Green Aviation Report

: Analysis on the Market, Trends, and TechnologiesThe green aviation market is scaling fast: the internal trend data values the sector at USD 1.87 billion in 2025 and projects it to reach USD 82.7 billion by 2035 (implying a 46.1% CAGR reported in the internal data), driven primarily by Sustainable Aviation Fuel (SAF) deployment, nascent hydrogen-electric propulsion, and operational digitalization. This growth comes with three practical constraints—SAF production cost and feedstock scarcity, immature hydrogen/electric infrastructure, and fragmented policy frameworks—each defining the near-term competitive battleground for technology providers, fuel producers, airports, and airlines.

We updated this report 115 days ago. Missing information? Contact us to add your insights.

Topic Dominance Index of Green Aviation

The Topic Dominance Index combines the distribution of news articles that mention Green Aviation, the timeline of newly founded companies working within this sector, and the share of voice within the global search data

Key Activities and Applications

- Sustainable Aviation Fuel (SAF) production and offtake contracting: industrialization of HEFA, ATJ, FT-SPK and PtL pathways to supply airline blending mandates and corporate procurement.

- Power-to-Liquid (PtL) and e-fuel pilots connected to cheap renewable electricity for synthetic kerosene production and CO2 circularity.

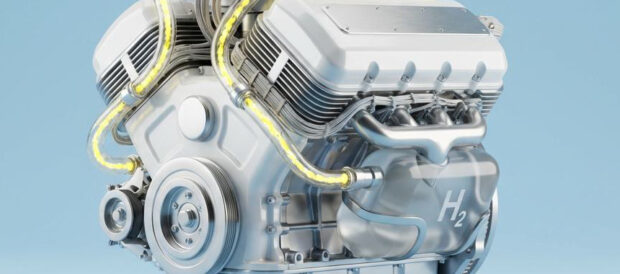

- Hydrogen and hydrogen-electric powertrain development for regional and commuter aircraft, including fuel-cell systems and cryogenic logistics pilots.

- Hybrid and battery-electric propulsion and hybrid range-extenders for short regional routes and AAM/eVTOL platforms.

- Operational efficiency and atmospheric impact reduction: flight-planning, contrail-aware routing, and fuel burn optimization using data analytics and AI to reduce scope-1 emissions and non-CO2 warming impacts SATAVIA.

- Airport-level decarbonization: on-site blending/distribution, renewable electricity integration, EV ground support and charging, and SAF logistics demonstration projects ALIGHT.

- End-of-life circularity and lightweighting: recycling of interiors, composite recovery and lightweight composite manufacture to reduce life-cycle emissions.

Emergent Trends and Core Insights

- SAF leads near-term decarbonization while hydrogen/electric target longer-distance zero-emission goals. Practically, SAF is the immediate lever because it is “drop-in” in many cases; hydrogen and battery options require coordinated infrastructure investment and certification lift.

So what: investors and operators must balance SAF offtake and PtL investments to meet near-term mandates while funding hydrogen demonstration ecosystems for the 2030s. - Large variance in market forecasts requires strategic stress-testing. Internal data values the 2025 market at USD 1.87B, while independent market research reports place 2025 values between ~USD 1.87B and USD 2.55B and longer-term scenarios that reach into the tens to hundreds of billions by 2035–2037 ResearchNester.

So what: plan for high capital intensity; use staged capacity expansion and contracted offtakes to hedge price and feedstock risk. - Policy and mandates are the demand accelerator. Regional blending quotas and targets (EU ReFuelEU, national SAF targets, US SAF Grand Challenge) materially de-risk SAF markets and attract energy majors to the sector European Sustainable Aviation Fuel Growth Opportunities, 2024–2030 North American Sustainable Aviation Fuel Growth Opportunities, 2024–2030.

So what: projects with regulatory alignment and access to incentives (tax credits, credits under IRA frameworks) obtain the lowest offtake and financing cost. - Operations and digital services form a defensible margin layer. Data platforms that reduce fuel burn 2–5% translate into fast paybacks for airlines and act as an adoption channel for SAF and hybrid operations OpenAirlines.

So what: digital service providers that integrate with fuel procurement and emissions accounting can become indispensable to airline buyers.

Technologies and Methodologies

- Hydroprocessed Esters and Fatty Acids (HEFA-SPK) and Hydrotreated pathways: current commercial backbone for many SAF volumes; low technical risk but limited by sustainable feedstock volumes.

- Alcohol-to-Jet (ATJ) and Fischer-Tropsch (FT-SPK): flexible on feedstock (ethanol, syngas) and suited to waste/biomass plus industrial off-gas integration LanzaJet AvIndia.

