Hematology Report

: Analysis on the Market, Trends, and TechnologiesThe hematology market shows persistent, data-driven expansion: current market models list $4,600,000,000 in diagnostics revenue with a projected CAGR of 6.7% toward a $8,800,000,000 forecast, signaling sustained demand for diagnostics, reagents, and workflow software. External market analyses report a broader market range and higher aggregate valuations that reflect differing scope definitions (instruments plus services vs. full ecosystem), for example larger industry estimates that place total hematology market values well above single-segment diagnostics figures gminsights – Hematology Diagnostics Market, 2025. This combination of steady base demand, multiple credible CAGR estimates, and accelerating adoption of AI and point-of-care platforms creates a clear commercial imperative: prioritize scalable diagnostics that feed interoperable data platforms and reduce per-test cost through reagent and consumable optimization grandviewresearch – Hematology Analyzers And Reagents.

We updated this report 32 days ago. Missing information? Contact us to add your insights.

Topic Dominance Index of Hematology

The Topic Dominance Index combines the distribution of news articles that mention Hematology, the timeline of newly founded companies working within this sector, and the share of voice within the global search data

Key Activities and Applications

- Advanced automated diagnostics (CBC+, high-parameter differentials): Clinical labs continue replacing manual workflows with multi-part automated analyzers that expand test panels beyond basic CBC to include reticulocytes, advanced RBC indices, and integrated ESR/ESR-calibrated outputs

- Digital morphology and AI-assisted smear interpretation: Adoption of whole-slide and full-field peripheral smear imaging with ML-driven decision support reduces reviewer variability and lowers turn-around time for morphology-based diagnoses

- Flow cytometry and MRD monitoring: Multi-parameter flow cytometry, paired with standardized computational gating and unsupervised clustering, is central to leukemia/lymphoma phenotyping and minimal residual disease surveillance.

- Point-of-care hemostasis and viscoelastic testing: Rapid bedside coagulation assessment and cartridge-based viscoelastic assays guide perioperative transfusion and reduce unnecessary allogeneic transfusions

- Genetic and molecular hematology for hemoglobinopathies and inherited disorders: Targeted NGS panels and functional biochemical assays (e.g. hepcidin, labile plasma iron) support carrier screening, diagnostic confirmation, and clinical trial enrollment for gene therapies

- Transfusion management and traceability: RFID/IoT inventory systems and supply-chain software optimize product use, lower wastage, and ensure chain-of-custody for high-value blood products

Emergent Trends and Core Insights

- Data-first platformization: The highest-return investments concentrate on companies that ingest diagnostic outputs and provide downstream clinical decision pathways rather than on standalone instruments; this explains concentration of market influence among integrators and platform players.

- Platelets and cellular cargo as diagnostic vectors: Research and early-stage products are using platelet proteomics and single-cell platelet analysis to generate disease signatures, shifting some diagnostics from plasma-centric assays to cell-based molecular readouts Hessian Labs.

- Decentralization of complex tests: Micro-sampling, dried blood spot technologies, and compact POC analyzers enable earlier triage and MRD sampling outside centralized labs, increasing testing volume while changing ASP dynamics

- Consumables as recurring revenue anchors: Reagents, controls, and calibrated consumables remain the largest recurring revenue pools; companies with differentiated consumable chemistry or proprietary control materials retain predictable margin streams alliedmarketresearch – Hematology Analyzers and Reagents Market, 2025.

- Convergence of HSC engineering and transplant logistics: Ex vivo HSC expansion and engineered, off-the-shelf cellular products are shifting HSCT economics by reducing donor-dependency and enabling broader patient access; this raises demand for regulated cell processing and cryopreservation platforms.

- Regulatory and supply-chain pressure is reshaping product roadmaps: CE-IVDR and tariff volatility force vendors to design modular, upgradeable systems and to localize manufacturing for critical consumables.

Technologies and Methodologies

- AI-native digital morphology and cytometry interpretation: Convolutional and graph-based models applied to whole-slide images and cytometry output are replacing subjective pattern recognition with reproducible classification and triage scores hema.to GmbH.

- High-dimensional flow cytometry with computational phenotyping: 20+ color panels coupled with unsupervised analysis pipelines (t-SNE, FlowSOM) improve detection of rare malignant and precursor populations and enable sensitive MRD workflows Phenotypic Analysis of HSPCs.

- Viscoelastic sonorheometry and dynamic clot assays: Real-time clot mechanics via resonance techniques and reaction-diffusion clot modeling generate actionable transfusion algorithms that reduce blood product use and complication rates HemoSonics.

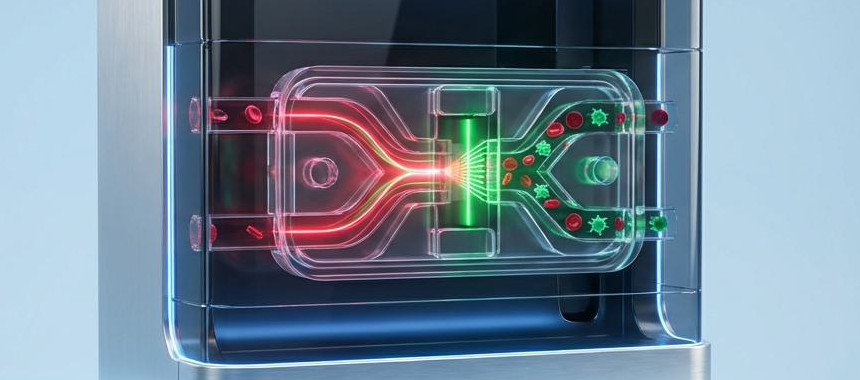

- Microfluidics and DBS extraction platforms: Precision volume control and plasma separation for low-volume sampling support decentralized testing and biobanking initiatives DBS System.

