Car-t Cell Report

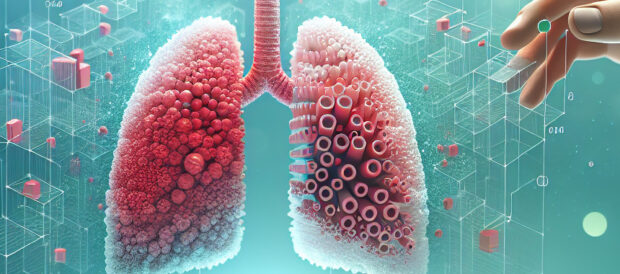

: Analysis on the Market, Trends, and TechnologiesThe CAR-T cell therapy sector represents a promising and rapidly evolving field within the healthcare and biotechnology industries. With a growth trend marked by an 11.95% annual increase in news coverage and an 8.99% annual growth in funding, CAR-T cell therapy is garnering significant investment and media attention. The domain intersects with critical healthcare areas such as diseases, stem cell therapy, and biotechnology, indicating its multidisciplinary nature and robust market presence. Companies are engaged in a range of activities from R&D to clinical-grade product manufacturing, showcasing a vibrant ecosystem ripe for strategic investment and innovation.

We updated this report 27 days ago. Noticed something’s off? Let’s make it right together — reach out!

Topic Dominance Index of Car-t Cell

To identify the Dominance Index of Car-t Cell in the Trend and Technology ecosystem, we look at 3 different time series: the timeline of published articles, founded companies, and global search. These timelines are normalized and combined to show a comprehensive view of the Car-t Cell evolution relative to all known Trends and Technologies.

Key Activities and Applications

- Development of CAR-T cell therapies targeting hematological malignancies and solid tumors.

- Precision oncology through targeted radiopharmaceuticals.

- Immunotherapy applications, including memory natural killer (NK) and CAR-T cell therapies.

- Advanced Cellular Control through Engineered Ligands (ACCEL) platforms for precise CAR-T cell therapy.

- Commercial cGMP facilities for clinical-grade cell and gene therapy products.

- Gene and genome engineering for blood cancers and autoimmune diseases.

Emergent Trends and Core Insights

- Surging interest in CAR-T cell therapy as a revolutionary cancer treatment.

- Expansion of CAR-T therapy applications beyond hematological malignancies to solid tumors.

- Growth in media coverage and funding, signaling a positive market trajectory.

- Increasing involvement of major investors in the sector, such as Casdin Capital, Adage Capital, and 5AM Ventures.

- Development of platforms for scalable and automated cell culture manufacturing processes.

Technologies and Methodologies

- ACCEL and convertibleCAR-T platforms for targeted and controllable CAR-T cell therapy.

- Use of chimeric antigen receptors (CARs) that enhance T-cell-based cellular immunotherapy.

- Integration of gene editing technologies like CRISPR/Cas9 for advanced cell therapy development.

- Employment of advanced bioprocessing and cGMP manufacturing for cell and gene therapy products.

- Application of AI and machine learning algorithms to enhance drug discovery and development processes.

Car-t Cell Funding

A total of 161 Car-t Cell companies have received funding.

Overall, Car-t Cell companies have raised $16.6B.

Companies within the Car-t Cell domain have secured capital from 489 funding rounds.

The chart shows the funding trendline of Car-t Cell companies over the last 5 years

Car-t Cell Companies

The Companies feature is a crucial part of TrendFeedr. It offers in-depth information about 396 companies working within Car-t Cell and other trends and technologies. Identify and analyze innovators and key players in relevant industries more easily with this feature.

396 Car-t Cell Companies

Discover Car-t Cell Companies, their Funding, Manpower, Revenues, Stages, and much more

Car-t Cell Investors

TrendFeedr’s investors tool offers a detailed view of investment activities that align with specific trends and technologies. This tool features comprehensive data on 175 Car-t Cell investors, funding rounds, and investment trends, providing an overview of market dynamics.

175 Car-t Cell Investors

Discover Car-t Cell Investors, Funding Rounds, Invested Amounts, and Funding Growth

Car-t Cell News

Stay informed and ahead of the curve with TrendFeedr’s News feature, which provides access to 2.7K Car-t Cell articles. The tool is tailored for professionals seeking to understand the historical trajectory and current momentum of changing market trends.

2.7K Car-t Cell News Articles

Discover Latest Car-t Cell Articles, News Magnitude, Publication Propagation, Yearly Growth, and Strongest Publications

Executive Summary

CAR-T cell therapy is gaining momentum as a transformative approach to cancer treatment, characterized by innovative platforms, significant funding growth, and heightened media interest. The sector's robust ecosystem is marked by strategic investments and a multidisciplinary approach that spans R&D, biotechnology, pharmaceuticals, and healthcare. Companies are pioneering advanced technologies and methodologies to enhance the efficacy, safety, and scalability of CAR-T cell therapies. As the industry continues to evolve, businesses and investors should closely monitor these developments for potential opportunities in this dynamic and impactful domain.

We seek partnerships with industry experts to deliver actionable insights into trends and tech. Interested? Let us know!