3D Imaging Report

: Analysis on the Market, Trends, and TechnologiesThe domain of 3D imaging is experiencing rapid evolution, signifying a pivotal shift in diverse industries ranging from Medical Practice and Hospital & Health Care to Information Technology & Services. This transformative technology is revolutionizing the creation of three-dimensional representations, thereby enhancing decision-making, analysis, and communication within businesses. An expansive topic with a significant presence, 3D imaging is witnessing steady growth and broad application potential, underscored by a surge in market penetration and news coverage. With a substantial growth in global search interest and a positive employee growth rate, the sector is attracting notable investments, indicating a stable yet dynamic investment landscape. The sector’s robust employee growth and retention rates reflect a thriving business environment, with companies generating considerable annual revenue. The 3D imaging sector stands out as a dynamic field with substantial potential for innovation and advancement, poised to play a critical role in the evolving business landscape.

This report was last updated 455 days ago. Spot an error or missing detail? Help us fix it by getting in touch!

Topic Dominance Index of 3D Imaging

To identify the Dominance Index of 3D Imaging in the Trend and Technology ecosystem, we look at 3 different time series: the timeline of published articles, founded companies, and global search.

Key Activities and Applications

- Creation of detailed, immersive visualizations for medical diagnostics and surgical planning.

- Development of 3D imaging software and hardware for architectural and urban planning.

- Enhancement of real estate and interior design through photorealistic 3D visualizations.

- Implementation in marketing and advertising for engaging, interactive customer experiences.

- Application in manufacturing for product visualization and quality control inspections.

- Integration in robotics and autonomous systems for enhanced environmental perception.

- Use in educational tools and digital content creation for interactive learning experiences.

Emergent Trends and Core Insights

- A marked increase in the application of 3D imaging in telemedicine and remote consultations.

- Growing trend of integrating 3D imaging with virtual and augmented reality for immersive experiences.

- Advancements in AI and machine learning algorithms for improved 3D image analysis and processing.

- Expansion of 3D imaging in consumer electronics for features like facial recognition and virtual try-ons.

- Surge in demand for 3D imaging technologies in the automotive industry for safety and autonomous driving.

- Increased use of 3D imaging in environmental monitoring and precision agriculture.

- Development of portable and wearable 3D imaging devices for on-the-go diagnostics and personal use.

Technologies and Methodologies

- Stereoscopic 3D imaging for depth perception and realistic visual experiences.

- Cone-beam computed tomography (CBCT) for high-resolution dental and maxillofacial imaging.

- Time-of-Flight (ToF) and structured light sensors for accurate depth mapping.

- Advanced algorithms for 3D reconstruction from 2D images and real-time processing.

- Integration of cloud computing for storage and analysis of large 3D imaging datasets.

- Use of photogrammetry for creating 3D models from photographs.

- Machine vision and optical metrology for precise industrial measurements and inspections.

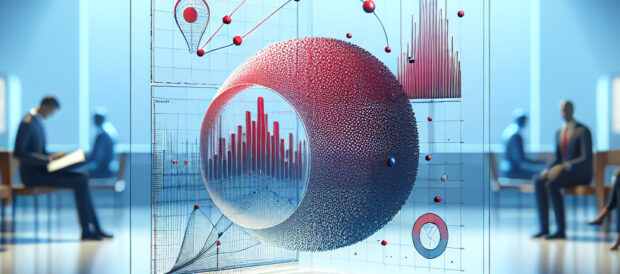

3D Imaging Funding

A total of 653 3D Imaging companies have received funding.

Overall, 3D Imaging companies have raised $10.8B.

Companies within the 3D Imaging domain have secured capital from 1.6K funding rounds.

The chart shows the funding trendline of 3D Imaging companies over the last 5 years

3D Imaging Companies

Identify and analyze 4.2K innovators and key players in 3D Imaging more easily with this feature.

4.2K 3D Imaging Companies

Discover 3D Imaging Companies, their Funding, Manpower, Revenues, Stages, and much more

3D Imaging Investors

TrendFeedr’s investors tool offers a detailed view of investment activities that align with specific trends and technologies. This tool features comprehensive data on 515 3D Imaging investors, funding rounds, and investment trends, providing an overview of market dynamics.

515 3D Imaging Investors

Discover 3D Imaging Investors, Funding Rounds, Invested Amounts, and Funding Growth

3D Imaging News

Stay informed and ahead of the curve with TrendFeedr’s News feature, which provides access to 6.5K 3D Imaging articles. The tool is tailored for professionals seeking to understand the historical trajectory and current momentum of changing market trends.

6.5K 3D Imaging News Articles

Discover Latest 3D Imaging Articles, News Magnitude, Publication Propagation, Yearly Growth, and Strongest Publications

Executive Summary

3D imaging stands at the forefront of technological innovation, offering a multifaceted ecosystem that caters to a spectrum of industries. The key activities within this domain, ranging from medical applications to product design and urban planning, underscore the versatility and depth of 3D imaging technologies. The emergent trends highlight a future where immersive experiences, enhanced by AI and machine learning, become commonplace. The technologies and methodologies adopted within this space are not only revolutionizing existing processes but are also paving the way for unforeseen applications, thereby reinforcing the sector's potential for continued growth and transformation. As businesses and innovators navigate this dynamic landscape, the insights provided by 3D imaging technologies will undoubtedly shape the future of industry and consumer engagement.

Interested in enhancing our coverage of trends and tech? We value insights from experts like you - reach out!