Optics Report

: Analysis on the Market, Trends, and TechnologiesThe optics sector shows accelerating commercial momentum: the internal optics trend data estimates a 2025 market size of $9.47 billion and an adaptive-optics CAGR of 35.2%, signaling concentrated investment into high-value optical platforms. This market expansion sits alongside larger consumer channels — for example, a U.S. quarterly optical market estimate of $17.4 billion (Q2 2025) — highlighting parallel growth in retail and device-grade optics demand New Research Spotlighting Optical Market Trends for Second Quarter of 2025. The business implications are clear: companies that combine precise optical hardware, software-driven performance (AI/ML), and manufacturable materials stacks (polymers, meta-optics, silicon photonics) capture value across medical imaging, AR/VR, machine vision, and telecom interconnects.

The last time we updated this report was 101 days ago. If there’s something missing or off, your tips are welcome!

Topic Dominance Index of Optics

The Dominance Index for Optics merges timelines of published articles, newly founded companies, and global search data to provide a comprehensive perspective into the topic.

Key Activities and Applications

- Vision correction and spectacle/contact lens manufacturing — high volume, stable revenue streams; demand driven by aging populations and rising myopia prevalence Spectacle Lens - Market Share Analysis, Industry Trends & Statistics, Growth Forecast (2025 - 2030).

So what: margins compress in mass eyewear, so differentiation shifts to prescription personalization, coatings, and add-on health services. - Ophthalmic diagnostics and imaging (OCT, handheld retinal imaging) — clinical screening, surgical guidance, and population screening use cases drive premium device sales and recurring services.

So what: diagnostic optics represent a high-margin, regulation-backed segment where performance and reimbursement matter. - AR/VR and near-eye optics (waveguides, optical engines, prescription AR lenses) — small, high-precision assemblies paired with microdisplays enable consumer and enterprise wearables Wave Optics.

So what: product success requires simultaneous mastery of waveguide design, projector optics, and prescription integration. - Machine vision and industrial inspection — telecentric lenses, 3D sensors, and illumination systems for automation, quality control, and robotics OPT Machine Vision.

So what: industrial buyers value repeatable metrology and low-defect manufacturing; optics suppliers with metrology/test solutions win scale contracts. - Fiber optic components, co-packaged optics and data-center interconnects — silicon photonics, PIC packaging, and co-packaged optics reduce energy and improve throughput for hyperscale networks.

So what: telecom/data center demand creates a growth corridor for integrated photonics and high-precision packaging firms. - LiDAR, sensing and free-form optics for autonomy and robotics — beam steering, metasurfaces and lightweight lenses for range and form-factor improvement.

So what: suppliers that shrink size, weight and cost of LiDAR optics unlock broader adoption in mobility and industrial robotics.

Emergent Trends and Core Insights

- Smart eyewear and prescription AR integration are moving toward commercial scale. Forecasts place smart eyewear revenue in the multi-billion range over the coming decade, creating cross-industry partnerships between display, optics, and eyewear supply chains 4 Key Optical Industry Trends Shaping 2025 for Global Buyers.

So what: incumbents in prescription optics can capture higher lifetime value by embedding AR capability into prescription workflows. - AI and computational optics shift value from passive lenses to data-enabled optical systems (AI for image reconstruction, wavefront optimization).

So what: firms that integrate software with optics increase product stickiness and open SaaS/service revenue lines. - Meta-optics and nanoimprint manufacturing are crossing into production (thinner lenses, flat optics, metasurfaces). This enables ultra-thin prescription lenses and compact near-eye designs imagia.io / Optica resources.

So what: mass manufacturability (nanoimprint) will determine which meta-optic concepts become commercial. - Co-packaged optics and open-optics architectures gain traction in carriers and data centers; CPO revenue and open-optics adoption are forecast to grow materially over the next 1–2 years 2025 Trends to Watch: Optical Networks.

So what: optical component makers must address thermal, packaging and integration challenges to participate in hyperscale deployments. - Sustainability and polymer optics adoption — polymer and bio-derived materials appear in an expanding share of product launches and lower device weight for consumer products.

So what: supply-chain and materials strategy become competitive levers for consumer optics brands and labs.

Technologies and Methodologies

- Optical Coherence Tomography (OCT) and OCTA variants — foundational for retinal diagnostics, increasing adoption of handheld and multi-modal instruments.

So what: OCT remains a primary route to clinical adoption and recurring consumable/service revenue. - Adaptive optics (wavefront sensing, deformable mirrors) — moving from astronomy into ophthalmology, microscopy and laser communications.

