Logistics Infrastructure Report

: Analysis on the Market, Trends, and TechnologiesThe logistics infrastructure sector is shifting from physical expansion to technology-led capacity and efficiency gains, with the internal data placing global transportation infrastructure at USD 2.10 trillion in 2024 and projecting USD 2.8 trillion by 2030, driven by investments in smarter hubs, electrified fleets, and automation. These investments sit alongside concentrated private funding (total market funding integrated into the market summary) and rising adoption of AI, IoT, and robotics that together compress lead times, reduce warehousing-to-last-mile costs, and raise the value proposition for modular, software-enabled logistics assets.

Our latest update of this report was 119 days ago. If you found a mistake or missing information, tell us!

Topic Dominance Index of Logistics Infrastructure

The Topic Dominance Index evaluates Logistics Infrastructure's significance by analyzing data on the distribution of news articles that mention Logistics Infrastructure, the timeline of newly founded companies working in this sector, and global search trends

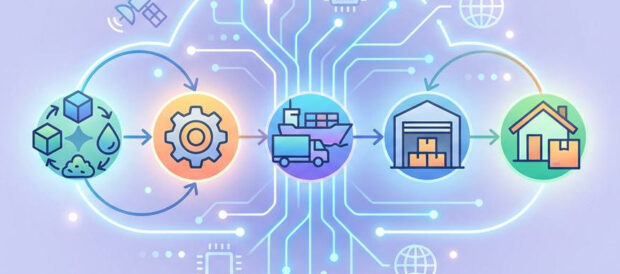

Key Activities and Applications

Automated warehouse operations: deployment of AMRs, AS/RS, conveyor and sortation systems to reduce manual pick-and-pack hours and increase throughput; these systems integrate with WMS/TMS layers to enable higher pick rates and shift capacity from labour to software-controlled hardware.

So what: shifting capital to automation reduces variable labour exposure and enables facilities to operate with tighter inventory turns and smaller footprints.Real-time shipment and asset visibility: IoT sensors, RFID, telematics and edge gateways feeding unified visibility platforms for inventory and fleet condition monitoring.

So what: continuous telemetry shortens exception resolution and supports premium SLAs for time-sensitive cargo.Digital freight marketplaces and orchestration: online load-matching, dynamic pricing and API-first control towers that increase utilization and reduce empty miles.

So what: marketplaces shift margin pools from asset owners to platform orchestration and create recurring software revenue models.Intermodal and terminal modernization: integrated rail-road-sea terminals and modal-agnostic hubs that reduce transit times and inventory days by planning across modes.

So what: improved modal mix reduces per-unit transport cost and carbon intensity for long-haul flows.Last-mile electrification and autonomous delivery pilots: Level 4 delivery vehicle pilots, electric vans and micromobility nodes to cut urban delivery costs and emissions.

So what: urban deliveries become economically viable at higher frequency without proportional increases in local emissions or operating cost.Cybersecurity for operational technology: AI-enabled security for OT/IoT endpoints in warehouses, ports and fleets to protect availability and compliance.

So what: cyber incidents now create direct operational stoppages; security investments convert to resilience and insurance cost savings.

Emergent Trends and Core Insights

Data-first infrastructure upgrades: owners prioritize sensor-ready power, dock packages and edge compute to accommodate real-time systems rather than speculative square footage.

So what: capital markets will reward facilities with built-in digital and electrical density.From speculative build to functional fit: developers shift toward plug-and-play industrial parks and modular fulfillment sites with predefined automation stacks to shorten tenant ramp times.

So what: rental yield premium accrues to properties that reduce tenant integration effort.Acceleration of Logistics 4.0 platforms: cloud-native WMS/TMS, digital twins and AI forecasting move from pilots to production, expanding the logistics-software market (software TAM expanding to tens of billions over the next decade) marketresearchfuture - 2025.

So what: software differentiation becomes the key competitive moat for providers of managed logistics services.Automation-as-a-service and RaaS business models: subscription and usage-based robotics offerings reduce entry cost and accelerate deployment cycles.

So what: smaller operators can adopt high-throughput automation without large upfront CAPEX.Sustainability as capital allocation filter: green logistics (electrified fleets, energy-ready roofs, carbon tracking) influence project finance and public incentives Sustainability in Transportation and Logistics.

So what: projects with measurable emissions reductions access lower-cost capital and favorable public–private partnership terms.Geographic innovation concentration: patent and R&D activity show high intensity in certain geographies, which accelerates local platform scale and exportable system designs.

So what: leaders in patent-heavy regions can monetize integration, licensing and system exports.

Technologies and Methodologies

AI-powered forecasting and optimization engines: demand forecasting, dynamic routing and inventory allocation that update in minutes rather than days.

