This packaging trends report explores the industry’s transition towards sustainable, efficient, and consumer-focused solutions. The shift towards eco-friendly materials such as plant-based plastics and mycelium packaging is a notable departure from the traditional dependence on petrochemical products.

Further, the incorporation of advanced technology in packaging is revolutionizing the way consumers interact with products. The use of QR codes and near-field communication (NFC) technology is becoming increasingly prevalent, transforming packaging into a gateway for enhanced customer experiences and valuable consumer data.

Mordor Intelligence forecasts that the packaging market will grow from US$1.10 trillion in 2023 to US$1.33 trillion by 2028. This growth represents a compound annual growth rate (CAGR) of 3.89% during the forecast period. The trajectory underscores the industry’s swift adaptation to evolving global demands and its dedication to innovation.

In this data-driven packaging trends report, we delve into the current trends in the packaging industry, focusing on the Internet of Packaging (IoP), automation, compostable packaging, 3D packaging, and active packaging.

Key Takeaways

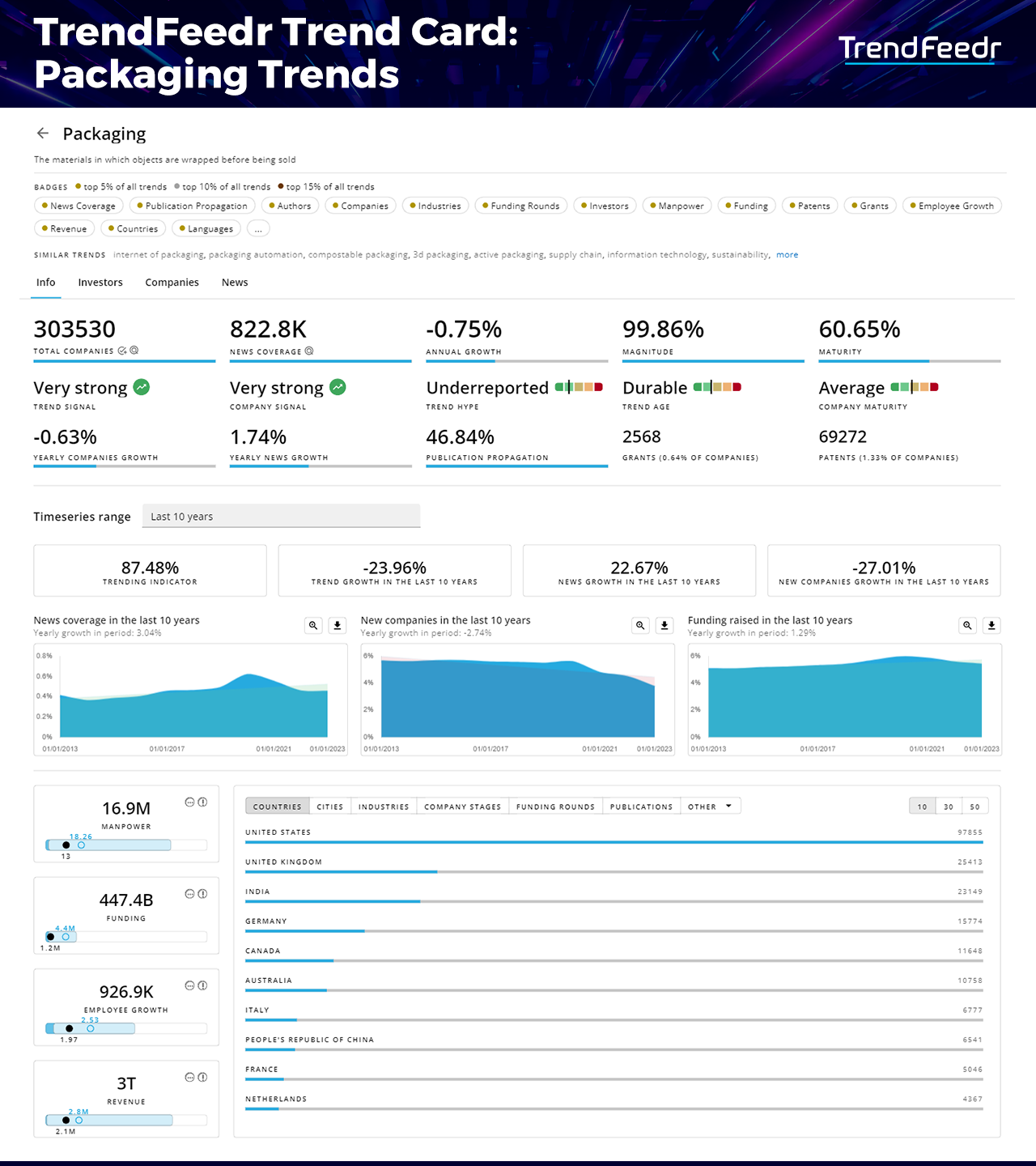

- Prominent Trend: According to TrendFeedr, the packaging industry has a trend magnitude of 99.86% and a trend maturity of 60.65%. This highlights that the trend is leading the global market in sustainable innovation and consumer-centric solutions.

- Diverse Innovations: Packaging companies are expanding their focus to include emerging trends such as IoP, packaging automation, compostable packaging, 3D packaging, and active packaging.

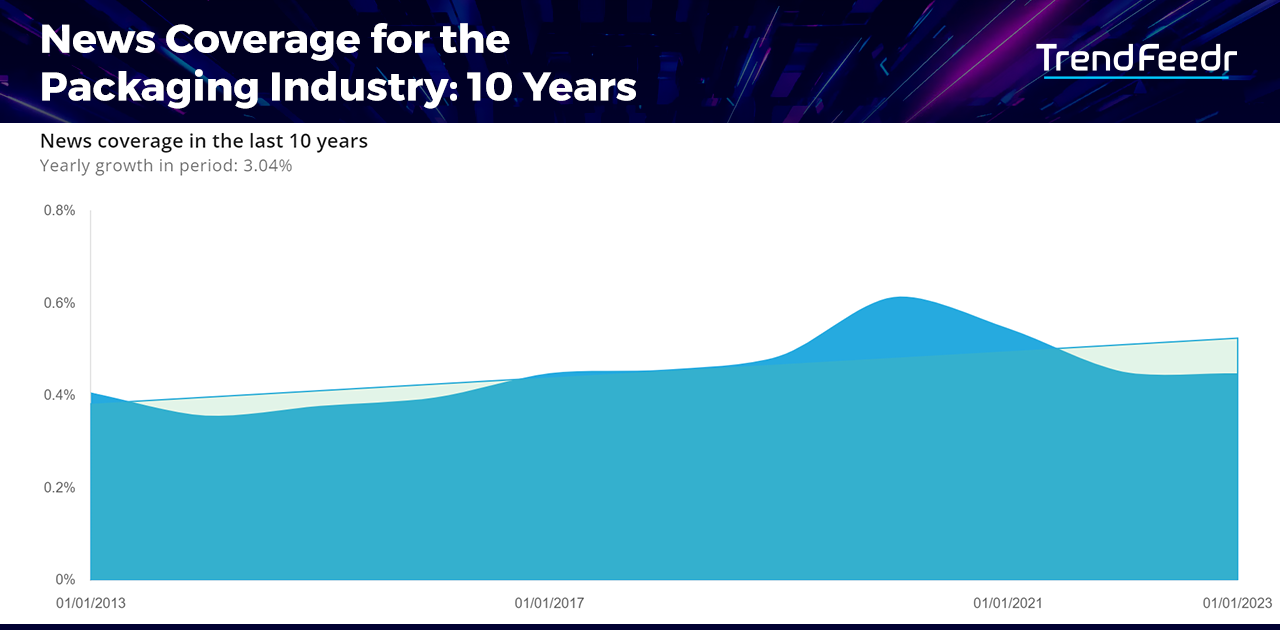

- Rising Media Attention: The consistent annual growth of 3.04% in news coverage over the last 10 years underlines the packaging industry’s growing relevance and influence in the global market.

- Organizational Involvement and Investment: Approximately 303,000 entities are actively participating in the packaging industry, collectively attracting investment capital of around US$3 trillion.

- Prominent Investors include Tiger Global Management, SoftBank Vision Fund, and International Finance Corporation, infusing billions into pioneering packaging ventures.

