Packaging Report

: Analysis on the Market, Trends, and TechnologiesThe packaging sector is reconfiguring around efficiency, material science, and data integration: e-commerce packaging is projected to account for over 60% of all shipping box volume by 2028, concentrating demand toward right-sizing, protective solutions, and traceable formats. Recent market forecasts place global packaging expansion in line with mid-single digit CAGRs, while food and protective formats show the strongest near-term dollar growth, directing capital to active preservation, flexible formats, and digital print capabilities Food Packaging Industry Outlook, Growth Drivers, Sustainable … – Yahoo Finance

The last time we updated this report was 73 days ago. If there’s something missing or off, your tips are welcome!

Topic Dominance Index of Packaging

The Dominance Index for Packaging merges timelines of published articles, newly founded companies, and global search data to provide a comprehensive perspective into the topic.

Key Activities and Applications

- On-demand right-sizing: generating custom box and cushioning templates in real time to reduce void fill, DIM penalties, and transit emissions; patent filings emphasize dimensional scanning feeding production to cut shipping costs.

- Active preservation for perishables: modified-atmosphere and agent-release systems extend shelf life for fresh produce and delicate foods, converting packaging into a functional, revenue-protecting asset.

- Protective, lightweight cushioning: molded pulp, recycled thermoformed cushions, and air-column systems replace EPS and loose fill to lower weight, waste, and return rates while keeping damage low for e-commerce parcels.

- Smart traceability & consumer engagement: QR/NFC/rfid labels and serialized blister formats support supply-chain visibility, anti-counterfeiting, and post-purchase services (returns/resale) for regulated and premium goods.

- Contract packaging and co-packing for regulated products: specialized secondary packaging (pharma, supplements, food) where compliance and artwork control are required, driving outsourcing to certified co-packers.

Emergent Trends and Core Insights

- Sustainability aligned with logistics savings: companies that treat material substitution as a logistics optimization — reducing weight/volume or enabling paper recycling streams — capture margin improvements rather than only marketing premiums.

- Digital print and versioning at scale: short runs, personalization, and faster SKU rollouts expand shelf agility and reduce inventory risk; digital presses are moving from niche to baseline in design-to-shelf workflows.

- Shelf-life economics drive active packaging investment: where extended freshness increases sell-through, brands accept higher per-unit pack cost for lower waste and fewer markdowns, favoring MAP and agent-release systems.

- Automation + software integration: MES and scan-to-manufacture linkages shorten lead times, enabling near-zero inventory and just-in-time custom packaging for e-commerce fulfillment centers.

- Regulatory/retailer pressure drives material clarity: EPR rules, single-use plastic bans, and retailer shelf requirements force rapid adoption of mono-material formats and verified PCR content Industry Insights: Top Trends in Packaging 2025.

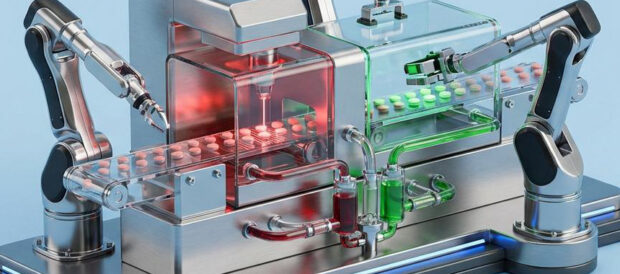

Technologies and Methodologies

- Forming + structural optimization: advanced blank-folding, engineered corrugated structures, and multi-panel designs deliver protection with less material by using geometry rather than thicker substrates.

- Modified atmosphere packaging (MAP) and active agents: tray-and-film systems plus micro-chamber agent release mechanisms that preserve freshness without cold chain extension for certain SKUs.

- Digital and hybrid printing: HP Indigo and UV flexo hybrid lines permit high-quality color, white ink, and variable data for personalization and rapid SKU changes.

- On-demand protective automation: right-sizing machines and inflatable cushion platforms that create made-to-fit protective elements at pack-out to cut material and dimensional weight costs.

- Data-driven packaging engineering: end-to-end simulation, ISTA transit testing, and order-history optimization to pick materials and sizes that minimize total landed cost rather than unit cost alone Packaging Design Corporation.

Key takeaway: technological winners combine structural engineering with software control to deliver lower total system cost and measurable ESG outcomes.

Packaging Funding

A total of 20.0K Packaging companies have received funding.

Overall, Packaging companies have raised $760.8B.

Companies within the Packaging domain have secured capital from 51.2K funding rounds.

The chart shows the funding trendline of Packaging companies over the last 5 years

Packaging Companies

- HALOPACK — HALOPACK develops carton-tray systems that apply modified-atmosphere concepts using ~90% cardboard and <10% plastic inserts to preserve freshness while enabling recyclability; this targets retailers seeking fewer plastic claims without sacrificing shelf life. HALOPACK positions its system as a chain-level value add by reducing plastic use and supporting gassing options for produce

- ZOEPAC — ZOEPAC commercializes modified-atmosphere and active packaging for post-harvest fresh produce, combining field-cooling recommendations with MA retail and bulk packs to cut spoilage and value loss; the firm emphasizes fast deployment for growers and distributors in higher-waste supply chains

- Packmage — Packmage supplies structural packaging design software used by engineers to produce 3D tube, tray, and lid templates and supports rapid prototype handoffs to production; the platform shortens structural iteration cycles for custom box programs and supports digital to die-cut workflows

- QuantiPack — QuantiPack offers data-first packaging sourcing and consulting; its analytics model blends order history, dimensional weight impacts, and material cost to recommend packaging strategies that reduce total landed cost and carbon intensity for regulated and high-SKU brands

Delve into the corporate landscape of Packaging with TrendFeedr’s Companies tool

391.3K Packaging Companies

Discover Packaging Companies, their Funding, Manpower, Revenues, Stages, and much more

Packaging Investors

TrendFeedr’s Investors tool provides insights into 35.7K Packaging investors for you to keep ahead of the curve. This resource is critical for analyzing investment activities, funding trends, and market potential within the Packaging industry.

35.7K Packaging Investors

Discover Packaging Investors, Funding Rounds, Invested Amounts, and Funding Growth

Packaging News

TrendFeedr’s News feature offers you access to 156.5K articles on Packaging. Stay informed about the latest trends, technologies, and market shifts to enhance your strategic planning and decision-making.

156.5K Packaging News Articles

Discover Latest Packaging Articles, News Magnitude, Publication Propagation, Yearly Growth, and Strongest Publications

Executive Summary

Packaging is shifting from commodity production to engineered service: the commercial frontier rewards firms that reduce total system cost through right-sizing, extend product value via active preservation, and provide verifiable material credentials that meet regulator and retailer demands. Brands will extract margin by paying for measured outcomes—fewer returns, longer shelf life, and lower DIM charges—so packaging suppliers must combine structural innovation, digital printing, and data analytics to remain relevant. Investment priorities that produce the clearest ROI are: integrating scan-to-manufacture workflows, deploying MAP/active solutions where shelf life drives sales, and converting protective formats to recyclable or reusable substrates to survive escalating EPR and retailer requirements.

Are you an insider in the trends or tech industry? We’d love for you to contribute to our content.