- Ex vivo expansion and cell engineering platforms for HSCs: Bioreactor and media innovations enable scalable HSC manufacturing and support therapeutic gene-editing or CAR-engineered HSC approaches Celaid Therapeutics.

- RFID/IoT traceability and inventory optimization: End-to-end tracking solutions reduce wastage and support transfusion safety and compliance workflows Biolog-id.

Hematology Funding

A total of 401 Hematology companies have received funding.

Overall, Hematology companies have raised $96.0B.

Companies within the Hematology domain have secured capital from 1.4K funding rounds.

The chart shows the funding trendline of Hematology companies over the last 5 years

Hematology Companies

- BLOODGENETICS S.L. — BLOODGENETICS S.L. provides targeted genetic diagnostics and clinical biochemical assays for hereditary hematological disorders, combining Next-Generation Sequencing panels with interpretive clinical recommendations for treating physicians. The company offers functional biochemical measurements such as hepcidin and labile plasma iron to monitor iron overload and therapy response, enabling integration with drug-development programs and specialized clinical workflows. Its small team and grant-stage funding profile position it as a niche clinical genetics partner for regionally focused hemoglobinopathy programs.

- AimaLabs — AimaLabs develops AI-driven blood smear analysis software that automates cellular identification and classification to reduce manual review burden. The company emphasizes reproducibility and regulatory-aligned workflows and has early seed-stage traction from acceleration programs and awards. As digital morphology adoption grows, AimaLabs can act as a lightweight integration layer for labs seeking low-friction AI augmentation.

- INNOVHEM — INNOVHEM focuses on quantitative biomarkers for red blood cell disorders, including precise measurement of fetal hemoglobin distribution and intravascular hemolysis indices. This specialization makes the company a practical partner for pharmaceutical development in sickle cell disease and thalassemia, offering validated assays for preclinical through Phase IV studies. Their high-margin assay niche and documented revenue progression reflect value as a contract R&D collaborator rather than a mass-market diagnostic vendor.

- Hemo bioscience — Hemo bioscience manufactures blood bank reagents and quality-control products within an FDA-registered facility, supplying reagents that underpin the daily operations of transfusion services. Their vertical focus on foundational consumables creates a predictable recurring revenue stream and positions them as an acquisition candidate for larger diagnostics firms seeking to secure reagent supply. Hemo bioscience’s in-house manufacturing and regulatory compliance are strategic assets for hospital clients requiring traceable, validated products.

- Hemotic — Hemotic delivers AI-driven software for blood bank inventory optimization and transfusion logistics, applying mathematical optimization to reduce expiry-related waste and match supply to demand. Their LHEMA tool targets operational cost savings for hospitals and blood centers and complements clinical PBM initiatives by aligning inventory decisions with clinical need. For organizations pursuing efficiency gains in transfusion services, Hemotic’s product represents a low-disruption, high-ROI intervention.

Gain a competitive edge with access to 4.6K Hematology companies.

4.6K Hematology Companies

Discover Hematology Companies, their Funding, Manpower, Revenues, Stages, and much more

Hematology Investors

Leverage TrendFeedr’s sophisticated investment intelligence into 1.7K Hematology investors. It covers funding rounds, investor activity, and key financial metrics in Hematology. investors tool is ideal for business strategists and investment experts as it offers crucial insights needed to seize investment opportunities.

1.7K Hematology Investors

Discover Hematology Investors, Funding Rounds, Invested Amounts, and Funding Growth

Hematology News

TrendFeedr’s News feature provides a historical overview and current momentum of Hematology by analyzing 5.7K news articles. This tool allows market analysts and strategists to align with latest market developments.

5.7K Hematology News Articles

Discover Latest Hematology Articles, News Magnitude, Publication Propagation, Yearly Growth, and Strongest Publications

Executive Summary

Hematology sits at an inflection point where diagnostics accuracy, consumable economics, and data integration determine commercial winners. Market-size models indicate steady, mid-single-digit CAGRs for diagnostics while broader segmentation analyses show substantially larger total-market valuations when therapeutic and platform services are included. The highest strategic value flows to solutions that connect test outputs into care pathways—AI morphology engines, MRD analytics, HSC manufacturing platforms, and transfusion management systems. Short- to medium-term investment and partnership opportunities exist in differentiated consumables, POC hemostasis, and regulated cell-processing infrastructure; medium- to long-term value accrues to entities that own longitudinal hematology data and clinical decision layers. Hospitals and diagnostic lab networks will favor modular, upgradeable platforms that lower per-test costs and deliver measurable clinical outcomes, creating acquisition prospects for vendors that combine validated assays with scalable software.

Interested in contributing your expertise on trends and tech? We’d love to hear from you.