Liquid Metal Report

: Analysis on the Market, Trends, and TechnologiesThe liquid metal sector shows clear commercial momentum: the internal trend report records a market size of $32,440,000 in 2023 with a projected CAGR of 9.17% toward a 2030 value of $57,970,000—signaling technology adoption across thermal management, additive manufacturing, flexible electronics, and grid batteries rather than a single niche application. Multiple external market studies present larger top-line estimates (see the forecast comparison table below), but the internal data anchors the analysis to measured company activity, patent counts, funding flows, and identified application pockets.

Our latest update of this report was 128 days ago. If you found a mistake or missing information, tell us!

Topic Dominance Index of Liquid Metal

The Topic Dominance Index evaluates Liquid Metal's significance by analyzing data on the distribution of news articles that mention Liquid Metal, the timeline of newly founded companies working in this sector, and global search trends

Key Activities and Applications

- Thermal interface materials (TIMs) for electronics and power electronics. Liquid-metal TIMs target microscopic gap filling and very high heat flux removal in CPUs, GPUs, and EV power modules; patents emphasize low-leakage formulations and self-packaging to enable deployment in consumer and industrial assemblies and the specialized TIM market study identifies TIMs as a growing subsegment.

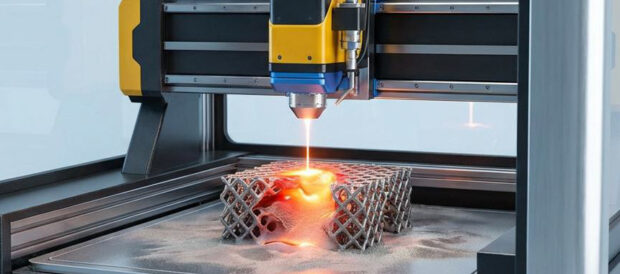

- Additive manufacturing with molten or low-melting alloys. New printing methods (liquid metal printing, liquid metal jetting) target rapid, low-waste production of large conductive or structural parts and enable printing on substrates such as textiles and paper for embedded electronics and commercial LMP systems launched from recent startups.

- Flexible and stretchable electronics. Gallium-indium alloys and metal gels serve as conductive interconnects and sensors for wearable and soft-robotic devices; research shows self-assembly and microchannel routing methods that turn common substrates into electronic surfaces Liquid metal particles self-assemble into electronics and printable liquid metal techniques have been validated across many substrates.

- Liquid-metal batteries and grid storage prototypes. R&D continues on Mg-Sb, Na-S and liquid-metal battery architectures for grid scale storage with dedicated companies pursuing scale and cost reductions and broader market coverage of liquid-metal battery categories Liquid Metal Battery market overview.

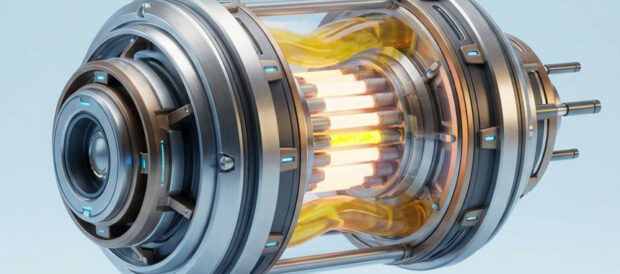

- Industrial heat transfer and niche high-temperature systems. Electromagnetic and induction pumps, nuclear and high-temperature heat-transfer loops use liquid metals for high thermal conductivity and continuous flow cooling in specialized facilities.

Emergent Trends and Core Insights

- Divergence in market sizing, convergence on use cases. External forecasts vary widely (see table), yet they converge on a common set of high-value applications: TIMs, additive manufacturing parts, flexible electronics, and energy storage; this means strategy should target application verticals rather than a single product line.

- Material design is the primary gate. Patent activity focuses on alloy formulation (controlling fluidity, anti-fusion, melting range) and processability (self-packaging TIMs, encapsulation) which translates directly into product readiness for electronics OEMs and targeted TIM patents.

- Manufacturing and handling innovations unlock commercial use. Advances in micro-encapsulation, nozzle materials for metal jetting, and semi-solid processing reduce safety and reliability barriers and thus shorten time to production integration.

- Regional roles split by volume and value. Asia-Pacific drives volume and pilot manufacturing for coatings and pump technologies, while North America centers on high-value TIMs and battery IP capture and the internal data shows diversified company activity across US, China, and Europe.

- Sustainability pressures reframing alloy choices. Movement toward recyclable formulations, water-based coatings, and low-energy manufacturing is explicit in company positioning and in patent filings emphasizing lower-toxicity, recyclable alloys.

Technologies and Methodologies

- Liquid metal thermal pads and LMEE embedded elastomers. Product work focuses on balancing conductivity and containment with printable or extrudable formats for assembly lines and specialized TIM market research.

