Medical Manufacturing Report

: Analysis on the Market, Trends, and TechnologiesThe medical manufacturing sector faces a strategic inflection where concentrated contract manufacturing growth meets intensified technological specialization; the internal trend data reports total sector revenue of approximately $31.6 billion and a workforce of about 160,000, signaling a sizable, skilled base even as headline CAGR shows slight contraction (-0.6%) in that dataset. Market forecasts for outsourced device production, additive fabrication, and implant manufacturing show materially higher growth trajectories, creating a two-speed industry in which scale players capture volume contracts while small, process-specialist firms capture high-margin complexity Medical Device Contract Manufacturing Market 2025: Detailed Insights into Market Size and Future Growth.

We last updated this report 93 days ago. Tell us if you find something’s not quite right!

Topic Dominance Index of Medical Manufacturing

To gauge the impact of Medical Manufacturing, the Topic Dominance Index integrates time series data from three key sources: published articles, number of newly founded startups in the sector, and global search popularity.

Key Activities and Applications

- Design-for-supply-chain and turnkey outsourcing: OEMs shift non-core production (molding, assembly, packaging, sterilization) to CMOs/CDMOs to shorten time-to-market and reduce capex exposure Medical Device Manufacturing Outsourcing Market, by Product Type … 2023-2032.

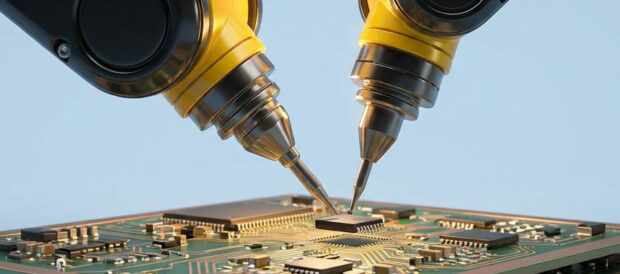

- High-precision micro-molding and micro-assembly for minimally invasive and wearable devices: micro molding and liquid silicone injection are central for micron-tolerance parts and single-use consumables Micro-Molding: Medical Manufacturing's Next Frontier?.

- Additive manufacturing for patient-specific implants and complex internal geometries: AM has moved from prototyping to regulated production routes for implants and instruments, including multi-material and drug-eluting constructs.

- Sterile assembly, validated packaging, and sterilization management: cleanroom assembly and packaging (ISO Class 7/8) and validated sterilization are routine deliverables for device CMOs handling Class II/III products Medical Device Contract Manufacturing Market Assessment.

- Precision metal machining and laser processing for load-bearing implants and nitinol devices: multi-axis CNC, laser welding, and finishing for orthopedic and cardiovascular parts remain core high-value services Norman Noble Medical Component Manufacturing Market Summary.

Emergent Trends and Core Insights

- Contract manufacturing growth outpaces many OEM segments, creating scale advantages for CMOs and raising acquisition interest from strategic industrial buyers Marketsize and CAGR projections for CMOs diverge by source: high-single to mid-teens CAGR projections in multiple forecasts.

- Additive manufacturing is the primary IP and technology battleground: patent filings concentrate in AM classes, multi-material deposition, and digital life-cycle management, implying future competition will center on validated digital workflows rather than single-machine performance.

- Miniaturization and microfabrication: demand for micron-tolerance components (micro-injection, Laser LIGA, precision extrusion) is rising with wearables, minimally invasive devices, and IVDs driving volume.

- Supply-chain geography rebalancing: reshoring and nearshoring (North America & Europe) coexist with expanding APAC manufacturing hubs; CMOs that can offer validated domestic capacity command premium assignments for high-risk product lines China and APAC growth profiles.

- Regulatory and quality as a competitive moat: ISO 13485, FDA QMS, and demonstrated cleanroom scale become gating assets; this shifts capital deployment from simple tooling to validated systems and digital traceability Regulatory & quality pressures in market reports.

Technologies and Methodologies

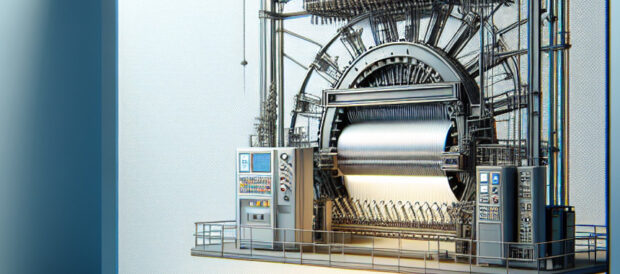

- Injection molding and scientific injection molding for high-volume polymer parts, LSR and multi-shot processes for single-use and drug-delivery device components PMC SMART Solutions.

