Warehouse Automation Report

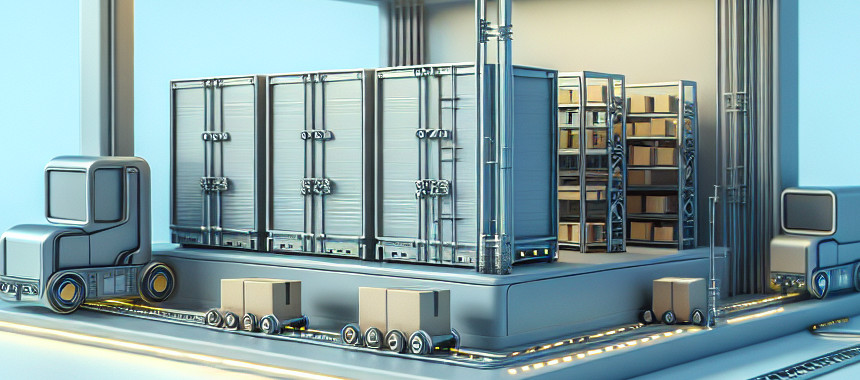

: Analysis on the Market, Trends, and TechnologiesThe warehouse automation sector has grown into a mature market with 1,519 active companies and $9.69 billion in aggregate funding, reflecting the drive to cut labor costs and boost throughput. Fueled by a 16 percent CAGR and surging e-commerce demand, operators are deploying solutions—from automated storage and retrieval systems to autonomous mobile robots—to meet same-day delivery targets and real-time inventory accuracy (Warehouse Automation Market).

151 days ago, we last updated this report. Notice something that’s not right? Let’s fix it together.

Topic Dominance Index of Warehouse Automation

To understand the relative impact of Warehouse Automation relative to other known Trends and Technologies, our Dominance Index examines three correlated timelines: the volume of articles published, the number of companies founded, and the intensity of global search interest.

Key Activities and Applications

- Automated Storage and Retrieval Systems (ASRS): Computer-controlled shuttles and cranes store and retrieve pallets in high-density racks, slashing floor space needs and order cycle times.

- Autonomous Mobile Robots (AMR) and Automated Guided Vehicles (AGV): Self-navigating robots transport totes and pallets, reducing worker travel by up to 60 percent and enabling 24/7 operations (Warehouse Automation Market).

- Goods-to-Person (GTP) Systems: Robotic shuttles deliver bins to pick stations, cutting picker walking distances by 85 percent and boosting lines per hour (Top 20 Warehouse Automation Companies).

- Robotic Piece Picking and Depalletizing: Vision-guided robots adapt to varied item shapes and weights, improving single-order accuracy above 99 percent and handling complex SKU mixes (Warehouse Automation – Market Share Analysis).

- Real-Time Inventory Management with Drones and IoT Sensors: Autonomous drones perform cycle counts up to 15× faster, while RFID and sensor networks deliver live stock levels, enabling immediate replenishment decisions (Global Warehouse Automation Market).

Emergent Trends and Core Insights

- Human-Robot Collaboration: Enhanced safety protocols and intuitive interfaces allow robots to shoulder repetitive tasks, freeing workers for exception handling and creative problem solving.

- Micro-Fulfillment Centers: Urban, small-footprint automation hubs process >300,000 orders annually to meet same-hour delivery, driving adoption of modular ASRS and AMR fleets (Warehouse Automation Market Research).

- Fixed Automation Resilience vs. Mobile Robotics Uncertainty: While fixed ASRS order intake in 2024 outpaced forecasts, mobile robot demand forecasts were lowered amid trade-policy headwinds, underscoring differentiated risk profiles across automation segments (Warehouse automation starts 2025 strong, but faces uncertainty).

- AI-Driven Predictive Maintenance: Machine-learning models now predict equipment failures days in advance, reducing unplanned downtime by up to 40 percent and optimizing service schedules.

Technologies and Methodologies

- Automated Guided Vehicles & Autonomous Mobile Robots: Flexible, software-driven fleets navigate dynamic warehouse layouts to transport goods and support order fulfillment.

- Automated Storage and Retrieval Systems: High-density, computer-controlled storage units (shuttles, stacker cranes) maximize cubic utilization and slash retrieval times.

- Warehouse Management and Execution Systems: Integrated software platforms coordinate inventory, labor, and equipment in real time, ensuring accurate order allocation and throughput optimization.

- Artificial Intelligence & Machine Learning: Advanced analytics optimize slotting, demand forecasting, and maintenance schedules, driving 10–15 percent improvements in order accuracy and uptime.

- Internet of Things and Real-Time Monitoring: Sensor networks and RFID systems deliver continuous visibility into stock levels, enabling rapid exception handling and dynamic process adjustments.

Warehouse Automation Funding

A total of 136 Warehouse Automation companies have received funding.

Overall, Warehouse Automation companies have raised $7.0B.

Companies within the Warehouse Automation domain have secured capital from 485 funding rounds.

The chart shows the funding trendline of Warehouse Automation companies over the last 5 years

Warehouse Automation Companies

- Unbox Robotics: Offers AI-powered robotic sorting systems that install in under two weeks, shrinking footprint by up to 80 percent and boosting sortation throughput 3–5× over manual methods.

- Anyware Robotics: Delivers subscription-based mobile robots that autonomously unload trucks and containers, addressing labor shortages with rapid deployment and minimal integration time.

- Collaborative Palletizer by AAA20: Provides lease-based, fence-free palletizing robots designed for quick setup, augmenting line throughput and reducing strain injuries without long-term contracts.

- AutoScheduler.AI: Enhances existing WMS platforms with AI-driven task prioritization, resolving dock conflicts and improving on-time delivery by up to 20 percent in large-scale consumer goods operations.

- Gather AI: Deploys autonomous drones and computer vision to perform cycle counts 15× faster, cutting inventory errors by 66 percent and uncovering hidden stock worth millions per facility.

TrendFeedr’s Companies feature offers comprehensive insights into 1.6K Warehouse Automation companies.

1.6K Warehouse Automation Companies

Discover Warehouse Automation Companies, their Funding, Manpower, Revenues, Stages, and much more

Warehouse Automation Investors

TrendFeedr’s Investors tool offers you a detailed perspective into 630 Warehouse Automation investors and their funding activities. This information enables you to analyze investment trends and make informed decisions in the Warehouse Automation market.

630 Warehouse Automation Investors

Discover Warehouse Automation Investors, Funding Rounds, Invested Amounts, and Funding Growth

Warehouse Automation News

TrendFeedr’s News feature delivers access to 3.2K articles focused on Warehouse Automation. Use this tool to stay informed about the latest market developments and historical context, which is crucial for strategic decision-making.

3.2K Warehouse Automation News Articles

Discover Latest Warehouse Automation Articles, News Magnitude, Publication Propagation, Yearly Growth, and Strongest Publications

Executive Summary

Warehouse automation has entered a phase of measured growth and strategic diversification, driven by e-commerce imperatives, labor dynamics, and environmental considerations. Companies now balance investments across fixed infrastructure and flexible robotics, leveraging AI, IoT, and collaborative systems to meet exacting delivery SLAs and operational resilience targets. For practitioners, success hinges on selecting the right mix of technologies—ASRS for throughput density, AMRs for layout agility, and advanced software for orchestration—while adopting financing models such as robotics-as-a-service to mitigate capital risk. As automation penetrates deeper, organizations that integrate continuous data feedback loops and cultivate human-robot partnerships will secure lasting advantage in the next generation of supply chain performance.

We're looking to collaborate with knowledgeable insiders to enhance our analysis of trends and tech. Join us!