- Power-to-Liquid (PtL / e-fuel): synthetic kerosene using renewable electricity + CO2 (from DAC or point sources); offers near-zero lifecycle emissions but requires low-cost renewable power and electrolytic hydrogen scale Nordic Electrofuel.

- Hydrogen fuel cells and hydrogen-electric powertrains for regional aircraft: enables true zero tailpipe CO2 for suitable mission profiles but imposes cryogenic storage and airport refuelling complexity ZeroAvia H2FLY.

- Distributed electric/hybrid propulsion and battery systems optimized for short regional and AAM/eVTOL missions H55 VoltAero.

- Digital MRV, SAF certificate registries and book-and-claim tracking for supply-chain traceability and credible emissions accounting ResearchAndMarkets.

- Lightweight materials and composite recycling to cut operational fuel burn and life-cycle emissions.

Green Aviation Funding

A total of 252 Green Aviation companies have received funding.

Overall, Green Aviation companies have raised $74.1B.

Companies within the Green Aviation domain have secured capital from 1.0K funding rounds.

The chart shows the funding trendline of Green Aviation companies over the last 5 years

Green Aviation Companies

-

Avioxx — Avioxx develops a patented process to convert low-cost waste hydrocarbons into jet fuel and positions SAF production on waste valorization principles; the company targets commercial SAF supply with a small, technically focused team and early seed capital commitments. Avioxx’s feedstock strategy directly addresses the feedstock scarcity challenge by focusing on low-value waste streams.

Citation: -

Metafuels — Metafuels pursues an aerobrew™ PtL pathway that combines green hydrogen and captured CO2 to deliver high-yield e-kerosene; the company emphasizes high carbon conversion and modular scale-up economics intended to lower PtL costs vs legacy designs. Their technology targets the long-run replacement of fossil jet kerosene with electricity-derived fuels, a direct hedge against feedstock constraints for bio-pathways.

Citation: -

Spark e-Fuels — Spark builds load-flexible, integrated e-fuel production modules designed to connect to low-cost renewable power; their proposition reduces PtL capex risk by matching production to variable renewable availability and aims to lower LCOE for e-kerosene. The company targets modular deployment at brown-field industrial sites to accelerate project finance.

Citation: -

RISE — RISE provides flight-scheduling and operational software that reduces empty-leg flights and improves fuel efficiency for business and charter operators; the product lowers emissions by optimizing aircraft utilization and routing and can serve as a rapid ROI play for operators that buy SAF and want to reduce fuel spend. RISE’s platform also positions it to integrate SAF certificate retirement and book-and-claim services for small operators.

Citation: -

AirGo Design — AirGo offers composite lightweighting and AI-accelerated CAE simulation services for thermoplastic composite components, a supply-chain play that reduces fuel burn via structural mass reduction and provides a retrofit path for interiors and secondary structures. Their engineering-to-manufacture offering targets OEM suppliers and MROs seeking quick, certified weight savings.

Citation:

Gain a competitive edge with access to 1.2K Green Aviation companies.

1.2K Green Aviation Companies

Discover Green Aviation Companies, their Funding, Manpower, Revenues, Stages, and much more

Green Aviation Investors

Leverage TrendFeedr’s sophisticated investment intelligence into 1.2K Green Aviation investors. It covers funding rounds, investor activity, and key financial metrics in Green Aviation. investors tool is ideal for business strategists and investment experts as it offers crucial insights needed to seize investment opportunities.

1.2K Green Aviation Investors

Discover Green Aviation Investors, Funding Rounds, Invested Amounts, and Funding Growth

Green Aviation News

TrendFeedr’s News feature provides a historical overview and current momentum of Green Aviation by analyzing 10.5K news articles. This tool allows market analysts and strategists to align with latest market developments.

10.5K Green Aviation News Articles

Discover Latest Green Aviation Articles, News Magnitude, Publication Propagation, Yearly Growth, and Strongest Publications

Executive Summary

SAF adoption will drive the majority of near-term emission reductions and create the principal commercial opportunities in green aviation for the rest of this decade; PtL and hydrogen solutions present credible but capital-intensive paths to full net-zero beyond 2030. The business strategy for incumbents and newcomers should combine three moves: secure offtake and policy alignment; phase plant development (cheap feedstock/waste first, then PtL scale); and embed digital operational services that ensure airlines realize immediate fuel and emissions savings. Investors should prioritize modular, exportable SAF technologies and digital operational moats while tracking hydrogen infrastructure pilots as the structural long-term payoff.

Interested in contributing your expertise on trends and tech? We’d love to hear from you.