Energy Harvesting Report

: Analysis on the Market, Trends, and TechnologiesThe energy-harvesting market is moving into practical commercial deployments, anchored by a global market size of $634,300,000 (2024) and a projected CAGR of 9.8%, which together indicate a clear, investable growth corridor for self-powered IoT and industrial sensing solutions. Hybrid modules, on-chip thermoelectrics and advanced PMICs are turning intermittent ambient sources (light, vibration, thermal, RF) into reliable micro-power streams that reduce maintenance cost and extend sensor lifetimes across smart buildings, industrial IoT, wearables and transport.

This article was last updated 3 days ago. If you find any info is missing, let us know!

Topic Dominance Index of Energy Harvesting

The Dominance Index of Energy Harvesting looks at the evolution of the sector through a combination of multiple data sources. We analyze the distribution of news articles that mention Energy Harvesting, the timeline of newly founded companies working in this sector, and the share of voice within the global search data

Key Activities and Applications

- Battery-free wireless sensor deployment for industrial automation — retrofitting vibration or thermal harvesters to monitoring nodes reduces scheduled battery replacements and service visits, lowering lifecycle OPEX in heavy-asset sites.

- Smart-building integrations — embedding light and vibration harvesters into lighting, HVAC and access control reduces wiring and enables long-life, maintenance-free nodes used in building automation and energy management Energy Harvesting Systems – Market Share Analysis, Industry Trends.

- Wearables and medical monitoring — thermoelectric and triboelectric harvesters enable extended operation or batteryless duty in body-worn devices and some implantables where regular battery service is impractical.

- Transport & telematics (tires, rail, vehicles) — kinetic harvesters inside tires and on rail bearings power telemetry and predictive-maintenance sensors, improving uptime and reducing fleet service costs.

- Remote/environmental monitoring with hybrid power stacks — solar + thermal or solar + vibration hybrid modules supply more consistent output for remote sensors (environmental, agricultural, pipeline/leak detection) and reduce dependency on long-life batteries and solar sizing.

Emergent Trends and Core Insights

- Power management is the commercial bottleneck and differentiator: design attention has shifted from raw transducer performance to PMICs that cold-start, run MPPT only when beneficial and arbitrate multiple inputs; the market now rewards PMICs that keep control overhead below harvested packets.

- Hybrid, multi-source modules are the reliability play: combining light, thermal and kinetic inputs materially increases uptime for always-on sensors and reduces required energy storage, improving ROI in remote and industrial deployments Energy Harvesting Market (2019–2025).

- Power density floor is rising via materials and form-factor work: innovations in perovskites, printed OPV, nano-engineered piezo/tribo layers and flexible TEGs are enabling harvesters to serve new device classes (e.g. small actuators, higher duty-cycle sensors).

- RF harvesting moves from niche to tactical: advances in rectenna design and CMOS rectifiers increase RF conversion efficiency for indoor deployments, making RF harvesting a pragmatic supplement for constrained indoor IoT nodes Energy Harvesting Market Size, 2024-2030.

- Application specificity drives adoption: investors and buyers favor solutions that demonstrate measurable OPEX reductions or regulatory compliance benefits (e.g. reduced maintenance costs or emissions), rather than general “battery replacement” claims.

Technologies and Methodologies

- Power Management Integrated Circuits (PMICs) with adaptive MPPT and cold-start — PMICs that sense ambient power and gate MPPT cycles only when net gain exists are critical to commercial viability.

- Thermoelectric generators (TEGs) and on-chip thermoelectrics — flexible and scalable TEG modules harvest low-grade waste heat continuously and increasingly target industrial process instrumentation and on-processor energy recovery.

- High-efficiency indoor photovoltaics (OPV and specialized indoor PV) — printed OPV and optimized indoor PV cells provide superior power under low lux conditions for asset trackers and building sensors Dracula Technologies.

- Piezo/triboelectric and frequency upconversion techniques — broadband piezoelectric harvesters, TENG hybrids and upconversion methods enable meaningful capture from low-frequency human/traffic/structural vibrations Piezoelectric Energy Harvesting System Market.

- RF rectennas and broadband CMOS rectifiers — improved impedance matching and rectifier efficiency permit practical indoor RF scavenging for ultra-low-power nodes Innovations in energy harvesting: A survey of low-power technologies.

- Form-factor and integration methods — harvesters designed with battery form-factors or integrated into device housings reduce retrofit friction and accelerate OEM adoption.

