Powder Bed Fusion Report

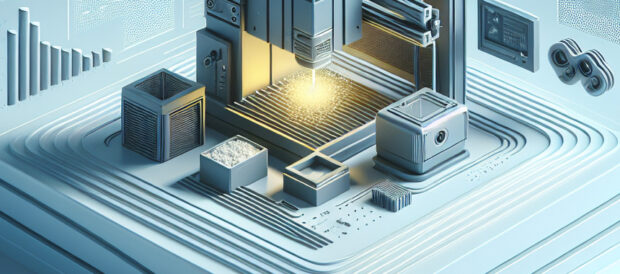

: Analysis on the Market, Trends, and TechnologiesThe powder bed fusion market is entering a commercial growth phase driven by material innovation and process digitization, with market data projecting Market Size: $3,070,000,000 in 2025 and a CAGR of 19.1% that underpins aggressive capacity and materials investment. External market estimates vary but concur on strong expansion as aerospace, medical and industrial tooling scale PBF from prototyping into certified production Powder Bed Fusion Market Report | Dataintelo.

The last time we updated this report was 32 days ago. If there’s something missing or off, your tips are welcome!

Topic Dominance Index of Powder Bed Fusion

The Dominance Index for Powder Bed Fusion merges timelines of published articles, newly founded companies, and global search data to provide a comprehensive perspective into the topic.

Key Activities and Applications

- Aerospace component production — manufacturing of lightweight brackets, complex ducting and high-temperature parts where Ti-6Al-4V and nickel alloys dominate design wins; aerospace demand remains a primary revenue engine Metal Powder Bed Fusion - Global Strategic Business Report.

- Medical implants and devices — patient-specific implants and surgical tooling with increasing certification activity that reduces time to clinical adoption and raises part-level margins.

- Low-volume production and functional tooling — short-run production of end-use metal parts and conformal-cooled tooling that shortens supply chains and eliminates complex fixtures Powder Bed Fusion Process 3D Printer Market.

- Feedstock engineering and recycling — closed-loop powder reuse, cradle-to-cradle powder production and new atomization routes that reduce cost per kilogram and embedded carbon intensity, increasingly linked to procurement decisions.

- Process digitization and qualification services — in-situ monitoring, digital twins and traceability stacks used to compress qualification cycles for regulated sectors.

Emergent Trends and Core Insights

- Material-first value capture — investment and patent activity show value shifting from machines to feedstock quality and sustainable powder production; firms that control powder characteristics gain pricing power and access to certified supply chains.

- Multi-laser and high-productivity machines — large format, multi-laser platforms address throughput constraints and lower per-part costs, enabling a move from prototyping to production pricing dynamics AMPower predictions via industry press.

- E-PBF expansion into high-temperature alloys — electron beam approaches gain traction for refractory and low-stress builds, creating differentiated process windows for aerospace and power applications.

- Sustainability as procurement gate — low-carbon or recycled powder technologies (melt-to-powder, microwave plasma) are becoming buying criteria for OEMs pursuing scope-3 reductions.

- Qualification and traceability are the bottleneck — machine capability improvements are outpacing qualification infrastructures; integrated digital reporting and audited process chains now determine which suppliers win certified programs.

Technologies and Methodologies

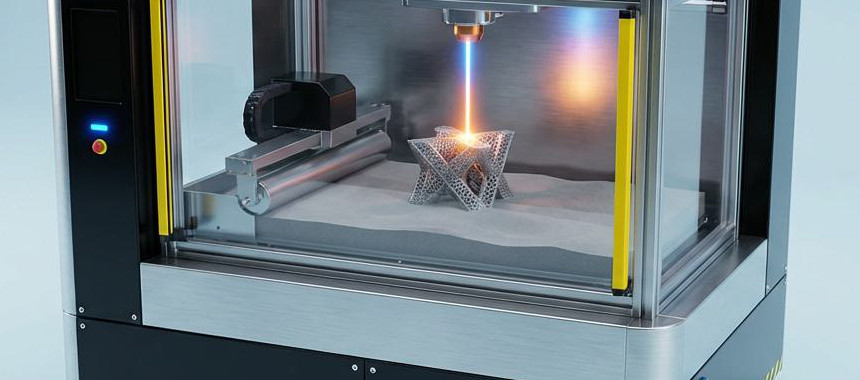

- Selective Laser Melting / Direct Metal Laser Sintering (SLM / DMLS) — standard for dense metal parts where microstructure control and post-processing paths (HIP, heat treat) are defined Powder Bed Fusion Process 3D Printing Technology Market Report.

- Electron Beam Powder Bed Fusion (E-PBF) — enables low residual stress builds for refractory or thick sections; gaining adoption for tungsten and niche aerospace alloys Freemelt AB.