- Liquid metal jetting and liquid metal printing (LMP). Techniques include drop-on-demand and wire-feed approaches that prioritize speed and low waste for conductive structures; commercial entrants have started system launches and pilots and basic science demonstrations show printability on diverse substrates.

- Semi-solid processing and electromagnetic manipulation. Methods such as rheo-casting, electromagnetic stirring, and controlled rapid solidification provide routes to semi-solid slurries and fine microstructures for downstream forming and electromagnetic manipulation patents for shaping and casting.

- Metallic gels and room-temperature printable metal pastes. New material classes that behave like gels enable room-temperature printing and wide substrate compatibility, with direct implications for wearable electronics and energy storage prototypes A Highly Conductive Metallic Gel for 3D Printing.

- Computational design and CFD for liquid flow and heat transfer. Simulation tools optimize alloy composition, nozzle design, and cooling loop efficiency; patents and technical papers emphasize coupling materials models with process control.

Liquid Metal Funding

A total of 47 Liquid Metal companies have received funding.

Overall, Liquid Metal companies have raised $2.1B.

Companies within the Liquid Metal domain have secured capital from 193 funding rounds.

The chart shows the funding trendline of Liquid Metal companies over the last 5 years

Liquid Metal Companies

- Fluent Metal — Fluent Metal commercialized a drop-on-demand, wire-based LMP process and launched from stealth with early funding aimed at low-waste, high-speed metal printing for conductive and structural parts; the company positions its process as waste free and suitable for larger parts where speed matters more than micro-detail, making it relevant to printed conductive structures and rapid prototyping and the internal data lists fluentmetal among active companies in the topic.

- Metalier Coatings — Metalier develops sprayable liquid metal coatings and is shifting to water-based formulations for improved sustainability and applicator safety; this product line serves architectural and furniture markets while providing a commercialized use case for real-metal finishes on diverse substrates.

- LMB Corporation — LMB (Liquid Metal Battery) pursues liquid-metal battery architectures for grid storage and has historically driven interest in liquid metal as an energy storage enabler; the company's work illuminates the material and system-level design challenges for high-temperature, liquid-phase electrochemistry and the internal topic specifically lists liquid metal battery technology as a defined application area.

- Arieca — Arieca develops Liquid Metal Embedded Elastomer (LMEE) solutions and other printable TIM formats for electronics cooling; the company's product focus sits directly at the intersection of TIM application demand and manufacturable, assembly-friendly materials and TIM markets are independently tracked by market reports.

- ADDiTEC — ADDiTEC and similar niche AM equipment suppliers develop high-power directed energy deposition systems and are active in validating liquid metal jetting, nozzle materials, and large-scale metal deposition workflows for defense and industrial use cases; industry news and event coverage show naval and defense pilots for liquid metal printing and jetting technology and technology articles cite military and industrial pilots for LMJ systems.

(Each company description above synthesizes internal topic listing and supporting industry or news coverage; see the cited links per company for the underlying evidence).

Explore comprehensive profiles of 462 companies shaping the future of Liquid Metal with TrendFeedr's Companies feature.

462 Liquid Metal Companies

Discover Liquid Metal Companies, their Funding, Manpower, Revenues, Stages, and much more

Liquid Metal Investors

TrendFeedr’s Investors tool allows you to explore detailed investment activities and trends based on 208 Liquid Metal investors. This tool provides an in-depth analysis of funding rounds and market dynamics to make informed investment decisions.

208 Liquid Metal Investors

Discover Liquid Metal Investors, Funding Rounds, Invested Amounts, and Funding Growth

Liquid Metal News

Stay updated with TrendFeedr’s News feature, which offers you access to 3.5K Liquid Metal articles. This tool provides you with a comprehensive understanding of the historical and current trends shaping the market.

3.5K Liquid Metal News Articles

Discover Latest Liquid Metal Articles, News Magnitude, Publication Propagation, Yearly Growth, and Strongest Publications

Executive Summary

The practical commercial frontier for liquid metal lies where engineered materials meet manufacturable process control. Investors and corporate strategists should prioritize assets that reduce handling risk and integrate into existing assembly flows: low-leakage TIMs, printable conductive inks and gels that tolerate standard substrates, and additive-manufacturing platforms that scale speed with acceptable feature fidelity. Patent activity indicates the competitive advantage sits in alloy formulations and containment strategies; companies that pair material IP with equipment that enforces safe, repeatable deposition will gain early adoption in electronics cooling, printed conductors, and select industrial cooling systems. Regional supply and manufacturing footprints will matter: target partnerships in Asia-Pacific for volume manufacturing and in North America for high-value TIM and battery development. The most actionable path to commercial momentum is to combine validated material formulations, proven process hardware, and a narrowly defined initial vertical use case where liquid metal's unique properties create measurable performance or cost advantage.

We’re keen to partner with subject matter experts to enrich our coverage. Think you can help? Let us know.