Graphene Technology Report

: Analysis on the Market, Trends, and TechnologiesThe graphene market sits at an inflection point: current analysis estimates a market size of $1,650,000,000 with a projected compound annual growth rate of 41.22%, targeting $9,280,000,000 in the forecast horizon, driven by concentrated commercial demand in energy storage, flexible electronics, and high-performance composites. This technical and commercial momentum coexists with persistent industrial bottlenecks in high-quality, high-volume synthesis and transfer methods, creating a two-track competitive field where scalable feedstock solutions and device-integration IP capture most investor and procurement attention Graphene Market to Grow at 27.5% CAGR by 2030 – BCC Research.

We updated this report 5 days ago. Missing information? Contact us to add your insights.

Topic Dominance Index of Graphene Technology

The Topic Dominance Index combines the distribution of news articles that mention Graphene Technology, the timeline of newly founded companies working within this sector, and the share of voice within the global search data

Key Activities and Applications

- Energy-storage electrode development: Graphene and graphene nanoplatelets appear widely in high-energy anode and supercapacitor formulations to increase capacity, rate performance, and cycle life; the graphene nanoplatelets market is estimated at $302,800,000 (2024) with strong demand from battery and composite makers

- Flexible and printed electronics: Conductive graphene inks and roll-to-roll graphene films enable flexible displays, printed sensors, and RFID; wafer-scale CVD plus improved transfer methods target telecom photonics and data-center interconnects.

- High-performance composites for mobility and aerospace: Graphene additives and masterbatches reduce part weight while improving toughness and thermal stability; compositional integration targets EV components and aerospace panels.

- Thermal management and TIMs: Graphene-based thermal interface materials and films deliver high in-plane and through-plane conductivity for power-electronics cooling, an immediate commercial lane for electronics suppliers SHT Smart High Tech AB.

- Sensors and diagnostics: Graphene Field-Effect Transistors and printed graphene biosensors deliver significantly higher sensitivity for point-of-care diagnostics and environmental monitoring, with the graphene sensor market estimated at $493,185,000 (2024) and a 32.29% CAGR to reach roughly $1,990,000,000 by 2029 Graphene Sensor Market – ResearchAndMarkets.

- Filtration and membranes: Functionalized graphene oxide membranes target selective water and gas separation applications where superior flux and fouling resistance yield life-cycle cost benefits.

Emergent Trends and Core Insights

- The market is splitting into a supply-chain axis and an integration axis: scalable, low-cost feedstock producers compete separately from application specialists who bundle functionalization and certification into product offerings. Evidence: investment velocity into circular feedstock and industrialization projects has risen alongside targeted application funding Graphene & 2D Materials 2026-2036 – IDTechEx.

- Sustainability as a competitive lever: Firms converting waste feedstocks (biomass, plastics, agricultural residues) now claim lower CO2e footprints and cost advantages, creating procurement preferences in construction and industrial composites Graphjet Technology.

- Quality control and standards adoption are emerging purchase filters: buyers for aerospace, defence, and medical devices increasingly require third-party validation or verified producer status before qualification Kyorene.

- Device integration outpaces materials novelty in value capture: patent and R&D focus has moved from pure synthesis to transfer mechanics, defect engineering, and patterned architectures required for semiconductor and photonic components First functional graphene semiconductor reports.

- Regional specialization persists: North America leads on TRL and device integration, Asia-Pacific on manufacturing scale and volume adoption, and Europe on coordinated R&D consortia and standards programs Graphene Flagship.

Technologies and Methodologies

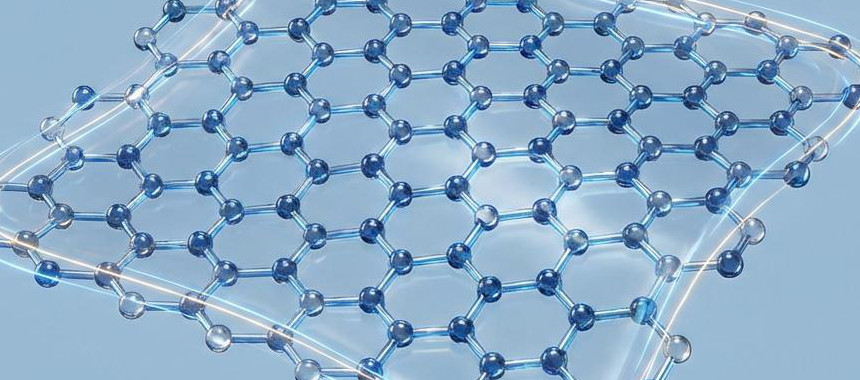

- Chemical Vapor Deposition (CVD) and roll-to-roll transfer: The primary route for electronics-grade monolayers and large-area films; success metrics hinge on oxygen control during growth and improved transfer mechanics to substrates.

- Electrochemical and liquid-phase exfoliation: Scalable, lower-capex routes for nanoplatelets and inks that serve composites, coatings, and conductive dispersions; these methods underpin many industrial GNP supply chains

- Detonation and explosion synthesis for pristine powder: Offers batch-consistent, high-purity powders for demanding applications where feedstock uniformity matters HydroGraph.

