Power Electronics Report

: Analysis on the Market, Trends, and TechnologiesThe power-electronics market sits at a decisive growth inflection as electrification and renewable integration drive demand for higher-density converters and new semiconductor materials; the market baseline in 2024 is $28,800,000,000 supporting a projected moderate CAGR of 4.3% into 2030. This landscape is defined by three converging vectors: widespread adoption of Wide-Bandgap devices (SiC, GaN) raising switching frequency and efficiency, accelerating product-level integration (power modules and integrated ICs) to shrink system footprint, and a shift in value capture from commodity die suppliers to teams that qualify system-level WBG modules for automotive and grid use Power Electronics Market | Global Market Analysis Report – 2035.

The last time we updated this report was 37 days ago. If there’s something missing or off, your tips are welcome!

Topic Dominance Index of Power Electronics

The Dominance Index for Power Electronics merges timelines of published articles, newly founded companies, and global search data to provide a comprehensive perspective into the topic.

Key Activities and Applications

- Electric-vehicle powertrains (inverters, DC-DC converters, BMS) — Vehicle electrification remains the primary growth engine, driving demand for higher-voltage SiC traction inverters and compact on-board chargers using GaN for high-frequency conversion Global Market for Power Electronics for Electric Vehicles (EVs) 2024-2035.

- Utility-scale inverters and energy-storage integration — Modular, high-power converters for solar and storage installations emphasize reliability and grid compliance; large EPCs and inverter specialists capture system revenue through vertical integration Power Electronics.

- Industrial motor drives and process electrification — High-frequency drives targeting motor fleets (up to tens of MW in aggregate) use GaN/SiC to shrink magnetics and reduce system losses, with direct impact on OPEX for heavy industry Power Electronics – Market Share Analysis, 2025-2030.

- Test, simulation and qualification (HIL/PHIL) — Hardware-in-the-loop and grid emulation for validating WBG modules and system thermal designs accelerate qualification cycles and reduce field recall risk EGSTON Power Electronics.

- High-density fast charging and data-center power — Rapid chargers and high-efficiency PDUs demand GaN-enabled, high-frequency converters to reduce footprint and cooling costs Power Electronics Market Size, 2024-2030.

Emergent Trends and Core Insights

- System qualification is the new bottleneck — Material performance (SiC, GaN) has advanced; the commercial edge now comes from proven module qualification for automotive and utility standards, not raw die performance Power Electronics Market, 2025.

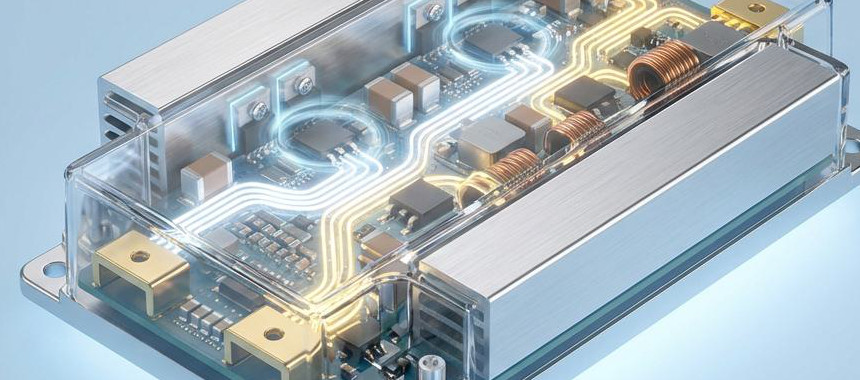

- Power modules and packaging drive margin capture — Integrated modules combining power switches, drivers, sensors and thermal paths concentrate value and shorten OEM integration time; module adoption rate is rising faster than discrete replacement in high-power segments Power Electronics Module Market, 2027.

- Dual-track WBG adoption — GaN dominates low-to-medium voltage, high-frequency niches (fast chargers, data center PDUs); SiC becomes default for high-voltage traction and utility converters, creating parallel product ecosystems rather than a single material winner Power Electronics IC Market, by Product Type (2023-2032).

- Design tool and digital-control differentiation — Companies coupling WBG hardware IP with digital control stacks, simulation flows and HIL validation reduce time-to-market and lower qualification risk, creating defensible commercial offerings Power Smart Control.

- Thermal management as a system requirement — Increasing switching frequency and power density shift limits from switching loss to heat extraction; advanced cooling (two-phase, microchannels, double-sided liquid cooling) becomes mandatory for high-power modules.

Technologies and Methodologies

- Silicon-Carbide (SiC) MOSFETs and diodes — Preferred for high-voltage traction and utility converters; enables higher junction temperatures and lower conduction loss per kW.

