Hydrogen Fuel Engines Report

: Analysis on the Market, Trends, and TechnologiesThe hydrogen fuel engine sector is at an inflection where commercial deployment decisions are driven as much by fuel logistics and integration models as by component R&D; the 2024 market for hydrogen fuel engines is estimated at $18,234,500,000, and the internal trend dataset records a CAGR of 4.9% for the segment, highlighting steady adoption despite infrastructure constraints. Investment and technology activity cluster around heavy-duty applications, on-site generation, and retrofit pathways that lower time-to-value for fleet operators and industrial users.

We updated this report 3 days ago. Missing information? Contact us to add your insights.

Topic Dominance Index of Hydrogen Fuel Engines

The Topic Dominance Index combines the distribution of news articles that mention Hydrogen Fuel Engines, the timeline of newly founded companies working within this sector, and the share of voice within the global search data

Key Activities and Applications

- Power-generation retrofits and peaking plants — Operators apply hydrogen-ready reciprocating engines for resilient on-site power and peaking capacity, targeting above-1 MW installations where hydrogen can displace liquid fuels or blend with gas.

- Heavy-duty transport (trucks, buses, long-haul) — Fleets prioritize rapid refueling and range; retrofit or dual-fuel conversions allow immediate emissions reductions while refueling networks scale.

- On-demand (vehicle-mounted) hydrogen generation and retrofit kits — Compact electrolyzers and water-to-hydrogen modules that avoid high-pressure storage let legacy diesel assets run on hydrogen enrichment or co-combustion, lowering capex and permitting phased adoption.

- Marine propulsion and maritime power — Solutions include dual-fuel marine engines and methanol-to-hydrogen reformers for vessels, targeting regulatory timelines under IMO decarbonization frameworks.

- Industrial/off-highway equipment and stationary CHP — Construction, mining and onsite combined heat and power use cases leverage hydrogen to avoid battery weight and to provide continuous operation in remote settings.

Emergent Trends and Core Insights

- On-site generation is strategic for early scale. Companies targeting pyrolysis, modular electrolyzers, or carrier cracking reduce dependence on external refueling networks and materially improve delivered hydrogen economics (well-to-wheel). This shift tightens the link between hydrogen-production innovators and engine integrators.

- Dual-fuel and retrofit pathways provide the fastest commercial traction. Dual-fuel conversions and hydrogen enrichment reduce fleet capital requirements and permit incremental substitution of diesel—this pathway is the principal near-term commercial vector for heavy fleets.

- Fuel logistics are the dominant economic lever. LOHCs, carrier cracking, and decentralized electrolyzers lower distribution costs and risk; firms that control these interfaces materially change project IRRs and adoption speed.

- NOx and abnormal combustion remain solvable engineering limits, not blockers. Advanced injection (direct, pre-chamber), water injection, and aftertreatment strategies are converging into operational packages that permit high hydrogen shares while meeting emission standards.

- Economic inflection depends on green-H2 cost. Achieving delivered prices near $1/kg (or comparable parity against diesel on a per-mile basis) is the single macro variable that unlocks large-scale fleet and power applications; several electrolyzer and pyrolysis startups target pathways to that threshold Advanced Ionics.

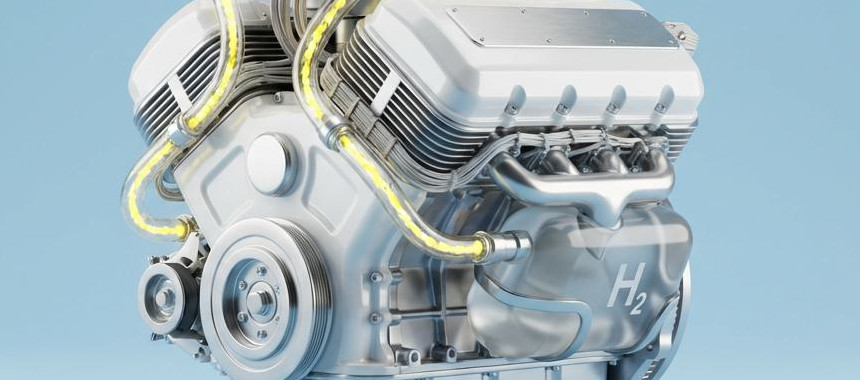

Technologies and Methodologies

- On-demand electrolysis modules and mobile generators — Systems that produce hydrogen at point of use (vehicle or station) reduce storage risk; designs range from membrane-less and decoupled electrolysis to rotating and plasma-assisted approaches Spiral Hydrogen.

- Liquid Organic Hydrogen Carriers (LOHC) and carrier cracking — LOHCs enable ambient storage and leverage existing liquid logistics; integrated membrane reactors and on-site cracking convert carriers back to high-purity hydrogen near the point of consumption Hydrogenious LOHC.

