Emissions Monitoring Report

: Analysis on the Market, Trends, and TechnologiesThe emissions monitoring market is now a measurable commercial opportunity: USD 3,730,000,000 market size in 2024 with a projected USD 5,960,000,000 by 2029 and a 9.8% CAGR, reflecting sustained investment in continuous monitoring, retro-fits and data platforms. This growth is driven by tighter regulatory requirements, rapid adoption of hybrid sensor networks and a structural shift from single-site analyzers toward integrated, auditable data pipelines that tie compliance data to financial outcomes Emission Monitoring Systems Market – Global Industry Size, Share, Trends, Opportunity, and Forecast, 2019-2029F.

This article was last updated 36 days ago. If you find any info is missing, let us know!

Topic Dominance Index of Emissions Monitoring

The Dominance Index of Emissions Monitoring looks at the evolution of the sector through a combination of multiple data sources. We analyze the distribution of news articles that mention Emissions Monitoring, the timeline of newly founded companies working in this sector, and the share of voice within the global search data

Key Activities and Applications

- Continuous stack and process monitoring for power plants and large industrial stacks, replacing periodic sampling with automated data acquisition and validation to satisfy regulatory QA/QC needs Continuous Emission Monitoring System Market 2025.

- Fugitive methane detection and quantification across oil & gas sites using wide-area laser systems, drone flux methods and sensor networks to localize leaks and produce verifiable emission rates for OGMP and EPA reporting LongPath Technologies, Inc..

- Hybrid monitoring workflows that combine fixed CEMS, portable PEMS and targeted UAV/satellite overflights to reduce capex while maintaining regulatory coverage for small and distributed emitters Emission Monitoring Systems Market Report 2025.

- Data-driven MRV and compliance automation: automated ingestion, calibration, validation and reporting pipelines that feed emissions registries, ETS platforms and corporate Scope 1 inventories

- Operational feedback loops and predictive maintenance where high-frequency emissions data optimize combustion setpoints, reduce excess fuel use and trigger equipment servicing to avoid excursions.

Emergent Trends and Core Insights

- Platform centricity over sensor supremacy: vendors bundling acquisition hardware with cloud DAHS, automated validation and regulatory flows capture more long-term value than point analyzers alone —a strategic shift from one-off instrumentation to recurring SaaS + service revenue models.

- Rapid commercialisation of remote and space-based verification: satellite and airborne spectroscopy now provide top-down crosschecks that materially alter verification and enforcement dynamics at facility scale Carbon Mapper.

- Retro-fit and hybrid deployments accelerate in mature markets where legacy plants require compliance upgrades without full stack replacement; retrofit projects now represent the fastest growing installation segment Fortune Business Insights – CEMS Market.

- Methane and high-GWP gas monitoring take commercial precedence as power and oil & gas portfolios change the emissions profile; methane localization and quantification are now direct inputs to asset valuation and insurance risk models Emissions Monitoring Report 2024.

- Regulatory-financial coupling: ETS and carbon-pricing schemes increasingly demand auditable, high-frequency MRV, turning accurate emissions data into a measurable P&L factor for covered entities.

Technologies and Methodologies

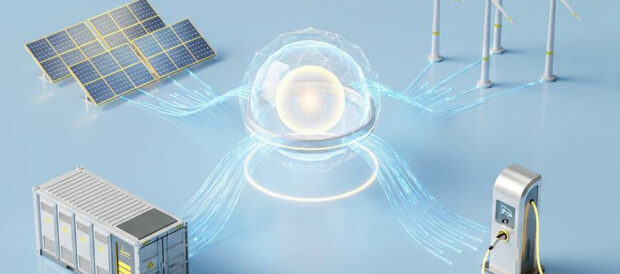

- Continuous Emission Monitoring Systems (CEMS) using extractive and in-situ multi-component analyzers for NOx, SO2, CO2 and PM measurement; these remain the backbone for large stacks and regulated sites.

- Tunable Diode Laser Absorption Spectroscopy (TDLAS) and laser dispersion lidar for high-sensitivity methane and VOC detection at distance, enabling full-site wide-area monitoring.

- Drone flux measurement (DFM) and UAV surveys that quantify point and area sources with accredited methods (ISO/ISO 17025 workflows), enabling rapid, geographically resolved leak mapping.