- Selective Powder Deposition (multi-material powder placement) — layerwise, selective deposition of different powders to make functionally graded parts and assemblies without post-join steps Schaeffler Aerosint.

- Advanced powder production methods — plasma atomization, microwave plasma and DirectPowder™ processes that change particle morphology, purity and life-cycle footprint, creating supply-side differentiation AP&C - a Colibrium Additive Company 6K.

- In-situ monitoring and AI control — optical, thermal and acoustic sensing feeding ML models and closed-loop adjustments to reduce scrap and compress inspection regimes.

Powder Bed Fusion Funding

A total of 68 Powder Bed Fusion companies have received funding.

Overall, Powder Bed Fusion companies have raised $6.3B.

Companies within the Powder Bed Fusion domain have secured capital from 257 funding rounds.

The chart shows the funding trendline of Powder Bed Fusion companies over the last 5 years

Powder Bed Fusion Companies

- Continuum Powders

Continuum Powders commercializes the Greyhound M2P melt-to-powder platform to convert alloyed metal waste into spherical, usable feedstock with near-zero cradle-to-powder carbon intensity; the model removes reliance on legacy atomization networks and targets OEMs seeking certified recycled powders. The company is positioned for supply agreements with green procurement mandates where traceable alloy integrity matters. Its financial stage and regional footprint remain small relative to incumbents, which allows agile qualification with early adopter customers. - Metal Powder Works

Metal Powder Works has patented the DirectPowder™ approach that produces tailored powders without traditional atomization, claiming significantly lower CO2 emissions and faster processing times; this positions the firm as a strategic supplier for defense and aerospace programs with strict ESG and traceability requirements. Their early DOE contracts and targeted demonstrations signal an IP moat around feedstock economics. The company remains small in revenue but technologically differentiated, creating a supplier alternative to legacy powder houses. - FABULOUS - 3D PRINTING

FABULOUS focuses on polymer powder feedstock—notably PA11—with regulatory certifications for food and pharmaceutical contact that open niche regulated markets where polymer PBF previously lacked qualified suppliers. Their strategy monetizes certification complexity rather than machine sales, enabling recurring material revenues across SLS ecosystems. As a small developer, they can prioritize specialty grades and certification services attractive to medical and consumer-goods contract manufacturers. - Laser Fusion Solutions

Laser Fusion Solutions operates as an M-LPBF research and modification center that provides machine retrofits, sensor integration and test-bed services for OEMs and contract manufacturers. Their value lies in practical machine modification expertise and rapid prototyping infrastructure that accelerates customer process development. The firm is compact and service-centric, enabling lean partnerships for companies pursuing in-house qualification without large CAPEX. - AM POLYMERS GmbH

AM POLYMERS supplies engineered polymer powders for laser sintering, including a high-ductility PP grade with >200% elongation at break that expands polymer PBF into applications needing toughness rather than rigid thermoplastics. Their plug-and-play material focus reduces start-up risk for customers and shortens machine parameter validation time. The company's product strategy targets growth in consumer and functional polymer applications where material performance is the gating factor.

Delve into the corporate landscape of Powder Bed Fusion with TrendFeedr’s Companies tool

278 Powder Bed Fusion Companies

Discover Powder Bed Fusion Companies, their Funding, Manpower, Revenues, Stages, and much more

Powder Bed Fusion Investors

TrendFeedr’s Investors tool provides insights into 293 Powder Bed Fusion investors for you to keep ahead of the curve. This resource is critical for analyzing investment activities, funding trends, and market potential within the Powder Bed Fusion industry.

293 Powder Bed Fusion Investors

Discover Powder Bed Fusion Investors, Funding Rounds, Invested Amounts, and Funding Growth

Powder Bed Fusion News

TrendFeedr’s News feature offers you access to 3.6K articles on Powder Bed Fusion. Stay informed about the latest trends, technologies, and market shifts to enhance your strategic planning and decision-making.

3.6K Powder Bed Fusion News Articles

Discover Latest Powder Bed Fusion Articles, News Magnitude, Publication Propagation, Yearly Growth, and Strongest Publications

Executive Summary

Powder bed fusion is shifting from machine-led differentiation to a market where powder chemistry, sustainable production and digital traceability determine industrial winners. Market projections and internal trend data indicate high growth and strong investment appetite, but commercial scale requires simultaneous progress on throughput, material qualification and certified traceability for aerospace and medical buyers. Strategic priorities for businesses are clear: secure low-carbon, traceable feedstock sources; invest in in-situ monitoring and audit-grade digital threads; and pursue partnerships that accelerate material qualification. Firms that align material IP, process control and certification workflows will capture the highest value as PBF scales into regulated, high-volume production Powder Bed Fusion Three-Dimensional (3D) Printing Technology Market Overview 2025

Are you an insider in the trends or tech industry? We’d love for you to contribute to our content.