Carbon Sequestration Report

: Analysis on the Market, Trends, and TechnologiesThe carbon-sequestration sector is entering an accelerated deployment phase: global capture capacity rose 22% YoY in 2023 to 49 MtCO₂, while sector forecasts place the market at $16.6B by 2032 under current project pipelines, indicating strong commercial momentum but a large gap to climate targets.

We updated this report 91 days ago. Noticed something’s off? Let’s make it right together — reach out!

Topic Dominance Index of Carbon Sequestration

The Topic Dominance Index trendline combines the share of voice distributions of Carbon Sequestration from 3 data sources: published articles, founded companies, and global search

Key Activities and Applications

- Geological Sequestration (CCS/CCUS) — large-scale injected storage in deep saline formations and depleted reservoirs remains the primary industrial pathway for permanent sequestration; near-term activity focuses on hub development to combine capture from multiple emitters with shared transport and storage assets.

- Direct Air Capture (DAC) — deployment of modular and megascale DAC plants to produce verifiable removal tonnage and secure long-term offtake contracts; falling unit costs and large equity rounds are accelerating build-out.

- Enhanced Rock Weathering (ERW) — spreading finely ground silicate minerals on cropland (particularly tropical soils) to lock CO₂ as stable bicarbonates; ERW couples removal with agronomic co-benefits and emerging MRV systems marketresearchfuture - Carbon Capture Sequestration Market, 2025.

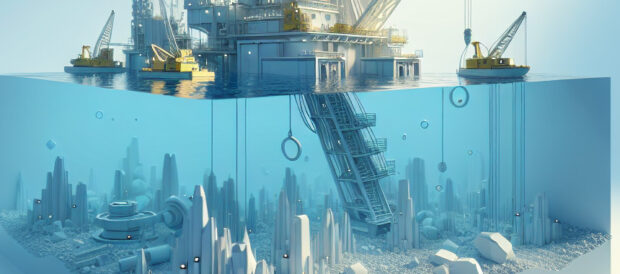

- Carbon Mineralization and Product Integration — injecting CO₂ into construction materials or accelerating natural mineralization (including engineered underground mineral trapping) to produce long-lived carbon sinks and industrial co-products CarbonBlue.

- Soil and Biomass Pathways (Biochar, Improved Soil Management) — scalable near-term removals with measurable farm income impacts; pilots show measurable sequestration and input savings but face MRV and permanence constraints.

- MRV, Traceability and Crediting Infrastructure — development of satellite/AI and ledger approaches to create auditable removal records that enable credit issuance and corporate procurement at scale.

Emergent Trends and Core Insights

- The market is shifting from avoidance credits to permanent removal premiums: buyers increasingly prize sequestration with long residence times and verifiable permanence, driving demand for mineralization, durable product storage, and geological assurance services.

- Regional hub strategies concentrate capital where geology, regulation, and industry converge; the U.S. Gulf Coast and certain North Sea and Oceania basins are focal points for clustered transport and storage investments Statista — Largest projects.

- Material-science improvements and process innovation are compressing costs: solvent and sorbent advances reduce energy penalties for point-source capture, while mineralization and bio-product approaches lower long-term liability per tonne.

- Nature-based and engineered pathways are complementary in scale and cost profile: biological approaches already operate at gigaton potential but face permanence and MRV hurdles, whereas engineered removal (DAC, mineralization) offers higher permanence but must reduce cost to reach gigaton scale.

- MRV and verification are the market gatekeepers: patent filings and platform development emphasize data integrity, automated monitoring, and auditable records — these functions will determine which removals command market premiums.

> "Scaling removals will hinge less on capture chemistry and more on verifiable permanence and integrated transport/storage capacity."

Technologies and Methodologies

- Geological Sequestration (Deep Saline, Depleted Fields, EOR) — mature engineering practices for large volumes; critical limitations include storage site availability, pressure management, and public permitting timelines Statista — BECCS capacity.

- Direct Air Capture (DAC) — adsorption and low-temperature regeneration architectures target sub-$100/tCO₂ levelized costs; current global DAC capacity remains small but funding rounds and modular designs are rapidly expanding deployment.

- Enhanced Rock Weathering (ERW) — mineral application to soils to accelerate carbonate formation; ERW pairs removals with yield and soil health gains but needs large feedstock logistics and field-scale MRV InPlanet.

