Explosives Report

: Analysis on the Market, Trends, and TechnologiesThe global explosives sector sits at a junction of steady commercial expansion and fast-moving safety and material innovation: total ecosystem funding across firms in this topic reached $30.86B, reflecting concentrated capital flows into differentiation rather than volume-driven incumbency. Market forecasts show industrial demand growth driven by mining, construction and defense — for example, market estimates place the explosives and pyrotechnics sector at US $31.95 billion in 2024, growing to US $40.87 billion by 2030 (projected 4.3% CAGR) grandviewresearch – Explosives & Pyrotechnics Market, 2025. Concurrently, patent activity centers on water-in-oil emulsion chemistry and initiation systems, while incident data and regulatory change increase purchasing of digital initiation, trace detection and disposal services TRIPwire – 2022 Explosives Incident Report (EIR).

This article was last updated 32 days ago. If you find any info is missing, let us know!

Topic Dominance Index of Explosives

The Dominance Index of Explosives looks at the evolution of the sector through a combination of multiple data sources. We analyze the distribution of news articles that mention Explosives, the timeline of newly founded companies working in this sector, and the share of voice within the global search data

Key Activities and Applications

- Bulk mining blasting — Production and on-site delivery of bulk emulsions and ANFO for large open-pit and underground operations remain the single largest industrial use; manufacturers optimize energy-range and on-site density control to match geology researchandmarkets – Explosives – Global Strategic Business Report, 2025.

- Packaged and precision blasting for urban/infra projects — Pre-formulated cartridges and packaged charges support civil tunneling, controlled demolition and urban construction where low vibration and predictable fragmentation are required.

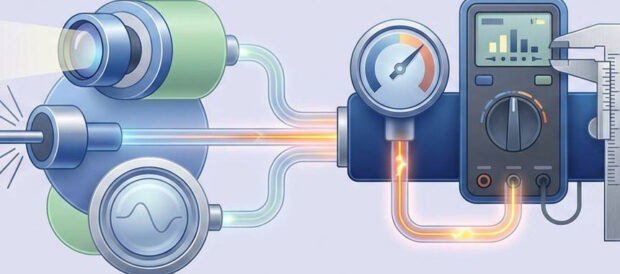

- Electronic and wireless initiation — Electronic detonators and wireless initiation networks provide microsecond timing, built-in diagnostics and end-of-line verification; adoption grows where safety, fragmentation control and analytics matter.

- Explosive ordnance disposal (EOD) and UXO remediation — Geophysical survey, risk mapping and controlled neutralization services scale in post-conflict and legacy industrial sites; robotics and remote tools reduce technician exposure.

- Detection, security screening and forensic analysis — Trace detection systems (mass spectrometry, ion mobility), mid-IR spectroscopy and miniature sensors meet rising regulatory demands and incident response needs.

Emergent Trends and Core Insights

- Digital, data-driven blasting — Blasting is moving from prescription to feedback-aware operations: software, digital twins and connected initiation hardware enable real-time verification and iterative blast optimization, improving fragmentation and reducing rework.

- Shift toward lower-impact formulations — Regulation and community exposure drive uptake of low-smoke, low-vibration and nitrate-reduced energetics; nitrate-free emulsions and hydrogen-peroxide-based oxidizers gain pilot deployments in sensitive sites.

- Electronic initiators as standard safety buy — Electronic detonators capture significant initiation market share (near 40% in some initiation market analyses) and show mid-single-digit CAGR reflecting preference for diagnostic capability and tamper resistance.

- Security and incident response expansion — High volumes of reported threats and loss events (e.g. 2,538 bomb-threat reports recorded in a recent year) create demand for hardened supply-chain controls, tamper-proof initiation devices and trace detection deployments.

- Service verticalization and on-shoring — Geopolitical supply-chain sensitivity and defense procurement preferences push countries and majors to on-shore production, create modular local manufacturing (MEMU) and favor service firms that combine regulatory compliance with digital traceability thebusinessresearchcompany – Explosives Market Insights, 2025.

Technologies and Methodologies

- Bulk emulsion manufacturing and Mobile Emulsion Manufacturing Units (MEMU) — On-site production units reduce transport risk for Class 1 cargo, trim logistics cost and enable density tailoring for site-specific energy delivery.

