Braking System Report

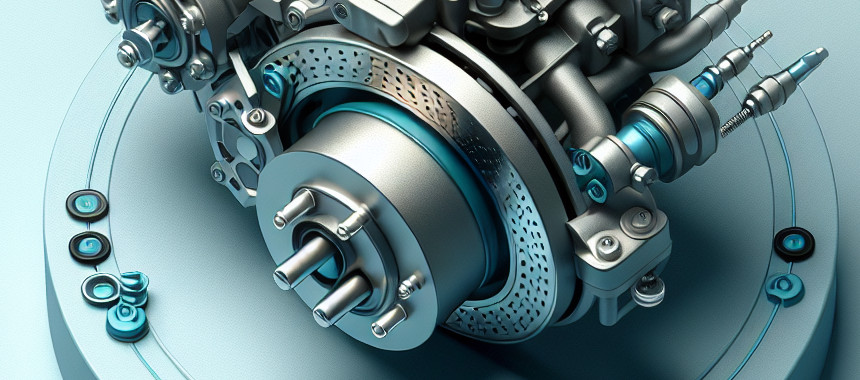

: Analysis on the Market, Trends, and TechnologiesThe internal braking system trend report identifies a 47.14% annual growth in funding rounds within the sector, reflecting surging investor interest. This surge aligns with forecasts projecting the automotive braking system market to expand from USD 23.97 billion in 2024 to USD 37.67 billion by 2032 at a 5.15% CAGR Global Brake System Market Size. Advanced solutions such as anti-lock braking systems and regenerative braking are driving demand amid stricter safety mandates and widespread electrification.

This report was last updated 127 days ago. Spot an error or missing detail? Help us fix it by getting in touch!

Topic Dominance Index of Braking System

To identify the Dominance Index of Braking System in the Trend and Technology ecosystem, we look at 3 different time series: the timeline of published articles, founded companies, and global search.

Key Activities and Applications

- Development and integration of anti-lock braking systems (ABS) to prevent wheel lock-up and maintain steering control during emergency braking.

- Implementation of regenerative braking in electric and hybrid vehicles to recover kinetic energy and improve vehicle range.

- Enhancement of electronic stability control (ESC), traction control systems (TCS), and electronic brakeforce distribution (EBD) for improved safety and cornering stability.

- Adoption of lightweight friction materials—ceramics, carbon-ceramic composites—and advanced alloys to reduce unsprung mass and improve thermal management.

- Government-backed research programs directing over USD 45 million toward next-generation braking technologies, particularly for electrified drivetrains Automotive Brake System Market Size, Growth Analysis 2037.

Emergent Trends and Core Insights

- Rapid shift toward brake-by-wire architectures replacing hydraulic circuits with electronic actuators for faster response and lower maintenance ZF Unveils Full-Spectrum Brake-by-Wire Portfolio for Electrified and Autonomous Vehicles.

- Near-universal ABS penetration in newly assembled light vehicles, projected to exceed 95% by 2036, driven by safety regulations and ADAS integration.

- Expansion of smart manufacturing and data-driven diagnostics enabling predictive maintenance through real-time brake performance monitoring.

- Asia-Pacific emerging as the primary growth engine, supported by rising EV production, cost-competitive supply chains, and government incentives.

- Sustainability initiatives leading to copper-free brake pad formulations and eco-friendly manufacturing processes TMD Friction Sustainability Initiative.

Technologies and Methodologies

- Anti-lock Braking Systems (ABS) market, forecast to grow from USD 81.18 billion in 2025 to USD 154.17 billion by 2034 at a 9% CAGR Automotive Anti-Lock Braking System Market to Increase.

- Regenerative braking technology valued at USD 7.83 billion in 2024 and projected to reach USD 15.18 billion by 2030 at a 12.1% CAGR Automotive Regenerative Braking System Market Report.

- Electronic Stability Control (ESC) and Electronic Brakeforce Distribution (EBD) with increasing mandates across major markets for improved vehicle stability Automotive Friction Brake System Market by Product Type.

- Brake-by-Wire and Electro-Mechanical Braking (EMB) systems eliminating hydraulic fluid, as exemplified by Nexteer and ZF's "dry" electric actuators ZF Creates Electric Brake-by-Wire System For Upcoming Software-Defined Vehicles.

- Advanced friction material science, including carbon-ceramic composites and cryogenic treatments, improving thermal resilience and wear life Brake System Market Outlook from 2024 to 2034.

Braking System Funding

A total of 202 Braking System companies have received funding.

Overall, Braking System companies have raised $4.8B.

Companies within the Braking System domain have secured capital from 399 funding rounds.

The chart shows the funding trendline of Braking System companies over the last 5 years

Braking System Companies

- 2electron: Specializes in modular regenerative braking units for electric commercial fleets, enabling retrofit of conventional vehicles to electric platforms while maximizing energy recovery. Their scalable designs address diverse vehicle classes and reduce dependency on hydraulic components. 2electron's patent-backed control algorithms optimize energy harvesting under varied driving conditions, positioning them as a key innovator in the EV conversion market.

- Point.Zero: Delivers predictive maintenance software for braking systems by aggregating wheel-speed and temperature sensor data to forecast pad replacement intervals. Their cloud-based analytics platform integrates with OEM telematics, reducing unplanned downtime and maintenance costs. Early adopters report a 20% extension in brake component life, demonstrating tangible operational savings.

- LeviStor: Develops magnetorheological fluid-based brake actuators that dynamically adjust braking force at each wheel. This allows real-time modulation for stability control and enhanced emergency response. Their compact, fail-safe design supports lightweight vehicle architectures and promises up to 15% reduction in stopping distance under emergency braking.

- Dyol: Pioneers graphene-enhanced composite brake pads that deliver superior friction performance and dramatically lower particulate emissions. Their materials achieve up to 40% reduction in pad wear rates and comply with the latest environmental regulations on brake dust.

Identify and analyze 3.2K innovators and key players in Braking System more easily with this feature.

3.2K Braking System Companies

Discover Braking System Companies, their Funding, Manpower, Revenues, Stages, and much more

Braking System Investors

TrendFeedr’s investors tool offers a detailed view of investment activities that align with specific trends and technologies. This tool features comprehensive data on 436 Braking System investors, funding rounds, and investment trends, providing an overview of market dynamics.

436 Braking System Investors

Discover Braking System Investors, Funding Rounds, Invested Amounts, and Funding Growth

Braking System News

Stay informed and ahead of the curve with TrendFeedr’s News feature, which provides access to 3.1K Braking System articles. The tool is tailored for professionals seeking to understand the historical trajectory and current momentum of changing market trends.

3.1K Braking System News Articles

Discover Latest Braking System Articles, News Magnitude, Publication Propagation, Yearly Growth, and Strongest Publications

Executive Summary

Critical findings indicate that investment in braking system innovation is accelerating, driven by safety regulations, electrification, and data-driven maintenance. Brake-by-wire and regenerative technologies represent the most significant growth vectors, while advanced materials research offers meaningful performance and sustainability gains. Companies that integrate software-enabled diagnostics with next-generation actuation will capture the most value, particularly in electric and autonomous vehicle segments. Strategic focus on low-latency control architectures and eco-friendly components will differentiate winners in this evolving market.

Interested in enhancing our coverage of trends and tech? We value insights from experts like you - reach out!