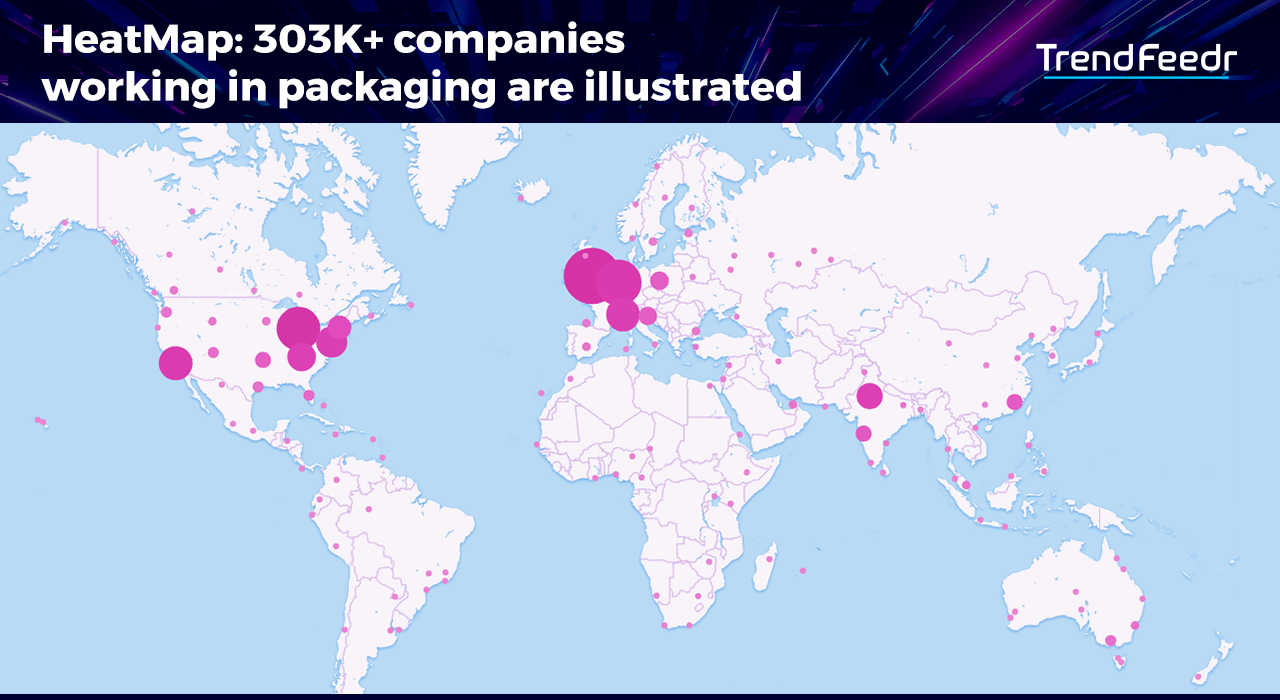

- Global Adoption and Innovation Hubs: Leading countries in packaging industry initiatives include the United States, the United Kingdom, India, Germany, and Canada. Cities such as London, New York City, Sydney, Melbourne, and Mumbai are emerging as significant hubs of innovation and development.

Table of Contents

- Understanding Packaging Trends

- Packaging Trend Card

- Emerging Trends & Technologies Disrupting the Packaging Industry

- 5 Key Packaging Trends

- 5 Emerging Packaging Companies

- Packaging Investment Trends

- Mapping Global Packaging Companies

- Media Coverage for the Packaging Industry

- Future of Packaging

For this detailed analysis of packaging trends, we use TrendFeedr, our all-in-one trend intelligence platform. TrendFeedr uses advanced algorithms to identify future industry and tech trends. With a focus on trend discovery, clustering, and analysis, the AI-powered platform reviews thousands of trends each week to provide actionable insights.

In the vast landscape of over 20,000 trends and technologies tracked by TrendFeedr, the packaging industry has made a significant impact. Here’s why:

- Securing a position in the top 50 trends and ranking within the top 1% of global trends, packaging underscores its role in facilitating safe, efficient, and environmentally friendly transportation and storage of goods.

- With a trend maturity of 60.65%, the packaging sector exhibits growth, predominantly driven by reputable entities along with agile startups.

- The packaging trend enhances product delivery systems and advocates for sustainable practices, striking a balance between commercial prosperity and environmental stewardship.

This packaging trends report explores performance, investment, regional, and future outlook.

Understanding Packaging Trends

What are the trends in packaging?

A major trend is the move towards sustainable packaging solutions, including the use of biodegradable materials, recycling-friendly designs, and a reduction in packaging waste. Companies are adopting materials like plant-based plastics, mushroom packages, and edible packages to respond to the growing consumer demand for environmentally responsible products.

