Pcb Manufacturing Report

: Analysis on the Market, Trends, and TechnologiesThe printed circuit board industry is at a strategic inflection driven by higher-performance connectivity, compute, and electrification demands: global PCB revenue is projected to reach US$104.58 billion by 2030 at a 5.24% CAGR, while equipment spending for fabrication and assembly is forecast to approach US$7.9 billion by 2030, pressuring suppliers to invest in precision tooling and advanced substrates to capture premium margins Printed Circuit Board Industry Size & Trends Report 2030. Market data from the internal PCB trend dossier shows concentrated capital activity with $6.63B in total funding across the sector, highlighting that targeted, technology-focused investments rather than broad expansion will determine winners.

The last time we updated this report was 27 days ago. If there’s something missing or off, your tips are welcome!

Topic Dominance Index of Pcb Manufacturing

The Dominance Index for Pcb Manufacturing merges timelines of published articles, newly founded companies, and global search data to provide a comprehensive perspective into the topic.

Key Activities and Applications

- High-Density Interconnect (HDI) fabrication for server, telecom, and handheld compute modules; manufacturers are increasing micro-via and multilayer capacities to meet higher routing density and signal integrity requirements.

- Rigid-flex and flexible PCB production for compact medical, wearable, and aerospace assemblies where conformability and reliable multilayer interconnects are required.

- High-frequency and RF board manufacturing (Rogers/LCP/Teflon substrates) to support 5G base stations, mmWave modules, and antenna arrays that demand low-loss laminates and controlled impedance Printed Circuit Board Market Size, Share | Industry Report 2032.

- Automotive power and EV PCBs (heavy copper, thermal management, BMS boards) engineered for higher current density and stricter reliability testing to satisfy automotive OEM standards

- Turnkey EMS and box-build services combining PCB fabrication, assembly, component sourcing, and final test to reduce OEM supplier count and accelerate time-to-market for complex products.

- Quick-turn prototyping and low-volume production using rapid fabrication lines and online ordering platforms to support iterative hardware development cycles.

Emergent Trends and Core Insights

- Supply chain bifurcation: Asia retains scale and cost leadership while North American and European players emphasize nearshoring, certification, and security for defense and regulated markets, creating segmented pricing power

- Digitized quote-to-factory flows: Platformized ordering, instant DFM checks, and AI quotations shorten lead times and lower friction for small runs; intelligent one-click quoting is already deployed in commercial factories kingford PCB & Assembly.

- Material specialization drives margin: IC substrate, ABF/FCBGA, and high-frequency laminates command premium ASPs and form the most defensible product niches versus commodity FR-4 boards.

- AI and closed-loop quality control: Adoption of ML models for AOI/SPI/X-ray analysis and production orchestration reduces false positives, improves yield, and shortens NPI cycles PCB Assembly Trends OEMs Need to Know in 2026.

- Regulatory and environmental pressure: E-waste rules and OEM ESG procurement requirements push investment into recyclable substrates and lead-free, lower-energy processes as differentiators for sellers targeting European and North American customers

- Additive and hybrid manufacturing experiments: 3D-printed conductive traces and high-performance polymer printing are moving from prototyping toward niche production for complex geometries and thermally constrained applications

Technologies and Methodologies

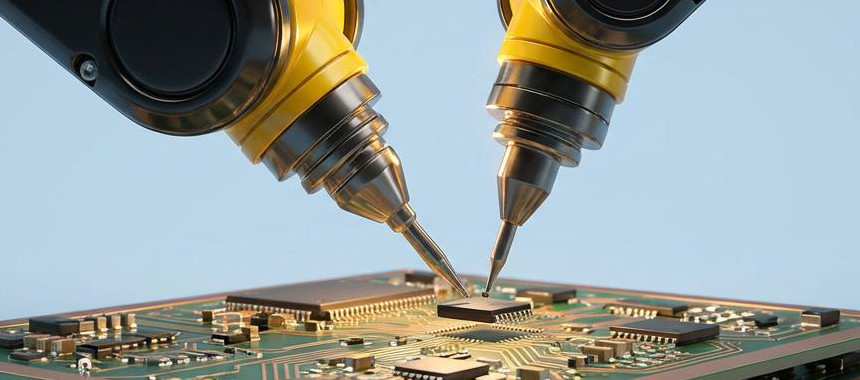

- Laser direct imaging (LDI) and advanced photolithography to enable sub-10 µm feature definition for HDI and microvia stacks.

