Solar Energy Report

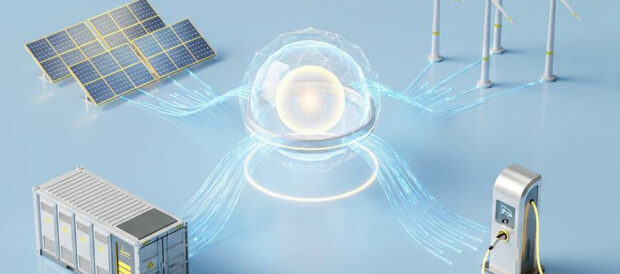

: Analysis on the Market, Trends, and TechnologiesThe solar sector is consolidating from a high-volume deployment market into a layered ecosystem where material innovations and digital finance layers capture premium value: the global market was $115,000,000,000 in 2024 with a 10.6% projected CAGR and a forecasted market value of $210,800,000,000 by 2030. Market drivers—policy incentives, falling module costs, and accelerating storage economics—are increasing addressable demand for residential, commercial, utility, and industrial process-heat applications, while patenting and targeted R&D activity concentrate on durability, tandem/perovskite cells, and system intelligence, shifting competitive advantage to firms that control ingredient technologies or the data/finance stacks that monetize distributed generation thebusinessresearchcompany – Solar Energy Market Report, 2024.

51 days ago, we last updated this report. Notice something that’s not right? Let’s fix it together.

Topic Dominance Index of Solar Energy

To gauge the influence of Solar Energy within the technological landscape, the Dominance Index analyzes trends from published articles, newly established companies, and global search activity

Key Activities and Applications

- Utility-scale PV development and corporate PPAs. Large ground-mounted parks remain the largest installed segment and continue to attract project finance and investor interest; corporate offtake (PPAs) is an established financing channel that accelerates project bankability.

- Residential rooftop solar combined with storage and subscription finance. Homeowner-facing software and subscription models reduce upfront CAPEX and increase adoption in dense markets; subscription and short-term models are expanding market reach.

- Building-Integrated Photovoltaics (BIPV) and architectural integration. Integrated roofs, tiles, glazing, and façade systems convert aesthetics from an adoption barrier into a product differentiator for new construction and major renovations.

- Solar for industrial heat and process applications. Concentrating and advanced thermal collectors address industrial heat demand and offer higher local conversion efficiency for heat-intensive industries, forming an adjacent market to electrical PV.

- Off-grid, microgrids, and access programs. PAYGO and community solar models expand access in emerging markets, pairing localized generation with fintech to overcome affordability constraints.

- Solar-driven water technologies (solar RO) and agri-applications. Solar-powered desalination and irrigation deployments resolve two core infrastructure gaps—clean water and farm electrification—enabling new commercial use cases.

Emergent Trends and Core Insights

- Value migration to materials and software. The next decade will reward companies that own high-efficiency cell IP (tandem/perovskite, HJT/TOPCon) or proprietary data/finance platforms that monetize distributed assets; investors increasingly underwrite ingredient tech and SaaS rather than pure installation margins OpenSolar.

- Land efficiency and dual-use deployments are rising. Vertically mounted bifacial systems and agrivoltaics capture more energy per hectare while preserving land productivity, reducing permitting friction and improving public acceptance.

- Thermal solutions regain strategic relevance. High-performance solar thermal collectors and hybrid PV/CSP prototypes deliver concentrated heat for industrial loads and create pathways to seasonal storage and industrial decarbonization.

- Energy storage cost declines harden solar-plus-storage economics. Battery prices and modular thermal storage reduce LCOE and enable reliable dispatch, turning time-shifted solar into baseload-complement assets.

- Asset-level intelligence and verification become liquidity enablers. High-fidelity measurement and verification for generation and carbon credits (sensor + blockchain stacks) accelerate secondary markets for RECs and create productized revenue streams beyond energy sales.

- Geographic diversification and supply-chain localization. Policy programs (PLI, IRA, EU industrial initiatives) are shifting capex toward localized cell/module manufacturing, but concentration in Asian polysilicon and wafer production remains a systemic risk Solar PV Growth Opportunities.

Technologies and Methodologies

- Perovskite-on-silicon tandems and HJT/TOPCon cells. Tandem architectures aim to surpass single-junction limits and are central to R&D roadmaps for module-level efficiency gains.

- Bifacial and vertical bifacial arrays. Capture rear-side albedo and enable agri-PV and narrow-footprint plant layouts that improve land economics.