Another significant trend is connected and intelligent packaging that incorporates features like QR codes and NFC tags. It provides product information and offers a personalized consumer experience to enhance user engagement. The trend also monitors freshness, displays quality information, and improves product safety. Digital printing and design technologies further advance customized packaging, allowing for greater flexibility in packaging aesthetics and functionality.

Additionally, automation in packaging processes improves efficiency, accuracy, and cost-effectiveness. This trend is particularly prevalent in the food and beverage industry, where speed and hygiene are paramount. Lastly, active packaging extends the shelf life of products and is particularly important in the food and pharmaceutical sectors.

What are new packaging technologies?

Emerging technologies form the foundation of new trends in the packaging industry, enabling companies to meet evolving consumer demands and environmental standards. The advent of bioplastics and compostable materials is transforming the packaging industry. These materials decompose naturally, reducing environmental impact compared to traditional plastics.

3D printing is revolutionizing packaging design and prototyping, facilitating rapid development and testing of new packaging concepts. The Internet of Packaging integrates digital connectivity into packaging using sensors and connected devices to track and monitor products throughout the supply chain.

Nanotechnology in packaging provides barrier properties, enhances material strength, and introduces new functionalities like antimicrobial surfaces. Lastly, Augmented reality (AR) in packaging offers an interactive experience by bringing the product to life through digital content, thereby enhancing brand engagement and consumer experience.

Packaging Trend Card: Explore the Most Recent Developments

The Packaging Trend Card offers an in-depth look at the sector’s performance, key patterns, and metrics:

Looking for all trends related to packaging?

- Sector Overview: The packaging industry, with its robust network of 303,530 companies globally, is a significant player in the international market, demonstrating its extensive influence across various sectors.

- Trend Growth: Exhibiting a trend magnitude of 99.86% and trend maturity of 60.65%, the packaging industry shows promise for further growth and innovation.

- Media Visibility: A total of 822,800 news articles have been published about the packaging industry with annual news coverage rising at 3.04%, showcasing ongoing interest in its progression.

- Innovation at the Forefront: The industry’s dedication to innovation is clear from the 69,272 patents it has filed, showcasing a strong culture of research and development. It has also received 2,568 grants, highlighting its strategic role in advancing environmental and technological solutions.

- Investment Scenario: The sector has drawn US$447.4 billion in funding, reflecting substantial investor confidence and the industry’s significant growth potential.

- Workforce & Revenue: With a workforce of 16.9 million, the industry plays a crucial role in global employment. Generating a total revenue of US$3 trillion, it is a significant contributor to the global economy.

- Global Presence: The industry’s dominance in regions like the United States, United Kingdom, India, Germany, and Canada underscores its global footprint and centers of packaging innovation and growth.

Join us as we reveal the latest data and insights, offering a detailed perspective on the evolving packaging industry.

How Do Emerging Trends and Technologies Disrupt the Packaging Industry?

The emerging trends and tech innovations are redefining packaging solutions. Let’s delve into these revolutionary changes in the packaging industry.

1. Internet Of Packaging

IoP communicates with external devices like scanners and mobile phones using machine-readable elements. This enables brands to track, gather, and disseminate product information throughout the supply chain. Integrating IoT in packaging is instrumental in minimizing human errors, drug counterfeits, and food spoilage.

Startups such as ReInPack offer PAKY, a smart, reusable packaging designed for food products. Its IoT technology enhances packaging by enabling easy interconnectivity to the ReInPack system, facilitating order management, product identification, and traceability. It also speeds up logistics processes and reduces waste.

2. Packaging Automation

Automation combines advanced robotics and AI to optimize packing processes. It streamlines operations by speeding up box production and reducing shipping expenses. Automation also optimizes warehouse space and reduces reliance on labor. By integrating with existing warehouse management systems (WMS), it controls end-to-end packaging processes.

Andropack, for example, provides robot-based turnkey solutions that combine case configurations with product handling, case packing, and palletizing. One of its products is the Robotic Case Erectors. It transforms case blanks into fully erected, sealed cases, ensuring perfectly aligned sides for optimal structural integrity and robust closure. The startup also offers flow-wrapping machines and lid applicators for end-of-line processes.

3. Compostable Packaging

Compostable packaging utilizes biodegradable materials like plant-based plastics and paper. These packages respond to the growing concern over plastic waste by providing packaging solutions that naturally decompose.

