Radar Sensors Report

: Analysis on the Market, Trends, and TechnologiesThe radar sensors market sits at a critical inflection point: market data records a USD 24,540,000,000 market size in 2025 with an asserted CAGR of 16.7%, and forecasts point to USD 53,120,000,000 by 2030, indicating substantial commercial traction for high-fidelity sensing across automotive, industrial, and defense uses. This expansion stems from three converging forces: rapid adoption of ADAS and higher-level autonomous functions, large defense and infrastructure modernization programs that demand resilient all-weather sensing, and a migration of value toward firms that pair advanced hardware with edge AI and sensor-fusion software Radar Sensor Market Overview. The immediate commercial battleground centers on 4D imaging, interference management in dense deployments, and low-power, tightly integrated mmWave SoCs that enable radar to move into IoT and health monitoring contexts.

This report was last revised 20 days ago. See a missing piece? Your input can help — contact us.

Topic Dominance Index of Radar Sensors

The Dominance Index for Radar Sensors delivers a multidimensional view by integrating data from three key viewpoints: published articles, companies founded, and global search trends

Key Activities and Applications

- Automotive ADAS and autonomous perception — Adaptive cruise control, blind-spot detection, emergency braking, and medium-range 4D imaging for richer object classification drive the largest single application demand and procurement cycles across OEMs and Tier-1 suppliers Automotive Radar Sensors Market – Global Market Analysis Report.

- Autonomous vehicle perception stacks — Development and integration of high-resolution 4D radars into perception stacks (range, azimuth, elevation, Doppler) for reliable operation in poor lighting and adverse weather conditions.

- Aerospace and defense sensing — Long-range imaging, SAR/ISAR, and AESA radar upgrades for surveillance, missile defense, and platform navigation continue to underpin steady procurement and large contract values Radar Market 2025.

- Industrial automation and safety — Safety-rated 3D radar for proximity monitoring, robotic cell protection, and process control where optical sensors fail (dust, smoke, steam) is gaining certified use in manufacturing and logistics.

- Smart-city traffic and infrastructure monitoring — Contactless vehicle/pedestrian detection, flow optimization, and perimeter surveillance allow municipalities to extend sensing beyond vehicles into infrastructure management Radar Sensors Market Research Report.

- Vital-sign and consumer IoT sensing — Ultra-wideband and 60 GHz in-cabin and home sensors for contactless respiration and micro-movement monitoring open healthcare and smart-appliance pathways.

Emergent Trends and Core Insights

- 4D imaging becomes table stakes for any supplier targeting L2+ and higher autonomy, with investment concentrated in angular fidelity, elevation estimation, and velocity-resolved point clouds.

- Software-defined radar architectures allow feature upgrades and field reconfiguration, shifting differentiation from pure RF hardware to software and algorithm suites that monetize updates and calibration services.

- Edge-AI at the sensor is standardizing: embedding classification and clutter rejection on the radar module reduces data throughput and enables real-time decisions without cloud dependency.

- Interference management and coordinated radar communications emerge as operational necessities as vehicle and infrastructure radar density grows; companies tackling mutual interference will command higher OEM preference.

- Verticalization of radar creates defensible niches: industrial-grade safety radars, bird/drone surveillance, subsea metallic detection, and GPR integrated into construction equipment show higher margin resilience versus commoditized automotive corner radars.

- Regulatory and testing standardization for performance metrics and interference certification will materially shape adoption speed in automotive and public-sector procurements.

Technologies and Methodologies

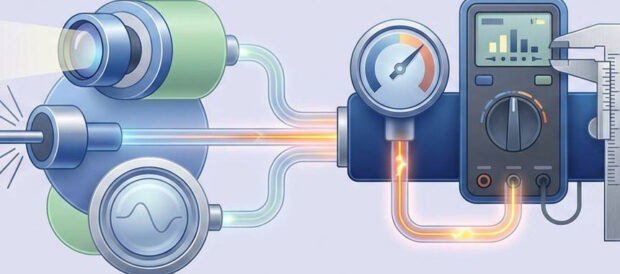

- Frequency-Modulated Continuous Wave (FMCW) — The dominant modality for automotive and short-range sensing because it balances range and velocity resolution with compact hardware.

- Millimeter-wave (mmWave) 60/77/79 GHz SoCs and AiP — High frequency mmWave transceivers and Antenna-in-Package solutions enable compact imaging radars with improved angular resolution; chip vendors and AiP integrators are central to cost and scale dynamics Calterah Semiconductor.

- 4D Imaging and Distributed Aperture Radar — Multi-channel MIMO plus distributed apertures synthesize larger virtual apertures, enabling fine spatial and velocity discrimination without large mechanical arrays.

