Maritime Logistics Report

: Analysis on the Market, Trends, and TechnologiesThe maritime logistics sector is shifting from scale to signal: capital and strategy now reward companies that convert vessel and port operations into auditable, contract-grade data and low-carbon performance, with the internal maritime dataset reporting total funding of $42.44 billion directed into the topic area, signalling meaningful investor attention to platform and service plays. Market forecasts reinforce steady demand for services while differentiating segments expand—one forecast pegs the maritime logistics market at $24.43 billion in 2025 rising to $35.36 billion by 2032 (5.3% CAGR), which sits alongside broader freight valuations that exceed $370 billion and are expected to grow into the mid-hundreds of billions over the next decade Maritime Logistics Market – Global Forecast 2025-2032 Maritime Freight Transport Market Size, Share, Competitive Landscape and Trend Analysis Report, by Cargo Type, by Vessel Type, by Industry Type: Global Opportunity Analysis and Industry Forecast, 2024-2033. The practical consequence for operators and investors is clear: prioritize investments that deliver measurable ETA accuracy, fuel and emission accounting, and multimodal handoff reliability because these capabilities command contractual premium and reduce exposure to emerging regulation Maritime Industry Outlook 2025 – StartUs Insights.

We last updated this report 84 days ago. Tell us if you find something’s not quite right!

Topic Dominance Index of Maritime Logistics

To gauge the impact of Maritime Logistics, the Topic Dominance Index integrates time series data from three key sources: published articles, number of newly founded startups in the sector, and global search popularity.

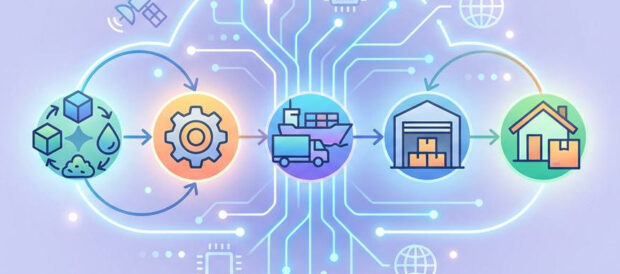

Key Activities and Applications

- Integrated multimodal scheduling and routing that coordinates sea, rail and road legs to reduce empty miles and improve throughput; patent filings and project pilots emphasise the software layer that selects optimal handoffs and routes.

- Time-critical ship spares and door-to-deck logistics for vessel uptime management; specialised forwarders operate consolidation hubs and rapid customs clearance services to meet repair windows and charter obligations.

- Predictive ETA and arrival management that fuses AIS, weather and port slot data to reduce idle time and fuel waste; vendors and startups deploy ML models to trade small speed changes for percent-level fuel improvements.

- Port-call orchestration and yard automation: coordinated crane, AGV and berth assignment to shorten turnaround and stabilize schedule reliability for carriers and terminal operators Marine Ports Service Market Research Report.

- Compliance-grade emissions monitoring and fuel-switching support to meet IMO and EU obligations, including onboard measurement, verified reporting and financing for green fuel retrofits Maritime Market Report and Forecast 2024-2032.

Emergent Trends and Core Insights

- Data-as-contract: market advantage flows to providers that supply verifiable, multi-party operational records (ETA, fuel burn, cargo condition) that can be used in contracts and financing.

- Decarbonisation drives differentiated service tiers: shippers and ports will pay for demonstrable emission reductions and shore-power readiness; financing mechanisms and green bonds are increasingly tied to measurable CO2 outcomes Global Maritime Logistics and Services Market Assessment.

- Multimodal corridor reshaping and nearshoring increase demand for regional transshipment hubs and feeder networks; APAC and selected European gateways remain vital growth areas while new corridors (India–Africa, China–LATAM) add complexity and opportunity Global Maritime Freight Transport Market Assessment.

- Productized intelligence (fleet analytics, predictive maintenance, verified emissions) becomes a commercial differentiator that commands recurring revenue and raises barriers to pure asset owners Maritime Research Inc.