- Gallium-Nitride (GaN) HEMTs / eGaN ICs — Enables high-frequency, compact converters for 48V architectures, fast chargers and DC/DC front ends; GaN monolithic power ICs cut solution area and improve efficiency at MHz switching rates EPC – Efficient Power Conversion.

- Advanced packaging and planar magnetics — Embedded die, LGA chip-scale power stages and planar transformers reduce parasitics and enable reliable high-frequency operation; large magnetics suppliers target up to 80% size reduction vs. wound cores in specific designs Payton Planar Magnetics Ltd.

- Digital control, FPGA and DSP platforms — High-speed digital regulation (FPGA + model-based control) unlocks adaptive switching, predictive thermal control and embedded health monitoring for long-life systems ELMG Digital Power.

- Thermal and fluid innovations — Two-phase pumped flow, micro-channel cold plates and integrated coolant channels are moving from prototypes into production for traction and data-center power modules.

- Power-module building blocks / PEBBs — Pre-validated building blocks that integrate switching, sensing and thermal subsystems shorten OEM integration cycles for megawatt systems.

Power Electronics Funding

A total of 428 Power Electronics companies have received funding.

Overall, Power Electronics companies have raised $20.5B.

Companies within the Power Electronics domain have secured capital from 1.4K funding rounds.

The chart shows the funding trendline of Power Electronics companies over the last 5 years

Power Electronics Companies

- QPT — QPT focuses on applying GaN to high-speed variable-frequency drives, addressing motor inefficiency (motors consume up to 45% of global electricity) with claims of >20x switching speed improvement versus next-generation SiC approaches; its approach centers on electromagnetic and thermal mitigation to enable GaN at industrial motor power levels. QPT targets EV traction and industrial VFDs where higher switching frequency reduces magnetics and improves system efficiency. Their small team and focused IP make them a likely partner or acquisition target for motor-drive OEMs.

- Present Power Systems — Present Power Systems designs ultra-compact converters based exclusively on SiC with high-speed FPGA control to minimize size and cost for residential and commercial energy storage and solar inverters. The company emphasizes system miniaturization and rapid prototyping; its IP portfolio is centered on module-level thermal architectures suited for constrained install spaces.

- ICERGi — ICERGi licenses isolated gate-drive and control silicon targeting Titanium-class PFC and AC/DC platforms; their modular gate-drive approach claims to reduce boost inductance by 4x and achieve near-99% PFC stage efficiency, offering a low-CAPEX pathway to efficiency gains without switching to GaN/SiC at the device level. Its business model centers on IP licensing to system integrators seeking rapid performance upgrades.

- SolidWatts — SolidWatts supplies solid-state RF power amplifiers for industrial process heating, attacking decarbonization of thermal processes with modular power amplifiers from 10 kW to MW scale; the product reduces process emissions and OPEX for industrial heat users. Their value lies in segment-specific electrification — an under-served industrial niche where system integration and safety compliance add stickiness.

- PE-Systems GmbH — PE-Systems provides automation and design-acceleration tools for power-electronics engineers, reducing development cycles for complex WBG designs and addressing the talent shortage by simplifying layout, control tuning and validation workflows. Their software and lab platforms are positioned as essential enablers for engineering teams scaling GaN/SiC adoption.

Delve into the corporate landscape of Power Electronics with TrendFeedr’s Companies tool

4.1K Power Electronics Companies

Discover Power Electronics Companies, their Funding, Manpower, Revenues, Stages, and much more

Power Electronics Investors

TrendFeedr’s Investors tool provides insights into 1.6K Power Electronics investors for you to keep ahead of the curve. This resource is critical for analyzing investment activities, funding trends, and market potential within the Power Electronics industry.

1.6K Power Electronics Investors

Discover Power Electronics Investors, Funding Rounds, Invested Amounts, and Funding Growth

Power Electronics News

TrendFeedr’s News feature offers you access to 6.9K articles on Power Electronics. Stay informed about the latest trends, technologies, and market shifts to enhance your strategic planning and decision-making.

6.9K Power Electronics News Articles

Discover Latest Power Electronics Articles, News Magnitude, Publication Propagation, Yearly Growth, and Strongest Publications

Executive Summary

The power-electronics market will expand steadily from the current internal baseline and external market projections, with primary value accruing to teams that convert WBG device performance into fully qualified, thermally managed modules and systems. Engineering investments that pair material IP with digital validation and module-level thermal solutions will shorten customer procurement cycles and command superior margins. For investors and strategics, the optimal moves target module integrators, thermal-cooling innovators and digital-validation platforms that lower qualification risk and accelerate enterprise adoption across EV, renewable and industrial electrification use cases.

Are you an insider in the trends or tech industry? We’d love for you to contribute to our content.