Geothermal Heating Report

: Analysis on the Market, Trends, and TechnologiesThe geothermal heating sector sits at a measurable inflection where established ground-source deployment meets industrial-grade, high-temperature initiatives: global baseline data show 270 PJ of geothermal heating utilized in 2004 and an installed capacity of 28 GW by 2007, indicating a long-running, measurable foundation for current scaling efforts. Recent market reports also register accelerated deployment in district networks and heat-pump rollouts, with forecasts ranging into the low-double-digit billions by the end of the decade 11.4 Billion Geothermal Heat Pumps Market Outlook, 2025-2030. This report synthesizes the operational activities, technological vectors, funding signals, and near-term strategic choices that will separate low-margin installers from companies capturing system-level value.

We updated this report 80 days ago. Missing information? Contact us to add your insights.

Topic Dominance Index of Geothermal Heating

The Topic Dominance Index combines the distribution of news articles that mention Geothermal Heating, the timeline of newly founded companies working within this sector, and the share of voice within the global search data

Key Activities and Applications

- District heating network development — Expanding geothermal into shared heat grids for residential and commercial loads is the dominant near-term deployment route; policy incentives and municipal procurement are the primary enablers

- Residential and commercial GSHP retrofits — Ground-source heat pump installations target building electrification with retrofit product lines that interface with existing radiators and hydronic systems, lowering consumer switching friction.

- Industrial high-temperature heat delivery — Projects delivering >220°C heat for process decarbonization focus on onsite heat and power replacement instead of grid supply, creating large single-contract value opportunities

- Underground thermal energy storage (UTES) — Seasonal heat storage in subsurface formations is used to shift summer surplus to winter demand, improving capacity utilization of geothermal and complementary renewables.

- Exploration risk reduction with advanced subsurface imaging — High-resolution pre-drill imaging materially shortens the discovery cycle and reduces exploration spend, making deeper and more marginal resources bankable.

- Logistics and materials optimization for boreholes and loops — Thermal grouts, improved loop designs, and slim-hole drilling lower per-site capital cost and shorten installation timelines, attacking the largest cost bucket in GSHP projects G.O. Loop.

Emergent Trends and Core Insights

- Market bifurcation: Activity splits into a high-volume shallow GSHP track and a high-value deep/EGS track. The former scales through installer networks and retrofit compatibility; the latter competes on subsurface risk reduction and advanced drilling Enhanced geothermal systems: 10 Breakthrough Technologies 2024.

- District heat as platformization: Municipal and utility procurement of geothermal heat creates an opportunity for companies that can own or operate network assets rather than just sell equipment Geothermal DHC.

- Storage integration raises utilization: Use of UTES to store converted electricity as heat for industrial consumers reduces seasonal demand swings and raises average capacity factors for geothermal assets.

- Exploration economics are improving via technology transfer from O&G: Firms using advanced imaging and drilling methods lower the exploration-to-production timeline and increase bankability for deeper projects Geothermal Growth Opportunities.

- Policy and finance remain decisive: Investment tax credits and dedicated R&D funds materially shift project IRRs; where incentives cover a meaningful portion of drilling risk, private capital follows

Technologies and Methodologies

- Closed-loop GSHP architectures — Standard for locations without accessible aquifers; loop field design, grout chemistry, and borehole integrity define thermal performance.

- Open-loop groundwater systems — Used where abundant aquifers and permissive regulation exist; lower installation cost but higher hydro-regulatory and water-quality exposure.

- Enhanced geothermal systems and advanced drilling — Hydraulic stimulation, horizontal multilateral wells, and experimental deep-drilling techniques seek to unlock higher-temperature reservoirs and create dispatchable heat and power assets.

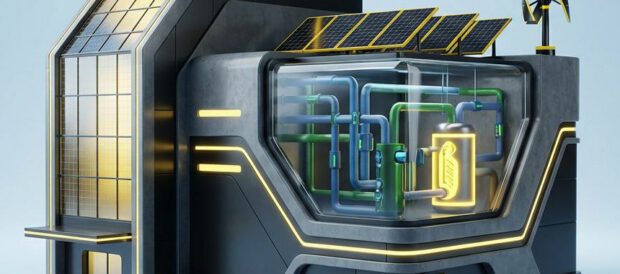

- Thermal energy storage integrated with heat pumps — Systems that convert surplus electricity into stored heat enable plants to time-shift thermal supply and raise seasonal capacity factors without changing primary geology HEATERNAL.

