Solar Storage Report

: Analysis on the Market, Trends, and TechnologiesThe solar storage market is accelerating into scale and specialization: the internal trend report records a market size of $10,620,000,000 in 2022 and a projected 34.9% CAGR that underpins an $88,940,000,000 projection for 2028. Rapid cost declines in battery systems (to about $115/kWh in 2024) and record additions—9.2 GW of storage in the U.S. in 2024, including hybrid solar-plus-storage projects—mean the industry is moving from isolated deployments to integrated dispatchable capacity stacks that monetize grid services as well as energy shifting.

55 days ago, we last updated this report. Notice something that’s not right? Let’s fix it together.

Topic Dominance Index of Solar Storage

To gauge the influence of Solar Storage within the technological landscape, the Dominance Index analyzes trends from published articles, newly established companies, and global search activity

Key Activities and Applications

- Utility-scale solar-plus-storage for firm capacity and ancillary services: Co-located projects use multi-MWh batteries to convert variable PV into dispatchable capacity, supporting peak shaving, frequency regulation, and transmission deferral U.S. Battery Storage Hits a New Record Growth in 2024.

- Mid-market modular systems (250–1,000 kW) for commercial and industrial use: Containerized, plug-and-play units target demand-charge reduction and resilience for C&I sites; the 251–500 kW segment alone held >14% of 2024 market share, reflecting a preference for scalable capacity blocks Solar Energy Storage Market Size & Share Report, 2025.

- Residential solar-plus-storage for backup and VPP participation: Household adoption is rising unevenly by state (examples: California 14%, Massachusetts 14.8% co-installation in 2023), with increasing residential systems enrolled in Virtual Power Plants for grid services Solar Market Insight Report 2024 Year in Review – SEIA.

- Long-duration storage pilots and thermal solutions to address multi-hour and seasonal needs: Developers test molten-salt, liquid-metal, and thermochemical stores to extend dispatch beyond the typical 4-hour window.

Emergent Trends and Core Insights

- Chemistry diversification is underway: Industry actors are actively moving beyond a lithium-ion monoculture toward flow batteries, iron/iron flow, and thermal stores to manage duration and supply-chain risk.

- Mid-size modularity captures fastest near-term demand: The combined 251–1,000 kW bands account for a significant slice of recent capacity, driven by modular container systems that lower deployment time and enable staged expansion.

- Software monetizes flexibility: Value accrues to firms that combine hardware with intelligent EMS/VPP bidding and market participation; software layers increasingly determine marginal revenue per kWh for owners Energy Toolbase Software.

- Policy remains a gating factor and accelerator simultaneously: Investment tax credits, regional rebate programs (e.g. U.S. ITC/IRA extensions and California rebates) materially change project IRRs and accelerate commercial uptake.

- Second-life EV batteries and circular supply models appear at scale: Repurposed EV packs reduce capital intensity for stationary storage while introducing new lifecycle and warranty considerations.

- Non-electrochemical options gain strategic interest for long-duration needs: Research into molecular thermal storage and large-scale molten salts suggests a pathway to multi-day and seasonal balancing at potentially lower per-MWh cost for long-duration applications.

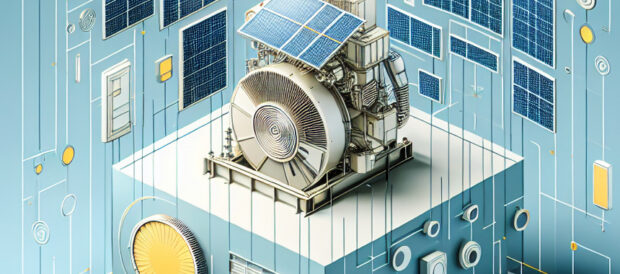

Technologies and Methodologies

- Lithium-ion and LiFePO4 battery packs for high-energy density and declining capex; they dominate near-term deployments due to manufacturing scale and falling cell costs Solar-Plus-Storage Analysis – NREL.

- Flow batteries (vanadium, quinone, zinc-bromine) for multi-hour, non-flammable storage in commercial and utility projects seeking long cycle life Quino Energy.

- Thermal energy storage (molten salt, liquid metal, thermochemical) for low-cost multi-hour to seasonal capacity; several projects and pilots target low $/kWh LCOE for long durations.

- Hybrid architectures (supercapacitor + battery, battery + thermal) to capture instant power and long sustain—this reduces required BESS size and improves economics for grid services.

- AI-driven BMS/EMS and VPP orchestration for predictive dispatch, trading, and lifecycle optimization, which materially increases project revenue streams by enabling market participation.

- Containerized, modular system design and pre-certified inverter + BMS stacks to shorten interconnection timelines and enable staged capacity growth for mid-market customers.

Solar Storage Funding

A total of 437 Solar Storage companies have received funding.

Overall, Solar Storage companies have raised $138.8B.

Companies within the Solar Storage domain have secured capital from 1.5K funding rounds.

The chart shows the funding trendline of Solar Storage companies over the last 5 years

Solar Storage Companies

- Yotta Energy — Yotta Energy designs panel-level storage modules targeted at Commercial & Industrial rooftops that remove the need for separate battery rooms and provide passive thermal management between 21°C and 38°C

- Photoncycle — Photoncycle develops seasonal storage concepts aimed at household self-sufficiency by moving surplus summer solar into longer-duration chemical stores; their model targets markets with pronounced seasonal variability where standard BESS economics fail.

- ESS Inc. — ESS Inc. supplies iron-flow battery systems that prioritize longevity and non-flammability for commercial and community systems; their value proposition reduces safety and recycling liabilities for long-duration grid assets.

- Infact — Infact is advancing integrated photo-assisted storage devices that directly combine light harvesting with storage in compact units for small commercial and rural electrification markets; the product aims to cut complexities in off-grid deployments where infrastructure support is limited.

Get detailed analytics and profiles on 5.6K companies driving change in Solar Storage, enabling you to make informed strategic decisions.

5.6K Solar Storage Companies

Discover Solar Storage Companies, their Funding, Manpower, Revenues, Stages, and much more

Solar Storage Investors

TrendFeedr’s Investors tool provides an extensive overview of 1.4K Solar Storage investors and their activities. By analyzing funding rounds and market trends, this tool equips you with the knowledge to make strategic investment decisions in the Solar Storage sector.

1.4K Solar Storage Investors

Discover Solar Storage Investors, Funding Rounds, Invested Amounts, and Funding Growth

Solar Storage News

Explore the evolution and current state of Solar Storage with TrendFeedr’s News feature. Access 15.9K Solar Storage articles that provide comprehensive insights into market trends and technological advancements.

15.9K Solar Storage News Articles

Discover Latest Solar Storage Articles, News Magnitude, Publication Propagation, Yearly Growth, and Strongest Publications

Executive Summary

Solar storage is shifting from cost-reduction and early adopters to strategically differentiated deployment: shorter payback mid-market modules capture near-term revenue while long-duration and thermal stores address the critical mismatch between daily solar cycles and seasonal demand. The commercial winner set will include firms that combine scalable hardware, durable chemistries for extended duration, and software that monetizes flexibility through markets and grid services. Policymakers and investors should prioritize support for interconnection standardization, incentives that reward firm capacity (not only energy), and demonstration projects that validate low-cost long-duration options; industry players should focus on integrated product/service models (hardware + EMS + financing) to secure recurring revenue and margin protection.

We're looking to collaborate with knowledgeable insiders to enhance our analysis of trends and tech. Join us!