Military Robot Report

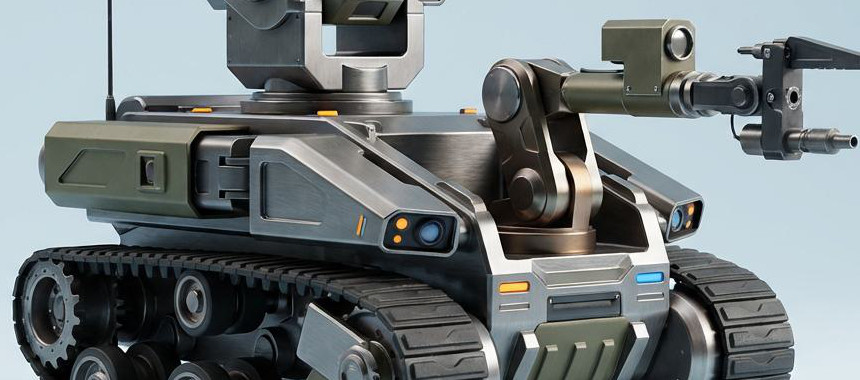

: Analysis on the Market, Trends, and TechnologiesThe military-robot market is expanding rapidly, with market data showing a market size of $21,660,000,000 (2024) and a projected CAGR of 8.5%, indicating sustained procurement and technology adoption over the next five years. Investment and procurement trends concentrate spend on land UGVs for ISR, EOD, and logistics while defense forces accelerate integration of AI-enabled autonomy and composable software stacks to field coordinated multi-robot formations.

We last updated this report yesterday. Tell us if you find something’s not quite right!

Topic Dominance Index of Military Robot

To gauge the impact of Military Robot, the Topic Dominance Index integrates time series data from three key sources: published articles, number of newly founded startups in the sector, and global search popularity.

Key Activities and Applications

- Explosive Ordnance Disposal (EOD) and Counter-IED operations: Remote manipulators, roll-on rollers, and specialized EOD platforms remain core mission sets because they directly reduce personnel risk; these capabilities appear repeatedly across operational briefs and product portfolios.

- Intelligence, Surveillance, Reconnaissance (ISR): Ground and airborne robotics carrying multi-sensor payloads (EO/IR, LiDAR, radar) provide persistent situational awareness for forward units and border security missions.

- Autonomous logistics and expeditionary resupply: Robotic cargo carriers and micro-autonomy for persistent logistics reduce convoy exposure and enable distributed sustainment near contested forward sites.

- Tactical reconnaissance in confined and GPS-denied environments: Throwable micro-robots and small legged/quadruped scouts perform short-range entry and inspection tasks in urban and subterranean environments.

- Training, simulation, and threat emulation: Deployable robotic targetry and autonomous adversary simulators increase realism in force-on-force exercises and accelerate readiness metrics.

Emergent Trends and Core Insights

- AI-first autonomy is shifting value away from purely mechanical performance toward software-defined mission capability. Large vision-language-action models and on-board mission agents are becoming strategic differentiators for converting platforms into mission-adaptive assets databridgemarketresearch – Global Military Robots Market.

- Attritable swarm architectures are reshaping procurement economics. Low-cost, COTS-driven swarms enable massed effect with acceptable attrition, changing lifecycle cost assumptions and operational doctrine for area denial and reconnaissance tasks.

- Mobility specialization addresses contested, non-permissive terrain. Legged and hybrid-drive systems extend reach into rubble, stairwells, and heavily obstructed urban zones where wheeled/tracked UGVs struggle.

- Standards for secure interoperability and HPI (heterogeneous platform interoperability) are emerging as the critical integration layer. Forces prize middleware and secure mesh communications that let heterogeneous fleets coordinate across air, land, and maritime domains ARX Robotics.

- Geopolitical sourcing and dual-use sovereignty affect buyer preference. NATO and European buyers increasingly favor indigenous or NATO-aligned suppliers to mitigate supply-chain and export-control risks SI Robotics.

Technologies and Methodologies

- Sensor Fusion and Perception Stacks: Integration of LiDAR, EO/IR, radar, and GNSS-resistant inertial systems for high-fidelity situational awareness in GPS-denied and EW-contested environments.