- Pre-drill subsurface imaging and Thermal Response Testing (TRT) — High-resolution imaging and TRT reduce over-design of loop fields and mitigate costly drilling surprises, compressing payback periods.

- Hybrid system integration — Combining geothermal with solar thermal or electric heaters plus batteries provides continuous heat for remote industrial sites and increases project revenue stacking GeoExchange.

Geothermal Heating Funding

A total of 94 Geothermal Heating companies have received funding.

Overall, Geothermal Heating companies have raised $2.2B.

Companies within the Geothermal Heating domain have secured capital from 159 funding rounds.

The chart shows the funding trendline of Geothermal Heating companies over the last 5 years

Geothermal Heating Companies

- Geoflow Imaging — Geoflow Imaging offers high-resolution subsurface imaging that maps fluid pathways before drilling, a capability that can halve exploration costs by reducing dry-hole risk and enabling targeted well placement. The company positions itself as an enabler of larger capital projects by converting geological uncertainty into quantifiable pre-drill data, which is attractive to both developers and financiers. Their trials in Indonesia and other jurisdictions aim to validate economic uplift before full commercial roll-out.

- QHeat — QHeat has developed a patented coaxial system that drastically reduces surface land footprint and simplifies loop field installation in dense urban sites. Their design targets building owners and district operators constrained by land availability and right-of-way costs, enabling geothermal in locations previously considered impractical. Financials indicate early-stage scale efforts with Series A funding to expand manufacturing and pilot deployments.

- GeoPro, Inc. — GeoPro supplies bentonite-based thermal grouts and graphite thermal enhancement compounds that materially improve borehole thermal conductivity and reduce loop length requirements. By improving the borehole interface, the company lowers installed cost per unit of thermal exchange, creating a component-level margin opportunity across thousands of GSHP projects. Their product focus makes them a natural partner for large installers seeking consistent thermal performance.

- Energie-Stat — Energie-Stat specializes in Thermal Response Testing and on-site characterization to right-size loop fields and minimize overspecification. Their precision testing reduces capital exposure from poorly sized systems and accelerates permit approvals in jurisdictions demanding documented site performance. For project developers, this service converts into a defensible technical assumption set for lenders and municipal partners.

- Geothermal Wells LLC — Geothermal Wells LLC targets industrial decarbonization by delivering high-grade heat (>220°C) and on-site power using ORC and molten-salt cycle concepts, reframing geothermal as a direct substitute for fossil process heat. Their client value is measured in large CO2 reductions per site and replacement of fuel-intensive thermal loads, creating large single-site contracts with attractive IRR profiles. The company focuses on regions within a ~12 km radius of industrial demand centres to minimize transport and surface logistics.

Gain a competitive edge with access to 934 Geothermal Heating companies.

934 Geothermal Heating Companies

Discover Geothermal Heating Companies, their Funding, Manpower, Revenues, Stages, and much more

Geothermal Heating Investors

Leverage TrendFeedr’s sophisticated investment intelligence into 154 Geothermal Heating investors. It covers funding rounds, investor activity, and key financial metrics in Geothermal Heating. investors tool is ideal for business strategists and investment experts as it offers crucial insights needed to seize investment opportunities.

154 Geothermal Heating Investors

Discover Geothermal Heating Investors, Funding Rounds, Invested Amounts, and Funding Growth

Geothermal Heating News

TrendFeedr’s News feature provides a historical overview and current momentum of Geothermal Heating by analyzing 1.7K news articles. This tool allows market analysts and strategists to align with latest market developments.

1.7K Geothermal Heating News Articles

Discover Latest Geothermal Heating Articles, News Magnitude, Publication Propagation, Yearly Growth, and Strongest Publications

Executive Summary

Geothermal heating now presents two clear pathways for commercial value creation: scale GSHP delivery through retrofit-friendly products and logistics optimization, or capture system-level margins through deep-resource development, UTES integration, and district heat ownership. The decisive differentiators will be the ability to reduce subsurface risk, lower per-well and per-loop installation cost, and package heat as a contracted utility service that municipal and industrial buyers can procure with predictable economics. Investors and operators should therefore prioritize firms that combine measurable subsurface intelligence, material-level performance improvements, and business models that shift revenue from one-off equipment sales to recurring heat-supply contracts.

Interested in contributing your expertise on trends and tech? We’d love to hear from you.