- Additive manufacturing (SLA, SLS, SLM) plus post-processing workflows for implants and patient-matched components; emphasis on process qualification and life-cycle digital records AM market growth & application focus.

- Microfabrication techniques (micro-injection, Laser LIGA, micro-EDM, precision extrusion) for sub-millimeter parts used in catheters, microneedles, and sensors.

- Advanced machining and laser processing for metal implants (nitinol, titanium), including electropolish and metallurgical testing to meet implant tolerances.

- Digital thread / MES / validated traceability: full lot genealogy, electronic DMR/DHR, and integrated MES/quality systems enable regulatory evidence packages and reduce validation cycles virtual factory and MES adoption recommendations.

Medical Manufacturing Funding

A total of 221 Medical Manufacturing companies have received funding.

Overall, Medical Manufacturing companies have raised $12.0B.

Companies within the Medical Manufacturing domain have secured capital from 620 funding rounds.

The chart shows the funding trendline of Medical Manufacturing companies over the last 5 years

Medical Manufacturing Companies

MTD Micro Molding

MTD focuses exclusively on medical micro-molding and bioabsorbable materials, providing micro-scale molding, overmolding, and drug-delivery molding expertise that generalist molders do not offer. Their ISO 13485 and Class 8 cleanroom positioning support regulated product runs for minimally invasive and delivery systems, making them a direct fit for micro-catheter components and wearable connectors.MicroBase Technology Corporation

MicroBase holds Laser LIGA microfabrication capabilities in APAC, enabling high-precision, high-volume micromachined parts (nozzles, microneedles, nebulizer components) that replace silicon processing in some applications. Their FDA/CE class approvals and public financials position them as a scalable microfabrication partner for device innovators targeting miniaturized fluidics and inhalation devices.Device Science, Inc.

Device Science targets remanufacturing and professional refurbishment for surgical devices, proposing cost and waste reduction in hospital supply chains. Their model addresses medical waste and procurement pressure, offering validated remanufactured products as an ESG and cost containment play for health systems.Medterials, Inc

Medterials blends materials science and small-scale GMP production to produce drug-encapsulated microspheres, nanoparticles, and drug-eluting implants—services that traditional hardware CMOs typically do not provide. This hybrid drug-device capability positions them as an upstream partner for combination products and early-stage biopharma device concepts.MAJiK Medical Solutions Pvt. Ltd.

MAJiK provides specialized reinforced tubing, braiding, hydrophilic coating, and catheter assembly at scale from India, combining cost advantage with cleanroom validated production and in-house R&D labs—making them an attractive supply-base for complex catheter and introducer sheathing programs.

Enhance your understanding of market leadership and innovation patterns in your business domain.

2.6K Medical Manufacturing Companies

Discover Medical Manufacturing Companies, their Funding, Manpower, Revenues, Stages, and much more

Medical Manufacturing Investors

TrendFeedr’s Investors tool offers comprehensive insights into 572 Medical Manufacturing investors by examining funding patterns and investment trends. This enables you to strategize effectively and identify opportunities in the Medical Manufacturing sector.

572 Medical Manufacturing Investors

Discover Medical Manufacturing Investors, Funding Rounds, Invested Amounts, and Funding Growth

Medical Manufacturing News

TrendFeedr’s News feature provides access to 3.9K Medical Manufacturing articles. This extensive database covers both historical and recent developments, enabling innovators and leaders to stay informed.

3.9K Medical Manufacturing News Articles

Discover Latest Medical Manufacturing Articles, News Magnitude, Publication Propagation, Yearly Growth, and Strongest Publications

Executive Summary

Medical manufacturing now resolves into two durable strategic roads: scale and integration for CMOs that can absorb regulatory cost and supply risk, and narrow process mastery for small specialists who supply irreplaceable, high-value capabilities. Near-term commercial winners will be those that demonstrate audited digital traceability, validated cleanroom scale, and either deep materials/process expertise (micro-molding, Laser LIGA, nitinol processing) or the ability to deliver domestic capacity to risk-sensitive OEMs. Investors and corporate strategists should treat process competence and regulatory evidence as primary assets, and prioritize partnerships or acquisitions that close either a capability gap (for scale players) or a channel gap (for specialists) rather than chasing generalist volume alone.

We value collaboration with industry professionals to offer even better insights. Interested in contributing? Get in touch!