Brain Implants Report

: Analysis on the Market, Trends, and TechnologiesThe brain-implant market has moved from laboratory demonstrations toward clinically actionable product families, but the pace of commercial translation varies by subsegment: the internal trend report records a market size of $4,700,000,000 in 2023 and a CAGR of 9.64%, projecting $10,770,000,000 by 2032. Investment and patent activity concentrate on three converging value levers — AI-driven closed-loop neuromodulation, battery-free wireless implants, and minimally invasive delivery — each creating distinct near-term commercial pathways (diagnostic/monitoring devices; therapeutic neuromodulation; and high-fidelity restorative BCIs). Market research outside the internal forecast shows larger, faster estimates, but the internal projections should guide short-to-midterm planning because they synthesize company, clinical, and funding signals specific to the brain-implant field Brain Implants Market Summary.

This report was last updated 51 days ago. Spot an error or missing detail? Help us fix it by getting in touch!

Topic Dominance Index of Brain Implants

To identify the Dominance Index of Brain Implants in the Trend and Technology ecosystem, we look at 3 different time series: the timeline of published articles, founded companies, and global search.

Key Activities and Applications

- Deep Brain Stimulation (DBS) for movement and psychiatric disorders — established revenue driver in clinical settings, now evolving toward adaptive DBS that senses neural state and modulates stimulation in real time.

- Implantable continuous EEG and seizure management — chronic intracranial monitoring is shifting care from episodic visits to continuous, data-driven management for epilepsy and seizure risk stratification.

- High-fidelity Brain-Computer Interfaces (BCI) for motor restoration and communication — ultra-high channel count arrays and on-implant processing aim to restore cursor/typing and prosthetic control to people with paralysis Paradromics.

- Targeted intracranial drug delivery and blood-brain barrier bypass — skull-implanted delivery systems designed for focal oncology and pharmacologic interventions reduce systemic exposure and raise new commercial pathways for neuro-oncology.

- Sensory restoration (vision, somatosensory feedback) — retinal and cortical sensory implants target narrow, high-value clinical populations and serve as testbeds for longer-term BCI therapeutic expansion.

- Minimally invasive endovascular and injectable interfaces — endovascular stentrodes and injectable nanoelectronic meshes reduce surgical burden and broaden candidate populations for monitoring and stimulation.

Emergent Trends and Core Insights

- AI-first closed-loop therapy is becoming the primary commercial differentiator, with companies integrating on-implant or near-implant ML to personalize stimulation patterns and reduce clinic burden; this trend shifts product value from hardware density to algorithm lifecycle and clinical evidence.

- Wireless power and battery-free architectures materially reduce procedural and maintenance costs, enabling slimmer form factors and fewer revision surgeries; manufacturers that solve deep-tissue powering will capture nonoperative segments faster.

- Minimally invasive delivery (stentrode, injectable meshes, endovascular access) creates a commercial bridge between research BCIs and mainstream clinical adoption by lowering operator risk and enabling outpatient workflows.

- Materials and interface engineering produce durable competitive moats: soft polymers, graphene and carbon electrodes, and biohybrid substrates directly address long-term signal loss and foreign-body reaction; companies commercializing validated surface treatments or carbon electrodes can reduce lifetime cost of ownership.

- Cybersecurity and device identity are ascending from niche risk to market requirement because bidirectional wireless implants create new attack surfaces that must be handled in product design and regulatory submissions.

- Geographic adoption is bifurcating: North America remains the clinical leader for high-fidelity invasive systems, while Asia-Pacific is the fastest growth market for minimally invasive and monitoring devices, reflecting regulatory alignment and capacity expansion Brain Implants Market Size, Industry Trends & Share Report 2030.

Technologies and Methodologies

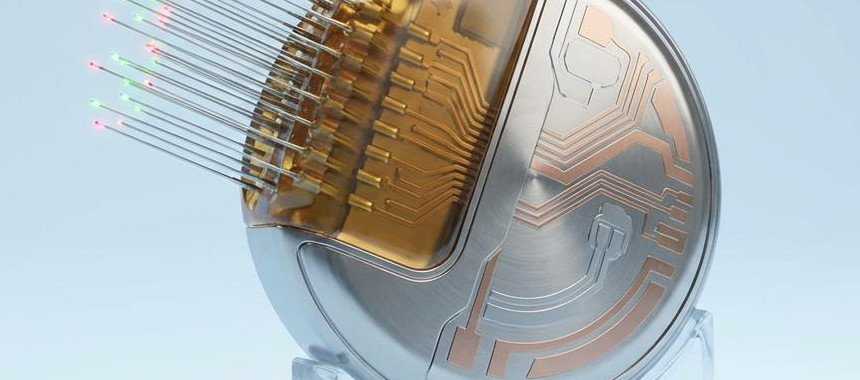

- Flexible polymeric microelectrode arrays and injectable nanoelectronic meshes — engineered to reduce scarring, prolong signal fidelity, and permit long-term recording.

- High-density µECoG / active-pixel sensing arrays — CMOS-based, ultra-thin chips that increase channel counts by orders of magnitude while maintaining a low profile for cortical surface interfaces.

