Medical Imaging Report

: Analysis on the Market, Trends, and TechnologiesThe medical imaging sector stands at a decisive market inflection where clinical demand, device upgrades, and software-enabled workflows converge; the internal medical imaging trend report estimates a 2025 market size of USD 47,660,000,000 with a 6.5% CAGR that guides our baseline projections and strategic conclusions. That internal baseline aligns with independent forecasts showing multi-billion dollar expansion driven by modality upgrades (CT/MRI), AI adoption, and a shift to outpatient and mobile imaging capacity.

We last updated this report 119 days ago. Tell us if you find something’s not quite right!

Topic Dominance Index of Medical Imaging

To gauge the impact of Medical Imaging, the Topic Dominance Index integrates time series data from three key sources: published articles, number of newly founded startups in the sector, and global search popularity.

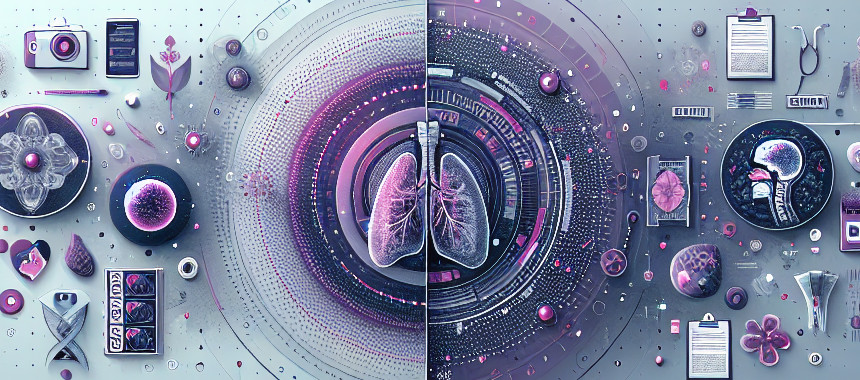

Key Activities and Applications

- Diagnostic outpatient imaging (MRI, CT, X-ray, ultrasound) — expansion of diagnostic imaging centers and ambulatory sites is increasing procedure volumes and shifting care away from hospital-only models.

- Image-guided interventions and interventional radiology — real-time fluoroscopy, C-arm and hybrid suites support minimally invasive procedures and interventional oncology workflows.

- Quantitative imaging and biomarker extraction — conversion of images into measurable biomarkers for oncology, neurology and cardiology to support precision medicine and trials Quibim.

- AI-assisted acquisition, reconstruction and interpretation — AI reduces scan time, denoises low-dose exams, automates segmentation and triages cases to specialists.

- Mobile, point-of-care and low-field MRI / portable CT — moving imaging closer to patients via mobile units and compact scanners to address access gaps in suburban and rural settings Mobile Imaging Solutions.

- Enterprise imaging, cloud PACS and federated sharing — centralizing image data for multi-site workflows, clinical trials and AI pipelines while confronting privacy and interoperability requirements AlliedMarketResearch (image management).

Emergent Trends and Core Insights

- AI as operational multiplier, not novelty — the data show AI moving from research to embedded clinical modules (reconstruction, triage, report automation) that directly shorten turnaround and improve throughput; vendors that demonstrate validated clinical performance capture procurement decisions Subtle Medical.

- Shift toward decentralization and capacity expansion — diagnostic centers and mobile units scale to satisfy rising procedure counts and outpatient preference, creating new channels for software and subscription services Data Bridge Market Research (regional data).

- Quantitative imaging and regulatory momentum — growth in qMRI, radiomics and standardized phantoms makes imaging outputs acceptable as trial endpoints and reimbursement drivers; standards/adoption accelerate when vendors deliver traceable QA tools RootsAnalysis.

- Modality convergence and hybrid systems — PET/CT, PET/MRI, spectral and photon-counting CT expand diagnostic yield for oncology and vascular imaging, driving capital upgrades in tertiary centers.

- Regional manufacturing and access plays — growing demand in Asia-Pacific has prompted OEM localization and mobile deployment strategies to shorten lead times and reduce total cost of ownership.

Technologies and Methodologies

- Deep learning reconstruction and AI denoising — reduces scan duration and radiation dose while increasing image fidelity; critical for low-dose CT and faster MRI protocols AlliedMarketResearch (image processing).

