Cervical Cancer Screening Report

: Analysis on the Market, Trends, and TechnologiesThe cervical cancer screening business domain is a critical component of preventive healthcare, directly impacting the healthcare industry, medical device manufacturers, and research and development sectors. With 509 companies involved, the sector is characterized by its emergent nature and promising growth potential. The interconnectedness of cervical cancer screening with broader healthcare and medical fields is evident through its association with diagnostics, healthcare, diseases, cervical cancer, medical disciplines, and cancer. The market’s vitality is reflected in its prevalence across various industries, substantial funding ($7.49 billion average), and significant annual revenue ($37.22 million average). Despite a decline in media coverage and new company entries, the sector has experienced positive global search growth and manpower expansion, indicating a robust and evolving market. Strategic investments and collaborations are essential to sustain and enhance the momentum within the cervical cancer screening industry.

We updated this report 676 days ago. Noticed something’s off? Let’s make it right together — reach out!

Topic Dominance Index of Cervical Cancer Screening

The Topic Dominance Index trendline combines the share of voice distributions of Cervical Cancer Screening from 3 data sources: published articles, founded companies, and global search

Key Activities and Applications

- Development and manufacturing of medical devices for cervical cancer screening.

- Research and innovation in non-destructive biological tissue diagnostics.

- Expansion of molecular diagnostics markets, especially in regions like China.

- Trading and distribution of medical devices, including those for cervical cancer screening.

- Provision of healthcare services, including screenings for insured patients.

- Comprehensive reproductive health education and services.

- Implementation of AI-based screening and treatment solutions for cervical cancer.

- Development of home-based diagnostic kits for easy accessibility.

Emergent Trends and Core Insights

- Growth in funding for early-stage VC, seed, and accelerator/incubator investments.

- Increasing adoption of AI and machine learning technologies for accurate and early detection.

- Expansion of workforce in the sector, indicating a surge in employment opportunities.

- Emergence of virtual microscopy and cancer risk assessment tools.

- Positive trend in global search growth, showcasing rising public interest and awareness.

- Decline in new company entries, suggesting market consolidation or barriers to entry.

Technologies and Methodologies

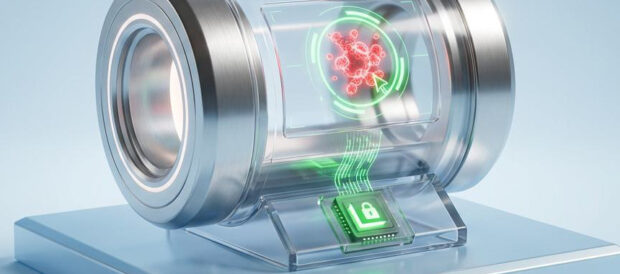

- Optical spectroscopy for non-destructive biological tissue diagnostics.

- Gene chip development and molecular diagnostics advancements.

- AI-based screening and treatment solutions.

- Digital microscopy and telemedicine for remote cervical cancer screening.

- Development of portable and user-friendly cervical cancer screening devices.

- Implementation of cloud-based learning algorithms for diagnostics.

- Adoption of high-resolution imaging for improved documentation and patient communication.

Cervical Cancer Screening Funding

A total of 73 Cervical Cancer Screening companies have received funding.

Overall, Cervical Cancer Screening companies have raised $2.1B.

Companies within the Cervical Cancer Screening domain have secured capital from 174 funding rounds.

The chart shows the funding trendline of Cervical Cancer Screening companies over the last 5 years

Cervical Cancer Screening Companies

Gain a better understanding of 451 companies that drive Cervical Cancer Screening, how mature and well-funded these companies are.

451 Cervical Cancer Screening Companies

Discover Cervical Cancer Screening Companies, their Funding, Manpower, Revenues, Stages, and much more

Cervical Cancer Screening Investors

Gain insights into 47 Cervical Cancer Screening investors and investment deals. TrendFeedr’s investors tool presents an overview of investment trends and activities, helping create better investment strategies and partnerships.

47 Cervical Cancer Screening Investors

Discover Cervical Cancer Screening Investors, Funding Rounds, Invested Amounts, and Funding Growth

Cervical Cancer Screening News

Gain a competitive advantage with access to 1.4K Cervical Cancer Screening articles with TrendFeedr's News feature. The tool offers an extensive database of articles covering recent trends and past events in Cervical Cancer Screening. This enables innovators and market leaders to make well-informed fact-based decisions.

1.4K Cervical Cancer Screening News Articles

Discover Latest Cervical Cancer Screening Articles, News Magnitude, Publication Propagation, Yearly Growth, and Strongest Publications

Executive Summary

The cervical cancer screening sector is a dynamic and emergent field within the healthcare landscape, demonstrating significant investment, innovation, and workforce growth. The integration of AI, digital microscopy, and machine learning technologies is revolutionizing screening and diagnostics, offering new opportunities for early detection and treatment. Despite challenges such as decreased media coverage and a drop in new entrants, the sector's robust funding and revenue metrics, coupled with strategic collaborations, position it for continued growth and potential market expansion. It is crucial for companies and investors to navigate this evolving ecosystem with strategic foresight, leveraging technological advancements to enhance patient care and propel the industry forward.

We seek partnerships with industry experts to deliver actionable insights into trends and tech. Interested? Let us know!