- Functionalization and dispersion science: Surface chemistries and plasma/aminated functionalizations enable compatibility with polymers, inks, and battery chemistries; these chemistries translate material metrics into measurable component performance Haydale.

- 3D architectures and mesoscale structuring: Engineered porous and 3D graphene constructs (for example, Graphene MesoSponge) address mechanical cycling issues in high-capacity battery electrodes and expand the design space beyond flat films 3DC Inc..

- Printed 2D films and module-level integration: Printed photovoltaic films, heating films, and flexible supercapacitors enable product-level differentiation and faster route to market than raw material sales

Graphene Technology Funding

A total of 396 Graphene Technology companies have received funding.

Overall, Graphene Technology companies have raised $20.0B.

Companies within the Graphene Technology domain have secured capital from 1.6K funding rounds.

The chart shows the funding trendline of Graphene Technology companies over the last 5 years

Graphene Technology Companies

- Sixonia — Sixonia commercializes electrochemically produced, functionalized large-flake graphenes branded as e-Graphenes, optimized for batteries, coatings, and composites; the company emphasizes on-site customization and autonomous production modules validated across >150 customer projects with partners such as Bosch and Continental Sixonia’s model reduces supplier risk for OEMs by enabling local, configurable supply while preserving industrial performance metrics Graphene Nanoplatelets market adoption context. Their niche focus on functionalized, application-ready flakes positions them as an ingredient partner rather than a commodity seller

- GrapheneTX — GrapheneTX supplies aminated graphene powders and positions its ecofriendly process as a domestic supply solution for aerospace and automotive fillers; the product strategy centers on chemical functionalization to improve polymer compatibility and EMI shielding performance GrapheneTX targets clients seeking consistent, regulatory-friendly powders with clear dispersion recipes to accelerate compounder adoption. Their small manufacturing footprint enables rapid qualification cycles for tier-1 customers

- GRAPHENATON Technologies SA — GRAPHENATON develops printed 2D material films for heating, photovoltaic, and energy-dissipation applications, pairing film printing with module-level integration to capture higher margins than bulk material sales Their patented film processes target building-scale de-icing and soft-mobility heating systems where long service life and recyclability justify premium pricing By selling films and application subsystems, the company positions itself as a systems supplier in the energy transition market segment.

- Graphenel — Graphenel uses animal-fat derived feedstock to produce graphene additives for construction and industrial use, delivering a low-cost material suited to concrete and asphalt performance enhancement; the firm reports early order validation in construction additives and highlights a low-carbon manufacturing pathway Graphenel’s value play is volume and cost per ton rather than electronics-grade purity, which gives them a procurement advantage in large, price-sensitive verticals. Their approach exemplifies the circular feedstock strategy driving margin capture in heavy industry

- Destination 2D — Destination 2D focuses on CMOS-compatible graphene interconnects claiming up to 100-fold higher current-carrying capacity than copper, an architectural lever for logic and memory scaling in advanced nodes Their equipment and integration targeting BEOL interconnect substitution aim directly at foundry roadmaps; success would materialize as a step change in chip energy and reliability metrics, moving graphene from component novelty to critical infrastructure The company remains in early commercialization steps but represents a high-value application pathway if transfer and defect engineering challenges are resolved.

Gain a competitive edge with access to 2.7K Graphene Technology companies.

2.7K Graphene Technology Companies

Discover Graphene Technology Companies, their Funding, Manpower, Revenues, Stages, and much more

Graphene Technology Investors

Leverage TrendFeedr’s sophisticated investment intelligence into 1.4K Graphene Technology investors. It covers funding rounds, investor activity, and key financial metrics in Graphene Technology. investors tool is ideal for business strategists and investment experts as it offers crucial insights needed to seize investment opportunities.

1.4K Graphene Technology Investors

Discover Graphene Technology Investors, Funding Rounds, Invested Amounts, and Funding Growth

Graphene Technology News

TrendFeedr’s News feature provides a historical overview and current momentum of Graphene Technology by analyzing 27.0K news articles. This tool allows market analysts and strategists to align with latest market developments.

27.0K Graphene Technology News Articles

Discover Latest Graphene Technology Articles, News Magnitude, Publication Propagation, Yearly Growth, and Strongest Publications

Executive Summary

Graphene technology now presents a clear commercial bifurcation: suppliers that solve scale, cost, and sustainability for bulk industrial applications and providers that convert high-quality films and functionalized materials into certified device-level solutions will appropriate the largest share of near-term value. Market projections and company signals indicate that energy storage, printed electronics, thermal management, and high-value composites will drive procurement and strategic partnerships. For investors and industrial buyers the priority is to verify performance at the component and system level, secure diversified feedstock sources—especially circular or waste-derived routes—and insist on standardized quality metrics and transfer validation before committing to long lead-time integration programs. The companies that combine validated, reproducible material quality with clear application metrics and supply security will capture the established industrial contracts and scale revenue as forecasted.

Interested in contributing your expertise on trends and tech? We’d love to hear from you.