For instance, Circlepac specializes in environmentally friendly packaging solutions, focusing on biodegradable and compostable packaging made from agricultural waste. Its products are made from materials such as bamboo, bagasse, and birchwood as well as decompose into nutrient-rich compost within 90 to 270 days.

4. 3D Packaging

Through the creation, visualization, and iteration of packaging designs in 3D space, 3D packaging boosts efficiency. It enables designers to easily make adjustments and allows visualization of dieline cuts and print effects, such as embossed images or logos. Further, it reduces the need for physical prototypes, promoting sustainability.

Startups like Pacdora develop a platform that integrates template, dieline, and mockup editing, offering a 3D preview and online rendering. The platform leverages a proprietary algorithm that powers the automatic 2D-3D conversion. The startup also provides packaging templates for various products and facilitates real-time custom packaging design.

5. Active Packaging

To extend shelf life and maintain quality, materials that interact with the product are integrated into packaging. This includes oxygen absorbers, moisture controllers, and ethylene scavengers. Active packaging is vital in reducing food waste and preserving freshness, particularly in the food and beverage sector.

For instance, ALKELUX develops Alkelux VT-1, a carbon-based nanomaterial. It is a natural antimicrobial additive derived from licorice processing waste. This additive features antibacterial, antifungal, and antiviral properties, and is water-soluble with photoactivation capability. The startup’s solution has various applications in fields such as active packaging, sterilization environments, and food packaging.

Key Packaging Trends & Firmographic Insights

Boasting a workforce of 16.9 million individuals, the packaging industry presents a robust employment landscape. The average company size is approximately 80 employees, indicating that the sector comprises not only large corporations but also a lot of medium-sized businesses. The median value is 13, underscoring the prevalence of small-scale enterprises that constitute the industry’s backbone.

In terms of annual employee growth, the total increase of 926.9K employees signifies an industry expansion. There’s an average yearly increase of 5 employees per company and the median annual increase is 2 employees per company. This further substantiates the narrative of consistent, albeit gradual, expansion within the industry.

Let’s delve into the dynamic landscape of the packaging industry by spotlighting 5 key trends we discussed. Here are insights into the number of packaging companies, the total investment, and the workforce dedicated to each of these trends.

1. Internet Of Packaging (IoP)

- IoP enhances product traceability and consumer engagement through smart labels and QR codes.

- This trend has engaged 1,053 organizations, amassing a remarkable US$22.62 billion in funding.

- With a robust workforce of 161.1K, IoP is transforming the interaction between consumers and products.

2. Packaging Automation

- Automation increases efficiency and reduces labor costs in packaging processes in manufacturing and distribution.

- This sector has engaged 677 organizations, with a total funding of US$2.3 billion.

- With 43.1K professionals employed, packaging automation is vital in optimizing operations across various sectors of the industry.

3. Compostable Packaging

- By using materials that decompose naturally and reduce waste, compostable packaging promotes environmental sustainability.

- This trend has engaged 643 organizations, collectively securing US$675.4 million in funding.

- The sector, employing a total of 24.4K individuals, plays a crucial role in steering the industry towards a more eco-conscious approach.

4. 3D Packaging

- 3D Packaging is revolutionizing the design and functionality of packaging, enabling more personalized and complex shapes and structures.

- With 263 organizations dedicated to this innovative field, a total of US$60.2 million has been invested.

- The workforce powering this trend comprises 10K professionals, who are leading this advanced packaging technology.

5. Active Packaging

- By enhancing shelf life and quality, active packaging maintains and improves the properties of packaged products.

- The trend has attracted 151 organizations, which have collectively raised US$1 billion in funding.

- With a manpower of 13.1K, this segment is instrumental in introducing intelligent features to everyday packaging.