- Satellite imaging spectroscopy and inversion models (IMEs, Gaussian plume inversion) to deliver top-down estimates; used both for independent verification and prioritization of ground response MethaneSAT.

- PEMS and predictive analytics: software models that estimate emissions from process control variables as cost-effective alternatives or complements to physical analyzers.

- Cloud DAHS, automated calibration and validation pipelines with built-in audit trails supporting ETS compliance and independent verification.

Emissions Monitoring Funding

A total of 180 Emissions Monitoring companies have received funding.

Overall, Emissions Monitoring companies have raised $6.4B.

Companies within the Emissions Monitoring domain have secured capital from 579 funding rounds.

The chart shows the funding trendline of Emissions Monitoring companies over the last 5 years

Emissions Monitoring Companies

- EmissionBox — EmissionBox provides an AI-agent driven platform that automates permit interpretation, task scheduling and compliance workflows for oil & gas and utilities, converting permit language into executable compliance calendars and traceable records; this reduces manual reporting overhead and supports auditability for registries and ETS submissions. EmissionBox operates with a small technical team and places software automation at the centre of emissions operationalization (estimated revenue ~ USD 2.09M ).

- Unisense Environment A/S — Unisense Environment A/S offers a unique dissolved N₂O sensor for wastewater process control that measures nitrous oxide in real time, addressing a niche where N₂O can account for up to 90% of a plant's GHG footprint; their product enables immediate process control actions that reduce total GHG accounting exposure and meet wastewater-specific reporting needs.

- Taikun.ai — Taikun.ai develops a low-cost wireless methane monitor combined with satellite telemetry and automated reporting aimed at small operators and remote sites; the firm's compact sensor + comms design lowers monitoring barriers for geographically dispersed assets and simplifies EPA compliance workflows (very small team / focused pilot deployments).

- Airdar Inc. — Airdar Inc. provides continuous, unattended site coverage that identifies plumes, back-tracks sources and quantifies emission rates across complex facilities; its strength is in offering full-site situational awareness—useful to operators seeking to recover product and reduce safety risks while documenting reductions for regulators (long operating history and applied field methodology).

- Emissium — Emissium focuses on real-time electricity emissions data and APIs that translate grid generation mixes into localized CO₂ intensity metrics for enterprise consumption (data updated at regional granularity and short intervals); this capability allows data centers and industrial consumers to link operational choices to immediate emissions measurements and to integrate these signals into automated load-shifting strategies (seed-stage, specialized dataset provider).

Uncover actionable market insights on 1.2K companies driving Emissions Monitoring with TrendFeedr's Companies tool.

1.2K Emissions Monitoring Companies

Discover Emissions Monitoring Companies, their Funding, Manpower, Revenues, Stages, and much more

Emissions Monitoring Investors

Get ahead with your investment strategy with insights into 728 Emissions Monitoring investors. TrendFeedr’s investors tool is your go-to source for comprehensive analysis of investment activities and financial trends. The tool is tailored for navigating the investment world, offering insights for successful market positioning and partnerships within Emissions Monitoring.

728 Emissions Monitoring Investors

Discover Emissions Monitoring Investors, Funding Rounds, Invested Amounts, and Funding Growth

Emissions Monitoring News

TrendFeedr’s News feature offers access to 782 news articles on Emissions Monitoring. The tool provides up-to-date news on trends, technologies, and companies, enabling effective trend and sentiment tracking.

782 Emissions Monitoring News Articles

Discover Latest Emissions Monitoring Articles, News Magnitude, Publication Propagation, Yearly Growth, and Strongest Publications

Executive Summary

Emissions monitoring now sits at the intersection of regulation, operations and finance: accurate, high-frequency measurement transforms compliance from paperwork into an auditable data asset that alters capital allocation and operational decisions. Market expansion—driven by retro-fits, hybrid sensor networks, and a growing preference for data platforms—favors providers that can deliver verifiable, end-to-end MRV pipelines rather than suppliers of incremental sensor improvements. For operators and investors the clear priorities are systems that combine reliable acquisition, automated calibration/validation and a certified reporting flow into carbon markets and registries; success will accrue to those who can reduce the cost of trustworthy emissions observability while preserving traceability required by both regulators and financial stakeholders.

Have expertise in trends or technology? Your input can enrich our content — consider collaborating with us!