- Digital Beamforming and MIMO cascades — These drive angular precision and 360-degree coverage with electronically steered beams for automotive corner and forward-looking packages.

- Metamaterials MESA arrays — Electronically scanned metamaterial arrays reduce SWaP while delivering beam agility for portable and perimeter radars Echodyne.

- Ultra-Wideband (UWB) and THz sensing — UWB enables centimeter-level ranging and indoor localization; terahertz bands promise higher resolution imaging for niche automotive and industrial use cases Aria Sensing.

- Model-based system analysis and test-bench standardization — Rigorous MBSA lowers integration risk and accelerates certification of complex, sensor-fused perception stacks SafeRadar Research Sweden AB.

Radar Sensors Funding

A total of 134 Radar Sensors companies have received funding.

Overall, Radar Sensors companies have raised $4.5B.

Companies within the Radar Sensors domain have secured capital from 469 funding rounds.

The chart shows the funding trendline of Radar Sensors companies over the last 5 years

Radar Sensors Companies

- OndoSense OndoSense

OndoSense develops high-precision industrial radar sensors tuned for digitized production environments where optical sensors fail. Their product set focuses on micrometer-level distance and wear measurement, with embedded IoT connectivity and sensor-network software for plant monitoring. This profile aligns directly with the industrial automation and safety activities described earlier, and positions them for factory modernization projects driven by Industry 4.0 investments. - Inxpect Inxpect

Inxpect produces certified 3D radar safety sensors for industrial robotics and automated lines, marketed as safety-rated alternatives to light curtains and scanners. The company emphasizes compliance to international safety standards and licenses its core technology across verticals, making it a prime candidate for customers that prioritize certified, integration-ready radar in harsh environments. - Radar Reticence AB Radar Reticence AB

Radar Reticence AB focuses on advanced signal processing and interference mitigation for automotive radar, addressing the growing real-world problem of mutual radar interference in high-density deployments. Their approach targets improved detection reliability and lower false-positive rates, which directly supports ADAS supply chains and OEM sensor harmonization efforts. - KMB Telematics Inc. KMB Telematics Inc.

KMB develops 3D point-cloud radar optimized for drone detection and low-RCS aerial targets, tailored to the counter-UAS and tactical surveillance market. Their small, tactical units produce rich 3D returns that integrate readily with AI fusion engines for classification in defense and critical-infrastructure settings. - SEADAR Technologies SEADAR Technologies

SEADAR offers a novel subsea radar modality for detection, geolocation, and tracking of metallic objects and electronic signatures underwater, a unique niche that addresses maritime survey, port security, and naval MCM (mine countermeasure) needs. Their focus exemplifies an effective verticalization play where radar capability meets an otherwise under-served sensing requirement.

TrendFeedr's Companies feature is your gateway to 749 Radar Sensors companies.

749 Radar Sensors Companies

Discover Radar Sensors Companies, their Funding, Manpower, Revenues, Stages, and much more

Radar Sensors Investors

The Investors tool by TrendFeedr offers a detailed perspective on 611 Radar Sensors investors and their funding activities. Utilize this tool to dissect investment patterns and gain actionable insights into the financial landscape of Radar Sensors.

611 Radar Sensors Investors

Discover Radar Sensors Investors, Funding Rounds, Invested Amounts, and Funding Growth

Radar Sensors News

TrendFeedr’s News feature allows you to access 1.9K Radar Sensors articles as well as a detailed look at both historical trends and current market dynamics. This tool is essential for professionals seeking to stay ahead in a rapidly changing environment.

1.9K Radar Sensors News Articles

Discover Latest Radar Sensors Articles, News Magnitude, Publication Propagation, Yearly Growth, and Strongest Publications

Executive Summary

Radar sensors are moving from component-level competition to platform competition defined by software, edge AI, and integration depth. The market's mid-to-long term expansion rests on two linked outcomes: first, achieving cost and power profiles (via mmWave SoCs and AiP designs) that fit high-volume automotive and IoT deployments; second, proving resilient, interference-aware performance through embedded AI and standardized testing so that OEMs and public authorities accept radar as a reliable perception standard. Strategic winners will combine chip access, advanced beamforming architectures, and proprietary signal-processing stacks that are proven in certified field trials. Niche specialists that sharpen vertical use cases or own critical subdomains such as subsea detection, industrial safety certification, or counter-UAS will retain stronger margin profiles while platform integrators pursue scale across vehicle and infrastructure programs.

Partner with us to offer cutting-edge insights into trends and tech. We welcome your input.