Electric School Bus Report

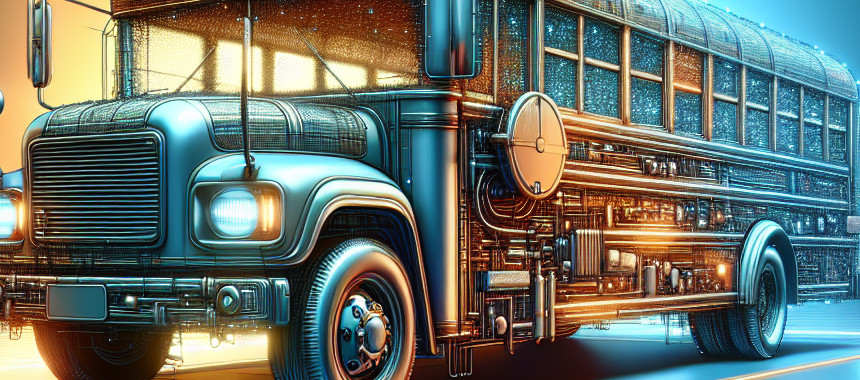

: Analysis on the Market, Trends, and TechnologiesThe electric school bus market is entering a decisive commercial phase: $21,950,000,000 market value in 2023 with a projected expansion to $79,110,000,000 by 2030, driven by rapid technology adoption, financing innovation, and large public grants that shift purchase decisions toward lifecycle economics.

This article was last updated 83 days ago. If you find any info is missing, let us know!

Topic Dominance Index of Electric School Bus

The Dominance Index of Electric School Bus looks at the evolution of the sector through a combination of multiple data sources. We analyze the distribution of news articles that mention Electric School Bus, the timeline of newly founded companies working in this sector, and the share of voice within the global search data

Key Activities and Applications

- Fleet electrification and depot conversion — Districts and private operators are replacing diesel fleets and installing depot chargers and energy-management platforms to support scheduled routes; this remains the primary application area for school-transport decarbonization.

- Electrification-as-a-Service (EaaS) — Providers bundle vehicle acquisition, charging infrastructure, operations and maintenance into subscription or OPEX contracts to reduce upfront capital needs for cash-constrained districts.

- Vehicle repowering and retrofit programs — Converting existing diesel chassis with electric drivetrains offers a lower-cost pathway to zero emissions for many fleets, enabling faster emissions reductions at scale.

- Managed charging and grid services — Operators deploy smart charging, time-of-use optimization, and bidirectional charging (V2G) to reduce operating cost and create new revenue streams by providing grid flexibility.

- Routing, telematics and safety systems — Cloud routing, telematics and AI safety monitoring reduce energy use and improve student safety, becoming standard procurement requirements for modern deployments.

Emergent Trends and Core Insights

- Procurement is shifting from capital cost to TCO. Buyers prioritize lifecycle cost, service guarantees, and integrated energy value (charging + V2G) over vehicle sticker price.

- Electrification platforms capture disproportionate value. Companies that package vehicles with charging, managed services, and financing secure longer contracts and recurring revenue, compressing margins for pure OEM sellers.

- Repowering opens a large price-sensitive segment. Repower/retrofit solutions target districts that cannot afford full fleet replacement and accelerate emissions reductions at lower capital cost.

- V2G moves buses from cost centers to distributed energy assets. Districts and utilities are piloting bidirectional programs that monetize parked-fleet batteries for grid services, improving the fleet economics when integrated into contracts North America Electric Bus Market Opportunity.

- Model diversity and right-sizing broaden addressable routes. Expanded model counts and capacity variants enable electrification across urban, suburban and rural routes, reducing the "one-size-fits-all" constraints that slowed early adoption Electric School Bus Market.

- Public funding shapes the adoption curve. Large federal and state programs remain the single largest enabler of procurement velocity; successful vendors embed grants and rebate navigation into their offers Electric School Bus Market Assessment.

Technologies and Methodologies

- Battery chemistry and lifecycle systems — Emphasis on LFP and advanced battery-management systems for safety, long cycle life and second-use applications; lifecycle planning (reuse/refurbish) is now a procurement item Electric Bus Market Size.

