Decentralized Finance Report

: Analysis on the Market, Trends, and TechnologiesThe decentralized finance (DeFi) ecosystem is undergoing a transformative shift, challenging the traditional financial systems by providing services without intermediaries through smart contracts on blockchain. DeFi is characterized by high-interest opportunities and inherent risks, marked by its widespread presence, early-stage development, and diverse applications across various industries. The sector shows immense growth potential, reflected by its significant media presence, explosive news coverage growth, and substantial annual investment growth. The total funding in DeFi amounts to $43.36 billion, indicating robust investor confidence. The sector’s workforce engagement and scalability potential are evidenced by the manpower across companies and the range of annual revenues. DeFi’s market penetration and media growth underscore its rising prominence, positioning it as a disruptive force with innovative solutions in the financial landscape.

We updated this report 450 days ago. Noticed something’s off? Let’s make it right together — reach out!

Topic Dominance Index of Decentralized Finance

The Topic Dominance Index trendline combines the share of voice distributions of Decentralized Finance from 3 data sources: published articles, founded companies, and global search

Key Activities and Applications

- Yield farming and liquidity mining: Popular strategies for earning rewards through cryptocurrency lending.

- Decentralized exchanges (DEXs): Platforms allowing peer-to-peer trading without intermediaries.

- Non-custodial wallets: Wallets that give users full control over their private keys and funds.

- Cross-border trade finance: Using stablecoins to facilitate international trade.

- Multi-chain DeFi platforms: Services that operate across different blockchain networks.

- AI-driven fintech platforms: Combining DeFi with AI for enhanced financial services.

- Real-world asset (RWA) tokenization: Creating digital representations of physical assets on the blockchain.

Emergent Trends and Core Insights

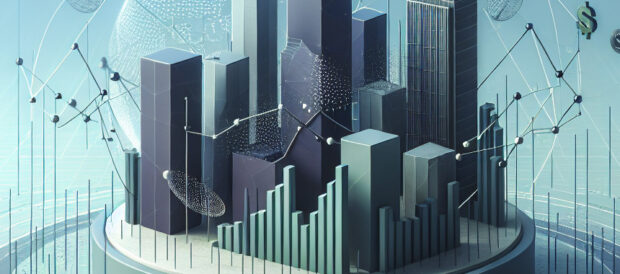

- Significant growth in DeFi coverage and investment: A 980.13% growth in news coverage and a 21.19% annual growth in funding.

- Rise of multi-chain and cross-chain solutions: Addressing interoperability issues between different blockchains.

- Increasing institutional involvement: Notable investors shaping the sector's growth trajectory.

- Expansion of DeFi into traditional sectors: Integrating DeFi with industries like gaming and entertainment.

- Focus on security and compliance: Addressing vulnerabilities and regulatory challenges.

Technologies and Methodologies

- Blockchain and smart contracts: The backbone of DeFi, enabling decentralized and automated financial services.

- Machine learning and AI: Enhancing DeFi platforms' decision-making and profitability.

- Layer 2 scaling solutions: Improving transaction speed and reducing costs on blockchains like Ethereum.

- Zero-knowledge proofs: Enhancing privacy and security in DeFi transactions.

Decentralized Finance Funding

A total of 2.2K Decentralized Finance companies have received funding.

Overall, Decentralized Finance companies have raised $48.9B.

Companies within the Decentralized Finance domain have secured capital from 5.1K funding rounds.

The chart shows the funding trendline of Decentralized Finance companies over the last 5 years

Decentralized Finance Companies

Gain a better understanding of 9.6K companies that drive Decentralized Finance, how mature and well-funded these companies are.

9.6K Decentralized Finance Companies

Discover Decentralized Finance Companies, their Funding, Manpower, Revenues, Stages, and much more

Decentralized Finance Investors

Gain insights into 1.5K Decentralized Finance investors and investment deals. TrendFeedr’s investors tool presents an overview of investment trends and activities, helping create better investment strategies and partnerships.

1.5K Decentralized Finance Investors

Discover Decentralized Finance Investors, Funding Rounds, Invested Amounts, and Funding Growth

Decentralized Finance News

Gain a competitive advantage with access to 47.1K Decentralized Finance articles with TrendFeedr's News feature. The tool offers an extensive database of articles covering recent trends and past events in Decentralized Finance. This enables innovators and market leaders to make well-informed fact-based decisions.

47.1K Decentralized Finance News Articles

Discover Latest Decentralized Finance Articles, News Magnitude, Publication Propagation, Yearly Growth, and Strongest Publications

Executive Summary

DeFi represents a significant shift in the financial paradigm, providing innovative and decentralized solutions that challenge traditional financial institutions. Its rapid growth, fueled by investor confidence and widespread adoption, indicates a promising future. As businesses and individuals increasingly engage with DeFi, the sector continues to evolve with a focus on interoperability, security, and regulatory compliance. It is crucial for stakeholders to monitor trends and developments within DeFi to capitalize on growth opportunities and navigate the complexities of this dynamic ecosystem.

We seek partnerships with industry experts to deliver actionable insights into trends and tech. Interested? Let us know!