Energy Harvesting Funding

A total of 202 Energy Harvesting companies have received funding.

Overall, Energy Harvesting companies have raised $7.8B.

Companies within the Energy Harvesting domain have secured capital from 772 funding rounds.

The chart shows the funding trendline of Energy Harvesting companies over the last 5 years

Energy Harvesting Companies

- MEMSYS — MEMSYS develops vibration energy harvesters targeted at industrial IoT retrofits and moving assets, emphasizing reliability for rail and heavy machinery monitoring; their compact harvesters aim to replace periodic battery swaps by converting ambient kinetic energy into maintenance-free power. Their product focus and modest headcount position them as a deployable, revenue-oriented player in IIoT niches.

- Pyro-E — Pyro-E commercializes broadband vibrational harvesters designed to supply power where single-use batteries dominate; they market retrofit modules for industrial sensors and smart infrastructure and highlight cost advantages versus chemical cells. Pyro-E’s positioning targets customers seeking clear OPEX reductions through avoided battery logistics.

- Teratonix — Teratonix is an RF-harvesting spin-out that claims broadband RF capture and high conversion efficiency to power ultra-low-power IoT nodes indoors; they emphasize batteryless operation for distributed sensors and wearable use cases. Their IP-centric model aims at licensing or integration into OEM platforms where RF density supports continuous trickle charging.

- TEGmat — TEGmat produces flexible thermoelectric modules built for low-grade waste heat harvesting in industrial settings; their modules target long-lived, maintenance-free deployment where stable temperature differentials exist and ROI windows are short. TEGmat’s licensing of materials/process patents gives them a route into OEM integration for process plants and heavy machinery.

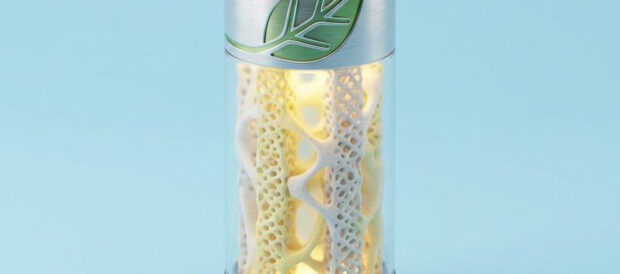

- Plant-e — Plant-e pioneers plant-microbial fuel cell systems that harvest electrons from rhizosphere microbes, offering continuous, low-power output with negative carbon impact for niche lighting and sensor applications; the approach suits demonstration projects and sustainability-oriented clients in environmental monitoring and public spaces. Their product roadmap targets off-grid sensors and educational deployments where environmental benefit supports procurement.

Uncover actionable market insights on 930 companies driving Energy Harvesting with TrendFeedr's Companies tool.

930 Energy Harvesting Companies

Discover Energy Harvesting Companies, their Funding, Manpower, Revenues, Stages, and much more

Energy Harvesting Investors

Get ahead with your investment strategy with insights into 626 Energy Harvesting investors. TrendFeedr’s investors tool is your go-to source for comprehensive analysis of investment activities and financial trends. The tool is tailored for navigating the investment world, offering insights for successful market positioning and partnerships within Energy Harvesting.

626 Energy Harvesting Investors

Discover Energy Harvesting Investors, Funding Rounds, Invested Amounts, and Funding Growth

Energy Harvesting News

TrendFeedr’s News feature offers access to 5.6K news articles on Energy Harvesting. The tool provides up-to-date news on trends, technologies, and companies, enabling effective trend and sentiment tracking.

5.6K Energy Harvesting News Articles

Discover Latest Energy Harvesting Articles, News Magnitude, Publication Propagation, Yearly Growth, and Strongest Publications

Executive Summary

Energy harvesting has moved into a deployment phase defined by integration intelligence rather than pure transducer novelty. The most valuable companies will either provide platform-level solutions (PMIC + system integration + verified ROI) or hold narrow, defensible IP that addresses a high-value operational pain point. For buyers, the clear procurement path is to prioritize demonstrable cost reduction (fewer site visits, longer asset life, regulatory compliance) over theoretical maximum power. For investors, the best risk/return profile lies in firms that combine field-validated deployments with scalable PMIC or hybrid-module architectures capable of cross-OEM integration.

Have expertise in trends or technology? Your input can enrich our content — consider collaborating with us!