- Advanced solar thermal and concentrated photovoltaic hybrids. Hybrid receivers that deliver both heat and electricity improve site value for industrial users and provide cheaper seasonal storage vectors SunOyster Systems GmbH.

- Roll-to-roll printing and flexible printed photovoltaics. Low-mass, low-embodied-carbon printed modules promise rapid, low-capex deployment for curved and lightweight surfaces and support circular-economy claims.

- AI-driven asset management and predictive O&M. Digital twins, drone EL/thermal imaging, and physics-informed ML reduce downtime, lower O&M costs and permit portfolio-level monetization Grand View Research - Solar PV Systems Industry.

- Blockchain and sensor stacks for verified attribute trading. Real-time, panel-level data anchored to immutable records enables fractional REC markets and faster retirement of credits, improving revenue certainty for asset owners.

Solar Energy Funding

A total of 7.9K Solar Energy companies have received funding.

Overall, Solar Energy companies have raised $1.3T.

Companies within the Solar Energy domain have secured capital from 25.2K funding rounds.

The chart shows the funding trendline of Solar Energy companies over the last 5 years

Solar Energy Companies

- Kardinia Energy — Kardinia Energy develops fully recyclable, printed solar sheets that can be produced on roll-to-roll lines and applied to flat or curved surfaces; the low weight (~300 g/m²) and polymer-based chemistry remove dependence on wafer supply chains and target off-grid and lightweight-structure markets. The product aim is low embodied carbon and simplified installation for emerging-market electrification and retrofit use cases; commercialization is at seed stage with a small technical team focused on scaling manufacturing.

- EnergySolaris — EnergySolaris focuses on high-efficiency solar air collectors for heating, cooling, and drying; their AirSolaris PLUS collector achieved 70% ISO-measured thermal efficiency in independent tests, positioning the company to serve industrial and building heat loads where PV cannot economically substitute. This technology competes in process heat and HVAC electrification, offering a clearer path to decarbonize heat-intensive segments than electrical PV alone.

- Next2Sun AG — Next2Sun commercializes vertical, bifacial PV systems that orient module faces east/west to harvest morning and evening irradiance, enabling productive dual-use of agricultural land and higher energy yield per hectare. The configuration reduces shading penalties in narrow-row farms and eases public acceptance in land-constrained regions, where land economics and permitting determine project viability.

- Sunified Group — Sunified Group offers a sensor + platform approach to digitally verify generation and attribute data at panel level; their UNITY™ sensor and PaaS enable near real-time energy tagging and vastly faster credit verification, creating liquidity for carbon and energy attribute markets and enabling automated asset monetization. The firm pairs data products with an Australian project pipeline to demonstrate the technology in live trading and VPP use cases.

- Solarstone Solar Roof — Solarstone produces Building-Integrated Photovoltaic roofing systems and opened a high-capacity European BIPV factory in 2024; the product family (full-roof systems, tiles, carports) targets architects and new builds where aesthetic expectations and building codes drive procurement. By industrializing BIPV manufacturing the company aims to close the cost and installation time gap versus conventional roofing while securing a premium product segment.

Get detailed analytics and profiles on 145.9K companies driving change in Solar Energy, enabling you to make informed strategic decisions.

145.9K Solar Energy Companies

Discover Solar Energy Companies, their Funding, Manpower, Revenues, Stages, and much more

Solar Energy Investors

TrendFeedr’s Investors tool provides an extensive overview of 18.5K Solar Energy investors and their activities. By analyzing funding rounds and market trends, this tool equips you with the knowledge to make strategic investment decisions in the Solar Energy sector.

18.5K Solar Energy Investors

Discover Solar Energy Investors, Funding Rounds, Invested Amounts, and Funding Growth

Solar Energy News

Explore the evolution and current state of Solar Energy with TrendFeedr’s News feature. Access 152.4K Solar Energy articles that provide comprehensive insights into market trends and technological advancements.

152.4K Solar Energy News Articles

Discover Latest Solar Energy Articles, News Magnitude, Publication Propagation, Yearly Growth, and Strongest Publications

Executive Summary

The practical implication for business leaders is clear: pursue strategies that acquire or secure privileged access to high-value upstream technologies (tandem/perovskite, printed PV, thermal receivers) and to the digital finance and verification layers that aggregate, verify, and monetize distributed generation. Project developers must hedge supply-chain exposure and differentiate through land-efficient deployments (bifacial, agri-PV) and bundled storage offerings. Investors should favor firms that either control scarce technological ingredients or provide platform utilities—asset management, verification, and financing—that convert generation into more liquid revenue streams.

We're looking to collaborate with knowledgeable insiders to enhance our analysis of trends and tech. Join us!