Private Networking Report

: Analysis on the Market, Trends, and TechnologiesThe private networking market shows concentrated investment and expanding technical ambition: total funding across topic companies stands at $57.38B and the ecosystem includes 3,670 active companies, even as news and company formation rates decline, signaling a maturing commercial layer with accelerating technology adoption. Market forecasts and vendor metrics reinforce the commercial opportunity—analysts project a private-network market of US$6 billion by 2030 driven by manufacturing, logistics, energy and public safety Mobile Experts: Private networking market worth $6B by 2030. The result is a market split between software-first overlay players promising frictionless, identity-centric access and infrastructure players offering controlled physical or carrier-grade private fabrics; enterprises will choose by risk profile (latency, data residency, OT safety) rather than by cost alone

The last time we updated this report was 7 days ago. If there’s something missing or off, your tips are welcome!

Topic Dominance Index of Private Networking

The Dominance Index for Private Networking merges timelines of published articles, newly founded companies, and global search data to provide a comprehensive perspective into the topic.

Key Activities and Applications

- Zero Trust Network Access (ZTNA) deployment as the primary replacement for legacy site-to-site VPNs, enabling per-device and per-service policy enforcement for distributed OT and IT assets.

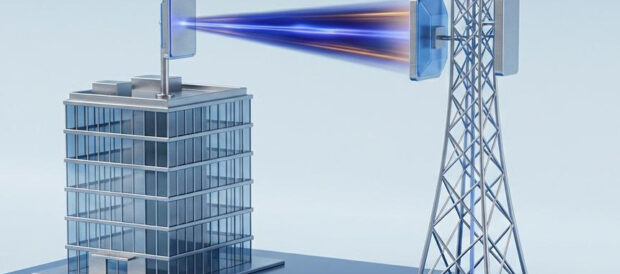

- On-premises private cellular rollouts (private LTE/5G) for latency-sensitive automation in factories, ports and mines; on-premises models already accounted for 51% of deployments in 2024, and enterprises favor them for control of spectrum and latency 5G Enterprise Private Network Market Size, Growth Report 2034.

- Peer-to-peer/mesh overlays that create direct, encrypted device-to-device paths for low latency and simpler NAT traversal, used in distributed IoT and edge compute scenarios.

- Edge AI + private RAN integration to keep inference and control loops local, reducing backhaul and enabling deterministic operations in Industry 4.0 use cases Private LTE & 5G Network Ecosystem Market Research Report 2025 ….

- Physical isolation and fail-stop controls for high-assurance environments, where hardware-level disconnects or dedicated L2 fabrics are required to maintain critical services.

Emergent Trends and Core Insights

- Infrastructure disaggregation is winning commercial traction: software that decouples control from proprietary forwarding planes captures strategic value, evidenced by large investments into cloud-native network software and whitebox adoption.

- Identity and intent trump location: policy enforcement increasingly attaches to user/device identity and service intent rather than IP ranges, moving enterprises toward identity-defined perimeters.

- A two-track security posture emerges: one track layers zero-trust overlays over any transport; the other demands protocol/hardware isolation (including physical disconnect devices) for the highest assurance customers.

- Supply concentration creates operational risk: five major RAN vendors account for the bulk of private-RAN shipments; strong vendor concentration compresses choice but also accelerates interoperability work and vendor partnerships Private Wireless Growth Continues in 1H25 – Dell'Oro Group.

- Neutral-host and regional sovereign networks gain momentum as enterprises and venues seek multi-carrier coverage with single operational control, pushing alternative business models for large campuses and venues Private networks: the future of enterprise connectivity – STL Partners.

Technologies and Methodologies

- WireGuard and modern VPN overlays as the de facto high-performance encrypted overlay; used widely in open and proprietary mesh products (low configuration, efficient crypto).

- Private 5G (standalone) and private LTE combined with virtualized cores and network slicing for deterministic throughput and QoS in industrial deployments Global Private 5G Network Growth Opportunities.

- Zero Trust and microsegmentation implemented via automated policy engines and agentless/agent-based controls for lateral movement prevention.

- Open RAN and vRAN architectures to allow multi-vendor radio/topology choices while supporting commodity radio hardware and centralized orchestration.

- Time Sensitive Networking (TSN) and deterministic Ethernet to provide sub-millisecond synchronization for industrial control when combined with private cellular or dedicated L2 fabrics.

