics and reducing reliance on new mining. The firm's emphasis on regeneration for LFP customers aligns with the industry's shift to LFP in volume markets and provides a margin capture point at the pack-end. Their early traction in the US market positions them to benefit from domestic circularity incentives.

- Ionic Mineral Technologies — Ionic MT produces nano-silicon anode powders (Ionisil™) using halloysite feedstock and targets high-volume, drop-in production for EV and ESS cell makers. Independent OEM verification and targeted Series-B scaling show a path to supply the silicon volumes the anode transition requires. Their focus on vertically integrated feedstock processing reduces commodity exposure for downstream cell manufacturers.

Explore comprehensive profiles of 14.5K companies shaping the future of Lithium-ion Battery with TrendFeedr's Companies feature.

14.5K Lithium-ion Battery Companies

Discover Lithium-ion Battery Companies, their Funding, Manpower, Revenues, Stages, and much more

Lithium-ion Battery Investors

TrendFeedr’s Investors tool allows you to explore detailed investment activities and trends based on 7.4K Lithium-ion Battery investors. This tool provides an in-depth analysis of funding rounds and market dynamics to make informed investment decisions.

7.4K Lithium-ion Battery Investors

Discover Lithium-ion Battery Investors, Funding Rounds, Invested Amounts, and Funding Growth

Lithium-ion Battery News

Stay updated with TrendFeedr’s News feature, which offers you access to 27.8K Lithium-ion Battery articles. This tool provides you with a comprehensive understanding of the historical and current trends shaping the market.

27.8K Lithium-ion Battery News Articles

Discover Latest Lithium-ion Battery Articles, News Magnitude, Publication Propagation, Yearly Growth, and Strongest Publications

Executive Summary

The lithium-ion battery industry will remain the dominant commercial energy storage technology for the coming decade, yet the competitive field is fragmenting. The arithmetic of value capture increasingly rewards operators who secure feedstock through domestic extraction or high-yield recycling and those who convert materials and process advantages into manufacturable cells at scale. Near term, LFP scale and silicon-anode commercialization will determine cost leadership in mass markets while electrolyte and interface engineering will define safety and fast-charge leadership. Firms that combine upstream material certainty, pragmatic manufacturing innovations, and strong pack-level integration stand to convert growth into durable margin.

We’re keen to partner with subject matter experts to enrich our coverage. Think you can help? Let us know.