Manufacturing Automation System Report

: Analysis on the Market, Trends, and TechnologiesThe manufacturing automation system market recorded a 2024 market size of $13,100,000,000 and is projected to grow at a CAGR of 8.6%, reaching $21,500,000,000 by 2030, underlining a strong investment case for software-led, modular automation investments. The combination of rising IIoT adoption, demand from EV and semiconductor production, and cloud/hybrid MES rollouts is moving commercial value from discrete hardware to integrated data and control layers, forcing vendors and buyers to prioritize edge-enabled analytics, recipe-based reconfiguration, and plug-and-play cell architectures to capture measurable OEE and time-to-market gains GrandViewResearch – Manufacturing Automation Market, 2024.

We last updated this report 52 days ago. Tell us if you find something’s not quite right!

Topic Dominance Index of Manufacturing Automation System

To gauge the impact of Manufacturing Automation System, the Topic Dominance Index integrates time series data from three key sources: published articles, number of newly founded startups in the sector, and global search popularity.

Key Activities and Applications

- Data-driven material handling and intralogistics: Embedding process metadata on carriers and using AMRs as mobile sensing platforms reduces routing errors and shortens cycle times in high-mix lines Automate Show – Electronics Manufacturing Automation.

- Assembly line modularization and plug-and-produce cells: Rapid reconfiguration using standardized mechanical and digital interfaces enables mass customization and shorter product runs, lowering conversion costs for SKU changes.

- AI-assisted quality and visual inspection: Deploying on-edge deep-learning vision reduces manual inspection time and defect escape rates, delivering immediate closed-loop adjustments to upstream processes Machine vision advances.

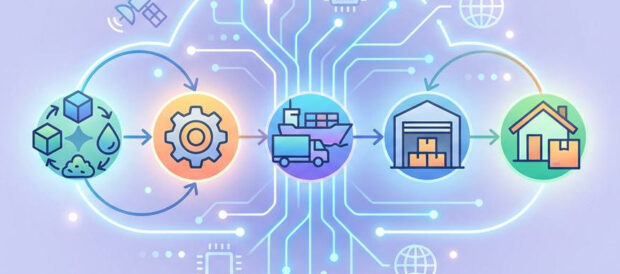

- Predictive maintenance and operations analytics (MES integration): Cloud/hybrid MES plus edge analytics drive predictive replacement cycles and OEE improvements, especially in regulated industries that require traceability.

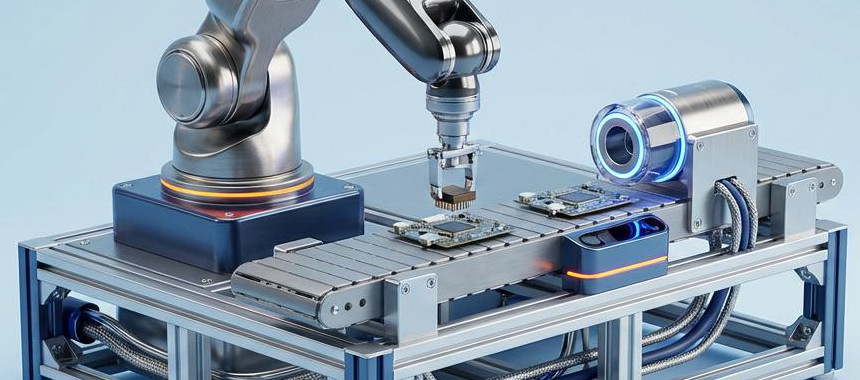

- Specialized automation for high-regulation sectors: Automated assembly and certified PCBA/PCBA-to-product workflows for medical, aerospace, and semiconductor manufacturing are high-value applications where compliance and repeatability justify premium system design ResearchAndMarkets – India 2025.

Emergent Trends and Core Insights

- Software-Defined Automation (SDA) and recipe-based reconfiguration are replacing hardware-centric lock-ins; manufacturers prefer systems where configuration metadata, not low-level code, determines production behavior SDA for Industrial Automation.

- Edge cognition at scale: AI pushed to the device/PLC boundary enables real-time control loops (vision, motion, safety) without cloud latency; this shift reduces central orchestration load and shortens reaction windows for high throughput lines.

- Integration friction is the adoption limiter: High upfront integration costs and legacy interoperability problems remain the primary barrier; solutions that minimize systems-integration labour (no-code/low-code configuration, standard MTP/OPC UA stacks) accelerate ROI realization MarketResearch – Factory Automation 2024.

- Sectoral demand concentration in EV, semiconductor, and pharma creates pull for specialized modules (ultra-clean handling, precision motion, validated MES), increasing the value of niche suppliers that can meet certification and environmental constraints.

- Sovereignty and data-context risk: Proprietary data formats and vendor-specific object models create integration lock-in; standardized, self-describing manufacturing data objects will be a differentiator for platform winners Automation rush among US businesses.

Technologies and Methodologies

- Digital twins and factory emulation: Synchronized digital twins enable virtual commissioning and risk-free validation of control changes, reducing downtime and first-pass errors Digital twins adoption.