- Automated inline inspection (AOI, SPI, X-ray) with ML classification to reduce manual rework and improve first-pass yields in high-mix environments.

- Industry 4.0 production management and digital twins for real-time throughput optimization and predictive maintenance that compress time-to-volume for new product introductions.

- Heavy copper and metal-core PCB processes for thermal management in power electronics and EV inverters, requiring specialized plating and thermal vias.

- Dry/laser or plasma patterning to reduce chemical waste and improve resolution for next-generation flexible and high-frequency boards.

- Integrated design-for-manufacturability (DFM) toolchains and automated BOM reconciliation to cut NPI cycles and reduce component shortages during assembly.

Pcb Manufacturing Funding

A total of 303 Pcb Manufacturing companies have received funding.

Overall, Pcb Manufacturing companies have raised $6.6B.

Companies within the Pcb Manufacturing domain have secured capital from 528 funding rounds.

The chart shows the funding trendline of Pcb Manufacturing companies over the last 5 years

Pcb Manufacturing Companies

- CircuitHub — CircuitHub builds an automated, software-first contract manufacturing platform that converts EDA files into rapid turnkey quotes and allocates North American factory capacity for short runs and prototyping; their model targets fast-iterating robotics, satellite, and autonomous systems teams that require predictable turn and traceability. The company emphasizes automated routing of orders to partner factories and claims to cut prototype lead time through an integrated tech stack

- HOREXS — HOREXS specializes in IC package substrates and BGA/FCBGA build-up films, positioning the firm at the interface between PCB fabrication and semiconductor packaging where higher margins and technical barriers protect incumbents; their roadmap toward ABF and coreless substrates targets server and processor markets that require dense interconnects and tight process control

- PCBasic — PCBasic operates an intelligent, small-batch factory optimized for multi-variety production with integrated CRM/MES/ERP stacks and in-house AOI/SPI systems, enabling one-stop rapid PCBA deliveries for OEMs who need certified supply chains and fast NPI cycles; their vertical focus includes automotive and medical electronics where traceability and certifications matter

- Bond3D — Bond3D develops additive manufacturing processes for high-performance polymers (e.g. PAEK/PEEK) that produce functional parts retaining flight- or medical-grade material properties; while not a conventional PCB house, their capability to 3D-print electrically functional, high-temp parts creates complementary pathways for modular electronics and custom form-factor interconnects in specialty markets

- OverflyPacific Corporation — OverflyPacific focuses on cost-efficient turnkey manufacturing combining PCB fabrication, assembly, wire harness, and parts production for customers seeking a single vendor for product build-outs; their model targets mid-market OEMs that trade off premium speed for consolidated procurement and simplified logistics

Delve into the corporate landscape of Pcb Manufacturing with TrendFeedr’s Companies tool

5.0K Pcb Manufacturing Companies

Discover Pcb Manufacturing Companies, their Funding, Manpower, Revenues, Stages, and much more

Pcb Manufacturing Investors

TrendFeedr’s Investors tool provides insights into 508 Pcb Manufacturing investors for you to keep ahead of the curve. This resource is critical for analyzing investment activities, funding trends, and market potential within the Pcb Manufacturing industry.

508 Pcb Manufacturing Investors

Discover Pcb Manufacturing Investors, Funding Rounds, Invested Amounts, and Funding Growth

Pcb Manufacturing News

TrendFeedr’s News feature offers you access to 1.5K articles on Pcb Manufacturing. Stay informed about the latest trends, technologies, and market shifts to enhance your strategic planning and decision-making.

1.5K Pcb Manufacturing News Articles

Discover Latest Pcb Manufacturing Articles, News Magnitude, Publication Propagation, Yearly Growth, and Strongest Publications

Executive Summary

PCB manufacturing now balances two strategic imperatives: defending cost leadership through scale and regional manufacturing density, and capturing margin by mastering advanced materials, high-precision processes, and tightly integrated EMS services. Firms that pair targeted process investments (HDI, IC substrates, heavy copper) with digital factory controls and AI-assisted inspection will win premium segments in telecom, AI compute, automotive electrification, and medical devices; simultaneously, platform-driven quick-turn models will continue to serve fast-iteration product teams. For supply chain planners and investors, the highest-probability moves are clear: allocate R&D and capital to substrate specialization and inline quality automation, and pursue nearshore partnerships or platform orchestration to secure regulated, time-sensitive contracts.

Are you an insider in the trends or tech industry? We’d love for you to contribute to our content.