Significance: reduces safety stock and improves service levels.Edge computing and IoT sensor networks: on-site processing for low-latency condition monitoring and real-time alarms for temperature-critical and high-value cargo.

Significance: supports compliance and reduces spoilage costs in cold chains.Robotic automation and AMRs/AGVs: modular robots for picking, transport and palletizing integrated via APIs to WMS layers.

Significance: boosts throughput and enables 24/7 operations with predictable unit costs.Digital twins and simulation: virtual replicas of terminals and networks for scenario testing, capacity planning and berth/time-window optimization Logistics Visualization System Market (2025-2034).

Significance: reduces risk in layout and automation investments.Blockchain for provenance and secure transactions: selective deployment for high-value or regulated flows where immutable records reduce disputes.

Significance: shortens reconciliation cycles and improves trade compliance.API-first integration and low-code connectors: standardized interfaces that link ERP, TMS, WMS and marketplace platforms to shorten integration time.

Significance: speeds partner onboarding and enables modular service stacks.

Logistics Infrastructure Funding

A total of 117 Logistics Infrastructure companies have received funding.

Overall, Logistics Infrastructure companies have raised $69.9B.

Companies within the Logistics Infrastructure domain have secured capital from 435 funding rounds.

The chart shows the funding trendline of Logistics Infrastructure companies over the last 5 years

Logistics Infrastructure Companies

FreightTiger — FreightTiger provides a cloud-first transportation management and execution platform targeted at complex regional carriers and 3PLs. It focuses on real-time tracking, document workflows and last-mile orchestration that map directly to distribution and last-mile activities described above. The company emphasizes rapid integration with existing TMS through API connectors to reduce deployment friction and to enable smaller carriers to participate in digital freight marketplaces.

Renatus Robotics — Renatus builds modular AMR fleets and RaaS delivery models for mid-size fulfillment centers. Their approach pairs subscription hardware with a cloud orchestration layer to enable plug-and-play intralogistics automation. The company focuses on short lead-time deployments and commercial terms that align robot uptime to client throughput, which lowers adoption barriers for operators with constrained CAPEX.

Port.app — Port.app offers a digital twin and terminal scheduling platform for small to mid-size port operators and inland terminals, enabling berth optimization, equipment scheduling and energy modeling. Their platform yields faster vessel turnaround and clearer berth utilization metrics, which helps port owners raise throughput without major civil expansion.

FleetBase — FleetBase provides edge-enabled telematics and fleet orchestration for mixed fleets with integrated predictive maintenance and routing optimization. By processing sensor streams at the edge and syncing summaries to cloud control towers, FleetBase reduces bandwidth costs and supports sub-second alerts for high-priority assets such as reefers or hazardous shipments.

KSH Infra — KSH develops plug-and-play industrial parks and modular warehousing with pre-provisioned power, high dock counts and standardized automation footprints. Their product targets occupiers who require quick ramp-up for automated fulfillment lines and integrates pre-approved charging and renewable energy options to match sustainability requirements.

Explore comprehensive profiles of 821 companies shaping the future of Logistics Infrastructure with TrendFeedr's Companies feature.

821 Logistics Infrastructure Companies

Discover Logistics Infrastructure Companies, their Funding, Manpower, Revenues, Stages, and much more

Logistics Infrastructure Investors

TrendFeedr’s Investors tool allows you to explore detailed investment activities and trends based on 631 Logistics Infrastructure investors. This tool provides an in-depth analysis of funding rounds and market dynamics to make informed investment decisions.

631 Logistics Infrastructure Investors

Discover Logistics Infrastructure Investors, Funding Rounds, Invested Amounts, and Funding Growth

Logistics Infrastructure News

Stay updated with TrendFeedr’s News feature, which offers you access to 1.5K Logistics Infrastructure articles. This tool provides you with a comprehensive understanding of the historical and current trends shaping the market.

1.5K Logistics Infrastructure News Articles

Discover Latest Logistics Infrastructure Articles, News Magnitude, Publication Propagation, Yearly Growth, and Strongest Publications

Executive Summary

Investors and operators should treat logistics infrastructure as a combined asset-plus-software opportunity: premium returns will attach to facilities and networks that provide power and connectivity for automation, measurable emissions reductions, and tightly integrated software stacks that turn physical throughput into recurring revenue. Short-term winners will be projects and providers that convert existing real estate into sensor-ready, automation-capable sites and that pair those sites with SaaS orchestration to capture margin uplift from reduced labour exposure, improved utilization and expanded service tiers. Long-term advantage will accrue to firms that combine capital efficiency in real assets with proprietary orchestration layers and demonstrable sustainability metrics.

We’re keen to partner with subject matter experts to enrich our coverage. Think you can help? Let us know.