- High-pressure direct injection and pre-chamber ignition — Precision injectors and pre-chamber designs manage hydrogen's flame speed and enable lean operation with controllable NOx formation for reciprocating H2-ICEs.

- Thermal-integration and waste-heat reforming — Using exhaust heat for steam reforming or dehydrogenation of carriers increases system energy efficiency and reduces auxiliary electrical load.

- Digital twins and CFD-driven combustion mapping — High-fidelity simulation shortens calibration cycles for converted engines and supports NOx trade-offs between combustion strategy and aftertreatment architectures.

Hydrogen Fuel Engines Funding

A total of 518 Hydrogen Fuel Engines companies have received funding.

Overall, Hydrogen Fuel Engines companies have raised $75.1B.

Companies within the Hydrogen Fuel Engines domain have secured capital from 2.0K funding rounds.

The chart shows the funding trendline of Hydrogen Fuel Engines companies over the last 5 years

Hydrogen Fuel Engines Companies

- KEYOU — KEYOU develops retrofit technologies and combustion-process adaptations that enable legacy internal-combustion engines to run on hydrogen with minimal base-engine changes. The company emphasizes economic scalability for commercial vehicles, aiming to preserve payload and range while delivering water-only exhaust. KEYOU reports a later-stage VC profile and prior funding rounds that support pilot vehicle deployments across logistics fleets.

- DCARB CleanTech Solutions — DCARB offers on-asset hydrogen generation and co-fueling modules that convert water into hydrogen and oxygen on demand, targeting diesel engines in trucks, buses and generators. Their retrofit units promise measurable operational gains—5–15% fuel reduction and particulate cuts—positioning the product as an immediate ESG upgrade for the "messy middle" between legacy assets and full fleet replacement. DCARB focuses on low-capex, rapid deployment for fleets where downtime is costly.

- BeHydro — BeHydro engineers dual-fuel and 100% hydrogen reciprocating engines in the 600 kW–2.7 MW power band with a focus on marine, rail and stationary power. The joint venture structure (industrial and shipping technology partners) aims to accelerate certification and marine trials, where retrofitting timelines and fuel logistics make LOHCs and dual-fuel strategies attractive. BeHydro positions its hardware for direct substitution in heavy applications.

- HYDI Hydrogen — HYDI builds compact, vehicle-mounted water-to-hydrogen units that do not store hydrogen but generate it while the engine runs, emphasizing safety and retrofit simplicity for heavy equipment. The product targets immediate fuel and emission improvements without high-pressure tanks; field deployments in remote and industrial fleets show quantifiable fuel savings that support short payback periods. HYDI targets operators where electrification is operationally impractical.

- REVYVE Technologies — REVYVE focuses on adapting marine and recreational boating engines to hydrogen combustion and offers simulation-driven engineering services for engine OEMs. The company combines combustion simulation tools with prototype conversions to shorten validation cycles in small ship and leisure craft markets, where retrofit economics and docking logistics differ from road fleets. REVYVE positions itself as a specialist integrator for maritime hydrogen ICE conversion.

Gain a competitive edge with access to 2.5K Hydrogen Fuel Engines companies.

2.5K Hydrogen Fuel Engines Companies

Discover Hydrogen Fuel Engines Companies, their Funding, Manpower, Revenues, Stages, and much more

Hydrogen Fuel Engines Investors

Leverage TrendFeedr’s sophisticated investment intelligence into 2.0K Hydrogen Fuel Engines investors. It covers funding rounds, investor activity, and key financial metrics in Hydrogen Fuel Engines. investors tool is ideal for business strategists and investment experts as it offers crucial insights needed to seize investment opportunities.

2.0K Hydrogen Fuel Engines Investors

Discover Hydrogen Fuel Engines Investors, Funding Rounds, Invested Amounts, and Funding Growth

Hydrogen Fuel Engines News

TrendFeedr’s News feature provides a historical overview and current momentum of Hydrogen Fuel Engines by analyzing 25.6K news articles. This tool allows market analysts and strategists to align with latest market developments.

25.6K Hydrogen Fuel Engines News Articles

Discover Latest Hydrogen Fuel Engines Articles, News Magnitude, Publication Propagation, Yearly Growth, and Strongest Publications

Executive Summary

Hydrogen fuel engines now sit at the intersection of engineering maturity and logistical constraint. The evidence shows functional and near-commercial engine platforms across heavy transport, marine and stationary power, but adoption at scale depends on solving hydrogen supply, storage and refueling economics. Companies that combine engine expertise with control of the fuel interface—through on-site production, carrier logistics, or integrated HaaS offerings—will convert the sector's technical progress into predictable revenue. For industry incumbents and investors, the immediate commercial playbook is clear: finance and field-validate fuel-supply options that enable high hydrogen substitution ratios, deploy retrofit and service models that minimize operator capex, and package emissions compliance with competitive TCO to convert early adopters into scale customers.

Interested in contributing your expertise on trends and tech? We’d love to hear from you.