- Intent-based orchestration and intent-to-action automation for multi-site deployments to reduce manual configuration and accelerate lifecycle operations.

Private Networking Funding

A total of 426 Private Networking companies have received funding.

Overall, Private Networking companies have raised $57.4B.

Companies within the Private Networking domain have secured capital from 1.6K funding rounds.

The chart shows the funding trendline of Private Networking companies over the last 5 years

Private Networking Companies

- Husarnet — Husarnet focuses on peer-to-peer VPN overlays tailored for Industry 4.0 devices, enabling direct device-to-device communications across Wi-Fi, Ethernet, LTE and 5G without centralized routing. Its product targets robotics, sensors and microcontroller fleets where low latency and minimal configuration matter; the company emphasizes edge node operation and developer-friendly integration. This approach reduces reliance on centralized clouds and supports real-time control loops in distributed industrial deployments

- Remote.It — Remote.It delivers Zero Trust connectivity as code, replacing manual IP/subnet management with programmatic tools that make remote devices accessible without exposing services publicly; the product is positioned for IT/OT teams managing distributed endpoints. The offering targets enterprises that must reconcile overlapping address spaces and dynamic device inventories, and it reduces configuration overhead through developer APIs. Remote.It's commercial profile shows early-stage funding and a small, engineering-led team focused on code-first connectivity

- Niral Networks — Niral Networks builds a modular NOS and orchestration layer for private 5G and edge compute, marketed as a way to operate multi-site, low-latency private cellular with commodity hardware. Its NiralOS product family bundles core, edge and orchestration tooling to reduce integration friction for manufacturing, ports and energy customers that require strict performance and security SLAs. The company targets enterprises that need a full private 5G stack but want to avoid vendor lock-in

- Goldilock Secure — Goldilock Secure offers a hardware-centric approach to high-assurance isolation via its FireBreak™ physical connection controller, enabling remote physical disconnection of networks or segments on demand. The product suits defense and critical infrastructure customers that require a physical fail-stop capability that software controls alone cannot provide. Goldilock positions the offering as a complement to Zero Trust overlays for the very highest-risk environments

- nets360 — nets360 builds a provider-independent Layer-2 core and managed private network service focused on European enterprises and regulated industries that need in-region control and compliance. The company emphasizes low latency, regulated data paths and multi-carrier resilience through a dedicated core that bypasses the public internet, addressing data residency and critical critical-services reliability concerns. nets360 targets customers who prefer an infrastructure-first option rather than overlay-only solutions

Delve into the corporate landscape of Private Networking with TrendFeedr’s Companies tool

3.7K Private Networking Companies

Discover Private Networking Companies, their Funding, Manpower, Revenues, Stages, and much more

Private Networking Investors

TrendFeedr’s Investors tool provides insights into 2.1K Private Networking investors for you to keep ahead of the curve. This resource is critical for analyzing investment activities, funding trends, and market potential within the Private Networking industry.

2.1K Private Networking Investors

Discover Private Networking Investors, Funding Rounds, Invested Amounts, and Funding Growth

Private Networking News

TrendFeedr’s News feature offers you access to 6.7K articles on Private Networking. Stay informed about the latest trends, technologies, and market shifts to enhance your strategic planning and decision-making.

6.7K Private Networking News Articles

Discover Latest Private Networking Articles, News Magnitude, Publication Propagation, Yearly Growth, and Strongest Publications

Executive Summary

Private networking now sits at the intersection of access control, operational reliability and regulatory constraints. The dominant decisions for enterprise buyers will hinge on three tradeoffs: whether they prioritize control (on-premises private cellular or dedicated L2 fabrics), frictionless access (identity-centric overlays and mesh VPNs), or assured isolation (hardware enforced disconnects and protocol-level guarantees). Financial and patent activity shows the technical scoreboard: cloud-native orchestration, WireGuard-style overlays, and private 5G stacks attract investment and deployment cycles; however, high-risk verticals will continue to require physical or protocol-native assurances that software alone cannot guarantee. Businesses preparing procurement strategies should map applications to threat profiles and operational constraints, then select a mix of overlay intelligence, private RAN options, and hardened isolation controls so that connectivity becomes a controllable business variable rather than a brittle dependency.

Are you an insider in the trends or tech industry? We’d love for you to contribute to our content.