Optical Character Recognition Report

: Analysis on the Market, Trends, and TechnologiesThe OCR market is at a decisive industrial inflection, driven by enterprise automation and AI-enhanced document intelligence: $16,730,000,000 market size in 2025 with a projected $29,540,000,000 by 2029 at a 15.3% CAGR. Investment and product moves show that winners will be those that convert raw character extraction into reliable, auditable data flows tied to vertical workflows and low-latency deployment (cloud or edge), while legacy point tools risk margin compression as platform integrators consolidate capability stacks.

The last time we updated this report was 14 days ago. If there’s something missing or off, your tips are welcome!

Topic Dominance Index of Optical Character Recognition

The Dominance Index for Optical Character Recognition merges timelines of published articles, newly founded companies, and global search data to provide a comprehensive perspective into the topic.

Key Activities and Applications

- Automated invoice and accounts-payable processing: high-volume extraction of line-items, totals, and vendor fields to drive ERP workflows and reduce manual clerical cost.

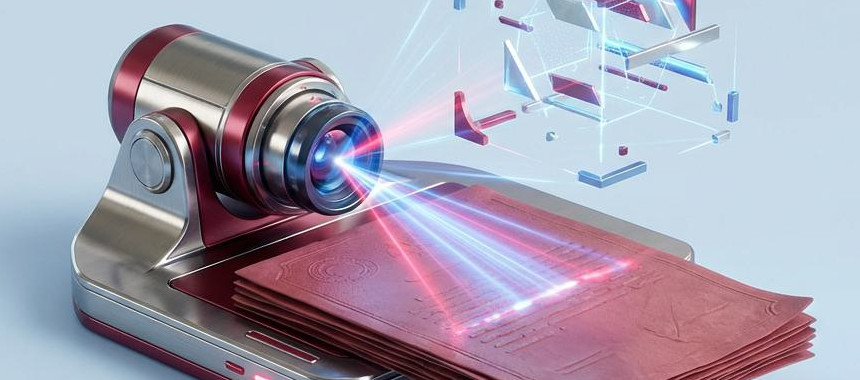

- Identity document capture and KYC automation: passport/MRZ, ID and document-photo parsing combined with verification logic for onboarding and fraud checks; integration with biometric systems increases transactional trust.

- Field/mobile data capture for logistics and inspections: SDKs and light-weight edge models read labels, container codes, and invoices in variable lighting and motion conditions to remove manual entry on the line.

- Clinical and medical record digitization: converting handwritten notes, prescriptions, and legacy charts into structured EHR inputs to improve billing accuracy and enable analytics pipelines.

- Archive and historical-text transcription: specialist pipelines that recover degraded prints and non-Latin scripts for cultural heritage and legal archives; often paired with post-OCR human verification loops.

- Real-time scene text and SKU recognition for retail automation: shelf monitoring and frictionless checkout use OCR/CV fusion to identify product labels and prices on camera feeds marketresearch - Global Optical Character Recognition Industry Trends Analysis Report 2024.

Emergent Trends and Core Insights

- AI-first accuracy gains anchored to context models: transformer and LLM-assisted post-processing now routinely reconcile ambiguous character hypotheses using field-level language constraints, improving end-to-end reliability.

- Hybrid deployment split: cloud scale + edge privacy: cloud services handle heavy throughput and model training while on-device inference reduces latency and data exposure for regulated workloads; vendors emphasize self-host and on-prem SDKs for compliance-sensitive customers.

- Multimodal pipelines (OCR + CV + biometrics + NLP): the value migrates from character strings to validated data objects (e.g. verified identity record, invoice line set), raising buyer willingness to pay for integrated solutions thebusinessresearchcompany - Optical Character Recognition Market, 2025.

- Specialization premium in regulated verticals: healthcare OCT/OCR hybrids and financial KYC stacks command higher ARR because domain constraints (privacy, audit) raise switching costs.

- Label-frugal training and structure-aware self-supervision: masked autoencoders and structure-aware pretraining reduce labeling needs for low-resource scripts and handwriting, lowering deployment barriers for emerging markets.

- Growing emphasis on auditability and tamper evidence: enterprises require encryption, immutable trails, and verifiable extraction logs as OCR becomes an input to compliance workflows.

Technologies and Methodologies

- Transformer-based recognition stacks: layout-aware transformers combine visual encoders with sequence modeling to handle complex forms and tabular data extraction grandviewresearch - Optical Character Recognition Market, (2024 - 2030).

