AI Sensors Report

: Analysis on the Market, Trends, and TechnologiesThe AI sensors market is entering a high-velocity expansion phase: in 2024 global revenues stood at USD 4.6 billion and the sector is forecast to grow at a CAGR of 43.20% toward USD 166.8 billion by 2034. This expansion reflects a structural move to place machine learning and lightweight inference inside sensing hardware—reducing latency, cutting bandwidth cost, and enabling new safety and health use cases—while regional demand (North America and Asia Pacific) and vertical pull from Automotive, Robotics, and Healthcare provide immediate commercial pathways market_us – Global AI Sensor Market, 2025.

This report was last updated 9 days ago. Spot an error or missing detail? Help us fix it by getting in touch!

Topic Dominance Index of AI Sensors

To identify the Dominance Index of AI Sensors in the Trend and Technology ecosystem, we look at 3 different time series: the timeline of published articles, founded companies, and global search.

Key Activities and Applications

- Edge inference embedded in IMUs and image sensors: Manufacturers integrate on-chip ML to support activity tracking, high-g impact detection, and privacy-preserving vision pre-processing, enabling always-on applications without continuous cloud connectivity Activity Tracking and High-Impact Sensing.

- Contactless human sensing for health and safety: Non-contact vitals extraction from cameras and mmWave radar supports remote patient monitoring, in-vehicle occupant detection, and AgeTech fall/frailty monitoring, reducing dependency on wearables Caire.

- Autonomy perception stacks for ADAS and robotics: Multimodal stacks (radar, lidar, ultrasonic, IMU, imaging) fuse data at low latency for navigation, obstacle avoidance, and manipulation in adverse conditions CES 2026 coverage.

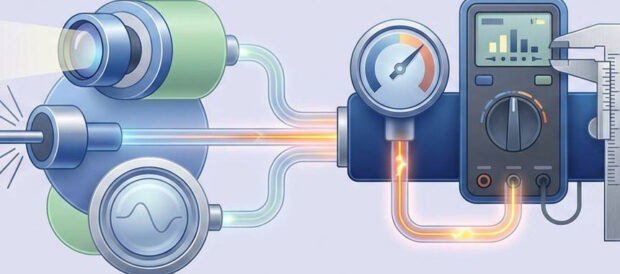

- Industrial condition monitoring and predictive maintenance: Edge AI on vibration, acoustic, and thermal sensors enables early fault detection and life-cycle optimization for rotating machinery and heavy assets, lowering unplanned downtime EWA Sensors.

- Environmental, air quality, and agriculture sensing: Multi-pollutant gas arrays and hyperspectral sensors feed AI classifiers for pollutant source apportionment and soil/crop assessment, supporting smart-city and sustainability programs.

Emergent Trends and Core Insights

- On-sensor machine learning is mainstreaming: Increasingly, sensors perform inference locally, with ML accounting for a 31% technology share in 2024; this reduces dependence on cloud pipelines and enables sub-second decisioning.

- Energy autonomy becomes a commercial differentiator: Self-powered sensors that harvest ambient thermal or kinetic energy remove maintenance barriers for large deployments and significantly improve total cost of ownership in industrial and infrastructure use cases.

- Multimodal fusion raises resilience: Combining radar, lidar, IMU, ultrasonic, and imaging compensates modality failures (fog, smoke, low light, GPS denial) and supports GNSS-denied navigation for drones and subterranean/indoor robotics SentiSystems.

- Physics-informed AI secures commercial moats: Models that embed sensor physics outperform generic AI in precision tasks (e.g. acoustic source localization, Time-of-Flight correction). This creates defensibility for firms pairing domain expertise with ML.

- Supply-side consolidation risk: Market concentration (top vendors holding a high share) and heavy capital flows into platform and chip IP indicate an acquisition wave is likely as incumbents secure edge compute and sensor IP.

Technologies and Methodologies

- Neuromorphic and analog near-sensor inference: Mixed-signal and charge-domain processing reduce energy per inference to enable continuous sensing on micro-watt budgets.

