Vehicle To Infrastructure Report

: Analysis on the Market, Trends, and TechnologiesThe V2I opportunity is moving from pilots into funded deployments: market analysis and project databases report Total funding raised: $9.65B for companies active in the topic, signaling material investor interest in product-to-infrastructure stacks. Market forecasts show the commercial V2I addressable expands materially through the early 2030s—estimates range from the mid-$0.5B market today to multi-billion dollar outcomes depending on scope and definition. This report synthesizes deployment activities, technology choices, company strategies, and the immediate commercial levers public agencies and operators must master to capture value.

48 days ago, we last updated this report. Notice something that’s not right? Let’s fix it together.

Topic Dominance Index of Vehicle To Infrastructure

The Topic Dominance Index offers a holistic analysis of Vehicle To Infrastructure, merging data from 3 diverse sources: relevant published articles, newly founded companies, and global search metrics.

Key Activities and Applications

- Real-time traffic signal orchestration (Transit Signal Priority & Emergency Vehicle Preemption): Cities deploy cloud-based TSP and EVP to reduce delays for transit and first responders; lightweight software overlays that use vehicle telemetry reduce capital needs and shorten roll-out times.

- Corridor and intersection optimization using V2V/V2I data: Corridor-level systems coordinate multiple intersections and leverage vehicle-to-vehicle messages to manage throughput across corridors rather than only optimizing isolated lights Vehicle to Vehicle (V2V)/Vehicle to Infrastructure (V2I) Market.

- Digital inventory and condition monitoring for asset planning: Automated fence-to-fence roadway assessments and digital twins enable prioritized maintenance and data-driven CAPEX allocation, reducing reactive repairs and improving lifecycle ROI.

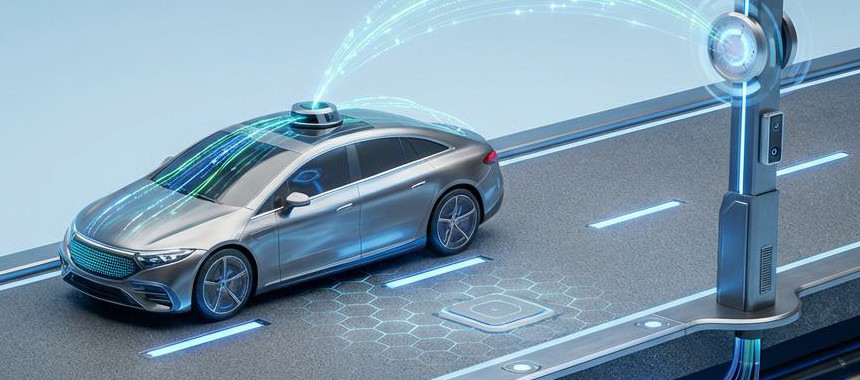

- Infrastructure-enabled safety feeds (I2V): Infrastructure sensors (cameras, LiDAR, radar) publish localized, validated warnings to vehicles and fleets to address hazards that onboard sensing cannot reliably detect in urban canyons.

- Tolling, revenue assurance and automated enforcement: Modern V2I tolling integrates C-V2X and cloud accounting to enable dynamic pricing, contactless collection and integrity checks for HOT/HOV schemes MEP Infrastructure Developers Ltd..

Emergent Trends and Core Insights

- Cellular V2X (C-V2X) is the de facto deployment path where 4G/5G coverage exists: Multiple market studies mark C-V2X as capturing the dominant share of communication-type revenue in early rollouts, driven by operator investment in 5G and better scalability than legacy DSRC Cellular Vehicle-To-Everything (C-V2X) Market – 2035.

- Edge processing at RSUs is emerging as the latency control point for safety use cases — placing AI inference near the road reduces dependency on wide-area backhaul and enables sub-100ms safety loops Vehicle-to-Everything (V2X) Communication Market.

- Two value pools are separating: (1) physical digitization and asset management (digital twins, remote inspection) and (2) real-time mobility orchestration (signal control, TSP, corridor orchestration). Firms that map clearly to one pool and provide standardized APIs attract integration contracts; firms trying to straddle both face longer sales cycles Vehicle-to-Infrastructure (V2I) Communication Market Report 2024.

- Regulatory and procurement momentum matters more than technology choice: Jurisdictional mandates and funding programs (highway and smart-city budgets) are the immediate gating factors for deployments—technology selection follows procurement models and spectrum/safety policy law360 - USDOT V2X plan.

- Service revenue is the recurring margin engine: Cities prefer SaaS and managed services for lifecycle management of RSUs and analytics; this shifts value from one-time hardware sales into subscription streams that capture long-term operational budgets.