- Electronic initiation suites and digital blasting software — Systems providing end-to-end voltage verification, programmable timing and cloud analytics underpin modern blast planning and compliance reporting.

- Trace detection and portable spectroscopy — Mass spectrometry, ion mobility spectrometry and mid-IR/QCL spectroscopy enable lower-ng detection limits for RDX/TNT and rapid screening in checkpoints and forensic workflows.

- Autonomous and remotely operated EOD platforms — Drone and ground robotics coupled with AR interfaces reduce human exposure and accelerate clearance throughput for UXO and counter-IED operations.

- Microstructure-informed modeling and high-resolution diagnostics — Shock-compression microscopy, reactive-flow calibration and computational hot-spot modeling tighten safety margins and permit formulation tuning for desired performance envelopes.

Explosives Funding

A total of 508 Explosives companies have received funding.

Overall, Explosives companies have raised $30.9B.

Companies within the Explosives domain have secured capital from 1.5K funding rounds.

The chart shows the funding trendline of Explosives companies over the last 5 years

Explosives Companies

- Hypex Bio Explosives Technology

Hypex Bio Explosives Technology develops nitrate-free, biodegradable emulsion explosives using hydrogen peroxide oxidizers and cold-emulsification sensitization; the company positions its products for urban tunneling and mines constrained by wastewater and nitrate regulation, and emphasizes CE certification and lower downstream remediation needs. The business model mixes toll-blending, licensing of emulsifier tech and pilot MEMU deployments to reduce transport of regulated oxides. - Delta-V Energetics

Delta-V Energetics operates an independent test and validation proving ground for energetic formulations and initiation systems, offering controlled detonation services, instrumentation and safety certification testing. Its value sits in enabling rapid R&D and third-party certification for startup energetics and defense contractors that cannot access government proving ranges. - ShipEcharter Pty Ltd

ShipEcharter digitizes dangerous-goods marine logistics with a real-time matching and tracking portal for Class 1 cargo, closing a long-standing operational gap in explosives freight where regulatory paperwork, permitted routes and storage windows multiply cost. The platform reduces dwell time, improves chain-of-custody records and enables safer cross-border movement for bulk emulsion suppliers and service contractors. - PAones India Pvt Ltd

PAones India supplies high-precision sensitivity testing and advanced laboratory instrumentation to defense and space programs, acting as an accredited gatekeeper for qualified energetic lots. By concentrating on validation, calibration and specialist equipment distribution in India, the company occupies a high-margin niche that ties into sovereign procurement ecosystems and quality-assurance chains.

Uncover actionable market insights on 6.9K companies driving Explosives with TrendFeedr's Companies tool.

6.9K Explosives Companies

Discover Explosives Companies, their Funding, Manpower, Revenues, Stages, and much more

Explosives Investors

Get ahead with your investment strategy with insights into 1.5K Explosives investors. TrendFeedr’s investors tool is your go-to source for comprehensive analysis of investment activities and financial trends. The tool is tailored for navigating the investment world, offering insights for successful market positioning and partnerships within Explosives.

1.5K Explosives Investors

Discover Explosives Investors, Funding Rounds, Invested Amounts, and Funding Growth

Explosives News

TrendFeedr’s News feature offers access to 13.2K news articles on Explosives. The tool provides up-to-date news on trends, technologies, and companies, enabling effective trend and sentiment tracking.

13.2K Explosives News Articles

Discover Latest Explosives Articles, News Magnitude, Publication Propagation, Yearly Growth, and Strongest Publications

Executive Summary

The explosives market will reward firms that convert raw energetic capability into predictable, auditable and low-externality outcomes. Investment flows concentrate on three commercial levers: safer and greener formulations that respond to environmental constraints, electronic initiation and digital control that reduce operational risk and raise service margins, and logistics/regulatory platforms that practicalize safe movement and on-site production. For incumbents, the path to defend margins runs through embedding proprietary measurement and initiation capabilities into product offers; for newcomers, the most credible route is a narrow, verifiable technology or service moat (e.g. certified testing, MEMU logistics or trace detection) that addresses a compliance or safety pain point. End users and procurement authorities will increasingly select suppliers not by commodity price alone but by demonstrable ability to reduce downstream risk, meet stricter emissions and disposal rules, and provide data that supports safe, auditable blasting programs.

Have expertise in trends or technology? Your input can enrich our content — consider collaborating with us!