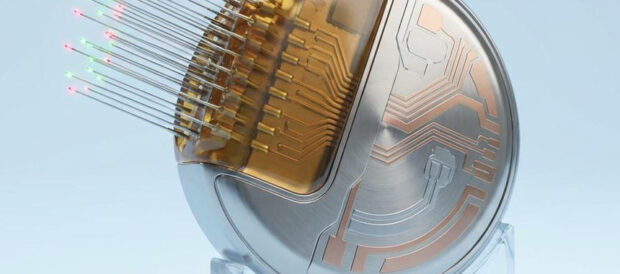

So what: adaptive modules provide performance tiers that support premium clinical and research instruments. - Silicon photonics and photonic integrated circuits (PICs) — enable dense, low-power interconnects and on-chip optical processing for telecom and AI interconnect needs.

So what: integration partners and packaging expertise become differentiators. - Meta-optics / metasurfaces and nanoimprint lithography — thin, engineered optical surfaces for beam steering and flat lenses.

So what: transition from lab proofs to volume hinges on imprint throughput and coating compatibility. - Freeform optics and diamond turning — enable high-performance, compact imaging designs used in AR/near-eye and automotive HUDs.

So what: suppliers with freeform machining plus measurement systems capture design-to-volume services. - AI-driven optical design and computational imaging — differentiates lens/system tradeoffs and shortens design cycles (raytracing + ML optimization) 3DOptix, LTI Photopia references.

So what: design software becomes a force multiplier for small teams to deliver complex optics rapidly.

Optics Funding

A total of 7.8K Optics companies have received funding.

Overall, Optics companies have raised $407.3B.

Companies within the Optics domain have secured capital from 22.2K funding rounds.

The chart shows the funding trendline of Optics companies over the last 5 years

Optics Companies

ABH Optics ApS — ABH commercializes meta-optic prescription lenses derived from Danish academic IP; the company targets ultra-thin, high-prescription lenses (claims of up to 90% thinner lenses) and recently closed seed funding to scale manufacturing. ABH's approach directly addresses the mass eyewear pain point of thickness and weight, and 1 mm-class lens profiles can change uptake for high-prescription segments. Their IP focus on meta-optics makes them a candidate supplier for premium eyewear and AR prescription integration.

Tunoptix, Inc. — a micro-startup commercializing meta-optics plus reconstruction software to replace bulky imaging stacks with thin meta-optic modules and computational backends; positioned for machine vision and low-cost camera modules. Their product reduces mechanical tolerances and enables compact imaging with fewer elements, making them suitable for robotics and consumer camera suppliers that prioritize integration and cost.

Occuity — UK medical-optics company developing handheld, non-contact eye measurement devices (pachymetry, axial length, other anterior-segment metrics) intended for clinic and community screening; Occuity holds granted patents and raised a Series B to advance product commercialization. Their devices target both optometry workflows and disease-screening use cases (diabetes, glaucoma), aiming to move diagnostics out of specialist clinics into broader care settings.

Millpond Optics — small precision house specializing in diamond-turned metallic mirrors, tooling for injection molding polymer optics, and freeform mirrors used in HUD/AR and LIDAR testbeds. Their capability to produce atypical freeform geometries addresses prototyping and low-volume runs for AR integrators and LiDAR developers that need unusual optical geometries.

AddOptics — focuses on scalable manufacturing of prescription AR lenses and integrated ARx smartlens solutions, combining ophthalmic lens manufacture with AR projection modules to enable everyday prescription AR wearables. Their value proposition is inserting prescription functionality into AR platforms without sacrificing optical correction — a crucial need for mass-market smartglasses.

Delve into the corporate landscape of Optics with TrendFeedr’s Companies tool

103.8K Optics Companies

Discover Optics Companies, their Funding, Manpower, Revenues, Stages, and much more

Optics Investors

TrendFeedr’s Investors tool provides insights into 16.9K Optics investors for you to keep ahead of the curve. This resource is critical for analyzing investment activities, funding trends, and market potential within the Optics industry.

16.9K Optics Investors

Discover Optics Investors, Funding Rounds, Invested Amounts, and Funding Growth

Optics News

TrendFeedr’s News feature offers you access to 134.2K articles on Optics. Stay informed about the latest trends, technologies, and market shifts to enhance your strategic planning and decision-making.

134.2K Optics News Articles

Discover Latest Optics Articles, News Magnitude, Publication Propagation, Yearly Growth, and Strongest Publications

Executive Summary

Market growth concentrates at the intersection of precision optics, software, and manufacturable materials. The highest near-term returns flow to firms that convert laboratory breakthroughs (meta-optics, adaptive modules, PIC-integrated transceivers) into manufacturable assemblies and pair them with data-driven services. For incumbents, the path to sustained value is to embed software and measurement into optics offerings; for specialists, the path is deep technical differentiation in freeform, coating, or microfabrication capabilities that become hard to replicate at scale. Operationally, prioritize supply-chain resilience for specialty materials and investments in metrology and packaging expertise; strategically, target use cases where optics create defensible product performance (medical diagnostics, AR prescription integration, and telecom interconnects).

Are you an insider in the trends or tech industry? We’d love for you to contribute to our content.