- Edge computing with real-time inference: Deploying containerized models at gateways or IPCs keeps tight control loops local and delivers deterministic responses for motion and vision stacks PC-Based Automation market.

- Machine vision + sensor fusion for in-process quality: Multi-modal inspection tied into MES/VMS drives immediate corrective actions and reduces scrap; deep-learning models are now optimized for edge inference on industrial GPUs and AI Box PCs.

- Modular hardware and plug-and-play cell design: Standardized mechanical/electrical interfaces and function blocks (CubeCell/plug-and-play) compress deployment cycles and enable redeployment across product families.

- Hybrid MES architectures (cloud + on-prem): Hybrid deployments balance latency, sovereignty, and scalability; they support regulated industries that require local recordkeeping while enabling centralized analytics.

Manufacturing Automation System Funding

A total of 282 Manufacturing Automation System companies have received funding.

Overall, Manufacturing Automation System companies have raised $14.9B.

Companies within the Manufacturing Automation System domain have secured capital from 867 funding rounds.

The chart shows the funding trendline of Manufacturing Automation System companies over the last 5 years

Manufacturing Automation System Companies

- DeviceSmartIoT — DeviceSmartIoT builds a platform-independent software control layer that connects firmware on disparate equipment to a unified rules engine, effectively combining BMS, SCADA, and DCIM capabilities into a single interface; this reduces integration points and provides enterprise-wide visibility that many manufacturers lack. Their approach targets brownfield sites where direct firmware communication yields immediate energy and uptime gains. Their positioning as a lightweight orchestration layer addresses the integration friction that slows automation projects.

- New Scale Technologies — New Scale Technologies supplies miniature, precision motion modules built around patented piezoelectric motors and integrated controllers, making them ideal for compact, high-precision assembly and inspection tools used in medtech and aerospace. Their embedded motion solutions reduce system complexity and panel space while delivering sub-millimeter accuracy important for micro-assembly cells. Their product set converts precision motion into a repeatable ingredient that larger automation platforms can buy and integrate.

- HPS Industrial B.V. — HPS Industrial B.V. assembles and configures rugged industrial computing and gateway platforms (AI Box PCs, Industrial Gateways) and positions them as long-life, serviceable nodes for edge AI and EtherCAT/industrial Ethernet integration. Their catalog approach addresses industrial buyers who need certified, field-grade compute at scale rather than prototype boards, reducing deployment risk for edge inference and vision stacks.

- Interventional Systems — Interventional Systems commercializes the FDA-cleared Micromate™ miniature robotic platform for image-guided interventional procedures and licenses the platform to OEMs, handling regulatory and manufacturing complexity so partners can deliver medical automation faster. Their B2B OEM model and regulatory capabilities show how platform licensing can accelerate high-regulation automation adoption by removing non-core burdens for integrators.

- All Motion — All Motion produces ultra-compact stepper drivers and motion controllers that reduce panel real-estate and simplify drive integration for OEMs building compact automation equipment. Their small form-factor drives are attractive to system designers pursuing modular cell architectures and micro-assembly platforms where space and heat budgets are constrained.

Enhance your understanding of market leadership and innovation patterns in your business domain.

4.0K Manufacturing Automation System Companies

Discover Manufacturing Automation System Companies, their Funding, Manpower, Revenues, Stages, and much more

Manufacturing Automation System Investors

TrendFeedr’s Investors tool offers comprehensive insights into 1.1K Manufacturing Automation System investors by examining funding patterns and investment trends. This enables you to strategize effectively and identify opportunities in the Manufacturing Automation System sector.

1.1K Manufacturing Automation System Investors

Discover Manufacturing Automation System Investors, Funding Rounds, Invested Amounts, and Funding Growth

Manufacturing Automation System News

TrendFeedr’s News feature provides access to 2.8K Manufacturing Automation System articles. This extensive database covers both historical and recent developments, enabling innovators and leaders to stay informed.

2.8K Manufacturing Automation System News Articles

Discover Latest Manufacturing Automation System Articles, News Magnitude, Publication Propagation, Yearly Growth, and Strongest Publications

Executive Summary

The manufacturing automation system landscape is maturing into an ecosystem where value shifts from bespoke mechanical subsystems to interoperable software layers, edge-native intelligence, and validated digital twins. Market dynamics and forecasted growth numbers make clear that firms should reallocate capital toward modular software stacks, edge compute platforms, and standardized data objects that reduce integration cost and vendor lock-in. For buyers, the immediate actions that deliver measurable returns are: prioritize hybrid MES deployments that preserve data sovereignty while enabling analytics, demand plug-and-play module interfaces for new cell purchases, and select suppliers that demonstrate firmware-level integration capability for fast brownfield ROI. Suppliers that can package validated software recipes, certify cross-vendor interoperability, and support regulated verticals will capture the premium margins the market offers.

We value collaboration with industry professionals to offer even better insights. Interested in contributing? Get in touch!