- Mineralization / Hard-Rock and Aqueous Approaches — converting CO₂ into stable carbonates either in situ or via ocean/industrial streams; recent work demonstrates rapid carbonation in mafic basalts and engineered reactor approaches that reduce leakage risk Cella.

- Biochar and Low-Energy Pyrolysis — stable solid carbon from biomass with co-benefits for agriculture and material substitution; economics hinge on feedstock logistics and certification for permanence Carba.

- Ocean Alkalinity Enhancement and Marine Pathways — electrochemical or biological routes that increase ocean uptake and long-term storage; potential scale is large but governance and ecosystem risk demand new regulatory frameworks Ebb Carbon.

- Monitoring, Reporting and Verification (MRV) — satellite imagery, machine learning, in-field sampling, and ledger technologies form the backbone for market credibility and premium pricing Seqana.

Carbon Sequestration Funding

A total of 533 Carbon Sequestration companies have received funding.

Overall, Carbon Sequestration companies have raised $21.0B.

Companies within the Carbon Sequestration domain have secured capital from 1.9K funding rounds.

The chart shows the funding trendline of Carbon Sequestration companies over the last 5 years

Carbon Sequestration Companies

- CarbonCycle — CarbonCycle develops integrated capture, transport, and deep-injection storage projects targeted at industrial CO₂ sources, coupling subsurface reservoir characterization with permitting and landowner coordination to accelerate site readiness; the company focuses on emitter partnerships and on mitigating subsurface risk for permanent sequestration (small developer, project development focus).

- TerraFixing — TerraFixing offers a mobile DAC solution designed for cold, dry climates that reduces the number of unit operations and targets deployment near sequestration sites and low-cost clean power; the company positions mobility and geographic fit as cost levers to reach the lowest $/tCO₂ for niche northern markets.

- Lithos Carbon — Lithos Carbon commercializes enhanced rock weathering on farmland with machine-learning MRV and agronomic uplift as co-value; the firm focuses on scalable feedstock logistics and farmer revenue-share models to reduce adoption friction while producing verifiable removal credits.

- Ceal Minerals — Ceal Minerals captures dissolved atmospheric CO₂ from seawater and mineralizes it into industrial minerals in a single, electrochemical step; the approach targets industrial customers with an integrated water treatment and revenue-generating mineral product that decouples removal economics from carbon markets.

- Tau Carbon — Tau Carbon produces durable carbon removal by preserving densified wood waste in engineered, non-reemitting storage containers and monetizes credits for the removal; the concept aims for low capital intensity and long permanence by converting waste streams into a product that stores carbon in a controlled environment.

Gain a better understanding of 1.8K companies that drive Carbon Sequestration, how mature and well-funded these companies are.

1.8K Carbon Sequestration Companies

Discover Carbon Sequestration Companies, their Funding, Manpower, Revenues, Stages, and much more

Carbon Sequestration Investors

Gain insights into 1.8K Carbon Sequestration investors and investment deals. TrendFeedr’s investors tool presents an overview of investment trends and activities, helping create better investment strategies and partnerships.

1.8K Carbon Sequestration Investors

Discover Carbon Sequestration Investors, Funding Rounds, Invested Amounts, and Funding Growth

Carbon Sequestration News

Gain a competitive advantage with access to 5.9K Carbon Sequestration articles with TrendFeedr's News feature. The tool offers an extensive database of articles covering recent trends and past events in Carbon Sequestration. This enables innovators and market leaders to make well-informed fact-based decisions.

5.9K Carbon Sequestration News Articles

Discover Latest Carbon Sequestration Articles, News Magnitude, Publication Propagation, Yearly Growth, and Strongest Publications

Executive Summary

The pathway to climate-relevant-scale carbon sequestration will be defined by three linked capabilities: achieving sub-$100/tCO₂ removal economics in engineered routes or securing high-integrity permanence in nature-based routes; assembling regionalized hubs that integrate capture, transport, and verified storage; and delivering MRV systems that create auditable, market-grade removal credits. Business strategy should prioritize asset control of storage capacity or exclusive access to durable sinks, partnerships that lower capital intensity for hub deployment, and investment in MRV and verification platforms that capture the price premium for permanence. Companies that combine materials innovation with supply-chain integration and transparent verification will convert technical potential into durable commercial value.

We seek partnerships with industry experts to deliver actionable insights into trends and tech. Interested? Let us know!