Microscopy Report

: Analysis on the Market, Trends, and TechnologiesThe microscopy market is expanding materially: the internal microscopy trend data records a 2024 market size of USD 9.74 billion and projects USD 14.57 billion by 2029 (CAGR 8.7%), signalling strong commercial momentum and rising adoption across life sciences and industry. Investment and product activity concentrate on three business levers: embedding AI for automated image acquisition and analysis, lowering access barriers through miniaturized and benchtop instruments, and combining imaging with chemical or mechanical modalities (multimodal and correlative systems). These shifts reframe value from pure resolution to operational throughput, interpretability, and integration with laboratory workflows, creating distinct commercial opportunities for software-first platforms, compact hardware vendors, and spectroscopy-enabled microscopy providers Microscopy Market Growth, Drivers, and Opportunities.

We last updated this report 110 days ago. Tell us if you find something’s not quite right!

Topic Dominance Index of Microscopy

To gauge the impact of Microscopy, the Topic Dominance Index integrates time series data from three key sources: published articles, number of newly founded startups in the sector, and global search popularity.

Key Activities and Applications

- High-resolution structural biology and cryo-EM for drug discovery — critical for target validation and structural pipelines in pharma; demand drives automation in sample prep and AI-assisted reconstruction.

- Automated, high-throughput imaging for cell-based screening and phenomics — increases assay throughput and reduces manual bottlenecks in CROs and discovery labs.

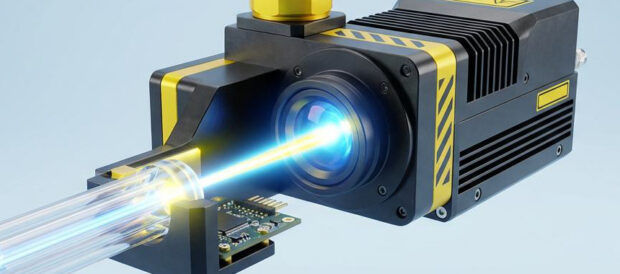

- Semiconductor and electronics inspection (failure analysis, process control) — microscopy remains essential for sub-micron defect detection and materials characterization; industry demand fuels electron and optical inspection upgrades.

- Point-of-care and field diagnostics using compact/portable microscopy — smartphone adapters, low-cost paper microscopes and benchtop EMs expand usage into clinics, environmental monitoring and education Foldscope Instruments, Inc. Skoped Micro.

- Multimodal, correlative workflows (optical + EM + spectroscopy + AFM) — generate richer datasets for materials science and mechanobiology, reducing cycle time for R&D decisions Quantum Design Microscopy Photothermal Spectroscopy Corp.

Emergent Trends and Core Insights

- AI-first microscopes: AI moves beyond post-processing to active control (autofocus, ROI selection, anomaly detection), converting instruments into decision-capable lab assets and reducing dependence on expert operators.

- Accessibility via miniaturization and benchtop EM: compact TEM/SEM and open-air SEM approaches materially lower facility requirements and operating costs—this broadens the buyer base from central facilities to departmental labs and manufacturing lines.

- Label-free, mechanical-property imaging (e.g. Brillouin) and spectro-microscopy convergence — provides orthogonal, non-destructive contrast (mechanics, chemistry) that accelerates early-stage biomarker discovery and materials analysis.

- Software and data ecosystems as the value layer — recurring revenue models (software, analysis-as-a-service), data-management, and interoperability determine long-term customer spend more than incremental hardware features Open Microscopy Environment.

- Regional concentration and growth asymmetry — Asia-Pacific leads in manufacturing-scale growth and price-competitive supply, while North America keeps R&D intensity and early commercial adoption; this geography split affects go-to-market and partnership strategies.

- Patent and innovation acceleration in computational and scanning techniques — patent filings surged since 2019 with thousands of active filings, indicating continued technical layering (optics + sensors + compute).

Technologies and Methodologies

- Super-resolution optical modalities (STED, PALM/STORM, SIM, MINFLUX) enabling sub-100 nm imaging in live cells; commercial desktop super-resolution platforms are expanding access ONI.