5 Emerging Packaging Companies

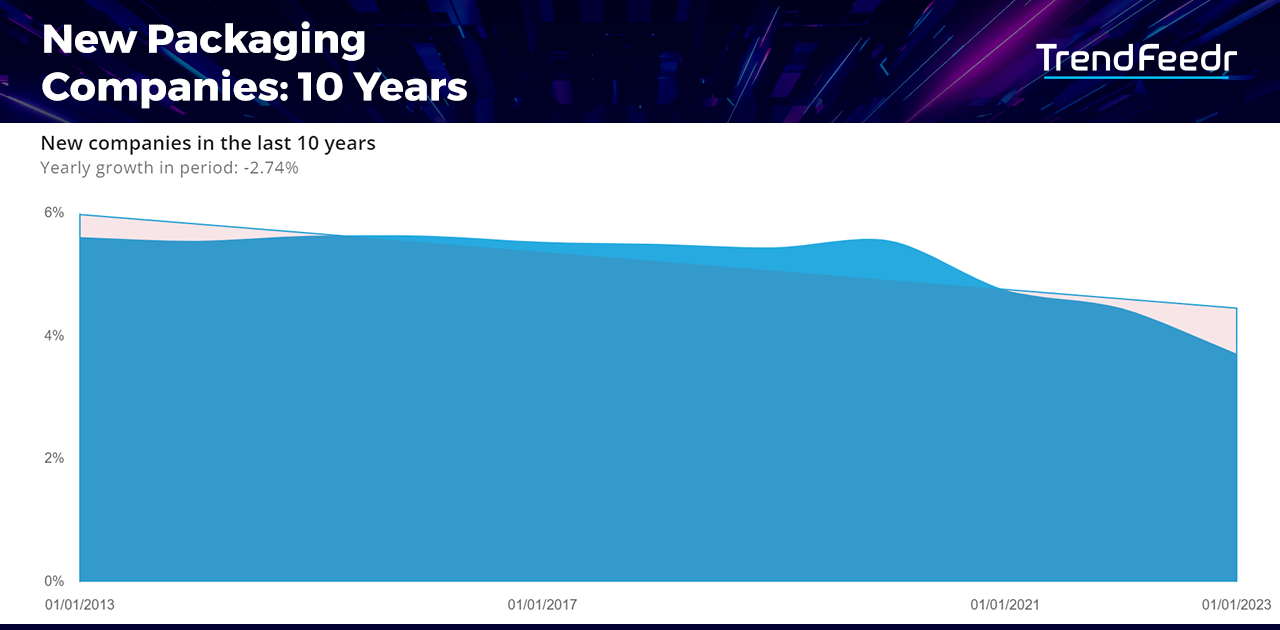

This time series chart shows a yearly decline of 2.74% for new organizations entering the packaging industry over the last decade. It suggests market consolidation, where established companies are growing stronger, possibly through mergers and acquisitions, leaving less room for new entrants.

5 Promising Packaging Startups

Packaging startups are reimagining the packaging industry, introducing innovative and sustainable solutions that are reshaping how products are protected, presented, and preserved. From biodegradable materials and smart packaging technologies to efficient design and circular economy models, these startups are tackling the pressing challenges of environmental impact, consumer convenience, and cost-effectiveness. Let’s highlight five packaging startups established within the past five years and their roles in revolutionizing the packaging landscape:

- Neptune Nanotechnologies creates nanostructured materials from organic ocean waste for high-performance, recyclable, and biodegradable plastics.

- GIGA Packaging specializes in custom packaging solutions, offering products like folding cartons, blister cards, displays, and rigid boxes for various industries.

- Rubitel develops a radio frequency identification (RFID) reader system to implement unit-level smart packaging.

- Sway develops bioplastics designed for seaweed-based, rapidly compostable replacements for plastic, with a focus on flexible packaging.

- Uuvipak manufactures edible packaging made from organic materials coming from food and drink manufacturing.

Packaging Investment Trends

In financial terms, the total funding of the packaging industry places it within the top 5% of all 20K+ trends and technologies monitored by TrendFeedr.