- Automation where economics allow: port terminals increase automation for throughput and cost control while vessel autonomy advances in constrained, pilotable environments such as short-sea and feeder operations.

Technologies and Methodologies

- IoT telematics and smart containers for continuous cargo condition and location telemetry, improving claims management and enabling premium services.

- Machine learning ETA and route optimisation that integrates ocean currents, weather windows and port queues to reduce fuel consumption and schedule variance.

- Digital twins of terminal and network operations to simulate capacity changes, test vessel call patterns and quantify the impact of rerouting or infrastructure upgrades.

- Permissioned blockchain and smart contracts for bill of lading issuance and automated customs triggers to reduce admin time and increase trust between parties.

- Shore-side electrification, methanol and methanol-ready engines, and methanol bunkering pilots for feeders and short-sea vessels to reduce port and route CO2 intensity.

Maritime Logistics Funding

A total of 156 Maritime Logistics companies have received funding.

Overall, Maritime Logistics companies have raised $42.3B.

Companies within the Maritime Logistics domain have secured capital from 454 funding rounds.

The chart shows the funding trendline of Maritime Logistics companies over the last 5 years

Maritime Logistics Companies

- Marinetrans – Specializes in door-to-deck forwarding of ship spares with consolidation hubs that prioritise schedule adherence and customs agility for time-critical repairs. The firm leverages dedicated consolidation flows and local customs expertise to reduce vessel downtime for operators dependent on fast part replacement.

- Marine Digital – Provides energy efficiency analytics and fleet performance optimisation tools combining hydrodynamic models with ML to recommend speed and routing changes that reduce fuel use and emissions. Its product set (FOS, route planner, port call modules) targets charterers and operators who monetize verified fuel savings.

- SeaLogs – Offers a digital logbook and fleet management platform that converts mandatory records into structured, queryable datasets for maintenance, compliance and performance monitoring. SeaLogs positions the digital record as an operational asset that reduces paperwork friction and feeds analytics back into voyage planning.

- Shi.E.L.D. Services srl – Focuses on end-to-end project logistics and dry bulk shipping support for high-value construction and energy projects, combining onshore engineering logistics with offshore transfer planning. The company's strength is tailored project execution and local presence across critical regions for heavy-lift and non-standard cargoes.

- Marlo a.s – A consultancy and technology integrator that commercialises EU-funded transport research into operational tools for short-sea and door-to-door waterborne logistics; its expertise helps operators stitch rail and sea data into usable scheduling systems.

Enhance your understanding of market leadership and innovation patterns in your business domain.

2.1K Maritime Logistics Companies

Discover Maritime Logistics Companies, their Funding, Manpower, Revenues, Stages, and much more

Maritime Logistics Investors

TrendFeedr’s Investors tool offers comprehensive insights into 447 Maritime Logistics investors by examining funding patterns and investment trends. This enables you to strategize effectively and identify opportunities in the Maritime Logistics sector.

447 Maritime Logistics Investors

Discover Maritime Logistics Investors, Funding Rounds, Invested Amounts, and Funding Growth

Maritime Logistics News

TrendFeedr’s News feature provides access to 1.6K Maritime Logistics articles. This extensive database covers both historical and recent developments, enabling innovators and leaders to stay informed.

1.6K Maritime Logistics News Articles

Discover Latest Maritime Logistics Articles, News Magnitude, Publication Propagation, Yearly Growth, and Strongest Publications

Executive Summary

The strategic battleground in maritime logistics has moved from owning more tonnage to generating higher-fidelity operational intelligence and documented emission performance. Market forecasts and funding patterns show sizable demand for services that reduce schedule uncertainty, improve asset utilisation and deliver verifiable emissions improvements. Firms that combine multimodal orchestration, predictive ETA capability and contract-grade data services will capture premium revenue streams and easier access to capital. For incumbents, the path to defend margins runs through integrating or partnering with software and analytics providers; for investors, the most durable returns will come from companies that turn compliance and visibility into recurring services rather than one-off hardware sales.

We value collaboration with industry professionals to offer even better insights. Interested in contributing? Get in touch!