Technologies and Methodologies

- C-V2X (Cellular V2X) / 5G NR: Enables sidelink and networked low-latency messaging for safety and traffic orchestration; prioritized for urban and corridor deployments where operator coverage exists.

- DSRC (IEEE 802.11p) for legacy compatibility: Still relevant in mixed-fleet environments and specialized regions that maintain investment in DSRC stacks.

- Edge computing at RSUs with AI/ML inference: Roadside nodes execute incident detection and predictive signal timing locally to meet safety latency bounds and reduce backhaul load Growth Opportunities in Intelligent Transportation System Technologies.

- Digital twins and remote sensing (mobile LiDAR, vehicle camera fleets): Create condition baselines and feed lifecycle planning; they convert inspection into repeatable data products for planners and InvIT investors PILLAR, Inc..

- Secure OTA, identity and data provenance stacks: Authentication for RSUs/OBUs, message signing and tamper detection are mandatory for safety certification and public procurement.

- Standardized APIs and NTCIP/ITS interop layers: Interoperability reduces lock-in and accelerates city procurement acceptance; vendors that expose standard interfaces win municipal pilots more often Butterfly Junction Technologies.

Vehicle To Infrastructure Funding

A total of 284 Vehicle To Infrastructure companies have received funding.

Overall, Vehicle To Infrastructure companies have raised $21.5B.

Companies within the Vehicle To Infrastructure domain have secured capital from 902 funding rounds.

The chart shows the funding trendline of Vehicle To Infrastructure companies over the last 5 years

Vehicle To Infrastructure Companies

- LYT — LYT offers a cloud traffic platform that connects vehicles and city controllers to deliver Transit Signal Priority and Emergency Vehicle Preemption without heavy roadside retrofits, enabling agencies to deploy mobility use cases in weeks rather than months. The company emphasizes AI-driven timing adjustments and minimal hardware dependency to lower procurement friction; clients cite faster installation and incremental performance gains versus full RSU rollouts.

- Virtual Traffic Lights — Virtual Traffic Lights spun out of Carnegie Mellon and commercialized a patented V2V/V2I approach plus the cloud-native Trafluid traffic management system that optimizes corridors instead of isolated intersections. Their model reduces per-intersection cost by shifting decisioning to cloud/edge ML and by leveraging vehicle messages where available.

- InfraHub — InfraHub automates fence-to-fence roadway assessments using AI, producing PCI and asset inventories that integrate with GIS and municipal workflows; this reduces manual survey costs and shortens capital planning cycles. Their product is aimed at DOTs and regional agencies seeking standardized condition data to inform multi-year budgets.

- Trafitizer — Trafitizer focuses on emergency vehicle preemption and has engineered systems proven in dense, chaotic traffic environments, delivering faster signal clearances for ambulances and fire apparatus where seconds matter. The product targets jurisdictions with high emergency response demands and constrained budgets for full RSU installations.

Stay connected with industry movements through TrendFeedr’s Companies tool, which covers 1.8K Vehicle To Infrastructure companies.

1.8K Vehicle To Infrastructure Companies

Discover Vehicle To Infrastructure Companies, their Funding, Manpower, Revenues, Stages, and much more

Vehicle To Infrastructure Investors

Discover investment patterns and trends with TrendFeedr’s Investors tool based on insights into 1.2K Vehicle To Infrastructure investors. This tool is essential for understanding the financial ecosystem of Vehicle To Infrastructure and developing successful investment strategies.

1.2K Vehicle To Infrastructure Investors

Discover Vehicle To Infrastructure Investors, Funding Rounds, Invested Amounts, and Funding Growth

Vehicle To Infrastructure News

TrendFeedr’s News feature grants you access to 4.4K Vehicle To Infrastructure articles. This tool supports professionals in tracking both past trends and current momentum in the industry.

4.4K Vehicle To Infrastructure News Articles

Discover Latest Vehicle To Infrastructure Articles, News Magnitude, Publication Propagation, Yearly Growth, and Strongest Publications

Executive Summary

Public agencies and operators face a near-term choice between incremental, low-capex software overlays that improve signal performance using existing controllers and full-scale RSU/OBU rollouts that enable deeper safety functions. Commercial returns concentrate where subscription services manage asset lifecycles, provide validated safety feeds, and offer city procurement outcomes measurable in reduced delay, lower incident response times, or deferred capital renewal. For investors and vendors, the clearest path to scale is to standardize APIs, design for hybrid C-V2X/DSRC environments, and package outcomes as recurring service contracts to municipal budgets rather than one-off hardware sales. Early success will come from pairing defensible edge AI capabilities with service models that align with public procurement timetables and regulatory safety requirements.

We're looking to collaborate with knowledgeable insiders to enhance our analysis of trends and tech. Join us!