- Cryo-electron microscopy and automated cryo workflows for near-atomic structural biology — software and sample-prep automation are key value opportunities.

- Computational microscopy (Fourier ptychography, coded illumination, phase retrieval) that trades hardware complexity for algorithmic reconstruction — enables low-cost, wide-field, and high-throughput instruments Computational Optics Lab.

- Correlative multimodal platforms (optical + EM + AFM + Raman/O-PTIR) delivering spatial + chemical + mechanical signatures from identical ROIs — drives higher-value analysis in materials and life sciences.

- Benchtop and open-air electron microscopy that reduces facility footprint and operational complexity, enabling new industrial inspection and lab deployment models.

Microscopy Funding

A total of 1.1K Microscopy companies have received funding.

Overall, Microscopy companies have raised $26.7B.

Companies within the Microscopy domain have secured capital from 3.6K funding rounds.

The chart shows the funding trendline of Microscopy companies over the last 5 years

Microscopy Companies

- CellSense — CellSense commercializes Brillouin microscopy systems for mechanobiology, offering label-free measurement of mechanical properties inside cells, organoids, and tissues; this capability addresses an unmet need in early disease-detection research and tissue engineering by providing non-invasive stiffness contrast that complements fluorescence assays. CellSense targets academic and translational research groups where mechanical phenotype is a key variable.

- AirSEM Technologies — AirSEM develops an open-air SEM that operates without a vacuum chamber, shrinking the operational envelope of electron microscopy and lowering infrastructure and training burdens; this design makes high-resolution electron imaging accessible to production lines and small labs that cannot host full EM facilities.

- Delong America — Delong produces benchtop low-voltage electron microscopes (including benchtop TEM options), aiming to move electron imaging into routine lab environments; their multi-mode, compact systems reduce capex and accelerate adoption in materials R&D and education.

- Scopio Labs — Scopio combines full-field digital imaging with AI-driven decision support for hematology and clinical morphology, improving diagnostic throughput and enabling rapid triage in clinical labs; their platform model demonstrates how software and AI can create recurring revenue and replace manual, expertise-heavy workflows.

- Spectral Coded Illumination (SCI) — SCI builds programmable illumination hardware and computational imaging tools that enable phase and coded-illumination reconstruction on conventional microscopes; this lowers hardware cost for advanced contrast modes and is attractive to researchers seeking high-information imaging without bespoke optics.

Enhance your understanding of market leadership and innovation patterns in your business domain.

11.7K Microscopy Companies

Discover Microscopy Companies, their Funding, Manpower, Revenues, Stages, and much more

Microscopy Investors

TrendFeedr’s Investors tool offers comprehensive insights into 3.1K Microscopy investors by examining funding patterns and investment trends. This enables you to strategize effectively and identify opportunities in the Microscopy sector.

3.1K Microscopy Investors

Discover Microscopy Investors, Funding Rounds, Invested Amounts, and Funding Growth

Microscopy News

TrendFeedr’s News feature provides access to 50.6K Microscopy articles. This extensive database covers both historical and recent developments, enabling innovators and leaders to stay informed.

50.6K Microscopy News Articles

Discover Latest Microscopy Articles, News Magnitude, Publication Propagation, Yearly Growth, and Strongest Publications

Executive Summary

Microscopy is moving from a hardware-centric commoditized market toward an integrated data and workflow market where software, algorithmic imaging, accessibility, and multimodal sensing determine differentiation and margins. Strategic winners will pair focused hardware innovation (miniaturization, correlative modalities, or unique contrast mechanisms) with scalable software platforms that standardize data ingestion, analysis, and sharing. For investors and operators, near-term priorities are: (1) secure partnerships across regional manufacturing and distribution to exploit Asia-Pacific scale while maintaining North American and European R&D ties; (2) monetise analysis and data services to raise lifetime customer value; and (3) target niche, high-value applications (mechanobiology, semiconductor inline inspection, point-of-care diagnostics) where specialized contrast or accessibility confers defensible advantage. These moves convert microscopy instruments from capital purchases into platformed research and diagnostic assets.

We value collaboration with industry professionals to offer even better insights. Interested in contributing? Get in touch!