- Endovascular (stentrode) and catheter-based delivery — access the cortex via blood vessels to avoid craniotomy, enabling shorter procedures and broader inclusion criteria.

- Battery-free wireless powering (ultrasound, optimized EM coupling, energy harvesting) — replaces internal battery maintenance with external energy delivery or in-body energy harvesters to extend implant life and reduce revision surgeries.

- On-implant signal processing and embedded ML ASICs — shift decoding and closed-loop decisions onto the device to reduce latency and external equipment dependence; this capability is becoming a gating factor for high-bandwidth clinical BCIs.

- Graphene and carbon-based electrodes with electrochemical sensing — permit simultaneous electrical and neurotransmitter sensing, opening combined diagnostic-therapeutic readouts and new clinical endpoints.

- 3D-printed patient-specific cranial implants and integrated drug reservoirs — merge structural repair, monitoring, and localized delivery for neuro-oncology and chronic care Meticuly.

Brain Implants Funding

A total of 94 Brain Implants companies have received funding.

Overall, Brain Implants companies have raised $5.7B.

Companies within the Brain Implants domain have secured capital from 449 funding rounds.

The chart shows the funding trendline of Brain Implants companies over the last 5 years

Brain Implants Companies

- - CraniUS Therapeutics — CraniUS commercializes a skull-implanted drug delivery platform that bypasses the blood-brain barrier to deliver targeted therapy for brain disease. The company positions its NeuroPASS device as a diagnostic and delivery chassis that reduces systemic toxicity for focal oncology indications. CraniUS emphasizes a surgical workflow that integrates with existing neurosurgical procedures to shorten adoption cycles. CraniUS Therapeutics.

- - Grapheton, Inc. — Grapheton develops carbon-based neural implants and power sources that claim multi-decade in-body lifetime and simultaneous electrical plus biochemical sensing (serotonin, dopamine, glucose). Their carbon electrodes target MRI compatibility and low impedance for long-term monitoring, offering a differentiated materials play against silicon and metal electrodes. Early commercialization focuses on high-value research and clinical partners to validate longevity and biochemical measurement claims. Grapheton, Inc..

- - Corticale Srl — Corticale supplies active CMOS high-density neural probe components using SiNAPS architecture to reach electrode densities two orders of magnitude above typical arrays. They pursue an OEM model supplying modular probe technology to clinical BCI developers, which reduces go-to-market risk for systems integrators while capturing IP at the component level. Their approach accelerates higher channel count human studies without requiring every developer to build full silicon fabrication capability. Corticale Srl.

- - RebrAIn — RebrAIn combines AI targeting algorithms with a collaborative clinical registry to standardize and refine DBS targeting for Parkinson's and essential tremor. The firm's value proposition is reduced operative time and improved patient selection through algorithmic targeting, enabling narrower therapy windows with higher efficacy per implant. This clinical data strategy creates a feedback loop that enhances algorithm performance and supports payer conversations. RebrAIn.

- - Intelligent Implants, Ltd. — Intelligent Implants markets the SmartFuse® platform: wireless, electrode-array implants that stimulate and monitor bone growth for orthopedic fusion. The product sells into surgical OEM channels and targets faster healing with remote monitoring services, creating a mixed hardware-recurring revenue model. Their clinical focus demonstrates how active implants can expand beyond neurology into adjacent surgical markets, offering cross-sell and regulatory pathway synergies. Intelligent Implants, Ltd..

Identify and analyze 326 innovators and key players in Brain Implants more easily with this feature.

326 Brain Implants Companies

Discover Brain Implants Companies, their Funding, Manpower, Revenues, Stages, and much more

Brain Implants Investors

TrendFeedr’s investors tool offers a detailed view of investment activities that align with specific trends and technologies. This tool features comprehensive data on 548 Brain Implants investors, funding rounds, and investment trends, providing an overview of market dynamics.

548 Brain Implants Investors

Discover Brain Implants Investors, Funding Rounds, Invested Amounts, and Funding Growth

Brain Implants News

Stay informed and ahead of the curve with TrendFeedr’s News feature, which provides access to 2.5K Brain Implants articles. The tool is tailored for professionals seeking to understand the historical trajectory and current momentum of changing market trends.

2.5K Brain Implants News Articles

Discover Latest Brain Implants Articles, News Magnitude, Publication Propagation, Yearly Growth, and Strongest Publications

Executive Summary

The immediate commercial battleground for brain implants splits into three pragmatic fronts: (1) diagnostic and monitoring implants that scale quickly because of lower surgical complexity; (2) minimally invasive delivery systems that expand eligible patient pools; and (3) high-fidelity invasive BCIs that will capture high lifetime value where full restoration of function is required. Investors and executives should prioritize product strategies that pair proven hardware durability with continuous, on-device intelligence and clear procedural workflows that reduce clinician time per patient. Material science and powering solutions are not secondary engineering tasks; they drive lifetime economics and reimbursement conversations. Finally, security and identity frameworks must be designed into product roadmaps today, because wireless bidirectional implants create regulatory and commercial risk if ignored.

Interested in enhancing our coverage of trends and tech? We value insights from experts like you - reach out!