- Intelligent Character Recognition (ICR) for handwriting: dedicated ICR modules (often fine-tuned LMs) raise recall on cursive and variable script inputs, important for healthcare and legacy records.

- Ensemble and multi-engine verification: pipelines that run multiple OCR engines then reconcile outputs using a context model produce materially fewer false positives on mission-critical fields.

- Preprocessing pipelines for degraded inputs: adaptive denoising, skew correction, and line-rectification (including curve handling) improve base recognition rates before model inference.

- Edge-optimized models and mobile SDKs: quantized networks and on-device inference libraries reduce latency and preserve privacy for field capture and access-control use cases marketresearch - AI-Based Optical Character Recognition Market, Forecasts from 2025 to 2030.

- Integration-first APIs and IDP orchestration: API/SDK-first product design that exposes confidence scores, correction hooks, and field-mapping reduces systems-integration cost and accelerates adoption researchandmarkets - Optical Character Recognition Market, 2025-2034.

- Optical hardware and lens improvements feeding capture quality: wafer-level optics and improved sensor-lens stacks drive higher SNR at capture, enabling downstream models to operate with fewer corrective steps.

Optical Character Recognition Funding

A total of 386 Optical Character Recognition companies have received funding.

Overall, Optical Character Recognition companies have raised $10.5B.

Companies within the Optical Character Recognition domain have secured capital from 1.7K funding rounds.

The chart shows the funding trendline of Optical Character Recognition companies over the last 5 years

Optical Character Recognition Companies

- CharacTell — CharacTell provides form-processing OCR tailored to high-throughput enterprise workflows; its stack combines proprietary OCR with neural networks and NLP to handle complex invoices, surveys, and elections-scale forms. The company positions for integrator partnerships where packaged, high-accuracy ingestion is a drop-in for larger document-management systems.

- OCR Studio — OCR Studio offers lightweight cross-platform SDKs (mobile, web) focused on MRZ, ID and passport reading with GDPR/CCPA-aware on-prem capabilities; this approach targets customers that require local processing for privacy-sensitive onboarding. Their small team and focused product make them an attractive partner for vertical integrators.

- POMEAS — POMEAS builds measurement and industrial vision devices that include high-quality capture hardware and lens systems; by controlling optics and capture, they reduce pre-OCR error and accelerate deployments in manufacturing inspection and serial-code reading contexts.

- ExperVision — ExperVision focuses on universal-language OCR engines and claims efficient alternatives to manual keyboarding; its product is designed for integrators seeking language coverage and throughput for enterprise content management, making it an ingredient vendor for large IDP stacks.

Delve into the corporate landscape of Optical Character Recognition with TrendFeedr’s Companies tool

1.9K Optical Character Recognition Companies

Discover Optical Character Recognition Companies, their Funding, Manpower, Revenues, Stages, and much more

Optical Character Recognition Investors

TrendFeedr’s Investors tool provides insights into 2.0K Optical Character Recognition investors for you to keep ahead of the curve. This resource is critical for analyzing investment activities, funding trends, and market potential within the Optical Character Recognition industry.

2.0K Optical Character Recognition Investors

Discover Optical Character Recognition Investors, Funding Rounds, Invested Amounts, and Funding Growth

Optical Character Recognition News

TrendFeedr’s News feature offers you access to 5.6K articles on Optical Character Recognition. Stay informed about the latest trends, technologies, and market shifts to enhance your strategic planning and decision-making.

5.6K Optical Character Recognition News Articles

Discover Latest Optical Character Recognition Articles, News Magnitude, Publication Propagation, Yearly Growth, and Strongest Publications

Executive Summary

OCR has moved beyond the simple extraction of glyphs to become an integral data-ingestion layer that must deliver verifiable, context-aware data objects into enterprise pipelines. The market numbers—$16.73 billion in 2025 and a mid-range projection to ~$29.54 billion by 2029—confirm a sustained appetite for automation and AI-augmented document intelligence. Strategic winners will be those that: embed OCR into vertical workflows, guarantee data privacy through flexible edge/cloud options, and productize post-processing layers that turn raw text into auditable, domain-validated data. For providers, the path to defensible value lies in either deep vertical specialization with regulatory and workflow moats or fast, open integration into platform ecosystems where OCR becomes a persistent, revenue-generating service rather than a one-time feature.

Are you an insider in the trends or tech industry? We’d love for you to contribute to our content.