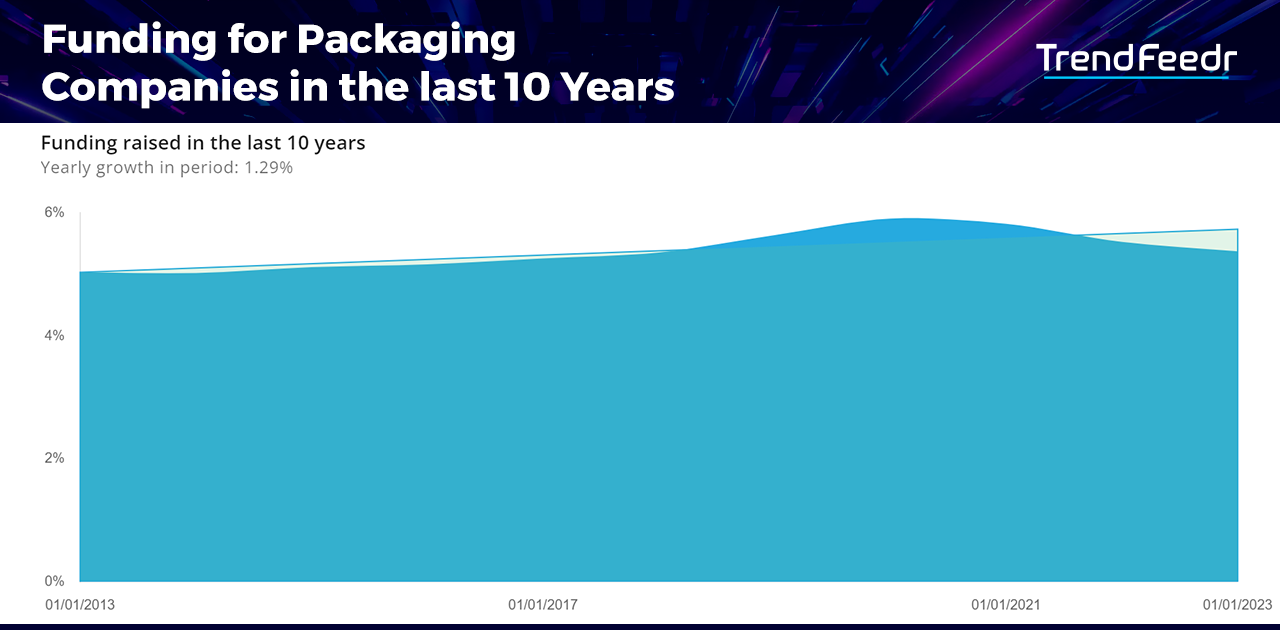

A time series chart analyzing funding raised over the past decade reveals a yearly growth of 1.29%, indicating a consistent flow of capital into the sector. This growth suggests a sustained interest from investors in the packaging industry, aligning with the global push towards sustainable and innovative packaging solutions.

A Closer Look at the Financials

As per TrendFeedr, the total funding involved in the packaging industry amounts to an impressive US$447.4 billion. The highest single funding instance reported was US$1.7 billion. The average funding per company is US$25.7 million, with a median of US$1.2 million.

TrendFeedr estimates the total revenue to be around US$3 trillion, demonstrating the sector’s substantial economic impact. DPD leads with a maximum revenue of US$1.8 billion. The average revenue across companies is approximately US$14 million, and the median is at US$2.1 million. These figures suggest a robust and diverse industry, with companies of various sizes contributing to its overall financial health.

5.75% of packaging companies have received funding, reflecting a diverse and targeted investment landscape. Seed funding serves as a crucial launchpad for innovative packaging startups, particularly those introducing groundbreaking materials or technologies. Early-stage VC or Series A funding is essential for scaling operations and expanding market reach, especially for ventures focusing on sustainable packaging solutions.

Debt financing is a common route for established packaging entities aiming to fund large-scale expansions or technology upgrades. Venture rounds represent significant investment phases for companies demonstrating substantial potential for market disruption or growth. Lastly, mergers and acquisitions (M&A) are indicative of the industry’s consolidation trends, where larger companies integrate smaller, niche players for strategic advantage.

Moreover, the industry has seen 2,568 grants, accounting for 0.64% of packaging companies, crucial for supporting research and development in areas like sustainable materials and smart packaging technologies.

Notable Investors in the Packaging Industry

Tiger Global Management is a prominent investor, with an investment sum of US$1.8 billion across 29 companies. It made significant investments in various ventures, with its top two being Instacart, receiving US$271 million, and Veho at US$192.7 million.

SoftBank Vision Fund is another key player, with a total investment of US$1.4 billion in 10 companies. Its notable contributions include US$328.5 million to Flock Freight and US$240 million to Sendcloud.

International Finance Corporation has also made its mark, investing US$1.1 billion across 18 companies. Its major investments include US$90 million in Assan Aluminyum and US$70.4 million in ECCBC.

In terms of public investment, a total of US$10.4 billion has been allocated to 312 companies, demonstrating the extensive reach and impact of public funds. Significant investments include US$270 million in SkinnyPop Popcorn and US$234 million in Darbond.

The packaging industry features a diverse and robust network of supporters, with unique investors in this sector ranking among the top 5% of all industry trends.

Mapping Packaging Companies Around the Globe

Our heatmap offers a comprehensive overview of the current scenario in the packaging industry, highlighting approximately 303,000 companies that are leading the charge in innovations in this domain.