- Photon-counting and spectral CT — enables material decomposition, higher spatial resolution and lower dose for vascular and oncology imaging use cases MARS Bioimaging Ltd.

- Quantitative MRI (qMRI) and standardized phantoms — harmonize multicenter imaging for trials and biomarker validation; platforms that provide SI-traceable calibration reduce site variance.

- Hybrid and multi-modal integration (PET/MRI, PET/CT) — fused functional + anatomical data improves staging and treatment response assessment for oncology and neurology Hybrid Imaging report.

- Cloud-native PACS, federated data sharing and AI orchestration — enable scalable deployments of AI tools, remote reading, and central review for trials while requiring strict privacy controls (HIPAA/GDPR) Medicai.

- Low-field and portable MRI technology — expands access, reduces capital and site requirements for MRI in nontraditional settings FutureMarketInsights (open/mid-field MRI trends).

Medical Imaging Funding

A total of 5.9K Medical Imaging companies have received funding.

Overall, Medical Imaging companies have raised $165.5B.

Companies within the Medical Imaging domain have secured capital from 15.4K funding rounds.

The chart shows the funding trendline of Medical Imaging companies over the last 5 years

Medical Imaging Companies

- mediaire

mediaire builds MRI-focused AI tools that integrate into radiology workflows to accelerate reporting and provide objective MRI decision support; the company focuses on clinically validated modules for routine MRI use and reports Series C / later-stage VC traction with a team of ~82 employees. - Aikenist Technologies

Aikenist offers an AI radiology suite (QuickSuite) that targets scan acceleration, automated reporting and PACS/RIS integration; the company claims field deployments across hundreds of centers and a CPU-efficient QuickScan product that halves MRI exam time—positioning it for high-throughput outpatient centers in cost-sensitive markets. - Imaginostics

Imaginostics pursues a physics-driven vascular MRI approach (QUTE-CE) that delivers quantitative microvascular metrics with much higher sensitivity than traditional MRI, aimed at drug developers and clinicians needing vascular biomarkers; the company is early stage with targeted partnerships in trials. - CaliberMRI (qMRI)

CaliberMRI supplies traceable MRI phantoms and automated QC software (qCal-MR®) that standardize multicenter qMRI acquisitions and support validation of imaging biomarkers—making it a key enabler for pharma trials and radiomics programs that require cross-site consistency. - Nephosity

Nephosity offers collaborative imaging and anywhere-access viewers (including an FDA-cleared mobile CT viewer), focused on secure sharing, second opinion workflows and tumor-board collaboration; its product addresses the pressing interoperability and remote-reading needs of community providers and networks.

(Each company profile above is drawn from the company dataset entries cited inline.)

Enhance your understanding of market leadership and innovation patterns in your business domain.

56.5K Medical Imaging Companies

Discover Medical Imaging Companies, their Funding, Manpower, Revenues, Stages, and much more

Medical Imaging Investors

TrendFeedr’s Investors tool offers comprehensive insights into 10.9K Medical Imaging investors by examining funding patterns and investment trends. This enables you to strategize effectively and identify opportunities in the Medical Imaging sector.

10.9K Medical Imaging Investors

Discover Medical Imaging Investors, Funding Rounds, Invested Amounts, and Funding Growth

Medical Imaging News

TrendFeedr’s News feature provides access to 72.1K Medical Imaging articles. This extensive database covers both historical and recent developments, enabling innovators and leaders to stay informed.

72.1K Medical Imaging News Articles

Discover Latest Medical Imaging Articles, News Magnitude, Publication Propagation, Yearly Growth, and Strongest Publications

Executive Summary

The business case in medical imaging centers on three converging, investable vectors: measurable market expansion, software and AI unlocking productivity gains, and modality innovation that raises clinical value per scan. The internal market baseline (USD 47.66B in 2025 at 6.5% CAGR) anchors strategy—vendors and investors should prefer plays that (1) shorten time-to-report and support decentralized imaging delivery, (2) provide verifiable quantitative outputs that map to trials and reimbursement, and (3) lower total cost for outpatient and mobile deployments. Competitive advantage will favor firms that combine clinically validated AI, cross-site data standardization, and pragmatic device integration into existing hospital and imaging-center workflows.

We value collaboration with industry professionals to offer even better insights. Interested in contributing? Get in touch!