- On-Board Edge AI and Foundation Models: Vision-language-action models and optimized edge inference accelerate mission-level autonomy and enable natural-language or intent-driven tasking for uncrewed platforms scoutco.ai.

- Low-Latency, Secure Mesh Communications: LPI links, resilient mesh routing, and radio spectrum hardening are core requirements to sustain coordinated multi-robot operations under EW pressure US Army to Stage Largest Robot Tank Experiment.

- Modular Hardware & Payload Standardization: Plug-and-play payload bays and standardized mechanical/electrical interfaces shorten integration timelines for ISR, EOD, or logistics roles.

- Digital Twin and Sim-to-Real Pipelines: High-fidelity simulation and digital twins for mission rehearsal and RL training compress development cycles and improve field reliability before deployment ROBOTICAN.

- Specialized Locomotion Methods: Patented stair-climb mechanics, wheeled-legged hybrids, and quadrupedal control strategies improve resilience in cluttered environments.

Military Robot Funding

A total of 403 Military Robot companies have received funding.

Overall, Military Robot companies have raised $29.9B.

Companies within the Military Robot domain have secured capital from 1.6K funding rounds.

The chart shows the funding trendline of Military Robot companies over the last 5 years

Military Robot Companies

- Transcend Robotics — Transcend commercializes a patented mobility solution that reliably ascends and descends stairs and complex obstacles, reducing dependence on high-cost sensing suites for certain missions. Their design emphasis on mechanical simplicity yields high first-attempt success rates in tactical access tasks, making the platform attractive for urban ISR and entry operations.

- Swarmbotics AI — Swarmbotics builds low-cost, attritable ground swarms optimized for tactical missions where mass and redundancy matter more than single-platform survivability. Their stack focuses on global planning, decentralized coordination, and low-BOM hardware to enable scalable swarm deployments in contested areas.

- Bhairav Robotics — A small quadruped UGV developer creating compact robot-dog platforms targeted at ISR and patrol tasks for low-cost defense customers and first responders. Their tight team and low employee count support rapid iteration on form factor and payload modularity for constrained budgets.

- Maren-go Solutions Corporation — An SDVOSB that focuses on expeditionary autonomy and micro-controller architectures for persistent logistics and small autonomous bases; their work centers on airfield operations and persistent autonomy in austere conditions, with solutions designed for straightforward integration into existing logistics chains.

- RAIDER Targetry — Developer of deployable, scalable robotic target systems used to raise training realism and test force effectiveness; RAIDER’s robotic targetry shortens training cycles and produces repeatable threat emulation at scale for live-fire and simulation events.

Enhance your understanding of market leadership and innovation patterns in your business domain.

1.8K Military Robot Companies

Discover Military Robot Companies, their Funding, Manpower, Revenues, Stages, and much more

Military Robot Investors

TrendFeedr’s Investors tool offers comprehensive insights into 1.8K Military Robot investors by examining funding patterns and investment trends. This enables you to strategize effectively and identify opportunities in the Military Robot sector.

1.8K Military Robot Investors

Discover Military Robot Investors, Funding Rounds, Invested Amounts, and Funding Growth

Military Robot News

TrendFeedr’s News feature provides access to 4.4K Military Robot articles. This extensive database covers both historical and recent developments, enabling innovators and leaders to stay informed.

4.4K Military Robot News Articles

Discover Latest Military Robot Articles, News Magnitude, Publication Propagation, Yearly Growth, and Strongest Publications

Executive Summary

The military-robot sector is entering a phase where software-defined capability and systems integration determine strategic advantage. Procurement is shifting toward architectures that accept platform attrition in exchange for massed effect, favor modular payload ecosystems, and require secure, low-latency interoperability across heterogeneous fleets. For defense buyers and investors the priority set compresses to three imperatives: fund and adopt mature autonomy stacks that enable one-to-many control; require open interoperability standards so mixed fleets can be combined without vendor lock-in; and prioritize mobility solutions tailored to the operational environment rather than selecting a single universal chassis. Executing against these priorities will separate firms that merely build platforms from those that deliver field-ready, mission-adaptive robotic capability.

We value collaboration with industry professionals to offer even better insights. Interested in contributing? Get in touch!