Climate Change Report

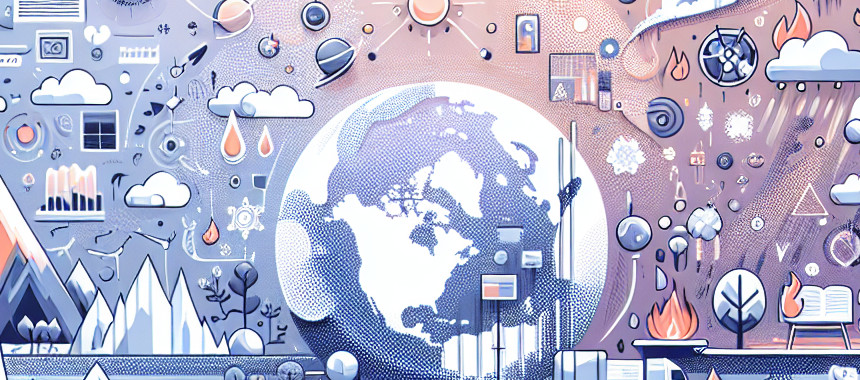

: Analysis on the Market, Trends, and TechnologiesThe climate challenge accelerated in 2024 and the business response must match that pace: total funding in climate-related companies reached $871.73 billion, reflecting concentrated capital flows into mitigation, adaptation, and analytics that firms must convert into measurable resilience and verification capabilities. Global observations confirm 2024 as the warmest year on record (near-surface warming ~1.55 °C above pre-industrial levels) and show record greenhouse-gas concentrations and a one-year ocean heat uptake of about 16 zettajoules, underlining rapid physical escalation that will drive demand for high-fidelity monitoring, asset-level risk quantification, and scalable carbon removal verification systems.

We updated this report 96 days ago. Noticed something’s off? Let’s make it right together — reach out!

Topic Dominance Index of Climate Change

The Topic Dominance Index trendline combines the share of voice distributions of Climate Change from 3 data sources: published articles, founded companies, and global search

Key Activities and Applications

- Extreme-event monitoring and attribution — Real-time detection, attribution, and localized forecasting of heatwaves, floods, and storms to support emergency response and insurance claims. This activity uses satellite and in-situ sensors combined with attribution workflows that quantify climate contribution to individual events.

- Climate-service delivery (NMHS modernization) — National meteorological and hydrological services provide tailored forecasts, impact guidance, and decision support for governments and private sectors; capacity gaps persist and finance flows target service scaling in Asia and Africa WMO - 2024 State of Climate Services.

- Asset-level physical risk quantification — Geospatial models that fuse asset footprints, exposure pathways, and forward hazard projections to produce risk scores for infrastructure owners, banks, and insurers.

- Health-impact analytics — Integrated systems linking temperature, air quality, vector ranges, and demographic vulnerability to forecast morbidity and allocate medical resources ahead of events.

- Carbon accounting, verification and CDR implementation — Continuous CO₂/CH₄ monitoring, chain-of-custody verification, and permanent removal pilots (e.g. accelerated mineralization) to supply high-integrity carbon credits and corporate removals Statista - Global climate change.

Emergent Trends and Core Insights

- The 1.5 °C threshold has been exceeded in observed near-surface temperatures, and that shift changes risk profiles for nearly every sector — especially food, health, and coastal infrastructure — compressing timelines for adaptation investments WMO - State of the Global Climate 2024 NOAA - 2024 Global Climate Report.

- Ocean heat content is a principal risk multiplier — a one-year jump of ~16 zettajoules accelerates sea-level rise and marine ecosystem stress, which translates into persistent operational risks for shipping, fisheries, and coastal real estate.

- Economic losses are rising even as mortality declines in many contexts, which shifts the imperative from life-saving early warning only toward large-scale resilience investments and contingent capital structures to cover fiscal losses Climate Central - 2024 Review.

- Health and climate systems converge as top-tier business risk — ten of fifteen Lancet health indicators hit record levels in 2024, creating demand for integrated surveillance, rapid diagnostics, and adaptive healthcare logistics tied to climate forecasts UN Climate Reports / Lancet Countdown.

- Data and service inequality will determine vulnerability outcomes — only about one-third of NMHSs provide "essential" services and financing shortfalls create market opportunities for private providers that can deliver auditable, subscription-grade climate data to underserved regions.