- Fast DC charging and automated opportunity charging — Depot chargers in the 150–250 kW class and pantograph/automated solutions reduce downtime for tight schedules and support variants with smaller battery packs.

- Vehicle-to-Grid (V2G) and managed charging stacks — Software and hardware stacks enabling bidirectional power flow and price-aware charging integrate utility contracts into fleet economics North America Electric Bus Market Size.

- Modular and swappable battery designs / repower kits — Modular packs and conversion kits lower upgrade cost and simplify depot servicing for different route profiles.

- Simulation and digital twins for route validation — Predictive simulators reduce physical testing cycles and help match battery capacity to route profiles, improving procurement confidence and reducing specification errors

- Telematics + AI routing — Integrated telematics and AI optimize range, charging windows and driver behavior to maximize vehicle uptime and minimize energy cost.

Electric School Bus Funding

A total of 32 Electric School Bus companies have received funding.

Overall, Electric School Bus companies have raised $3.3B.

Companies within the Electric School Bus domain have secured capital from 88 funding rounds.

The chart shows the funding trendline of Electric School Bus companies over the last 5 years

Electric School Bus Companies

- Arcadian Drive — Arcadian focuses on electric repowering of existing diesel buses, offering fleets quick decarbonization with meaningful cost savings versus new vehicles. Their engineering approach targets universities and municipal fleets that need rapid conversion without full vehicle replacement. This model reduces procurement lead times and leverages existing service infrastructure to shrink the total program cost.

- to zero electric vehicles GmbH — TO ZERO supplies a standardized conversion kit to turn diesel buses electric, including an 8-year component warranty aimed at mitigating retrofit risk for operators. Their product targets operators in Europe pursuing a circular approach to fleet renewal and emphasizes predictable TCO through guaranteed component coverage.

- tirn technology — tirn's E-Bus simulator applies physics and AI to validate route feasibility and battery sizing before prototypes, shortening R&D cycles and lowering validation cost for OEMs and fleet planners. Their tool helps match vehicle spec to route energy profiles, reducing over-specification and capital waste.

- Chariot Motors AD — Chariot commercializes ultra-capacitor-based buses and fast-charging systems for dense, stop-heavy routes where opportunity charging is frequent. Their approach can eliminate large battery mass for specific duty cycles and offers an alternative architecture for high-frequency urban school runs and shuttle services.

- eMIS — eMIS packages bidirectional charging, depot energy services and fleet rentals, positioning school fleets as managed distributed-energy resources. By offering bundled electricity and charging as part of a rental model, they convert capital needs into predictable operating fees while enabling districts to monetize grid services.

Uncover actionable market insights on 159 companies driving Electric School Bus with TrendFeedr's Companies tool.

159 Electric School Bus Companies

Discover Electric School Bus Companies, their Funding, Manpower, Revenues, Stages, and much more

Electric School Bus Investors

Get ahead with your investment strategy with insights into 84 Electric School Bus investors. TrendFeedr’s investors tool is your go-to source for comprehensive analysis of investment activities and financial trends. The tool is tailored for navigating the investment world, offering insights for successful market positioning and partnerships within Electric School Bus.

84 Electric School Bus Investors

Discover Electric School Bus Investors, Funding Rounds, Invested Amounts, and Funding Growth

Electric School Bus News

TrendFeedr’s News feature offers access to 1.1K news articles on Electric School Bus. The tool provides up-to-date news on trends, technologies, and companies, enabling effective trend and sentiment tracking.

1.1K Electric School Bus News Articles

Discover Latest Electric School Bus Articles, News Magnitude, Publication Propagation, Yearly Growth, and Strongest Publications

Executive Summary

Investment and operational attention have shifted from vehicle hardware to the systems that govern energy and service. The most durable competitive positions will belong to companies that convert vehicles into long-lived energy assets through integrated contracts combining charging, financing, maintenance and grid services. Districts that leverage grant programs and select partners who deliver both predictable TCO and grid-integration capabilities will see the fastest cost recovery and health benefits. Repowering and modular designs create pragmatic pathways for immediate emissions reductions in budget-constrained regions, while simulation and managed-charging stacks reduce deployment risk and accelerate scale.

Have expertise in trends or technology? Your input can enrich our content — consider collaborating with us!