- Quantized and pruned deep models for microcontrollers: Model compression applied to convolutional and temporal networks allows vision and acoustic classification on constrained sensor SoCs.

- 4D and terahertz imaging modalities: 4D imaging radar and terahertz sensing extend reliable perception in all-weather and non-line-of-sight conditions, expanding ADAS and heavy-machinery automation applicability TeraDAR.

- Hyperspectral CMOS and full-spectrum capture: Integration of multispectral imaging into standard CMOS enables low-cost material and crop analytics previously reserved for specialized systems AGATE Sensors.

- Self-calibration and trust-scoring algorithms: On-device calibration and real-time sensor trust weighting allow arrays to adapt to drift, temperature shifts, and partial failures without human intervention.

AI Sensors Funding

A total of 456 AI Sensors companies have received funding.

Overall, AI Sensors companies have raised $12.1B.

Companies within the AI Sensors domain have secured capital from 1.9K funding rounds.

The chart shows the funding trendline of AI Sensors companies over the last 5 years

AI Sensors Companies

- AiM Future, Inc. — AiM Future, Inc. develops the NeuroMosAIc Processor, a multi-modal, low-power AI/ML coprocessor designed to execute concurrent sensor workloads at the edge. The company traces engineering lineage to LG Electronics and has shipped production devices since 2019, positioning its IP as a turnkey acceleration layer for device OEMs seeking in-sensor inference.

- ai Linear Inc. — ai Linear Inc. focuses on mixed-mode IP that implements ML in tiny analog circuits close to the sensor front end, targeting sub-microjoule inference and extreme power budgets for always-on sensing. The company’s microscopic team and focused IP portfolio aim to serve sensor OEMs needing analog efficiency beyond conventional digital accelerators.

- Pontosense — Pontosense pairs patented mmWave radar with AI for privacy-preserving presence and wellbeing detection, offering production-ready modules (Euro NCAP-compliant child presence detection) and a large patent estate (600+ patents claimed by the company) that supports scale deployment in AgeTech and automotive safety.

- MOÏZ — MOÏZ manufactures energy-harvesting, batteryless sensors using patented thermoelectric nanomodules to power wireless environmental sensing (temperature, gas, humidity). Their autonomy strategy directly addresses maintenance costs in large industrial estates and remote infrastructure.

Identify and analyze 1.3K innovators and key players in AI Sensors more easily with this feature.

1.3K AI Sensors Companies

Discover AI Sensors Companies, their Funding, Manpower, Revenues, Stages, and much more

AI Sensors Investors

TrendFeedr’s investors tool offers a detailed view of investment activities that align with specific trends and technologies. This tool features comprehensive data on 2.1K AI Sensors investors, funding rounds, and investment trends, providing an overview of market dynamics.

2.1K AI Sensors Investors

Discover AI Sensors Investors, Funding Rounds, Invested Amounts, and Funding Growth

AI Sensors News

Stay informed and ahead of the curve with TrendFeedr’s News feature, which provides access to 1.5K AI Sensors articles. The tool is tailored for professionals seeking to understand the historical trajectory and current momentum of changing market trends.

1.5K AI Sensors News Articles

Discover Latest AI Sensors Articles, News Magnitude, Publication Propagation, Yearly Growth, and Strongest Publications

Executive Summary

The evidence shows the market is shifting from sending raw sensory streams to centralized systems toward intelligence located at or inside the sensor. Firms that combine energy-efficient edge compute, physics-aware ML, and sensor fusion will convert technical novelty into commercial advantage. Enterprises should evaluate three near-term plays: (1) retrofit-first software layers that extract more value from installed sensors, (2) targeted investment in energy-autonomous sensing for hard-to-service assets, and (3) strategic partnerships or acquisitions of edge-AI IP to secure long-term control over in-sensor inference capability. These moves will determine who captures the highest margin positions as the AI sensors market scales into the tens of billions.

Interested in enhancing our coverage of trends and tech? We value insights from experts like you - reach out!