Technologies and Methodologies

- Satellite remote sensing fused with in situ networks — daily greenhouse-gas retrievals and land-use monitoring provide backstops for CO₂ accounting and leakage detection; satellite observations also quantify heat-stress exposure at continental scales Copernicus - Global Climate Highlights 2024.

- AI and machine-learning forecasting stacks — ML models accelerate high-resolution climate downscaling and improve extreme-event lead times, enabling operational early-warning and asset control logic.

- Digital twins and physics-informed neural networks for infrastructure — real-time simulation of asset performance under projected hazards supports predictive maintenance and capital-expenditure planning.

- Multi-source data fusion and auditable chains — combining satellite, ground sensors, supply-chain records, and blockchain-style ledgers to create immutable Scope 3 trails and verifiable carbon crediting.

- Attribution and impact modeling for legal and financial uses — counterfactual simulation methods provide defensible links between emissions and specific damages, which supports litigation, insurance claims, and regulatory reporting.

Climate Change Funding

A total of 7.7K Climate Change companies have received funding.

Overall, Climate Change companies have raised $986.5B.

Companies within the Climate Change domain have secured capital from 26.0K funding rounds.

The chart shows the funding trendline of Climate Change companies over the last 5 years

Climate Change Companies

- Arrhenius — Arrhenius develops high-resolution greenhouse-gas monitoring and analytics tools targeted at corporate emissions verification; it packages multisensor feeds into subscription APIs that support Scope 1–3 audits and asset-level leakage alerts. The firm aims its product at mid-sized industrial customers that lack in-house monitoring capacity, enabling faster compliance with tightening disclosure rules.

- Hightide — Hightide applies machine learning to hyper-local weather and marine data to produce commercial risk scores for ports and coastal assets. Its value lies in short-term forecasting combined with long-horizon scenario projections, which insurers and port operators use to price resilience upgrades and contingency planning.

- AgroCCS — AgroCCS offers soil carbon measurement, verification, and marketplace tools for farmers and carbon buyers; it pairs remote sensing with soil microbiome sampling to create higher-confidence sequestration credits. The startup targets regional agricultural supply chains where verified nature-based removals command premium pricing.

- TerraSink — TerraSink pilots accelerated mineralization at small industrial sites, focusing on low-energy sorbents and local rock feeds to deliver verifiable, long-duration CO₂ removal. The company positions itself for corporate offtake agreements that require measurable permanence and rapid deployment capability.

- CarbonLockTech — CarbonLockTech builds tamper-resistant supply-chain provenance systems that link emissions data to product batches via cryptographic proofs. The firm addresses buyer demand for auditable Scope 3 claims and targets sectors where traceability gaps produce the largest accounting uncertainty.

Gain a better understanding of 53.7K companies that drive Climate Change, how mature and well-funded these companies are.

53.7K Climate Change Companies

Discover Climate Change Companies, their Funding, Manpower, Revenues, Stages, and much more

Climate Change Investors

Gain insights into 19.1K Climate Change investors and investment deals. TrendFeedr’s investors tool presents an overview of investment trends and activities, helping create better investment strategies and partnerships.

19.1K Climate Change Investors

Discover Climate Change Investors, Funding Rounds, Invested Amounts, and Funding Growth

Climate Change News

Gain a competitive advantage with access to 350.8K Climate Change articles with TrendFeedr's News feature. The tool offers an extensive database of articles covering recent trends and past events in Climate Change. This enables innovators and market leaders to make well-informed fact-based decisions.

350.8K Climate Change News Articles

Discover Latest Climate Change Articles, News Magnitude, Publication Propagation, Yearly Growth, and Strongest Publications

Executive Summary

The available data show a clear pivot: physical climate impacts now drive capital allocation and product demand more than theoretical mitigation narratives. Firms that convert observational intensity (satellites, in-situ sensors) and predictive power (AI downscaling, attribution models) into auditable, enterprise-grade services will capture the highest value: asset-level risk scoring, verified carbon removal credits, and health-integrated early warnings all sit at the intersection of commercial need and urgent public interest. Finance has already flowed at scale into climate companies, but the next phase requires rigorous verification, standardized data pipelines, and operational partnerships with public services to turn investment into measurable resilience and accountable decarbonization.

We seek partnerships with industry experts to deliver actionable insights into trends and tech. Interested? Let us know!