The United States is at the forefront, reflecting its vast consumer market and advanced manufacturing capabilities. The United Kingdom is next, benefiting from its strategic location and a focus on sustainable and innovative packaging solutions. India, with its rapidly expanding economy and large consumer base, has witnessed a significant rise in packaging companies. Germany’s reputation for engineering excellence is evident in its packaging industry, renowned for its high-quality, efficient, and technologically advanced solutions. Canada has seen a modest increase in packaging companies, driven by the country’s commitment to sustainability and the growing demand for eco-friendly packaging solutions.

In the urban landscape, London emerges as a hub for packaging innovation, fueled by a blend of financial services, creative industries, and a focus on sustainable practices. New York City, with its enormous consumer market and concentration of corporate headquarters, remains a key player, particularly in the luxury and consumer goods packaging sectors. Sydney and Melbourne in Australia have experienced a remarkable rise in packaging companies, benefiting from an increasing focus on sustainable practices and a push towards innovative packaging solutions in the Asia-Pacific region. Mumbai reflects the country’s overall growth in the packaging sector, driven by increasing urbanization and a thriving retail sector.

Interested to explore all 303K+ packaging companies?

Media Coverage for Packaging Sees a Yearly Uptick of 3.04% Over the Last 10 Years

The annual growth in media coverage for the packaging industry, as illustrated by a time series chart, has demonstrated a consistent upward trajectory of 3.04% over the past decade. The persistent escalation in media focus highlights the growing significance of the packaging sector within the global economy. It also underscores the industry’s implications for environmental sustainability, shifts in consumer behavior, and technological advancements.

In terms of publication coverage, the packaging industry has made a significant mark, securing a position within the top 5% of all trending topics. A total of 819,848 articles were published between 2005 and 2023, placing the industry within the top 5% of all trends in terms of content volume.

What will be the Future of Packaging?

Given the current trajectory and the data we have on packaging industry trends, several insights and predictions can be made about the future of this dynamic sector. Here’s the packaging outlook.

1. Continued Emphasis on Sustainability

The packaging industry’s future will continue to prioritize sustainability. This will involve increased utilization of environmentally friendly materials, such as biodegradable plastics and plant-based alternatives, to mitigate environmental impact.

Companies will progressively adopt circular economy principles to reduce waste and enhance the recyclability of packaging. Design innovations in packaging will further reduce material usage without compromising product safety.

2. Consumer Awareness and Preferences

As consumers become more environmentally aware, their preferences are molding the packaging industry. There is an escalating demand for packaging that is sustainable and transparent about its environmental footprint.

Consumers are leaning towards minimalistic and reusable packaging options, prompting brands to restructure their packaging strategies to align with these values. This shift is compelling companies to adopt more responsible packaging practices and articulate their sustainability initiatives more effectively.

3. Regulatory Changes and Compliance

Government regulations aimed at reducing environmental impact will increasingly shape the packaging sector. New policies may enforce stricter waste management standards and promote the reduction of single-use plastics.

Companies will need to navigate these evolving regulations, ensuring compliance while managing cost implications. This regulatory environment will stimulate innovation in sustainable packaging and may lead to a more standardized approach across industries.

4. Global Supply Chain Impact

Packaging plays a pivotal role in the global supply chain, and its future will be intimately tied to changes in this area. As supply chains become more intricate and extensive, the demand for robust and efficient packaging will rise. The shift towards sustainable packaging materials may impact global logistics, particularly in terms of transportation and storage requirements.

Moreover, disruptions in the supply chain, such as those triggered by global events or trade issues, can significantly affect packaging availability and cost, encouraging companies to seek more resilient and adaptable packaging solutions.

Packaging Trends: Charting the Progress in Sustainable Solutions

As we wrap up our packaging trends report, it is clear that we are moving through a rapidly changing landscape. The pace of discoveries is fast, and the range of possibilities seems endless. Keeping up with these changing trends is very important. It allows you to anticipate changes, take advantage of new opportunities, and stay ahead in a field that is shaping the future. But how do you do that?

Connect with packaging industry enthusiasts, industry leaders, and innovative creators; their insights can provide valuable perspectives and open up opportunities for collaboration. Dive into packaging market research reports, attend package industry-focused seminars and conferences, and participate in online packaging communities. Also, leverage trend-tracking tools, like TrendFeedr, that meticulously track up to 661 packaging sub-trends, offering a comprehensive view of the evolving packaging landscape.