Thermal Management Report

: Analysis on the Market, Trends, and TechnologiesThe thermal management business domain is witnessing a surge in innovation and growth, driven by the increasing need for efficient temperature regulation across various industries. The data reflects a mature market with a wide scope, encompassing appliances, machinery, automotive, and semiconductors. Key trends include the development of Thermal Interface Materials, Power Electronics, Cooling Systems, and Power Management. Significant investments from entities like the US Department of Defense and Modine Manufacturing are fueling advancements in thermal management technologies. The sector is experiencing a positive trajectory with substantial annual growth in funding, media coverage, and revenue, despite stability in the number of new entrants.

51 days ago, we last updated this report. Notice something that’s not right? Let’s fix it together.

Topic Dominance Index of Thermal Management

The Topic Dominance Index takes a comprehensive approach to analyzing the evolution of Thermal Management. It combines the distribution of news articles that mention Thermal Management, the timeline of newly founded companies working within this sector, and the share of voice within the global search data. These timelines are normalized and combined to show a comprehensive view of the Thermal Management evolution relative to all known Trends and Technologies.

Key Activities and Applications

- Development and manufacturing of thermal management products and insulation technology.

- Production of advanced high-performance ceramic-ceramic composite materials for thermal, structural, and electrical insulating applications.

- Specialization in thermal barrier technologies for various industries, including nuclear.

- Provision of comprehensive safety control solutions designed for thermal runaway in lithium-ion batteries.

- Manufacturing of thermal management solutions for the automotive, commercial truck, and recreational vehicle marketplaces.

- Design and development of cutting-edge fire safety and heat management solutions.

- Production of refractory bricks, temperature fabrics, and furnaces for thermal management.

Emergent Trends and Core Insights

- A mature and expansive market with significant annual growth in funding (110.72%) and news coverage (10.5%).

- Surging interest in thermal management solutions, ranking in the top 5.69% in article coverage.

- Stability in the number of new companies entering the market, indicating a focus on enhancing existing technologies.

- Notable advancements in temperature regulation technologies, influenced by trends in Thermal Interface Material, Power Electronics, Cooling Systems, and Power Management.

- Large-scale investments driving innovation, particularly from public funds and defense sectors.

Technologies and Methodologies

- Plasma-sprayed thermal barrier coatings for various applications.

- Thermal management systems, compound fire detectors, and fire suppression devices for energy safety and reliability.

- Water-based fire-protection paint and insulating paints for temperature management.

- Thermal simulation, thermosimulation, and thermal analysis for electronic systems.

- Immersion-Cooled Battery Systems for electric vehicles and energy storage systems, featuring ultra-fast charging capability and safety features.

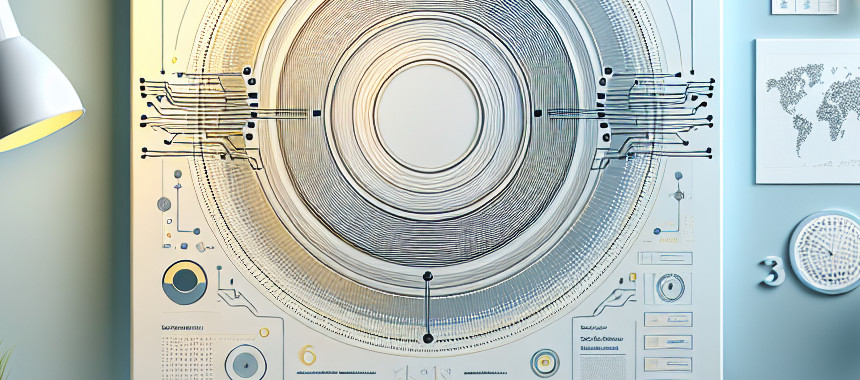

Thermal Management Funding

A total of 230 Thermal Management companies have received funding.

Overall, Thermal Management companies have raised $14.8B.

Companies within the Thermal Management domain have secured capital from 496 funding rounds.

The chart shows the funding trendline of Thermal Management companies over the last 5 years

Thermal Management Companies

Gain a competitive edge with access to 1.5K Thermal Management companies. Find out new technical advancements and market trends in Thermal Management through TrendFeedr’s extensive Companies feature. The tool is essential for business strategists and leaders in the field.

1.5K Thermal Management Companies

Discover Thermal Management Companies, their Funding, Manpower, Revenues, Stages, and much more

Thermal Management Investors

Leverage TrendFeedr’s sophisticated investment intelligence into 213 Thermal Management investors. It covers funding rounds, investor activity, and key financial metrics in Thermal Management. investors tool is ideal for business strategists and investment experts as it offers crucial insights needed to seize investment opportunities.

213 Thermal Management Investors

Discover Thermal Management Investors, Funding Rounds, Invested Amounts, and Funding Growth

Thermal Management News

TrendFeedr’s News feature provides a historical overview and current momentum of Thermal Management by analyzing 10.2K news articles. This tool allows market analysts and strategists to align with latest market developments.

10.2K Thermal Management News Articles

Discover Latest Thermal Management Articles, News Magnitude, Publication Propagation, Yearly Growth, and Strongest Publications

Executive Summary

The thermal management sector is a vital component in enhancing operational efficiency and product reliability across diverse industries. With a mature market and substantial investments fueling innovation, the sector is poised for continued growth. Companies are engaged in creating advanced materials and systems for effective temperature control, with a trend towards eco-friendly and energy-efficient solutions. The significant annual growth in funding and media presence underscores the sector's potential for future advancements, making it a critical area for businesses to explore for new opportunities.

We're looking to collaborate with knowledgeable insiders to enhance our analysis of trends and tech. Join us!